r24 capital 2025 Review: Everything You Need to Know

Abstract

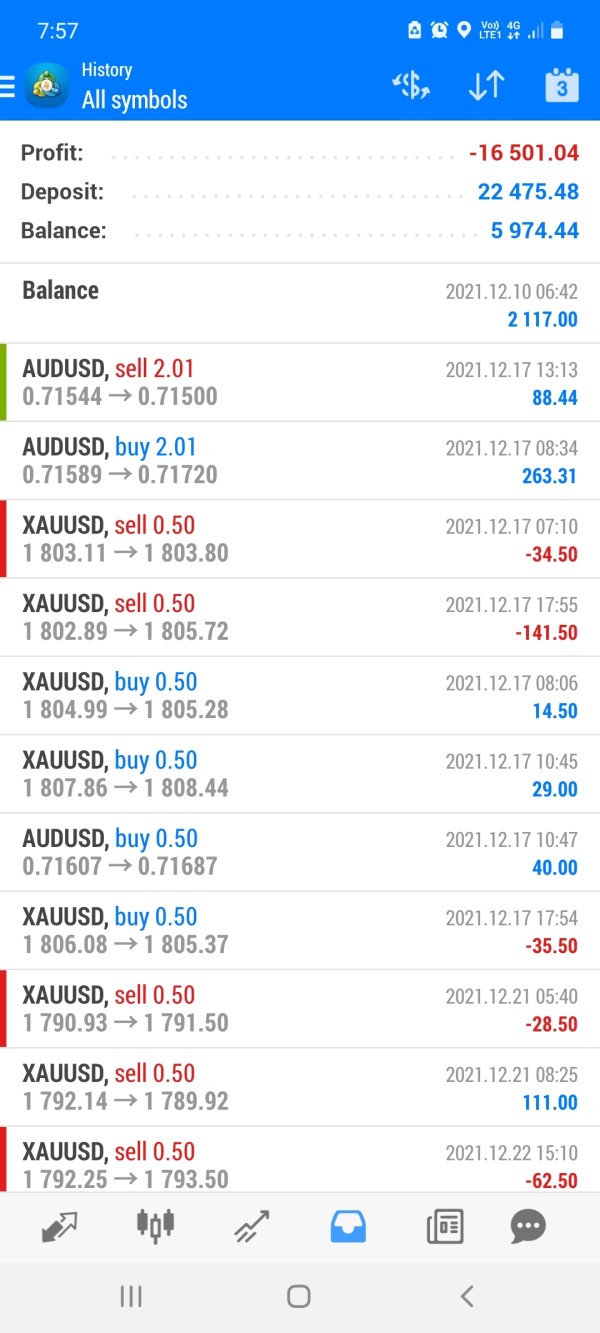

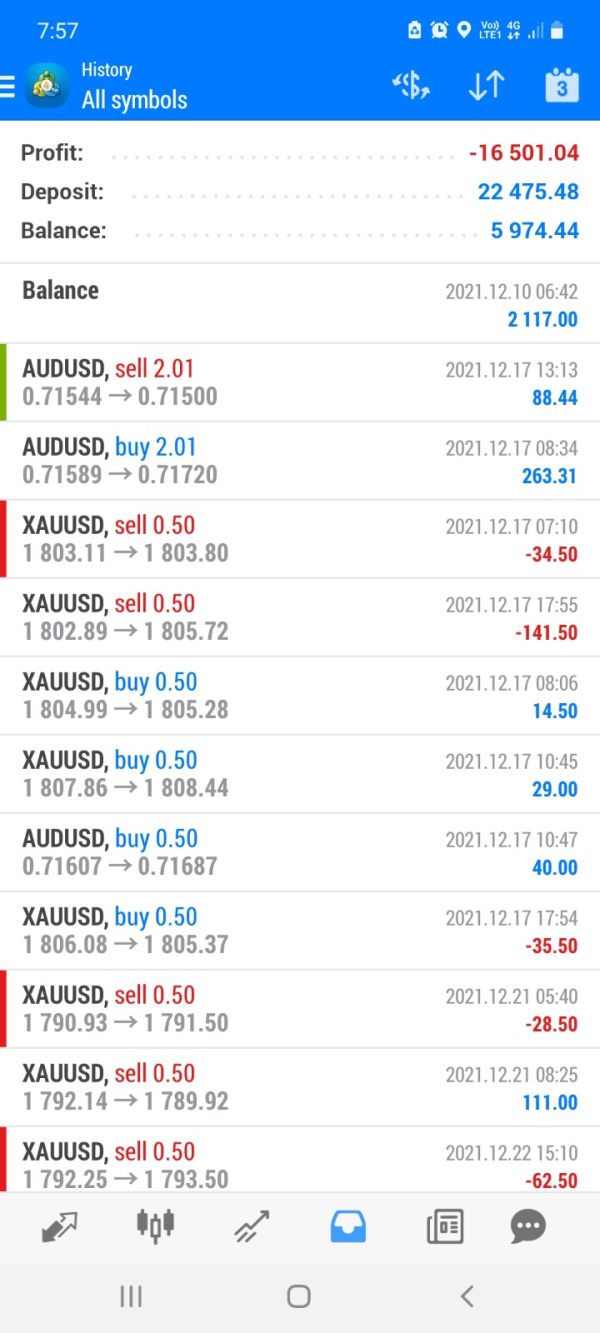

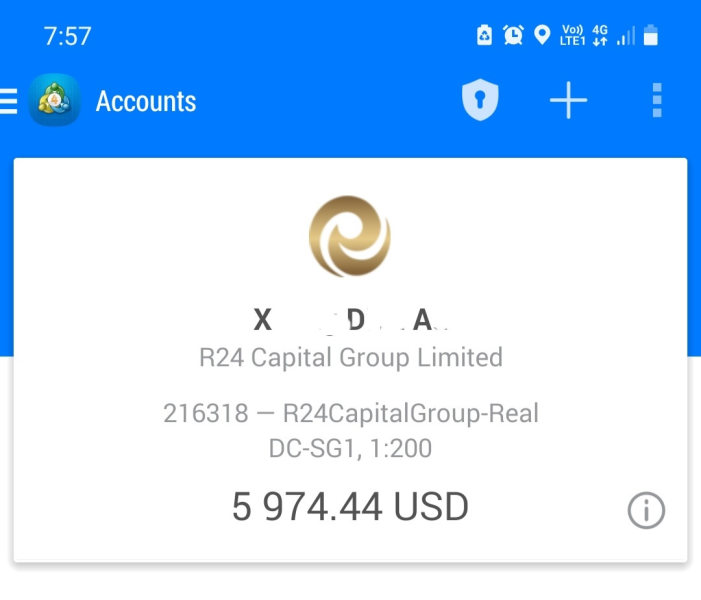

The r24 capital review shows an unregulated forex broker that worries many traders. This broker has a bad reputation and gets lots of user complaints that hurt its standing in the market. R24 Capital Group started in 2020 and works without any real regulatory oversight, which has caused many negative reviews and even claims of scam-like behavior. Despite these warning signs, the broker does offer some good features like a low minimum deposit of just $100 and high leverage up to 1:1000. These conditions might attract high-risk traders who feel comfortable with volatile markets and little regulatory protection, though such traders should understand the significant risks involved. However, while the low entry cost looks good, the lack of oversight and bad user experiences often outweigh its competitive spreads. This r24 capital review uses carefully gathered market data and many user opinions, stressing that potential clients must be very careful when thinking about this broker.

Important Considerations

R24 Capital claims to have authorization in the United States, but the real evidence shows the broker is not regulated by any recognized US authority. This difference must be seen as a major warning for future traders who might consider using their services. The evaluation in this r24 capital review is based on thorough market research, different user feedback, and analysis of available public information. No actual trading experiences were tested during the study, which means important details remain unclear. Details like deposit and withdrawal procedures, as well as support-related specifics, are still unknown to potential users. Potential investors should do their own research and not assume that authorization claims mean reliable regulatory oversight.

Rating Framework

Broker Overview

