Pipwise 2025 Review: Everything You Need to Know

Pipwise, a forex broker established in 2022, has garnered mixed reviews in the trading community. While some users appreciate its user-friendly platforms and responsive customer service, others raise concerns about its regulatory status and high minimum deposit requirements. This review aims to provide a comprehensive overview of Pipwise, highlighting its features, user experiences, and expert opinions.

Note: It is crucial to understand that Pipwise operates under different entities in various jurisdictions, which may impact its regulatory compliance and user experience. This review aims to present a fair and accurate assessment based on the available information.

Rating Overview

How We Rate Brokers: Our evaluations are based on a combination of user feedback, expert analysis, and factual data.

Broker Overview

Founded in 2022, Pipwise is a forex broker registered in Georgia and regulated by the Mwali International Service Authority (MISA) in Comoros, holding license number BF X 2024116. The broker offers trading on various platforms, including MetaTrader 5 (MT5) and cTrader, catering to a diverse range of assets such as forex, commodities, indices, stocks, and cryptocurrencies. However, the broker's regulatory status has raised concerns among potential users, as it operates in offshore jurisdictions.

Detailed Breakdown

Regulatory Jurisdictions

Pipwise is primarily regulated by MISA in Comoros, which is considered an offshore regulatory body. This raises red flags for many traders who prioritize security and regulatory oversight. As per WikiFX, the broker is categorized as offshore regulated with a medium potential risk. Additionally, it is essential to note that clients from the United States, Turkey, and Georgia are restricted from opening accounts.

