Lotus International 2025 Review: Everything You Need to Know

Executive Summary

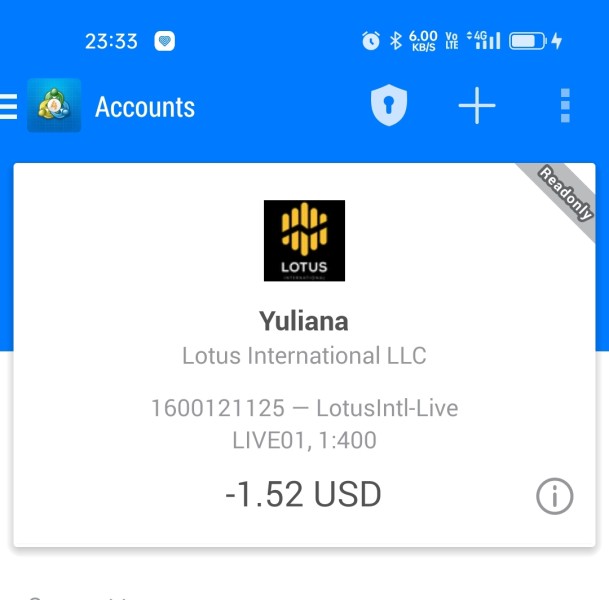

This comprehensive lotus international review examines a brokerage firm that operates in the forex and CFD trading space with significant regulatory concerns. Lotus International LLC presents itself as a forex and CFD broker offering trading services through MT4 and MT Mobile platforms, enabling users to trade forex currency pairs, commodities, indices, and stock CFDs. However, potential investors should exercise extreme caution as the company is registered in Belize and operates without proper regulatory oversight. This raises substantial red flags about its legitimacy and safety.

The broker's target audience consists primarily of forex and CFD traders seeking access to international markets. The lack of regulatory protection makes it unsuitable for most serious investors. With limited transparency regarding account conditions, trading costs, and operational procedures, Lotus International fails to meet the standards expected from reputable brokers in today's competitive marketplace.

Important Notice

Risk Warning: Lotus International is registered in Belize and operates without regulatory supervision from recognized financial authorities. This unregulated status presents significant risks to potential investors, including the possibility of fraudulent activities and lack of investor protection. Cross-regional regulatory differences mean that traders may have limited recourse in case of disputes or financial losses.

This review is based on available public information and has not been verified through direct testing or user verification processes. Potential clients should conduct their own due diligence before engaging with this broker.

Rating Overview

Broker Overview

Lotus International LLC positions itself as a forex and CFD brokerage firm. Specific details about its establishment date and founding history remain unclear in publicly available information. The company operates primarily in the foreign exchange and contracts for difference trading sectors, targeting individual retail traders seeking access to global financial markets.

The broker's business model focuses on providing electronic trading access to various financial instruments. The exact nature of its market-making or STP operations has not been clearly disclosed. This lack of transparency regarding operational structure is concerning for potential clients who need to understand how their orders are processed and executed.

lotus international review findings indicate that the company offers trading services through established platforms, specifically MetaTrader 4 and MT Mobile applications. These platforms provide access to forex currency pairs, commodities, indices, and stock CFDs, covering the major asset classes that most retail traders seek. However, the broker's registration in Belize without proper regulatory oversight significantly undermines its credibility. This raises questions about client fund protection and operational transparency.

Regulatory Status: Lotus International operates from Belize registration without oversight from recognized financial regulators such as FCA, CySEC, or ASIC. This unregulated status means clients lack standard investor protections and dispute resolution mechanisms available with properly licensed brokers.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees has not been disclosed in available materials. This creates uncertainty for potential clients about transaction procedures.

Minimum Deposit Requirements: The broker has not publicly specified minimum deposit amounts for different account types. This makes it difficult for traders to plan their initial investment.

Promotional Offers: No information about welcome bonuses, trading incentives, or promotional programs has been identified in available sources.

Tradeable Assets: The platform supports forex currency pairs across major, minor, and exotic categories, along with commodities, stock indices, and individual stock CFDs. This provides reasonable market coverage for retail traders.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This prevents accurate cost comparison with competing brokers.

Leverage Ratios: Maximum leverage levels and margin requirements have not been specified in available materials.

Platform Options: MT4 and MT Mobile platforms are available. They offer standard charting tools and order management capabilities.

Geographic Restrictions: Specific country limitations and compliance requirements have not been clearly outlined.

Customer Support Languages: Available support languages and communication channels remain unspecified in accessible information.

