Is Metadoro safe?

Pros

Cons

Is Metadoro A Scam?

Introduction

Metadoro is a forex and CFD broker that has emerged in the trading landscape, claiming to offer a wide range of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies. Positioned as an online trading platform, Metadoro aims to attract both novice and experienced traders with promises of competitive trading conditions and advanced technology. However, in the ever-evolving world of forex trading, it is crucial for traders to exercise caution and thoroughly evaluate any broker before committing their funds. This article investigates whether Metadoro is a reliable trading partner or if it raises red flags that suggest it may be a scam. Our evaluation is based on a comprehensive analysis of regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment is a fundamental aspect of any broker's legitimacy. Metadoro claims to be regulated by the Financial Services Commission (FSC) of Mauritius. While the FSC provides a legal framework for brokers operating in the region, it's essential to understand the implications of this regulation. Mauritius is considered a tier-3 regulatory jurisdiction, which means it imposes fewer requirements on brokers compared to more stringent regulatory bodies like the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | C115015381 | Mauritius | Active |

Despite holding a license, the FSC does not offer the same level of investor protection as higher-tier regulators. For instance, there are no mandatory compensation schemes or requirements for segregated accounts, which means that traders' funds may not be adequately protected in the event of broker insolvency. Furthermore, Metadoro has been blacklisted by the Ukrainian National Securities and Stock Market Commission (NSMC) due to numerous complaints regarding its operations, casting further doubt on its credibility. Thus, while Metadoro is technically regulated, the quality of that regulation is questionable and raises concerns about its legitimacy. In light of these factors, it is prudent for traders to ask, "Is Metadoro safe?"

Company Background Investigation

Metadoro operates under the ownership of RHC Investments, a company registered in Mauritius. Established in 2019, the broker claims to provide a comprehensive trading platform, but its history is marred by a lack of transparency regarding its ownership structure and management team. The absence of publicly available information about the individuals behind Metadoro raises significant concerns regarding accountability and trustworthiness.

Furthermore, the company's operational history is relatively short, which may indicate a lack of experience in the highly competitive forex market. Traders are advised to thoroughly investigate the background of any broker they consider, as a well-established company typically has a proven track record of compliance and customer satisfaction. The opacity surrounding Metadoro's ownership and management raises questions about its commitment to ethical trading practices. Therefore, potential clients must consider whether they can trust a broker with such limited transparency. This leads to the important question: Is Metadoro safe for traders looking to invest their hard-earned money?

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its reliability. Metadoro advertises competitive trading conditions, including leverage of up to 1:500, tight spreads, and various account types. However, it's essential to scrutinize these claims in detail.

| Fee Type | Metadoro | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Structure | $4 per lot | $10 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads appear favorable, the commission structure raises concerns. A commission of $4 per lot may seem attractive at first glance, but it could also indicate hidden costs that are not immediately apparent. Additionally, Metadoro's terms suggest that they reserve the right to impose various fees at their discretion, which is a common tactic used by less scrupulous brokers to extract additional funds from their clients.

Moreover, the broker has been reported to impose inactivity fees, which can accumulate quickly if an account remains dormant. Such practices can be indicative of a broker that prioritizes profit over customer service. Therefore, potential traders should carefully evaluate these trading conditions and consider whether they align with their trading strategies. Given these factors, one must ponder, "Is Metadoro safe for long-term trading?"

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. Metadoro claims to implement security measures to protect traders' investments; however, the effectiveness of these measures is questionable. The broker does not provide clear information regarding the segregation of client funds, which is crucial for ensuring that traders' money is kept separate from the broker's operational funds.

Additionally, the lack of a compensation scheme means that traders have no recourse in the event of broker insolvency. This absence of investor protection is a significant concern, particularly for those trading large sums of money. Historical complaints against Metadoro also point to potential issues with fund withdrawals, with many users reporting difficulties in accessing their funds after making deposits.