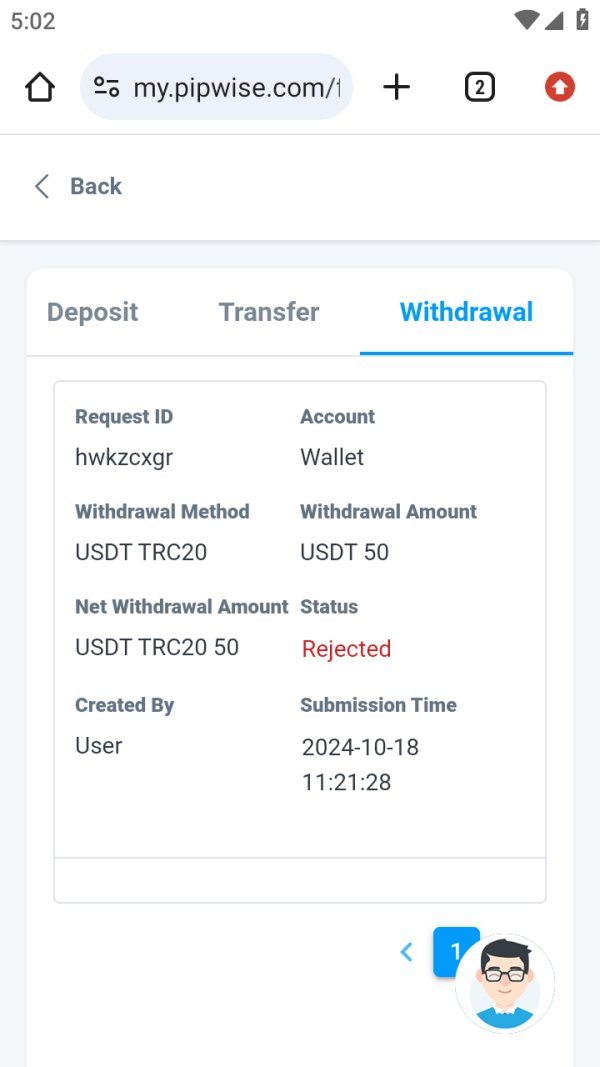

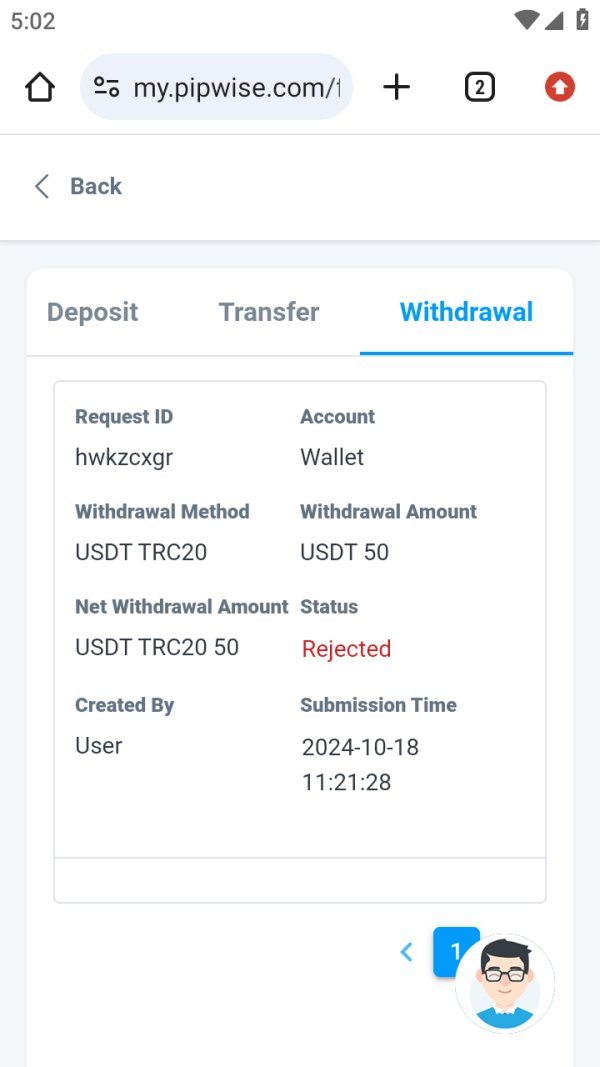

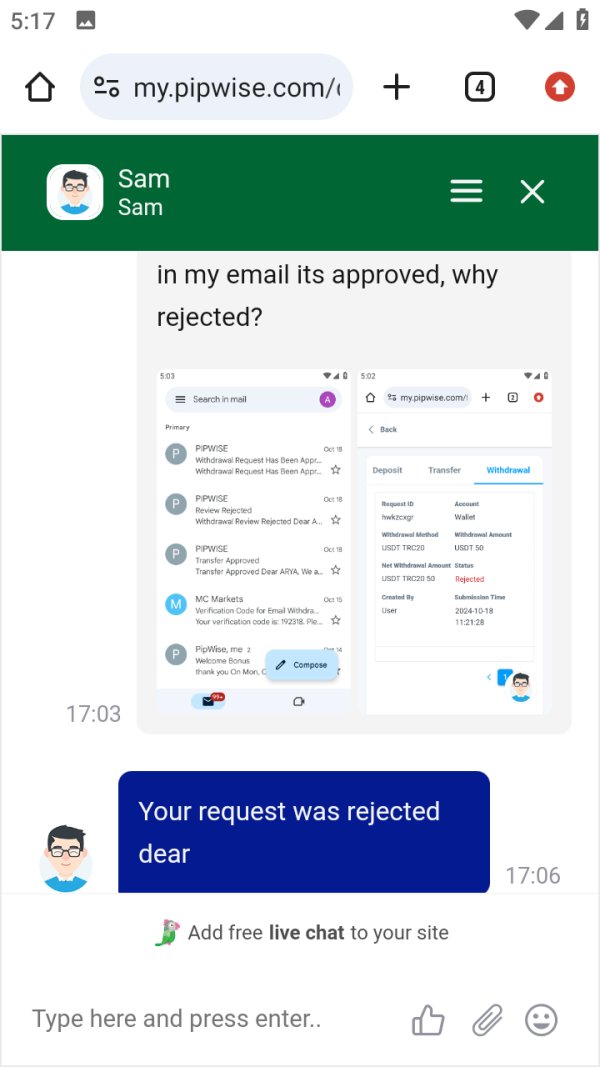

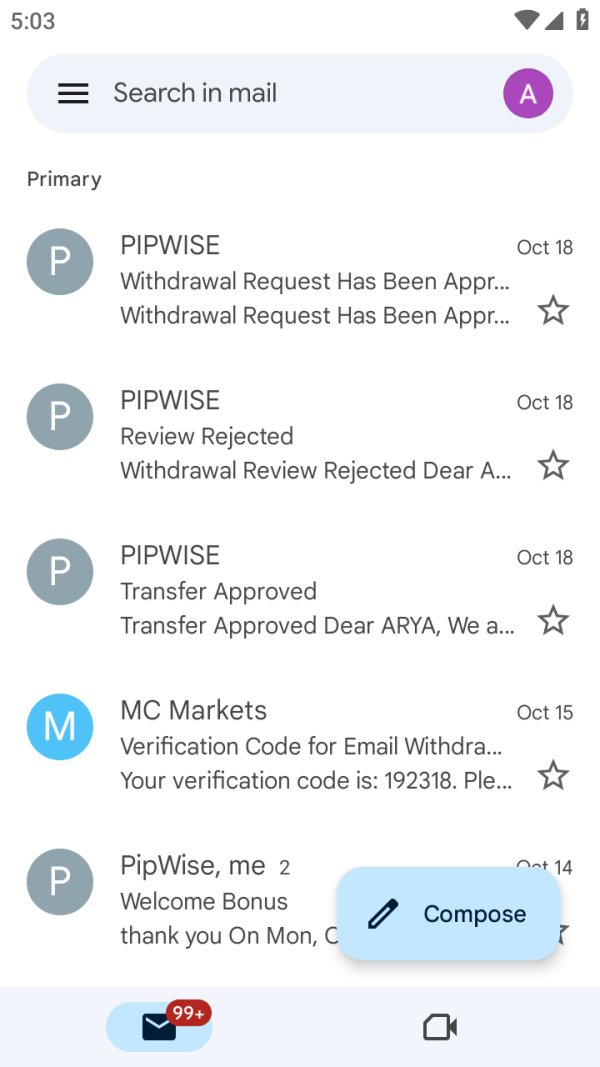

Deposit/Withdrawal Options

Pipwise supports a variety of deposit and withdrawal methods, including traditional options like Visa and Mastercard, as well as cryptocurrencies such as Bitcoin and Ethereum. The minimum deposit requirement varies by account type, with the standard account starting at $50. However, the higher-tier accounts, such as ECN and ECN Pro, require a minimum deposit of $1,000 and $5,000, respectively. Users have reported mixed experiences with withdrawals, with some stating that their requests were processed quickly, while others faced delays and difficulties, leading to concerns about the broker's reliability.

Currently, Pipwise does not prominently advertise any bonuses or promotional offers on its website. This absence may deter potential clients looking for incentives to start trading. However, the broker does offer a demo account, allowing traders to practice their skills without financial risk.

Tradable Asset Classes

Pipwise provides access to a broad range of tradable assets, including forex, energies, indices, commodities, metals, stocks, cryptocurrencies, and bonds. This variety can appeal to traders looking to diversify their portfolios. However, the availability of certain assets may depend on the user's location and regulatory restrictions.

Costs (Spreads, Fees, Commissions)

The cost structure at Pipwise varies significantly across account types. For instance, the standard account has floating spreads starting from 15 pips, while the ECN Pro account offers raw spreads from 1 pip but incurs a commission of $6 per lot. This pricing model may be less favorable for traders who rely on low-cost trading, particularly those using the standard account.

Leverage

Pipwise offers flexible leverage options, with maximum leverage ranging from 1:200 for ECN accounts to 1:1000 for standard accounts. While high leverage can amplify profits, it also increases the risk of significant losses, making it essential for traders to exercise caution.