This lotus international review reveals significant information gaps that potential clients should consider carefully before proceeding.

Account Conditions Analysis

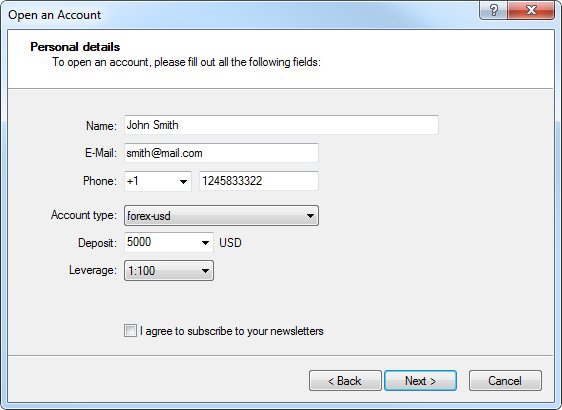

The evaluation of Lotus International's account offerings reveals substantial transparency issues that raise concerns about the broker's operational standards. Available information does not specify the types of accounts offered, whether standard retail accounts, professional accounts, or Islamic accounts are available. This leaves potential clients without essential details needed for informed decision-making.

Minimum deposit requirements across different account tiers remain undisclosed. This prevents traders from understanding the financial commitment required to begin trading. This lack of transparency extends to account features, benefits, and restrictions that typically differentiate various account levels at reputable brokers.

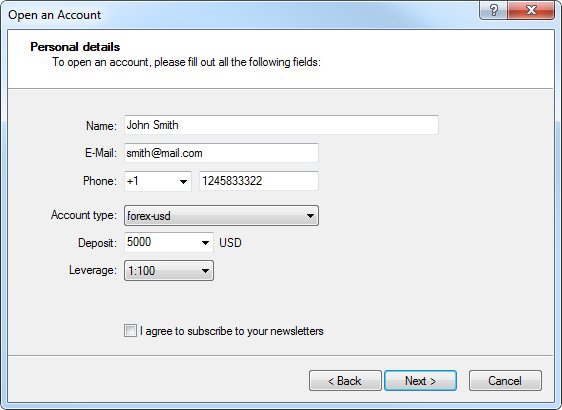

The account opening process, including required documentation, verification procedures, and approval timeframes, has not been detailed in available materials. Without clear information about KYC requirements and onboarding procedures, potential clients cannot assess the convenience and security of the registration process.

Special account features such as Islamic accounts for Muslim traders, managed accounts, or institutional services have not been mentioned in accessible sources. This absence of information suggests either limited service variety or poor communication about available options.

The lotus international review of account conditions highlights the broker's failure to provide basic transparency expected from legitimate financial service providers. This contributes to concerns about its overall credibility and professionalism.

