Is LifeCoinFEX safe?

Business

License

Is Lifecoinfex Safe or Scam?

Introduction

Lifecoinfex positions itself as a forex and CFD trading platform, claiming to offer a comprehensive range of trading instruments including cryptocurrencies, indices, commodities, and more. As the forex market continues to grow, it has attracted both legitimate brokers and fraudulent entities, making it crucial for traders to conduct thorough evaluations of any broker they consider. This article aims to provide an objective analysis of Lifecoinfex, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, and risk assessment. The information presented here is derived from a comprehensive review of multiple sources, including regulatory bodies, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a trading platform is paramount in determining its legitimacy and safety. Lifecoinfex operates without any recognized regulatory oversight, which raises significant concerns. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Lifecoinfex is not held accountable by any financial authority, which is a critical red flag for potential investors. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) enforce strict compliance measures to protect traders. The lack of oversight not only increases the risk of fraud but also indicates that the broker may not adhere to industry standards for operational transparency and client fund protection. Furthermore, warnings have been issued against Lifecoinfex by authorities such as the Spanish CNMV, categorizing it as a potential scam. This lack of regulatory legitimacy is a significant factor in determining whether Lifecoinfex is safe for trading.

Company Background Investigation

Lifecoinfex claims to be associated with companies like Lifecoin FEX Ltd and HY Marketing, with offices purportedly located in St. Vincent and the Grenadines. However, the actual ownership structure remains obscure, and there is little verifiable information regarding its management team or operational history. The company was established in May 2021, which raises questions about its longevity and experience in the market.

A thorough investigation reveals that the company has not provided adequate transparency regarding its operations, which is another indicator of potential risk. Legitimate brokers typically disclose their ownership and management team details, allowing traders to assess their credibility. In contrast, Lifecoinfex's lack of transparency raises concerns about its intentions and operational practices. The absence of an established track record and the unclear ownership structure further contribute to the skepticism surrounding its legitimacy. Thus, it is imperative for potential users to question if Lifecoinfex is safe given its dubious company background.

Trading Conditions Analysis

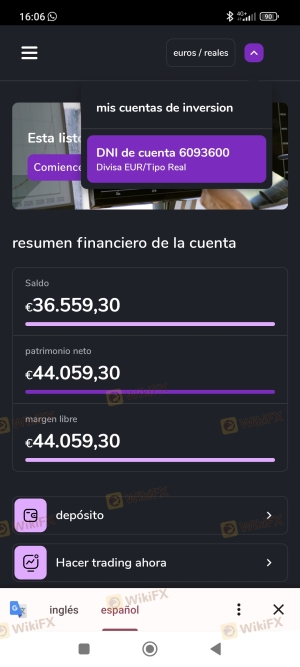

Lifecoinfex presents a variety of trading conditions that may initially appear attractive, but a deeper analysis reveals several concerning aspects. The broker requires a minimum deposit of €5,000 to open an account, which is significantly higher than the industry average. This high entry barrier may deter many retail traders and raises the question of whether the broker is targeting a specific demographic or simply attempting to limit its user base.

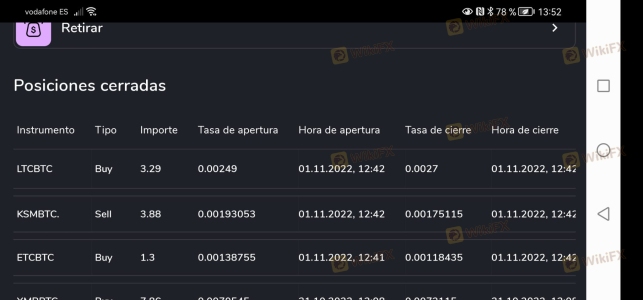

The fee structure is another critical area of concern. While Lifecoinfex claims to offer competitive spreads and no hidden fees, many users have reported unexpected charges and withdrawal issues. Below is a comparative table of core trading costs:

| Fee Type | Lifecoinfex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

This table illustrates that Lifecoinfex's lack of transparency regarding fees and commissions can lead to unexpected expenses for traders. Moreover, the absence of a clear commission structure and the high minimum deposit requirement suggest that the broker may not be operating in the best interest of its clients. As such, potential traders should carefully consider whether Lifecoinfex is safe to trade with, given its opaque trading conditions.