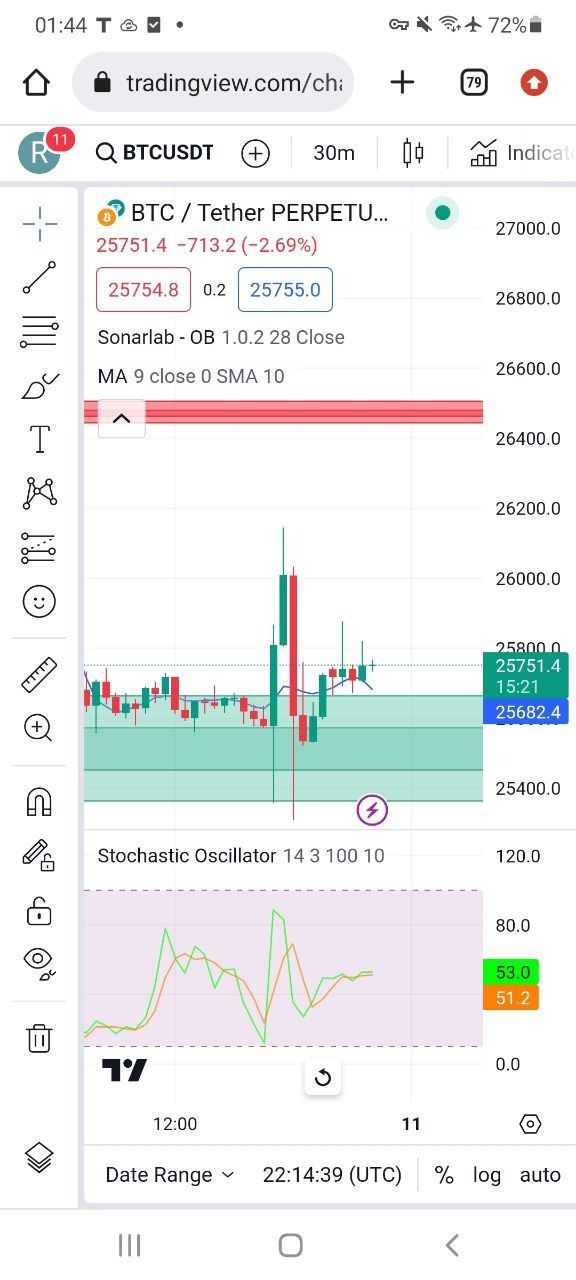

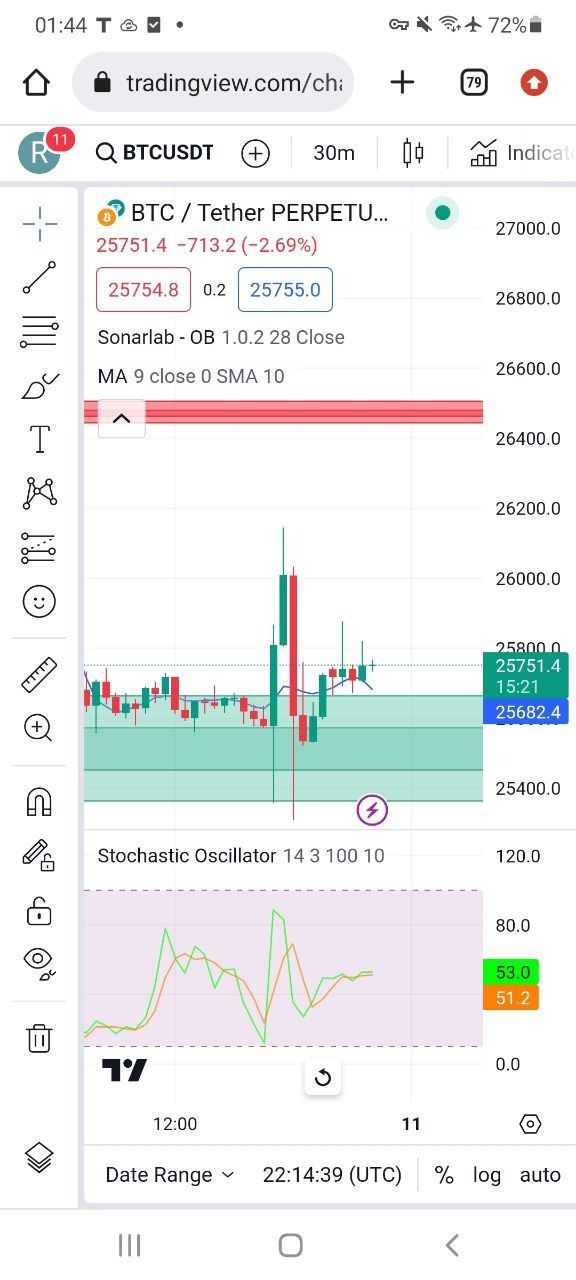

Traders can access Pipwise through MT5 and cTrader, both of which are well-regarded platforms that provide advanced trading tools and features. However, the absence of support for MT4 may be a drawback for traders accustomed to that platform.