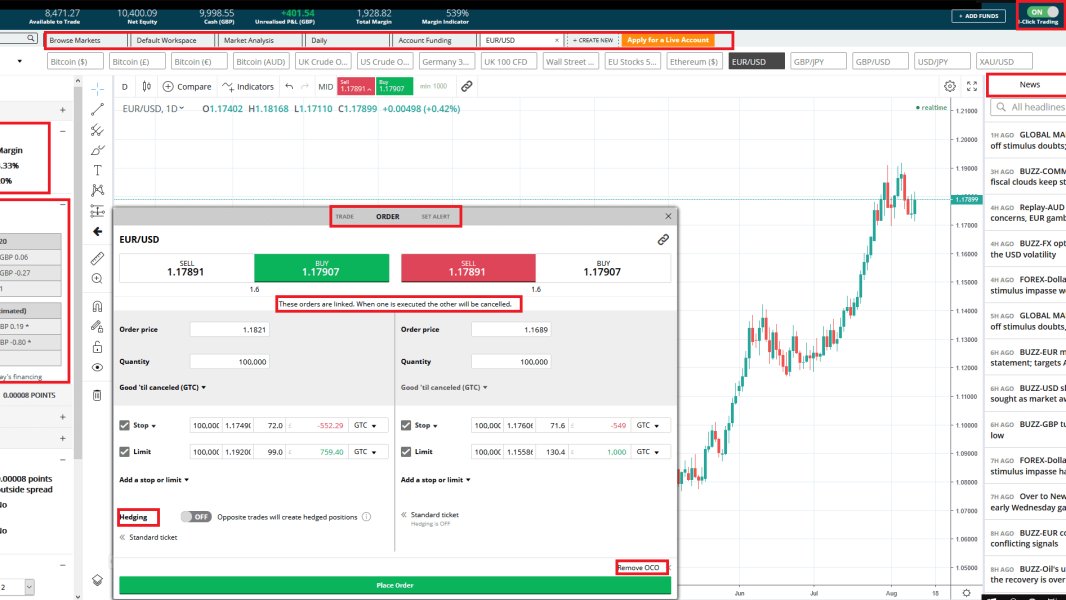

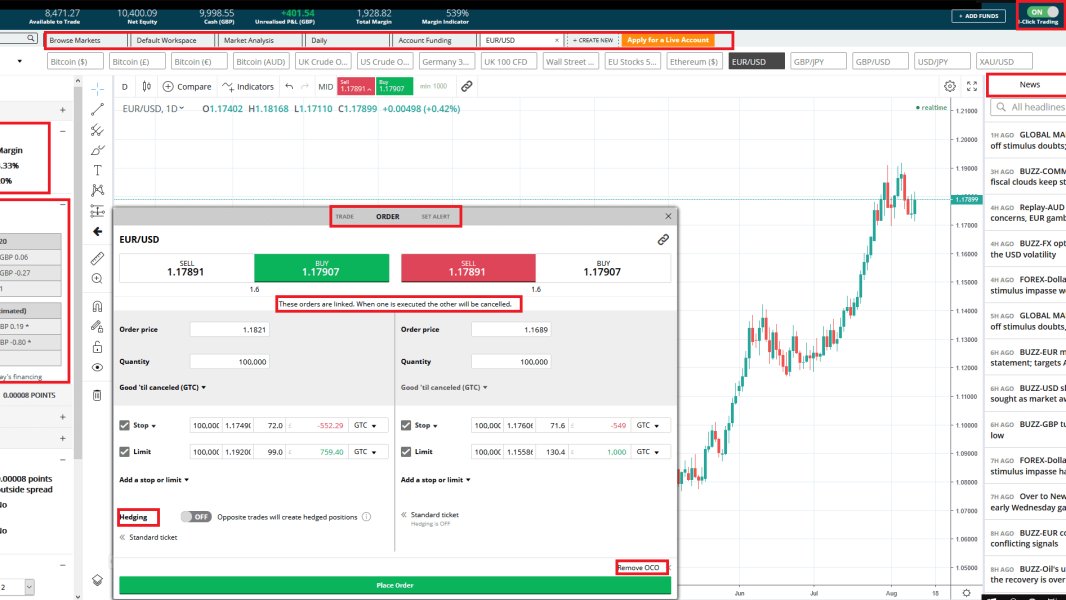

Lotus International's technology offering centers around the widely-used MetaTrader 4 platform alongside MT Mobile for smartphone trading. MT4 provides standard charting capabilities, technical indicators, and automated trading support through Expert Advisors, meeting basic requirements for most retail traders. The platform's stability and execution quality, however, remain unverified through independent testing.

The mobile trading solution through MT Mobile allows traders to monitor positions and execute trades while away from desktop computers. Specific features and performance characteristics have not been detailed in available information. Mobile platform functionality, including advanced order types and charting tools, requires verification through actual usage.

Research and market analysis resources appear limited based on available information. No mention of daily market commentary, economic calendars, trading signals, or fundamental analysis has been identified. This suggests potential deficiencies in supporting traders' decision-making processes.

Educational resources for new and experienced traders have not been documented in accessible materials. The absence of webinars, tutorials, trading guides, or market education indicates potential gaps in client support and development services.

Automated trading capabilities through MT4's Expert Advisor functionality should theoretically be available. Specific support for algorithmic trading, backtesting facilities, or strategy development tools has not been confirmed. Without proper documentation and support, traders may face challenges implementing automated strategies effectively.

Customer Service and Support Analysis

Customer service quality and availability represent critical factors in broker selection, yet Lotus International provides insufficient information about its support infrastructure. Available communication channels, including phone, email, live chat, or ticket systems, have not been clearly documented in accessible sources.

Response times for different inquiry types and support request priorities remain unspecified. This prevents potential clients from understanding service level expectations. Without clear service standards, traders cannot assess whether urgent trading issues or account problems will receive timely attention.

The professional competency of support staff, including their trading knowledge and problem-solving capabilities, cannot be evaluated based on available information. Language support options for international clients have also not been disclosed. This potentially limits accessibility for non-English speakers.

Operating hours for customer support, including weekend and holiday availability, remain unclear. Given the 24-hour nature of forex markets, traders need assurance that technical issues or account problems can be addressed outside standard business hours.