R24 Capital Group started in 2020 and is a fairly new company in the competitive forex industry. The company is registered in Hong Kong and operates as an unregulated broker, which immediately raises several red flags about how transparent and secure their operations are. R24 Capital tries to attract traders by offering various financial products, mainly focusing on forex trading, though their lack of regulation makes this risky. However, the lack of any real regulatory oversight or approval by a recognized licensing authority makes it a risky choice for many potential investors. The broker's business model focuses on attracting high-risk traders who are drawn to the chance of trading with very low initial capital requirements, which sounds good but has problems. This approach, while seeming attractive, has led to many negative reviews and user complaints that suggest customers have faced major issues with fund security and overall service quality.

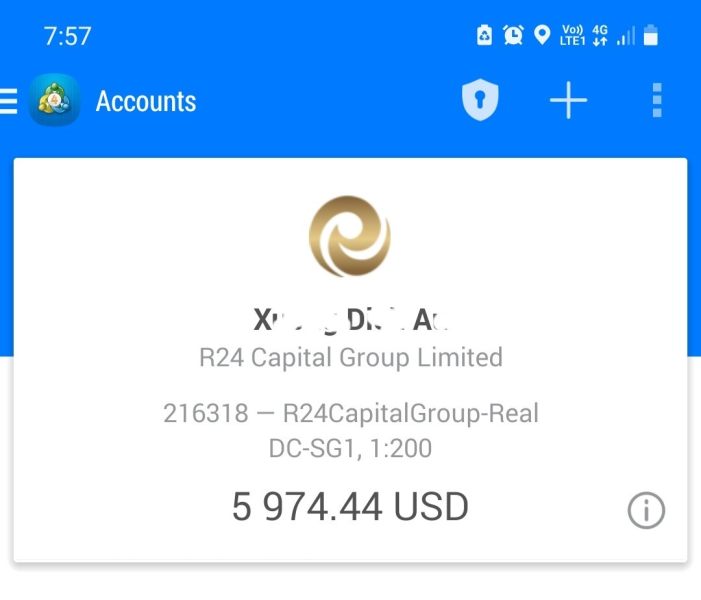

R24 Capital also provides access to the well-known MetaTrader 4 trading platform, which is popular in the trading community. This platform is widely used in the forex trading community because of its strong features and easy-to-use interface that most traders find familiar. The broker offers many tradable assets including forex pairs, precious metals, energy products, indices, and even cryptocurrencies, which appeals to traders with different preferences and strategies. Despite this wide asset coverage, R24 Capital has not provided any information about its licensing or any regulatory body, leaving traders without the usual safety and compliance assurances that regulated brokers provide. This second mention of "r24 capital review" highlights the need for potential clients to carefully consider the risks of a platform that offers appealing trading conditions but has unresolved regulatory and reputation issues.

- Regulated Jurisdictions: R24 Capital operates as an unregulated forex broker with no connection to or oversight from any recognized regulatory agency. The lack of regulatory data is a main concern for traders evaluating this broker and considering their services.

