Regarding the legitimacy of PIPWISE forex brokers, it provides MISA and WikiBit, .

Is PIPWISE safe?

Pros

Cons

Is PIPWISE markets regulated?

The regulatory license is the strongest proof.

MISA Forex Trading License (EP)

Mwali International Services Authority

Mwali International Services Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PIPWISE LTD

Effective Date:

2024-05-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.pipwise.comExpiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Pipwise A Scam?

Introduction

Pipwise is a forex broker that has emerged in the competitive landscape of online trading, aiming to cater to both novice and experienced traders. With its promise of a user-friendly platform and a variety of trading instruments, it seeks to position itself as a reliable partner in the forex market. However, the increasing number of unregulated brokers has raised concerns among traders, making it crucial to assess the legitimacy and safety of trading platforms like Pipwise. In this article, we will conduct a thorough investigation into Pipwise, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our evaluation will be based on a combination of qualitative analysis and quantitative data drawn from various credible sources, including user reviews and regulatory databases.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and reliability. A well-regulated broker is subject to stringent oversight, which helps protect traders from fraud and malpractice. In the case of Pipwise, it is essential to examine its regulatory framework to understand the level of protection it offers to its clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | BFX2024116 | Comoros | Offshore Regulation |

Pipwise operates under the regulation of the Comoros International Services Authority (MISA). However, it is important to note that this is considered an offshore regulation, which often lacks the stringent oversight provided by top-tier regulators such as the FCA (UK), ASIC (Australia), or SEC (USA). The absence of a robust regulatory framework raises significant concerns about the broker's legitimacy and compliance history. Traders should be aware that unregulated brokers may engage in practices that put client funds at risk, including the potential for market manipulation and fraudulent activities.

Company Background Investigation

Pipwise was established in 2022 and is registered in Tbilisi, Georgia. The broker claims to have a professional team with over 20 years of experience in the financial markets, catering to a wide range of trading preferences. However, a closer examination reveals a lack of transparency regarding the company's ownership structure and management team.

The absence of detailed information about the management's professional backgrounds and the company's operational history raises red flags. A reputable broker typically provides comprehensive information about its leadership and corporate governance, allowing potential clients to assess the qualifications and integrity of those managing their funds. The limited disclosure by Pipwise may lead to skepticism among traders about the broker's commitment to transparency and ethical practices.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall cost structure, including spreads, commissions, and other fees. Pipwise claims to offer competitive trading costs, but a detailed breakdown is necessary to assess whether these claims hold true.

| Fee Type | Pipwise | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0-2.0 pips |

| Commission Model | None | $5-$10 per lot |

| Overnight Interest Range | Variable | Variable |

Pipwise advertises a spread starting from 1.5 pips on major currency pairs, which is relatively competitive. However, the absence of commissions on standard accounts may indicate a hidden cost structure or higher spreads on less popular pairs. Traders should be cautious of any unusual or opaque fee policies that could erode their profits over time.

Additionally, the broker's variable overnight interest rates can impact trading costs, especially for those who hold positions overnight. Traders should carefully review the terms and conditions associated with overnight financing to avoid unexpected charges.

Customer Funds Security

The safety of customer funds is paramount when choosing a forex broker. Pipwise claims to implement various measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is contingent upon the broker's regulatory oversight.

Pipwise has not provided sufficient information regarding its fund segregation practices or the extent of investor protection available to clients. Without robust regulation, traders may face challenges in recovering their funds in the event of a dispute or insolvency. Historical issues related to fund security, including delayed withdrawals and unresponsive customer service, have been reported by users, further exacerbating concerns about the broker's reliability.

Customer Experience and Complaints

Analyzing customer feedback is essential to gauge the overall satisfaction of users with a broker. In the case of Pipwise, reviews are mixed, with a significant number of complaints highlighting issues related to withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Unresponsive |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Marketing Practices | High | No Clear Response |

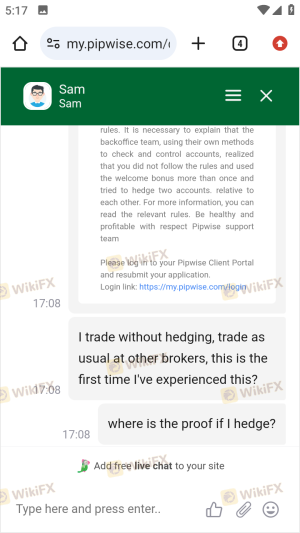

Common complaints include delayed or denied withdrawal requests, which is a significant red flag for any broker. Additionally, users have reported high-pressure sales tactics and misleading promises regarding potential profits. These practices are often indicative of fraudulent brokers aiming to maximize deposits while minimizing withdrawals, further supporting concerns about whether Pipwise is safe.

Platform and Execution

The performance of a trading platform is crucial for ensuring a smooth trading experience. Pipwise offers access to popular trading platforms like MetaTrader 5 (MT5) and cTrader, which are known for their advanced features and user-friendly interfaces. However, the platform's stability and execution quality are also essential factors to consider.

Traders have reported issues with order execution, including slippage and re-quotes, which can adversely affect trading outcomes. Signs of platform manipulation, such as frequent rejections of orders during volatile market conditions, should be closely monitored. A reliable broker should provide transparent execution policies and ensure that traders can execute their strategies without undue interference.

Risk Assessment

Using Pipwise involves several risks that traders should be aware of. The lack of robust regulation, coupled with mixed customer feedback, raises concerns about the overall safety and reliability of the broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under offshore regulation with limited oversight. |

| Financial Risk | Medium | Potential for hidden fees and unfavorable trading conditions. |

| Operational Risk | High | Reports of withdrawal issues and poor customer service. |

To mitigate these risks, traders should consider only depositing funds they can afford to lose and thoroughly research the broker's terms and conditions before engaging in trading activities. Additionally, utilizing a demo account can provide insight into the platform's functionality without risking real capital.

Conclusion and Recommendations

In conclusion, the investigation into Pipwise raises significant concerns about its legitimacy and safety. The lack of robust regulatory oversight, coupled with mixed customer experiences and reports of withdrawal difficulties, suggests that traders should exercise caution when considering this broker. While Pipwise may offer competitive trading conditions, the potential risks associated with unregulated brokers cannot be overlooked.

For traders seeking a reliable and secure trading environment, it is advisable to consider established brokers regulated by top-tier authorities. Brokers such as IG, OANDA, or TD Ameritrade offer a higher level of investor protection and transparency, making them more suitable options for serious investors. Ultimately, the question of is Pipwise safe remains unanswered, and potential clients should proceed with caution.

Is PIPWISE a scam, or is it legit?

The latest exposure and evaluation content of PIPWISE brokers.

PIPWISE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PIPWISE latest industry rating score is 6.04, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.04 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.