User feedback regarding support quality and responsiveness has not been documented in available sources. This makes it impossible to assess real-world service experiences. The absence of customer testimonials or service reviews raises questions about client satisfaction levels.

Without transparent information about support procedures, escalation processes, or complaint resolution mechanisms, potential clients face uncertainty about assistance availability when needed most during trading operations.

Trading Experience Analysis

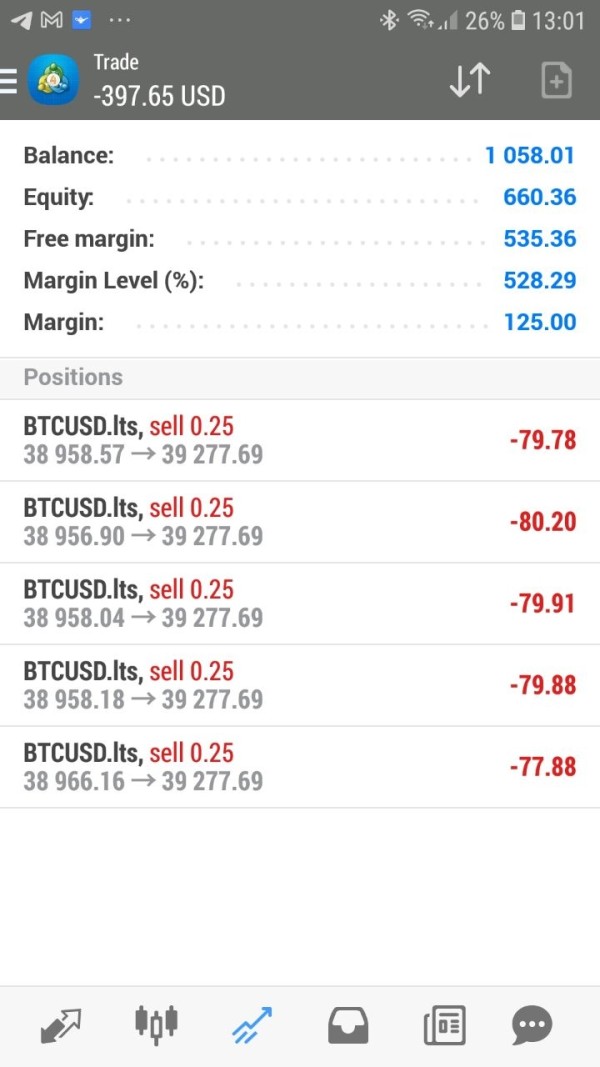

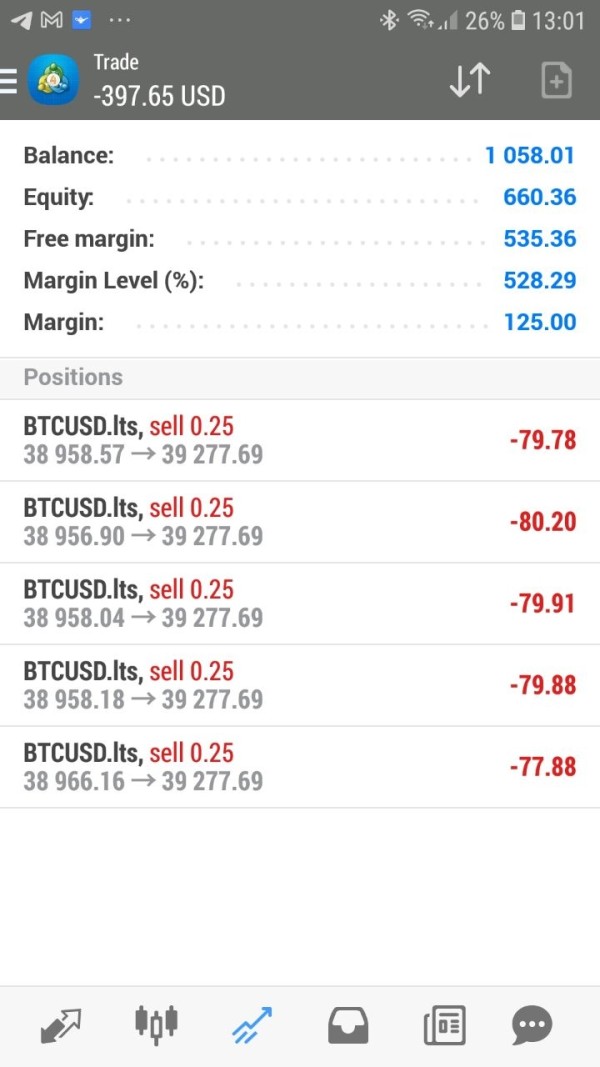

The trading experience evaluation for Lotus International faces significant limitations due to insufficient performance data and user feedback. Platform stability, a crucial factor for successful trading, cannot be properly assessed without independent testing results or verified user reports about system reliability during high-volatility periods.

