Is Lotus International safe?

Pros

Cons

Is Lotus International Safe or Scam?

Introduction

Lotus International is an online trading broker that positions itself within the forex market, claiming to offer a variety of trading instruments, including forex, CFDs, and commodities. As the forex market continues to grow, attracting both seasoned traders and newcomers, it becomes increasingly crucial for traders to carefully evaluate the legitimacy and safety of their chosen brokers. The potential for scams and fraudulent activities in the trading industry is high, making it essential for traders to conduct thorough research before making any financial commitments. This article aims to assess whether Lotus International is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory landscape is a significant factor in determining the safety and legitimacy of any trading broker. Regulatory authorities enforce strict guidelines to protect traders and ensure fair trading practices. In the case of Lotus International, the broker claims to be registered with the National Futures Association (NFA) and provides a license number. However, upon further investigation, it becomes clear that Lotus International is not a member of the NFA, which means it operates without any regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0541105 | USA | Not a member |

The absence of proper regulation raises significant concerns regarding the safety of funds and the broker's accountability. Unregulated brokers like Lotus International pose a considerable risk to traders, as they are not subject to any governmental oversight, which means they can operate unchecked. This lack of regulation allows for potential misuse of client funds, making it imperative for traders to exercise caution when considering this broker.

Company Background Investigation

Lotus International claims to have a rich history and experience in the trading industry, yet concrete information regarding its ownership structure and management team remains elusive. The company's website lacks transparency, failing to provide essential details about its founders or key personnel. This anonymity raises red flags about the broker's credibility and trustworthiness. A transparent broker typically shares information about its management team, including their qualifications and experience in the financial markets.

Furthermore, the lack of clear company registration details and physical addresses adds to the uncertainty surrounding Lotus International. Without verifiable information about the company's operations and history, traders are left with little assurance regarding the safety of their investments. The opacity surrounding the broker's operations is a significant factor that contributes to the perception of Lotus International being potentially unsafe.

Trading Conditions Analysis

When evaluating the trading conditions offered by Lotus International, it is crucial to assess the overall fee structure and any unusual cost policies. The broker advertises a minimum deposit requirement of $100, which is relatively standard in the industry. However, the absence of detailed information regarding spreads, commissions, and overnight interest rates creates ambiguity around the actual trading costs.

| Fee Type | Lotus International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.3 pips | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The spread of 2.3 pips for major currency pairs is notably higher than the industry average, indicating that traders may incur higher trading costs than they would with more reputable brokers. Additionally, the lack of transparency regarding commissions and overnight fees raises concerns about potential hidden costs that could affect profitability. These unfavorable trading conditions further suggest that traders should approach Lotus International with caution, as they may not be getting the best value for their trades.

Client Fund Security

The safety of client funds is a paramount concern for any trader, and Lotus International's measures in this regard are questionable. The broker does not provide information about client fund segregation, which is a critical practice that protects traders' investments by keeping their funds in separate accounts from the broker's operational funds. Additionally, there is no mention of negative balance protection, which would prevent traders from losing more than their initial investment.

The absence of these safety measures indicates that the funds deposited with Lotus International may not be secure. Furthermore, there have been no documented cases of compensation schemes for clients, which are typically offered by regulated brokers to protect traders in the event of insolvency. The lack of historical data on fund safety issues or disputes only adds to the uncertainty surrounding the broker's reliability.

Customer Experience and Complaints

An essential aspect of evaluating any broker is analyzing customer feedback and experiences. Numerous reviews and complaints regarding Lotus International indicate a pattern of dissatisfaction among clients. Common complaints include difficulties in withdrawing funds, high-pressure tactics to deposit more money, and a lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High-Pressure Sales Tactics | Medium | Poor |

| Customer Support Availability | High | Poor |

One notable case involved a trader who reported being unable to withdraw their funds after multiple attempts, leading to frustration and financial loss. Another trader highlighted aggressive follow-up calls urging them to invest more, raising concerns about the broker's ethical practices. These complaints suggest a troubling trend in customer experiences, further reinforcing the notion that Lotus International may not be a safe trading environment.

Platform and Trade Execution

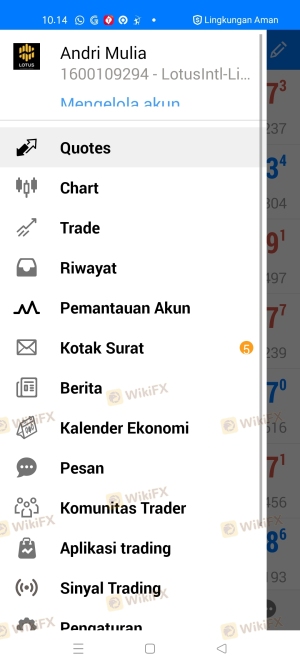

The trading platform offered by Lotus International is a significant factor in the overall trading experience. The broker claims to provide access to MetaTrader 4, a widely recognized trading platform known for its robust features and user-friendly interface. However, user reviews indicate that the platform's performance may not meet expectations, with reports of slippage and order rejections.

Traders have expressed concerns about the quality of order execution, citing instances of significant slippage during volatile market conditions. Such issues can adversely affect trading outcomes, particularly for those employing scalping or day trading strategies. Additionally, any signs of platform manipulation could indicate a lack of integrity in the broker's operations, further questioning the safety of trading with Lotus International.

Risk Assessment

Using Lotus International comes with inherent risks that traders must consider before engaging with the broker. The absence of regulation, high trading costs, and negative customer experiences contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, leading to potential fund mismanagement. |

| Financial Risk | High | High trading costs and unclear fee structures may erode profits. |

| Operational Risk | Medium | Platform issues and poor customer service may hinder trading effectiveness. |

To mitigate these risks, traders should consider diversifying their investments and exploring alternative brokers that offer better regulatory protection and more transparent trading conditions.

Conclusion and Recommendations

In conclusion, the investigation into Lotus International raises significant concerns about its safety as a trading broker. The lack of regulation, questionable trading conditions, and negative customer experiences suggest that traders should exercise extreme caution when considering this broker. There are evident signs of potential scams, including high-pressure tactics and difficulties in fund withdrawals, which further indicate that Lotus International may not be a safe choice for traders.

For those seeking reliable trading options, it is advisable to explore regulated brokers with a proven track record of client satisfaction and transparency. Brokers regulated by authorities such as the FCA, ASIC, or CySEC typically offer greater security and better trading conditions. In light of the findings, it is clear that Lotus International is not safe; thus, potential investors should prioritize their financial safety by opting for more reputable alternatives.

Is Lotus International a scam, or is it legit?

The latest exposure and evaluation content of Lotus International brokers.

Lotus International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Lotus International latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.