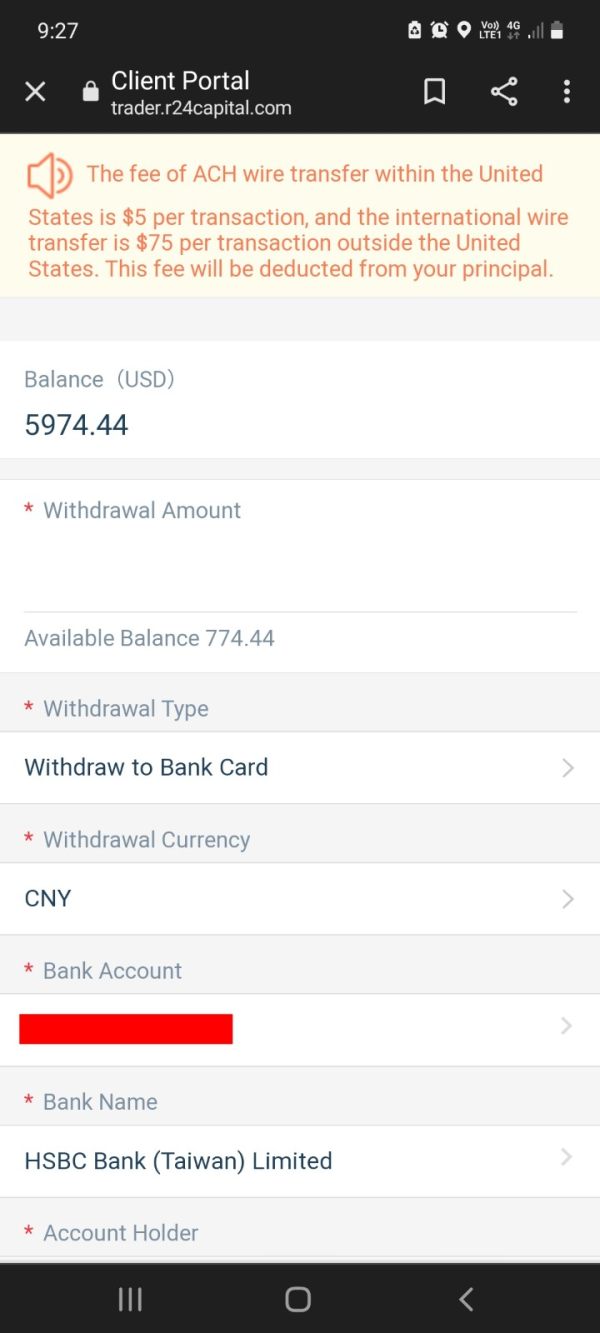

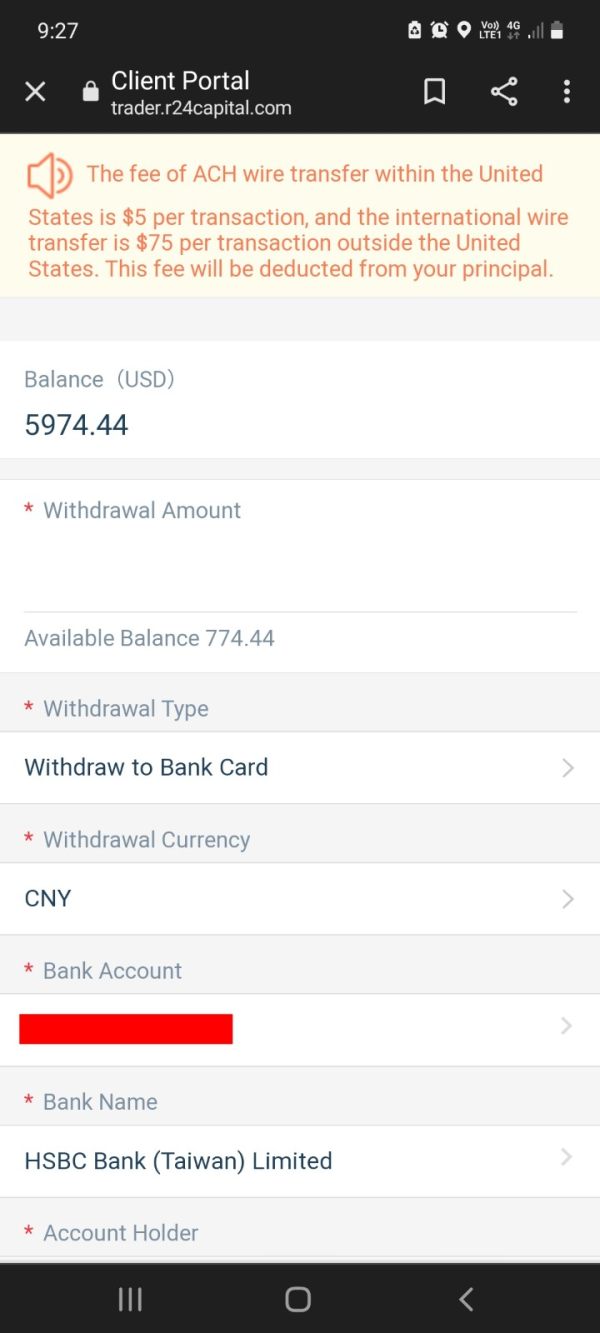

- Deposit and Withdrawal Methods: Details about the specific methods and processes for deposits and withdrawals are missing from the available information, which creates transparency concerns. This lack of clarity raises concerns about transparency and ease of transactions for potential users.

- Minimum Deposit Requirement: The broker requires a minimum deposit of only $100, which attracts new and risk-tolerant traders looking to minimize their initial capital commitment and start trading quickly.

- Bonuses and Promotions: There is no information provided about any bonus offers or promotional deals available to new or existing clients. This leaves potential clients without incentives typically seen in competitive markets where brokers try to attract new customers.

- Tradable Assets: Clients have access to a broad range of tradable assets including forex, precious metals, energy commodities, indices, and cryptocurrencies that allow for various trading strategies. This diversification allows for a variety of trading strategies and portfolio approaches that different traders might prefer.

- Cost Structure: The broker advertises spreads starting from 1.8 pips, which seems competitive in the current market. However, no details on additional commission charges are disclosed, making a full cost analysis challenging for potential traders.

- Leverage Ratio: One of the more enticing features is the option of high leverage, with ratios going up to 1:1000 that can amplify both profits and losses. This offers substantial trading power but also introduces significant risk that inexperienced traders might not fully understand.

- Platform Options: R24 Capital relies on the robust and widely-used MetaTrader 4 platform for executing trades, which is considered a standard in the industry. This platform choice provides familiarity for most traders who have used MT4 with other brokers in the past.

- Regional Restrictions: There is no explicit information regarding any regional restrictions imposed by the broker on potential clients. This leaves uncertainty about which geographical locations are permitted or excluded from using their services.

- Customer Support Language: The available materials do not clearly state the language options for customer support, which could impact non-English speaking traders significantly. This third mention of "r24 capital review" is crucial as we examine the specific details—many areas such as fund handling procedures and customer service channels remain vague, highlighting the importance of further scrutiny by potential clients.