Given these factors, traders must carefully consider the implications of trading with a broker like Metadoro. The question remains: Is Metadoro safe for traders who prioritize the security of their investments?

Customer Experience and Complaints

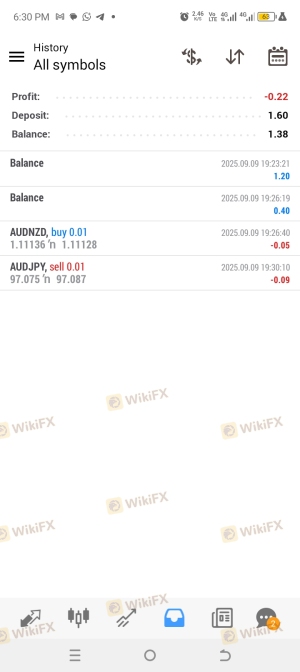

Customer feedback is a critical component of evaluating a broker's reliability. Reviews of Metadoro reveal a mixed bag of experiences, with numerous complaints highlighting issues such as withdrawal problems, unresponsive customer support, and aggressive sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Misleading Promotions | High | None |

Many users have reported that once they deposit funds, communication from the broker diminishes significantly, leading to frustration and distrust. Additionally, the aggressive marketing tactics employed by Metadoro, including persistent calls and emails urging traders to deposit more funds, are red flags that should not be ignored.

In some cases, traders have shared stories of being misled about the potential for profits, only to find themselves unable to withdraw their funds when they sought to do so. These experiences raise serious concerns about the integrity of Metadoro's operations. As such, it is essential for potential clients to ask themselves, "Is Metadoro safe based on the experiences of current and former users?"

Platform and Execution

The trading platform is a critical aspect of any trading experience. Metadoro claims to offer both MetaTrader 4 and MetaTrader 5, which are widely regarded as industry-leading platforms. However, the performance and reliability of these platforms are paramount. Users have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

Moreover, the potential for platform manipulation raises concerns, especially given the broker's lack of transparency regarding its operations. Traders should be wary of any signs of manipulation, as these can be indicative of a broker that is not operating in good faith. With these factors in mind, traders must carefully consider whether they can trust Metadoro's platform for their trading activities. The overarching question remains: Is Metadoro safe for executing trades without fear of manipulation?

Risk Assessment

Engaging with any forex broker carries inherent risks, and Metadoro is no exception. A comprehensive risk assessment reveals several areas of concern that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Tier-3 regulation with limited oversight. |

| Fund Security Risk | High | Lack of segregation and compensation schemes. |

| Customer Service Risk | Medium | Reports of poor communication and support. |

| Execution Risk | Medium | Issues with slippage and rejected orders. |

Given these risks, it is essential for traders to implement strategies to mitigate potential losses. For example, using risk management tools such as stop-loss orders can help protect against significant losses. Additionally, traders should consider diversifying their investments across multiple brokers to reduce exposure to any single entity. Ultimately, the question is whether the potential rewards outweigh the risks associated with trading with Metadoro. Is Metadoro safe enough to warrant such risks?

Conclusion and Recommendations

In conclusion, while Metadoro presents itself as a legitimate trading platform, a thorough analysis reveals several concerning factors that suggest it may not be a safe choice for traders. The broker's tier-3 regulation, lack of investor protection, and numerous complaints regarding customer service and fund withdrawals raise significant red flags.

For traders who prioritize security and reliability, it may be advisable to seek alternative brokers that are regulated by tier-1 authorities, which offer better protections for client funds. Brokers such as FCA-regulated firms or ASIC-licensed entities provide a higher level of assurance for traders.

Ultimately, the question remains: Is Metadoro safe for traders? Based on the evidence gathered, it is prudent for potential clients to exercise caution and consider their options carefully before engaging with this broker.

Is Metadoro a scam, or is it legit?

The latest exposure and evaluation content of Metadoro brokers.

Metadoro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Metadoro latest industry rating score is 2.18, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.18 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.