Order execution quality, including fill rates, slippage levels, and rejection frequencies, remains undocumented in available sources. Without this critical information, traders cannot evaluate whether their orders will be processed efficiently at requested prices. This is particularly important during fast-moving market conditions.

The completeness of platform functionality through MT4 and MT Mobile requires verification through actual usage. While these platforms offer standard features, the broker's implementation quality, server stability, and data feed accuracy need independent confirmation to ensure reliable trading operations.

Mobile trading experience through MT Mobile depends heavily on the broker's technical infrastructure and connection quality. Specific performance metrics, including order execution speed and platform responsiveness on mobile devices, have not been documented in accessible materials.

Trading environment factors such as spread consistency, liquidity provision, and price feed quality remain unverified. Without transparent information about market conditions and execution policies, traders face uncertainty about actual trading costs and market access quality.

User experience feedback regarding platform performance, execution quality, and overall trading satisfaction has not been documented. This prevents assessment of real-world trading conditions and client satisfaction levels.

Trust and Safety Analysis

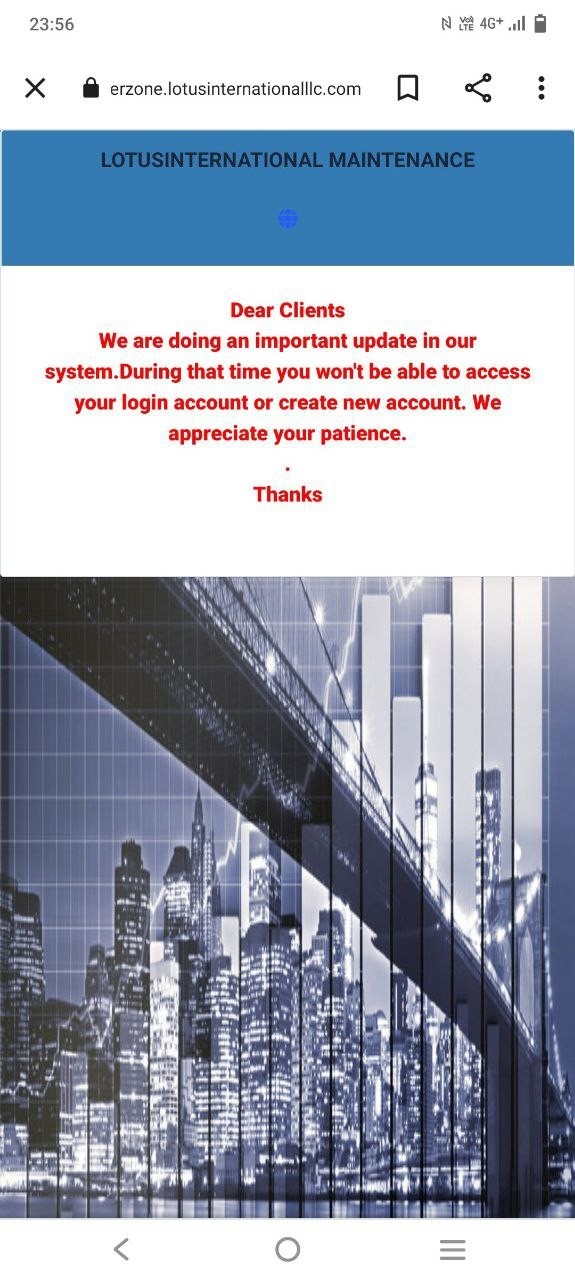

The trust and safety evaluation of Lotus International reveals serious concerns that potential clients must carefully consider. The broker's unregulated status represents the most significant risk factor, as registration in Belize without oversight from recognized financial authorities provides minimal investor protection compared to properly licensed brokers.

Client fund security measures, including segregated accounts, deposit insurance, or third-party custody arrangements, have not been disclosed in available materials. This lack of transparency about fund protection mechanisms raises substantial concerns about capital safety and recovery options in case of operational difficulties.

Corporate transparency regarding company ownership, management structure, and financial reporting appears limited based on accessible information. Without clear disclosure about company leadership and financial stability, clients cannot assess the organization's credibility and long-term viability.