Detailed Rating Analysis

1. Account Conditions Analysis

The account conditions at R24 Capital show several important areas that need close attention from potential traders. The broker offers a notably low minimum deposit of $100, which makes entry accessible for traders with limited capital and seems attractive at first glance. However, this benefit is offset by the lack of detailed information on account types, such as whether there are separate accounts for beginners, professionals, or those requiring Islamic accounts that comply with religious requirements. Additionally, the account opening process is not clearly explained, leaving questions about the verification and approval timeline that new traders need to know. Users have reported confusion and delays during the account setup process, which is especially problematic for a broker already under scrutiny for other problems and regulatory issues. Compared to other brokers in the market who provide a range of account types with transparent features, the information provided by R24 Capital remains very basic and incomplete. This gap makes it hard to assess whether any additional hidden fees or terms might apply after account creation, which could surprise new traders. Such gaps in transparency contribute to the low score of 4/10 in this category and raise red flags for potential users. Overall, this part of the r24 capital review demands more clarity on the account structure and associated benefits to build any trust with prospective clients.

R24 Capital gives its clients access to the popular MetaTrader 4 trading platform, which is widely appreciated in the forex community for its reliability and functionality. The platform supports multiple asset classes and offers essential trading tools that work well for both new and experienced traders who want familiar interfaces. However, the range of research and analytical resources available on the broker's website remains very limited compared to industry standards. In contrast to traditional forex brokers who invest heavily in comprehensive educational materials, market analysis, tutorials, and live webinars, R24 Capital offers little in the way of educational content that could help traders improve their skills. Automated trading functions such as Expert Advisors are supported on MT4, yet there is no mention of dedicated support for such tools or guidance on how to use them effectively. User feedback on the platform is mixed; while some traders appreciate the familiar interface of MT4, others indicate that the overall trading toolkit lacks advanced features and timely market insights that could improve their trading performance. This difference between expected and delivered value contributes to a moderate score of 6/10 in this important category. Future improvements in research tools and a stronger educational framework could significantly improve the perceived value of R24 Capital's trading platform, as highlighted in this r24 capital review.

3. Customer Service and Support Analysis

The evaluation of customer service at R24 Capital shows considerable problems that potential clients should know about. Information detailing available customer support channels, operating hours, response times, and language options is clearly missing, leaving traders uncertain about how effectively their issues will be addressed when problems arise. Multiple user complaints have pointed out delayed responses and an overall lack of clear communication from support teams that should be helping customers. In some cases, clients have reported unresolved issues for long periods, which becomes particularly concerning when dealing with unregulated brokers where fund security is already a primary worry for most traders. Additionally, the absence of a clear multi-language support policy adds another layer of risk for non-English speaking clientele who might struggle to get help when needed. Although automated support tools or an extensive FAQ section might exist, the clear evidence of such services is not present on their website or in user reports. This leaves potential customers to rely on stories from other traders who have experienced poor customer service and long wait times for responses. As a result, this dimension scores a low 4/10 due to the cited problems and the heavy reliance on self-service that many traders find frustrating. The overall negative feedback directly connects to broader trust issues around R24 Capital, as extensively discussed in various sections of this r24 capital review.