Restricted Regions

As mentioned earlier, clients from the United States, Turkey, and Georgia are not permitted to register with Pipwise. This limitation is crucial for potential users to consider before proceeding.

Available Customer Support Languages

Pipwise offers customer support in multiple languages, including English, which is available 24/7 through live chat, WhatsApp, and email. Users have reported positive experiences with the customer service team, highlighting their responsiveness and professionalism.

Repeating Rating Overview

Detailed Analysis

Account Conditions

Pipwise offers various account types, including a standard account with a low minimum deposit of $50. However, higher-tier accounts impose significantly higher minimum deposits, which may limit accessibility for novice traders.

The broker provides a decent range of trading tools and educational resources, particularly on the MT5 and cTrader platforms. These platforms offer advanced charting tools and analytics, which can enhance the trading experience.

Customer Service & Support

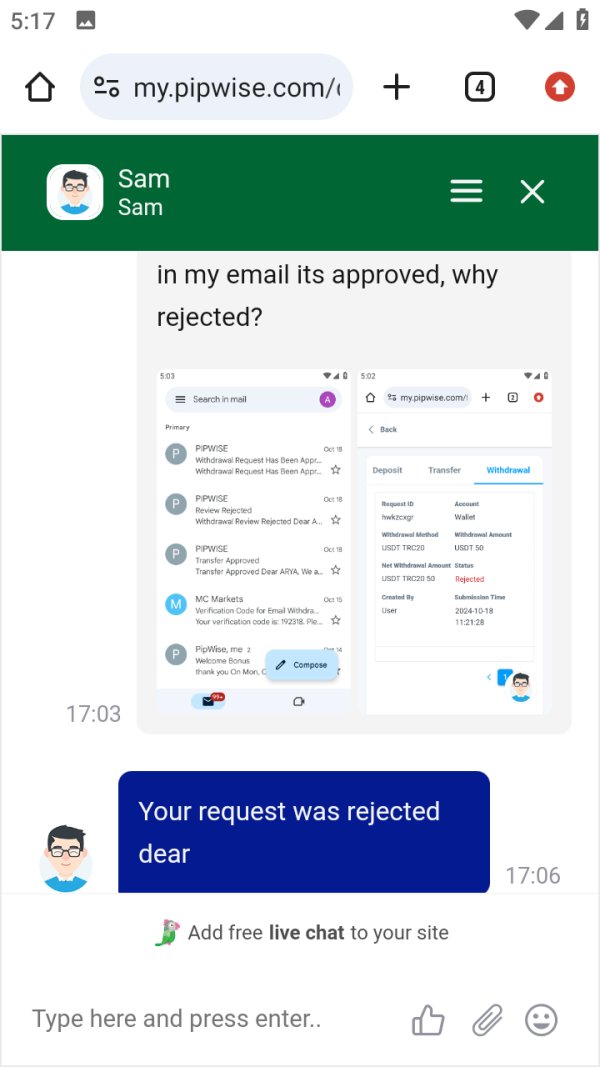

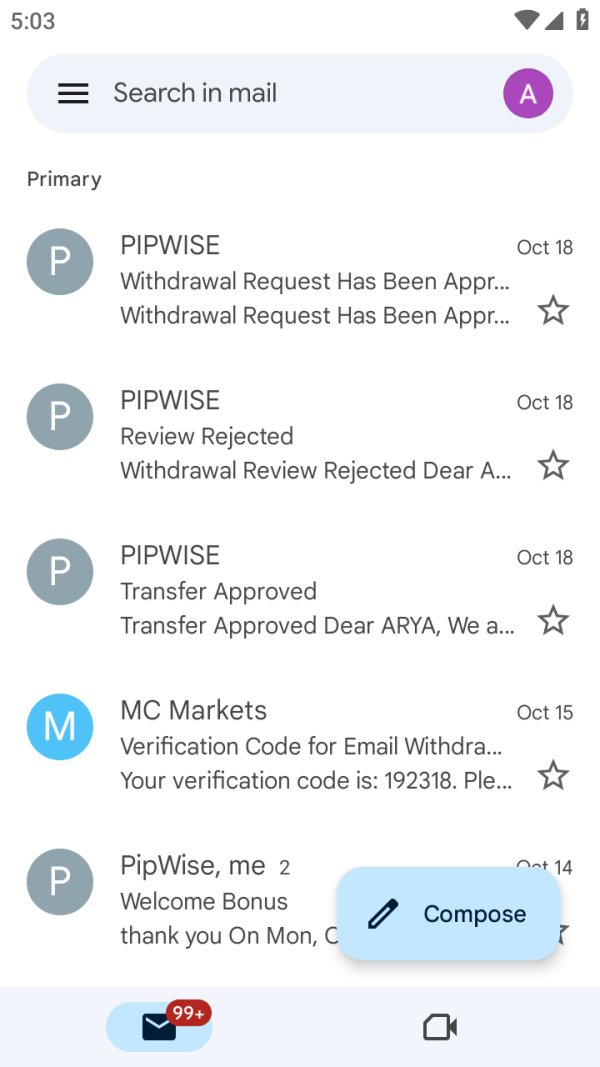

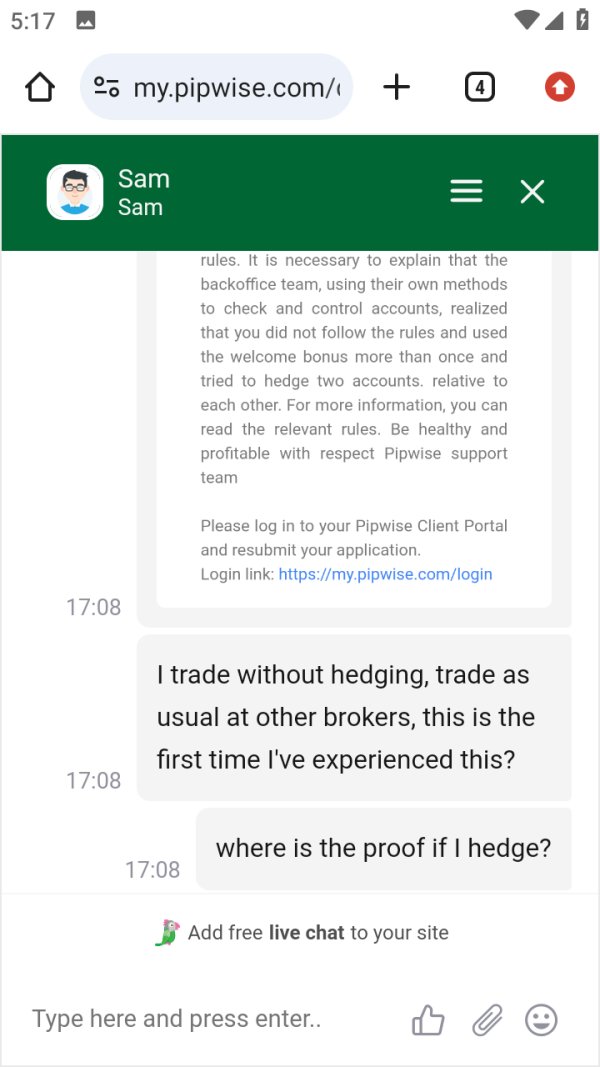

Users have generally praised Pipwise's customer service, noting the availability of support through various channels. However, some users have reported challenges with withdrawal requests, which could impact overall trust.

Trading Experience

While Pipwise offers a user-friendly interface, the trading experience can be hindered by the broker's regulatory status and associated risks. The mixed reviews regarding withdrawal processes further complicate the overall trading experience.

Trustworthiness

Pipwise's offshore regulatory status raises concerns about its trustworthiness. Many users have expressed doubts regarding the broker's legitimacy, with some warning others to avoid it due to potential scams.

User Experience

Overall, user experiences vary significantly. While some users report positive interactions and smooth withdrawals, others have encountered significant issues, leading to a lack of confidence in the broker.

In conclusion, while Pipwise offers a range of trading options and responsive customer service, potential users should carefully consider the broker's regulatory status and mixed reviews before deciding to engage. The findings from this Pipwise review suggest that while it may suit some traders, others may prefer more established and regulated platforms for their trading activities.