Is ORDER safe?

Pros

Cons

Is Order Safe or Scam?

Introduction

Order is a forex broker that has gained attention in the trading community for its services in the foreign exchange market. As trading becomes more accessible to individuals, the need for traders to carefully evaluate their brokers becomes increasingly crucial. The forex market, known for its volatility and potential for significant profit, also attracts unscrupulous entities looking to exploit inexperienced traders. This article aims to provide a comprehensive assessment of Order, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a thorough review of available online resources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a broker is a vital aspect of its legitimacy. A well-regulated broker is typically subject to stringent oversight, ensuring that it adheres to industry standards and protects client interests. For Order, the lack of clear regulatory information raises some concerns.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Not disclosed | N/A | N/A | Not verified |

The absence of a regulatory body overseeing Order suggests potential risks for traders. Regulatory bodies like the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia are known for their rigorous standards. Brokers regulated by such authorities are often required to maintain transparency, segregate client funds, and provide a fair trading environment. The lack of such oversight in Order's case indicates that traders should exercise caution. Historical compliance issues, if any, could further exacerbate the risks associated with trading with this broker.

Company Background Investigation

Understanding the history and ownership structure of a broker can provide insights into its reliability. Order appears to have a relatively short history in the forex market, which may raise questions about its stability and experience. The companys ownership remains unclear, with no publicly available information on its founders or major stakeholders.

The management team's background is also a critical factor in assessing a broker's credibility. A team with extensive experience in finance and trading can indicate a broker's commitment to ethical practices. However, without specific details about Order's management, it is challenging to gauge their expertise.

Furthermore, the level of transparency regarding company operations and information disclosure is a significant concern. A broker that lacks clear communication about its policies, fees, and operational practices may not be trustworthy. In the case of Order, the limited information available raises red flags regarding its transparency and accountability.

Trading Conditions Analysis

The trading conditions offered by a broker, including fees and spreads, play a crucial role in determining its attractiveness to traders. Order's fee structure must be analyzed to understand its competitiveness in the market.

| Fee Type | Order | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 1.5% | 1.0% |

The spreads offered by Order are relatively higher than the industry average, which could erode potential profits for traders. Additionally, any unusual or hidden fees may further complicate the cost structure. Traders should be wary of brokers that impose excessive fees, as these can significantly impact overall trading performance.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. Order's measures for securing client funds must be examined. Key aspects include fund segregation, investor protection policies, and negative balance protection.

Order's approach to fund security is not well-documented, which raises concerns. A reputable broker typically segregates client funds in separate accounts to ensure that traders' money is protected in the event of insolvency. Additionally, investor protection schemes, such as those offered by regulatory bodies, can provide an extra layer of security. The absence of such safeguards at Order could pose significant risks to traders.

Furthermore, any historical issues related to fund security or disputes should be addressed. A broker with a history of financial mismanagement or unresolved complaints may not be a safe choice for traders.

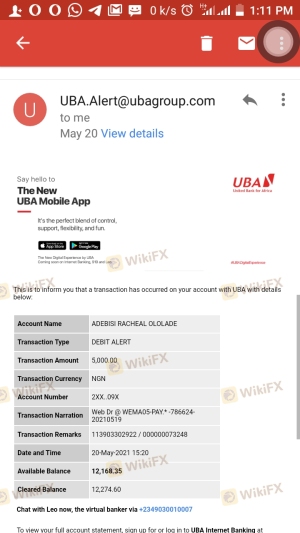

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Analyzing user experiences can reveal common issues and the company's responsiveness to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Fees | Medium | No acknowledgment |

| Poor Customer Service | High | Limited support |

Common complaints about Order include difficulties with fund withdrawals and unresponsive customer service. Such issues can indicate a lack of commitment to customer satisfaction and may suggest underlying operational problems.

Real-life case studies highlight the importance of evaluating customer experiences. For instance, one user reported significant delays in processing withdrawals, raising concerns about the broker's integrity. Another trader expressed frustration over high fees that were not clearly communicated during the account opening process.

Platform and Execution

The performance and stability of a trading platform are critical for a satisfactory trading experience. Order's platform must be evaluated for its usability, stability, and execution quality.

Order's platform may exhibit issues such as slippage and order rejections, which can negatively impact trading outcomes. Traders should be cautious of any indications of platform manipulation, as these can lead to significant financial losses.

Risk Assessment

The overall risk associated with trading with Order must be carefully considered.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation |

| Financial Stability Risk | Medium | Limited company history |

| Customer Service Risk | High | Poor responsiveness |

Traders should be aware of the high regulatory risk associated with Order. The absence of oversight can lead to potential fraud or mismanagement. Additionally, the company's limited history raises concerns about its financial stability.

To mitigate these risks, traders are advised to conduct thorough research, consider using smaller amounts for initial trades, and remain vigilant about any unusual activity.

Conclusion and Recommendations

In conclusion, the investigation into Order reveals several concerning factors that suggest it may not be a safe trading option. The lack of regulatory oversight, unclear company background, and numerous customer complaints raise significant red flags.

Traders should approach Order with caution and consider alternative, well-regulated brokers that offer transparent trading conditions and a proven track record of customer satisfaction. Options such as brokers regulated by the FCA or ASIC may provide a safer trading environment. Overall, it is crucial for traders to prioritize safety and do their due diligence before committing funds to any broker.

Is ORDER a scam, or is it legit?

The latest exposure and evaluation content of ORDER brokers.

ORDER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ORDER latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.