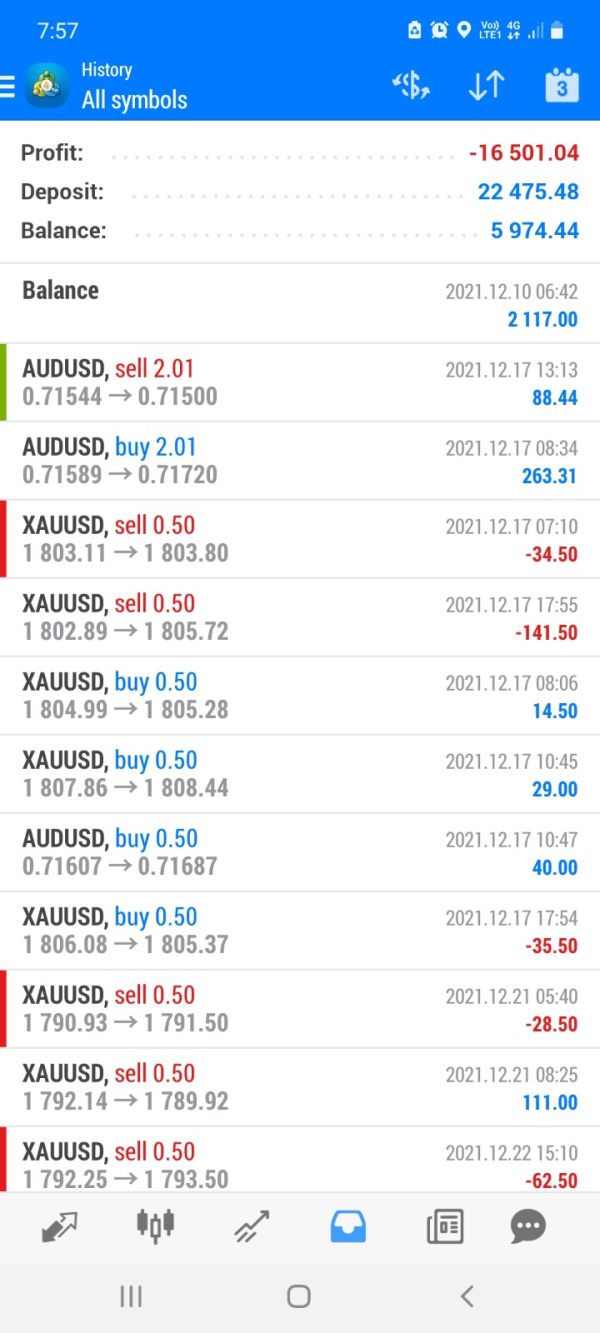

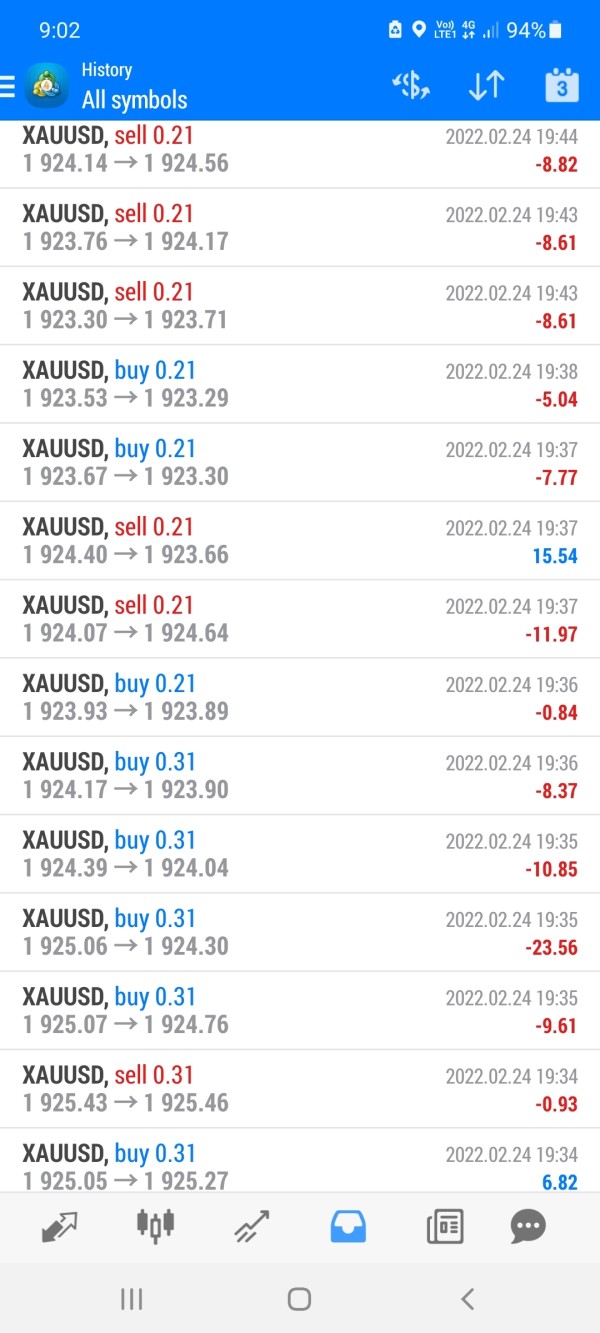

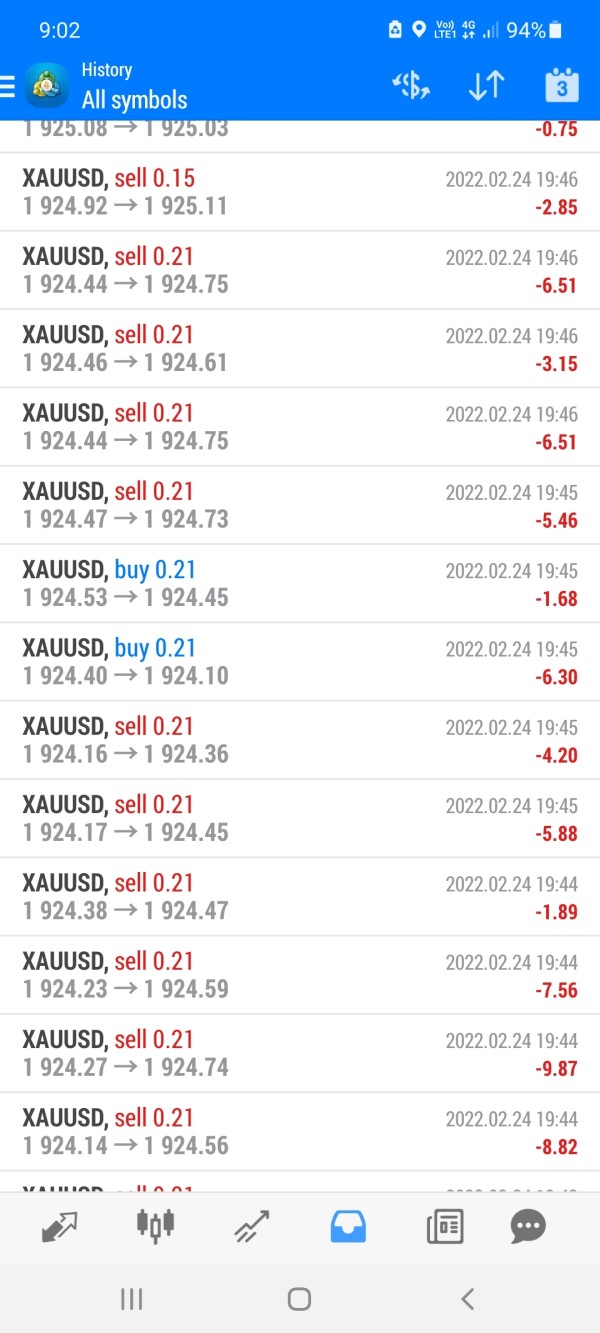

4. Trading Experience Analysis

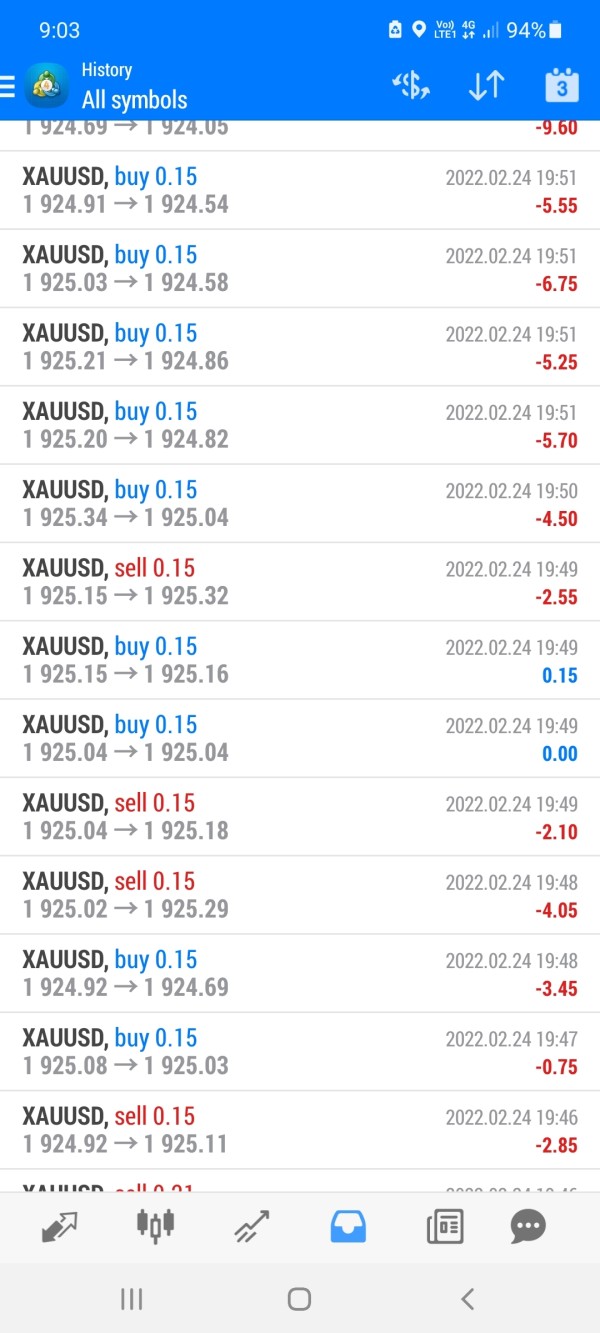

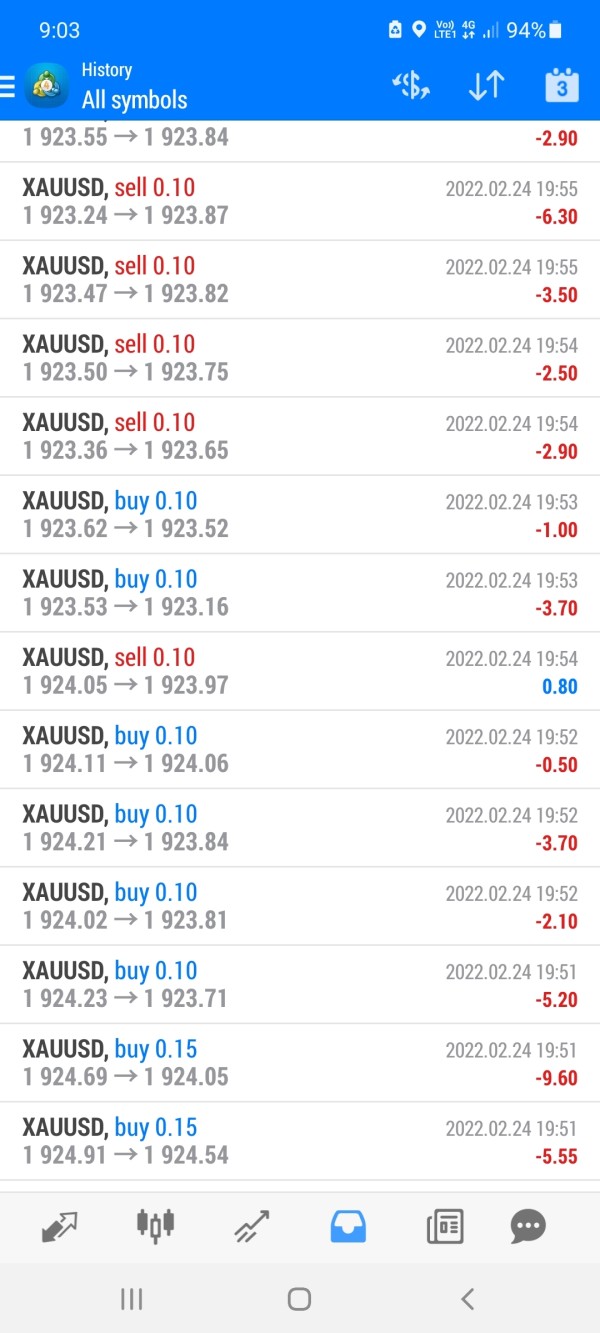

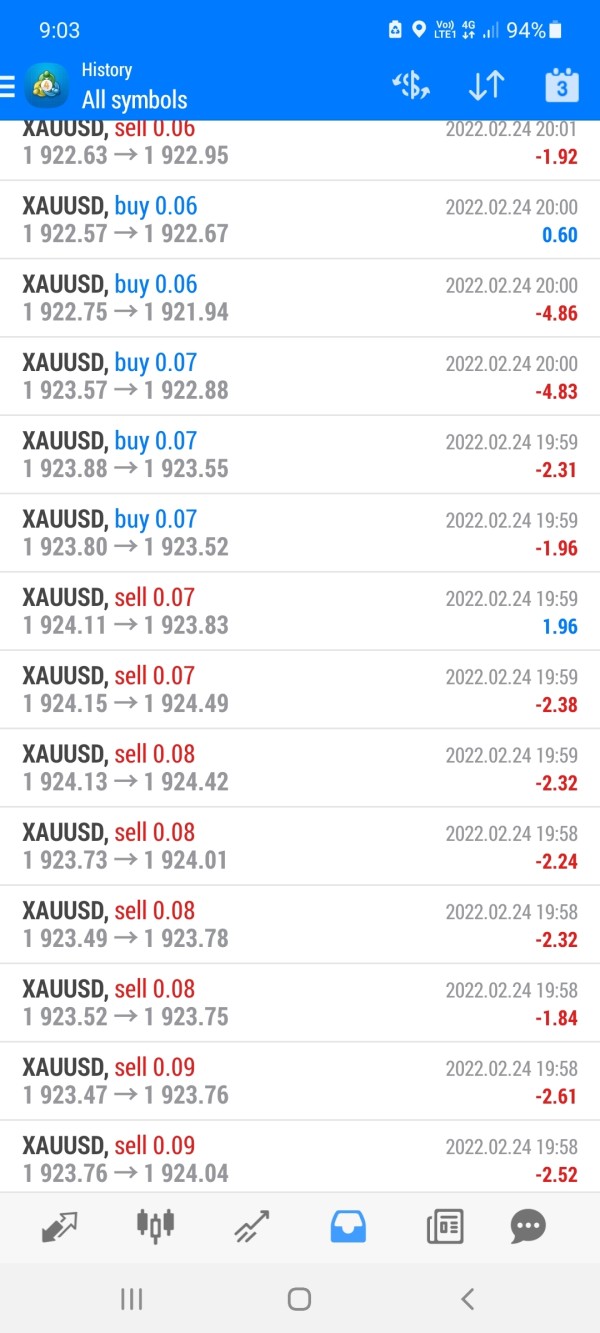

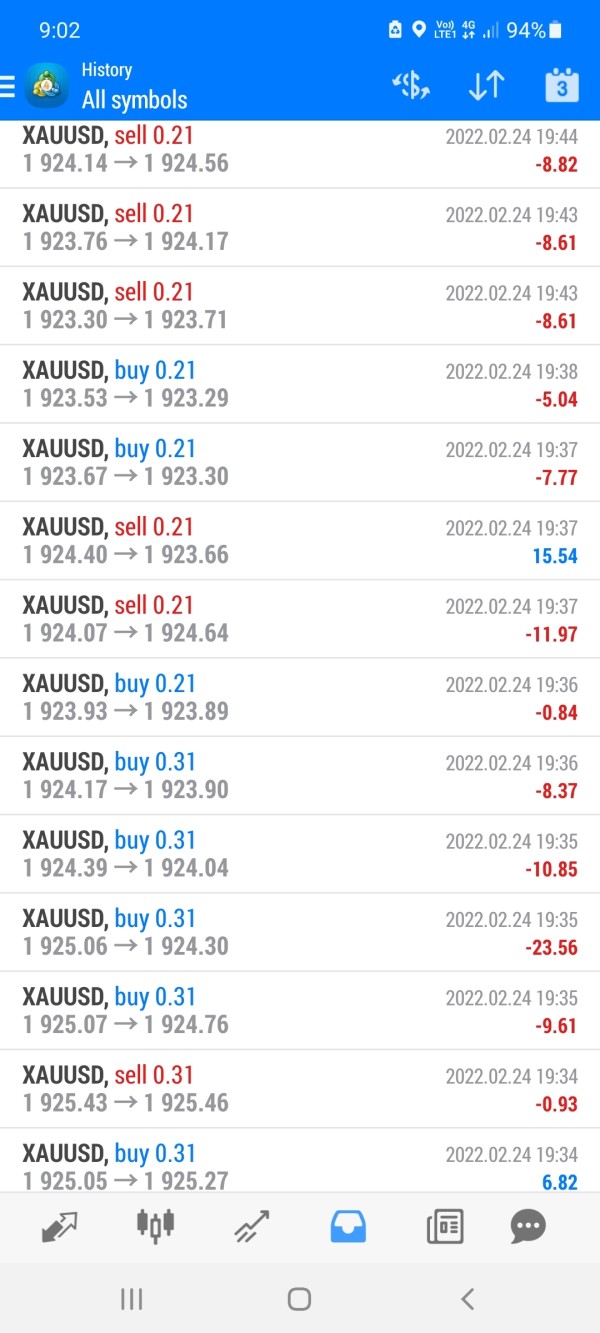

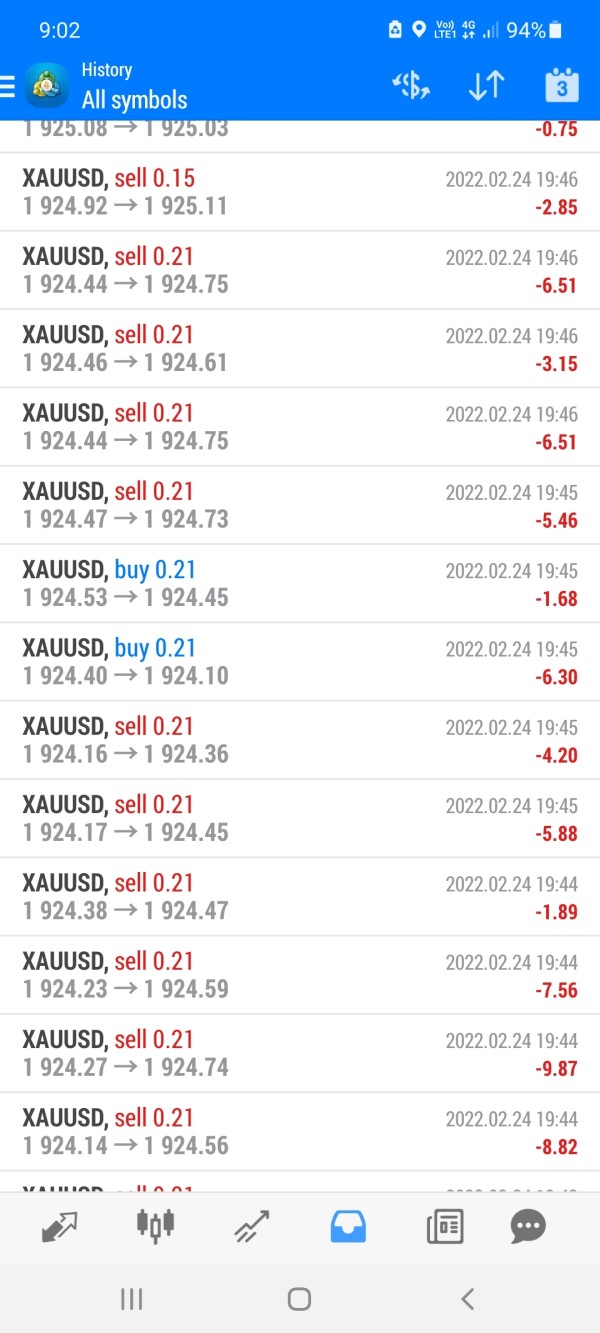

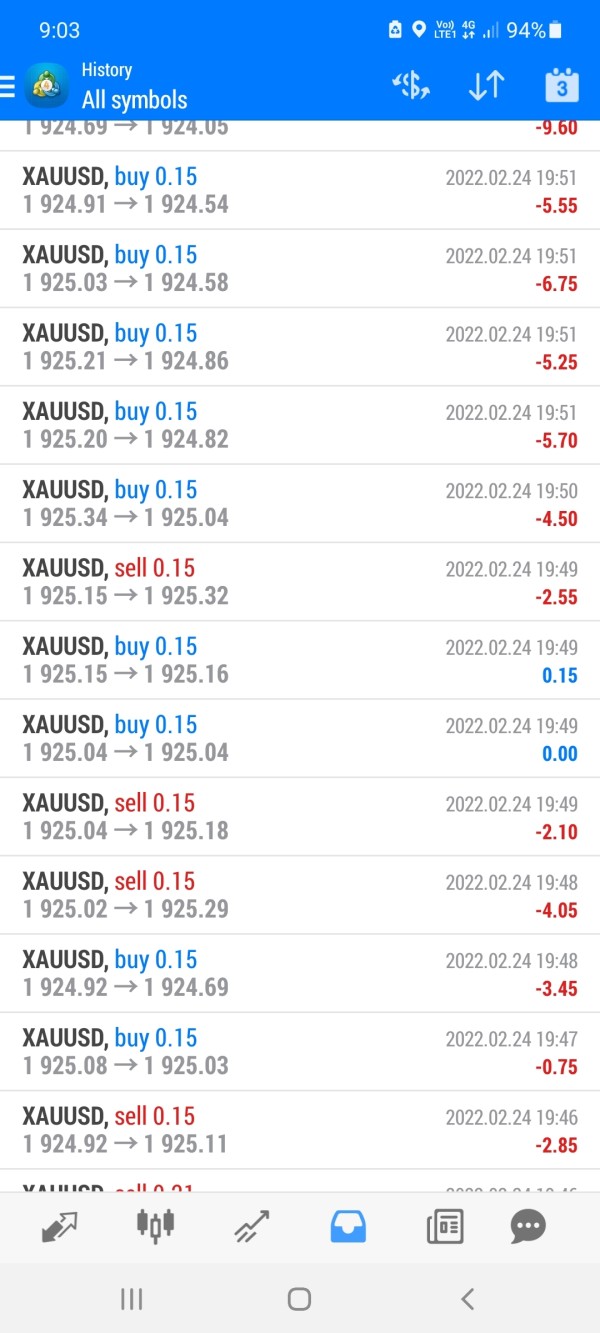

The trading experience at R24 Capital is shaped by both appealing features and notable problems that affect daily trading. On the positive side, the availability of the MetaTrader 4 platform offers traders a familiar and reliable environment with access to standard trading tools and technical indicators that most traders know how to use. The broker's competitive spread starting at 1.8 pips and the option for high leverage are attractive features that can potentially improve trading outcomes for experienced traders who understand the risks. However, these factors are balanced by inconsistent execution speeds and reported instances of slippage or re-quotes during volatile market conditions that can hurt trading performance. User reviews have highlighted that while some traders have enjoyed smooth order execution, others have experienced delays and differences that have negatively impacted their overall trading performance and profitability. Although the MT4 platform is strong, the absence of detailed metrics on order execution quality and liquidity makes it hard to fully assess trading