Is R24 CAPITAL safe?

Business

License

Is R24 Capital A Scam?

Introduction

R24 Capital is an online forex and CFD broker that has gained attention in the trading community since its establishment. Operating under the domain r24capital.com, the broker claims to offer a wide range of financial instruments, including forex, indices, commodities, and cryptocurrencies. However, as with any financial service, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of the broker before investing their hard-earned money. This article aims to provide an objective assessment of R24 Capital, exploring its regulatory status, company background, trading conditions, customer safety, and user experiences. The analysis is based on multiple sources, including user reviews, regulatory databases, and expert evaluations, ensuring a comprehensive overview of the broker's standing in the forex market.

Regulation and Legitimacy

The regulatory environment of a broker is one of the most critical factors investors should consider. R24 Capital claims to be registered in the United States and operates as a money services business (MSB) with a license from the National Futures Association (NFA). However, upon investigation, there is no verifiable evidence of this registration in the NFA database, raising significant concerns about the broker's legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0536614 | USA | Not Verified |

The lack of legitimate regulatory oversight is a major red flag. Regulatory bodies like the NFA impose strict compliance requirements on brokers to ensure the safety of client funds and fair trading practices. Without such oversight, traders are exposed to higher risks, including potential fraud and mismanagement of funds. Furthermore, R24 Capital's claims of being regulated are contradicted by various reports indicating that it operates as an unregulated offshore broker. This situation necessitates a cautious approach for any potential investor considering R24 Capital as a trading partner.

Company Background Investigation

R24 Capital's history and ownership structure are essential components in assessing its credibility. The broker claims to be based in the United States, but many sources indicate that it operates without a clear physical presence or verifiable headquarters. The company's transparency is questionable, as there is limited information available about its founding members, management team, and operational history.

The absence of detailed disclosures regarding the management team raises concerns about the broker's accountability and reliability. A reputable broker typically provides information about its leadership, including their professional backgrounds and experience in the financial services industry. Moreover, the lack of transparency about its ownership structure further complicates the assessment of R24 Capital's legitimacy. Investors should be wary of brokers that do not provide clear and accessible information about their operations and management.

Trading Conditions Analysis

R24 Capital offers a variety of trading accounts, each with different minimum deposit requirements and trading conditions. The broker claims to provide competitive spreads and leverage options, which can be attractive to traders. However, it is essential to scrutinize the fee structure and any unusual policies that may affect profitability.

| Fee Type | R24 Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.8 pips | 1.5 - 2.0 pips |

| Commission Model | No commissions for STP and VIP accounts | Varies by broker |

| Overnight Interest Range | Varies | Varies |

While R24 Capital promotes low trading costs, the actual execution conditions and hidden fees may differ from what is advertised. Users have reported issues with withdrawal processes and unexpected fees, which can significantly impact a trader's bottom line. It is crucial for traders to carefully read the terms and conditions associated with each account type to avoid any unpleasant surprises.

Customer Funds Safety

The safety of customer funds is paramount in the trading industry. R24 Capital claims to keep client funds in segregated accounts, but the lack of regulatory oversight raises concerns about the effectiveness of these measures. Segregation of funds is a common practice among regulated brokers, ensuring that client deposits are protected in the event of bankruptcy or financial distress.

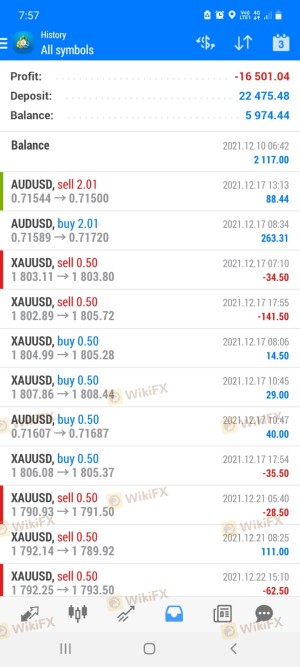

Moreover, the absence of investor protection mechanisms such as negative balance protection is a significant risk factor. Without these safeguards, traders could potentially lose more than their initial investment. Historical complaints from users indicate that R24 Capital has faced issues related to fund withdrawals, further underscoring the importance of ensuring that funds are secure and accessible.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of R24 Capital reveal a mixed bag of experiences, with several users expressing dissatisfaction with the broker's services. Common complaints include difficulties in withdrawing funds, lack of customer support responsiveness, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Fair |

| Account Management Problems | High | Poor |

For instance, some traders have reported being unable to withdraw their funds after making multiple requests, while others have experienced long wait times for customer service responses. These issues can significantly impact a trader's trust in the broker and should be taken seriously by potential investors.

Platform and Trade Execution

R24 Capital utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading tools. However, reviews suggest that the platform may experience technical issues, leading to concerns about order execution quality and potential slippage.

Traders have reported instances of delayed order executions, which can be detrimental in a fast-paced trading environment. Additionally, there are allegations of potential platform manipulation, which raises further doubts about the broker's integrity. Traders should be cautious and consider these factors before committing to trading with R24 Capital.

Risk Assessment

Engaging with R24 Capital involves several risks that potential investors should consider carefully. The lack of regulation, customer complaints, and issues with fund withdrawals contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Withdrawal Risk | Medium | Reports of difficulty in accessing funds. |

| Technical Risk | High | Platform issues could affect trading. |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial trades, and explore alternative brokers with better regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that R24 Capital exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, coupled with numerous customer complaints and issues related to fund withdrawals, raises significant concerns about the broker's legitimacy. Potential investors should approach this broker with caution and consider alternative options that offer stronger regulatory protections and better customer service.

For traders seeking reliable alternatives, consider brokers that are well-regulated by recognized authorities such as the FCA, ASIC, or NFA. These brokers typically provide greater transparency, enhanced security for client funds, and a more robust trading environment. Always prioritize safety and due diligence when selecting a broker to ensure a secure trading experience.

Is R24 CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of R24 CAPITAL brokers.

R24 CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

R24 CAPITAL latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.