Industry reputation and recognition through awards, certifications, or professional associations have not been documented in available sources. The absence of third-party validation or industry acknowledgment suggests limited standing within the financial services community.

Negative incident handling, including regulatory actions, client complaints, or operational issues, cannot be evaluated due to insufficient public information. The lack of transparent reporting about challenges or regulatory concerns prevents proper risk assessment.

According to available information, the broker's registration in Belize without proper regulatory oversight significantly undermines its trustworthiness and safety profile compared to properly licensed alternatives.

User Experience Analysis

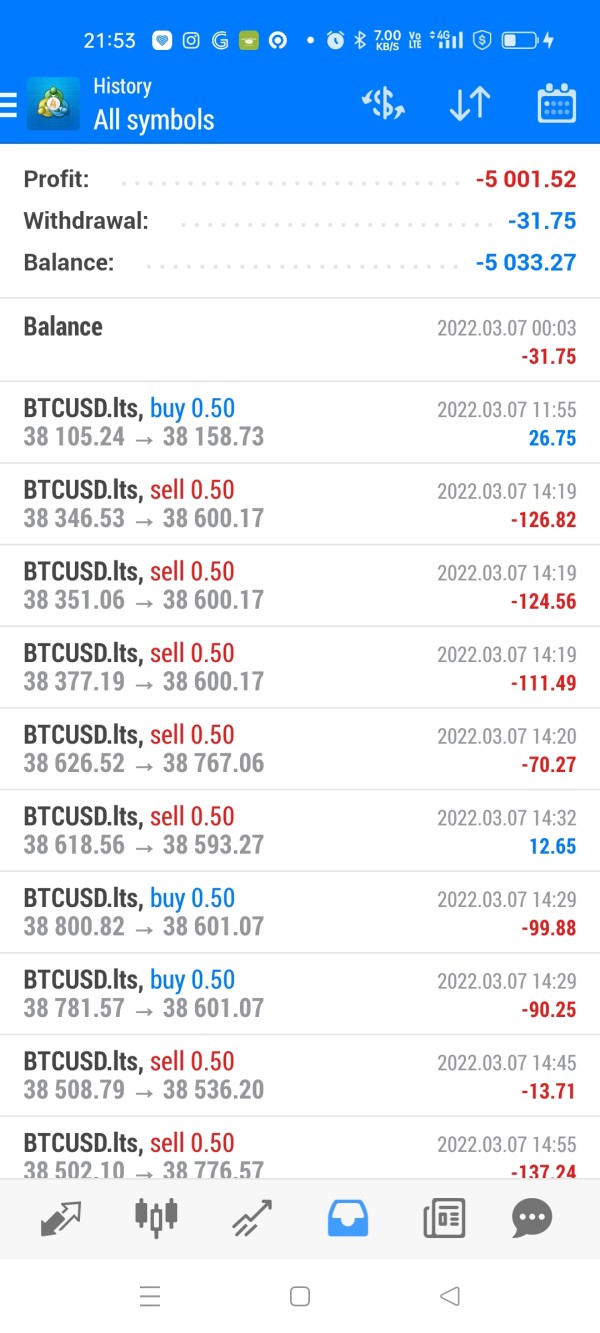

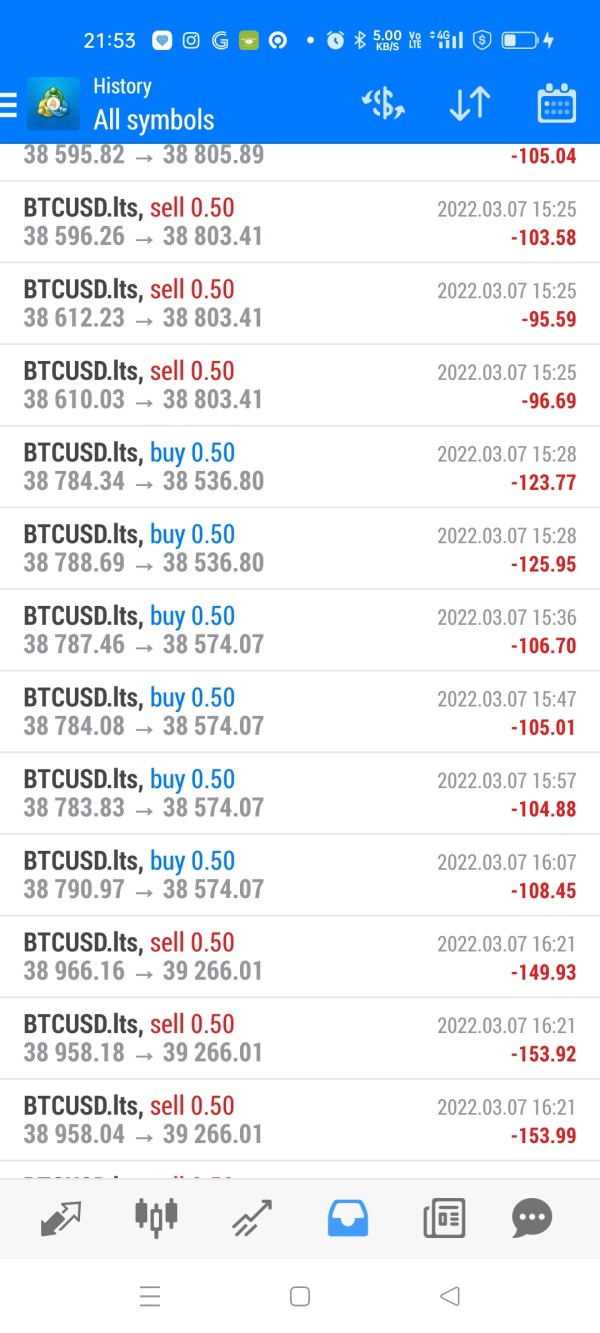

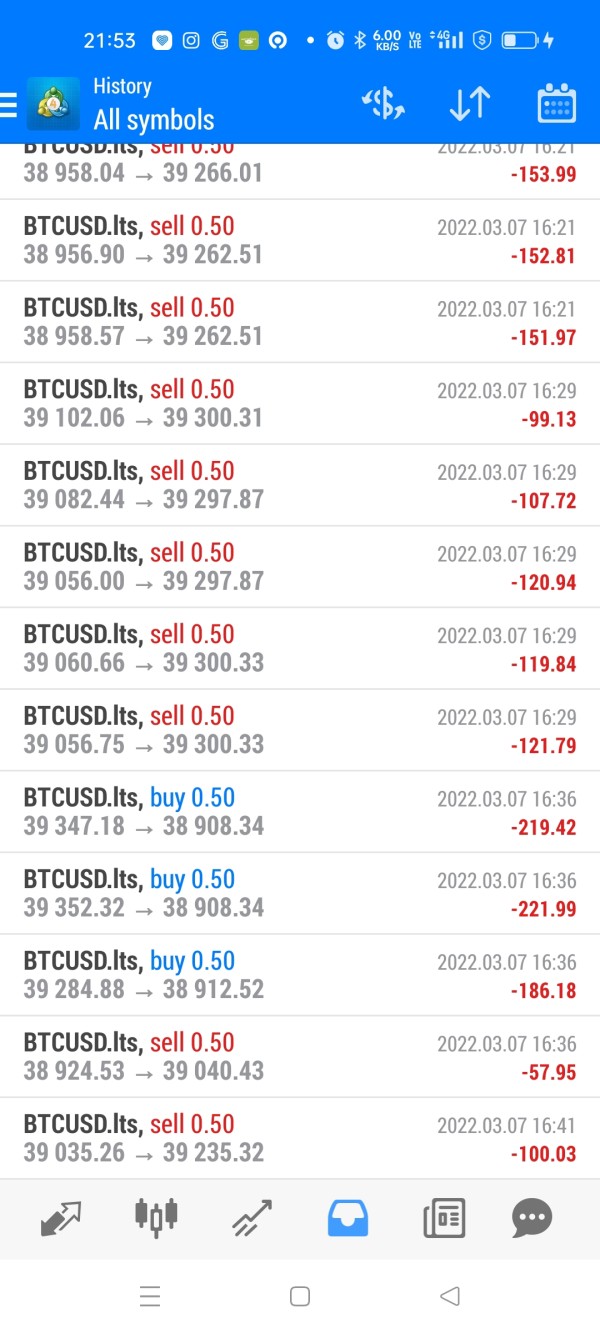

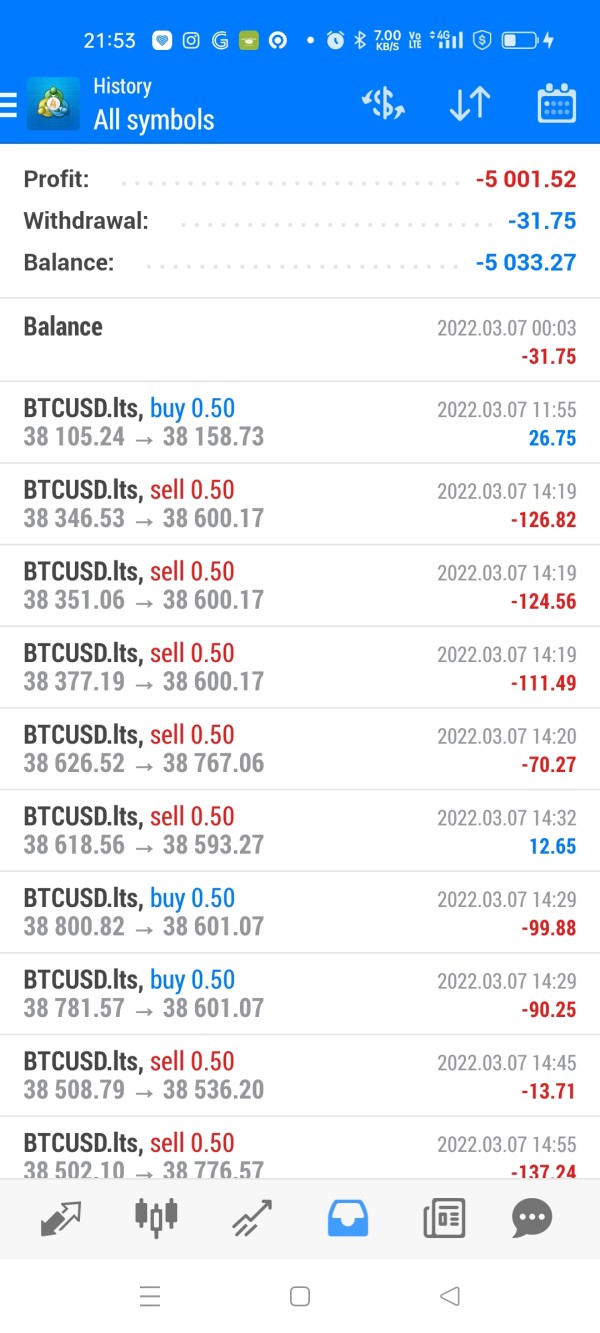

User satisfaction metrics for Lotus International present concerning indicators about overall service quality and client satisfaction. Available data suggests a user rating of 3.1 out of 5, which falls below industry standards for reputable brokers. This indicates significant room for improvement across multiple service areas.