Client Funds Security

The safety of client funds is a paramount concern when evaluating a trading platform. Lifecoinfex does not provide clear information on how it safeguards client funds, which is a significant risk factor. Legitimate brokers typically segregate client funds in separate accounts to protect them in the event of financial difficulties. However, Lifecoinfex has not disclosed any such measures.

Additionally, the broker lacks investor protection policies, which are essential for ensuring that traders can recover their funds in case of insolvency. The absence of negative balance protection further compounds the risk, as traders could potentially lose more than their initial investment. Historical complaints and reports of fund mismanagement have also surfaced, indicating that Lifecoinfex may have previously faced issues related to client fund safety. Therefore, the question of whether Lifecoinfex is safe becomes even more pressing, as the broker does not appear to prioritize the security of its clients' investments.

Customer Experience and Complaints

User feedback is a valuable resource for assessing the reliability of a trading platform. Lifecoinfex has garnered numerous negative reviews, particularly regarding withdrawal issues and customer service. Common complaints include difficulty in retrieving funds, unresponsive customer support, and misleading information regarding trading conditions.

The following table summarizes the primary types of complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Information | Medium | Poor |

| Customer Support Availability | High | Poor |

Many users have reported that once they attempt to withdraw their funds, they encounter numerous obstacles and excuses from the broker. This pattern of behavior is often indicative of a fraudulent entity. For instance, one user detailed their struggle to access their funds, only to be met with repeated requests for additional deposits or trading volume. Such experiences lead to the conclusion that Lifecoinfex is safe should be viewed with skepticism.

Platform and Trade Execution

The trading platform offered by Lifecoinfex is web-based, which may initially seem convenient. However, many users have reported issues related to platform stability, order execution quality, and instances of slippage. A reliable trading platform should provide seamless execution and minimal delays; however, reports of technical glitches and order rejections have raised concerns about the platform's integrity.

Moreover, the lack of support for popular trading software such as MetaTrader 4 or 5 further limits the trading capabilities for users. These factors contribute to the overall perception that Lifecoinfex is safe may not hold true, as the platform does not meet the standards expected from reputable brokers.

Risk Assessment

Engaging with Lifecoinfex presents several risks that potential traders should carefully consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund segregation and protection |

| Operational Risk | Medium | Reports of platform instability |

| Customer Service Risk | High | Poor response to complaints |

Given the high-risk levels across various categories, it is crucial for traders to approach Lifecoinfex with caution. To mitigate risks, potential users should consider diversifying their investments and only trading with funds they can afford to lose. Additionally, seeking out regulated brokers with a proven track record can significantly reduce exposure to potential fraud.

Conclusion and Recommendations

In conclusion, the analysis presented indicates that Lifecoinfex is not safe for trading. The broker's lack of regulation, poor customer reviews, and questionable trading conditions raise significant red flags for potential investors. Given the evidence of withdrawal issues, inadequate fund protection, and a lack of transparency, it is advisable for traders to exercise extreme caution.

For those considering forex trading, it is recommended to explore reputable alternatives that are regulated by recognized authorities. Brokers such as IG, OANDA, and Forex.com offer reliable trading environments with robust regulatory oversight, ensuring a safer trading experience. Ultimately, traders should prioritize their financial security and opt for platforms that demonstrate a commitment to transparency and client protection.

Is LifeCoinFEX a scam, or is it legit?

The latest exposure and evaluation content of LifeCoinFEX brokers.

LifeCoinFEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LifeCoinFEX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.