conditions and what traders can expect. This uneven trade execution, combined with the risks associated with unregulated brokers, results in the moderate score of 5/10 for the trading experience category. This section of the r24 capital review clearly indicates that while the platform's underlying technology is sound, the execution practices and market conditions require a more careful approach from potential traders.

5. Trust Factor Analysis

The overall trust factor associated with R24 Capital is very low, which is supported by numerous industry reports and user testimonials from actual traders. The primary concern stems from the broker's unregulated status; R24 Capital operates without the oversight of any respected financial regulatory body, leaving client funds and personal data vulnerable to potential misuse. This absence of regulatory supervision means that there are no enforced safety nets or adherence to standardized disclosure practices, which are typically required by regulatory agencies that protect traders and their investments. Furthermore, multiple reports and user feedback have flagged potential fraudulent activities, with several traders claiming that funds have been mishandled or withheld without proper justification or explanation from the company. The company's unclear operational structure further makes these issues worse, contributing to an overall image that is not only risky but also unreliable for serious traders. Compared to brokers with solid regulatory backing that ensure a higher degree of security through mandatory audits and financial safeguards, R24 Capital fails to meet basic industry standards that protect client interests. As a result, the trust factor score stands at a very low 2/10, which reflects the serious concerns that potential clients should consider. Such significant concerns highlight a crucial warning, as any well-constructed r24 capital review must emphasize the severe risks associated with engaging with an entity that consistently demonstrates low transparency and accountability.

6. User Experience Analysis

User experience with R24 Capital presents a mixed picture that is heavily influenced by the broker's overarching issues of transparency and regulatory shortcomings. On one hand, the ease of registration and access to the MetaTrader 4 platform is recognized by some users who appreciate the straightforward initial setup process. The platform's widespread familiarity does help reduce certain initial hurdles that new traders might face when starting with a new broker. However, complaints from various traders suggest that the overall experience is damaged by problems in customer support, unclear deposit and withdrawal procedures, and a lack of dedicated educational resources or market analysis tools that could help improve trading skills. Many users have expressed frustration over their inability to quickly resolve issues or access clear information, which ultimately impacts their confidence in the trading environment and their willingness to continue using the platform. Furthermore, the high-risk nature of trading with unregulated brokers further harms the experience, as concerns over fund security create an atmosphere of uncertainty that affects daily trading decisions. Combined, these factors result in an overall average score of 5/10 for user experience, which reflects the mixed nature of trader feedback. While some aspects of the interface and platform performance are adequate for basic trading needs, the recurring themes of poor support and informational gaps cast a long shadow on the overall user satisfaction, as emphasized in this r24 capital review.

Conclusion

In summary, R24 Capital stands out as an unregulated broker that presents significant challenges in terms of transparency, regulatory oversight, and customer support. While the broker's appeal lies in its low minimum deposit of $100 and high leverage options up to 1:1000, these features are overshadowed by widespread user complaints and a clear lack of reliability as shown by negative reviews from actual users. This r24 capital review suggests that the broker is best suited for high-risk traders who are willing to overlook regulatory shortcomings in pursuit of potentially profitable trading conditions, though such traders should fully understand the risks involved. Overall, prospective clients should exercise extreme caution before engaging with R24 Capital and consider more regulated alternatives that offer better protection and transparency.