The recommendation rate of only 44% among users represents a particularly troubling statistic, suggesting that more than half of clients would not endorse the broker to others. This low recommendation rate typically indicates serious issues with service quality, platform performance, or client relationship management.

Interface design and platform usability cannot be properly evaluated without detailed user feedback about navigation, functionality, and overall user experience. The quality of platform design and ease of use significantly impact trading efficiency and client satisfaction.

Registration and account verification processes have not been documented in available sources. This prevents assessment of onboarding convenience and security measures. Smooth account opening procedures are essential for positive initial client experiences.

Funding operation experiences, including deposit and withdrawal convenience, processing speeds, and fee transparency, remain undocumented in accessible materials. Efficient money management capabilities are crucial for maintaining client satisfaction and trust.

Common user complaints and recurring issues have not been identified in available information. This makes it difficult to understand specific problem areas that potential clients should anticipate. The target user profile appears to focus on forex and CFD traders, though the low satisfaction metrics suggest significant service delivery challenges that require careful consideration.

Conclusion

This lotus international review reveals a brokerage operation with significant regulatory and transparency concerns that potential clients should carefully consider. While Lotus International offers access to popular trading platforms including MT4 and MT Mobile with coverage of major asset classes such as forex, commodities, indices, and stock CFDs, the broker's unregulated status and lack of operational transparency create substantial risks for potential investors.

The broker may appeal to traders seeking basic forex and CFD trading capabilities. However, the absence of regulatory oversight, limited transparency about trading conditions, and concerning user satisfaction metrics make it unsuitable for most serious investors. The low user rating of 3.1/5 and recommendation rate of only 44% suggest significant service quality issues that prospective clients should weigh heavily in their decision-making process.

Primary advantages include platform availability and asset variety, while critical disadvantages encompass regulatory concerns, transparency deficiencies, and poor user satisfaction indicators. Given the numerous well-regulated alternatives available in today's competitive brokerage landscape, potential clients are advised to consider properly licensed brokers that offer comprehensive investor protections and transparent operational standards.