Is JIUSUN safe?

Business

License

Is Jiusun Safe or a Scam?

Introduction

Jiusun is an online forex broker that positions itself as a provider of financial trading services, particularly in the Asia-Pacific region. With the rapid expansion of the forex market, the need for traders to assess the credibility and reliability of brokers has become paramount. Traders often find themselves navigating a landscape filled with potential scams, unregulated entities, and misleading claims. Therefore, evaluating a broker like Jiusun is crucial to ensure a safe trading environment. This article employs a comprehensive framework that includes regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment to determine whether Jiusun is safe or a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy. Jiusun lacks regulation from any major financial authority, which raises significant concerns about its operational integrity. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory license means that Jiusun operates without the oversight that reputable brokers are subjected to. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US enforce strict guidelines that protect traders from fraud and malpractice. Without such oversight, traders are exposed to increased risks, including the potential for fund mismanagement and unethical trading practices. Historically, unregulated brokers have been linked to various compliance issues, making it imperative for traders to exercise caution.

Company Background Investigation

Jiusun is operated by Jiu Sun International Trade Group Co., Limited, a company that appears to have limited public information available regarding its history and ownership structure. The lack of transparency raises red flags about its operations. The management teams background is also unclear, which can be a significant concern for potential investors. A broker's credibility is often bolstered by experienced leadership with a proven track record in the financial services industry. Unfortunately, Jiusun does not provide sufficient information to evaluate the expertise of its management team.

Moreover, the company's commitment to transparency is questionable. It is essential for brokers to disclose their operational practices, fee structures, and risk factors. Jiusuns vague disclosures can lead to misunderstandings and potential exploitation of traders, making it difficult for clients to make informed decisions. Given these factors, the absence of a clear company background further complicates the assessment of whether Jiusun is safe or a scam.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital. Jiusun claims to offer competitive trading conditions, but the lack of transparency regarding its fee structure is concerning. Traders should be aware of any hidden fees that can significantly impact their profitability. Below is a comparison of Jiusun's trading costs against industry averages:

| Fee Type | Jiusun | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The absence of clear information on spreads and commissions raises questions about the broker's pricing model. Traders have reported issues such as severe slippage and hidden fees, which can lead to unexpected losses. Without a transparent fee structure, it becomes challenging for traders to assess the overall cost of trading with Jiusun. The lack of clarity in trading conditions is a significant factor in determining whether Jiusun is safe or a scam.

Client Fund Security

The safety of client funds is a paramount concern for any forex trader. Jiusun states that it maintains client funds in a separate margin account, but without regulatory oversight, the effectiveness of these measures cannot be verified. The absence of investor protection schemes, such as those provided by regulatory bodies, leaves traders vulnerable.

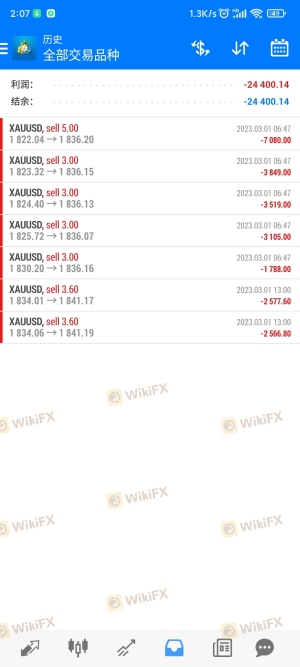

In addition, Jiusun does not provide clear information about negative balance protection policies, which can safeguard traders from incurring debts beyond their initial investments. Historical issues related to fund safety, such as withdrawal problems and fund mismanagement, have been reported by users, further complicating the assessment of whether Jiusun is safe or a scam.

Customer Experience and Complaints

Customer feedback plays a crucial role in evaluating a broker's reliability. Reviews and testimonials about Jiusun indicate a mixed reception, with many users expressing dissatisfaction with the trading experience. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Slippage Problems | Medium | Poor |

| Customer Support Quality | High | Poor |

One notable case involved a trader who reported difficulties withdrawing funds after achieving a profitable trading period. The lack of timely responses from customer support exacerbated the situation, leading to frustration and distrust. Such complaints are red flags that suggest potential operational issues within Jiusun, raising further concerns about whether Jiusun is safe or a scam.

Platform and Execution

The trading platform is another critical aspect to consider. Jiusun claims to offer a technologically advanced platform; however, user reviews suggest that the platform suffers from stability issues and poor execution quality. Reports of frequent slippage and rejected orders have surfaced, indicating potential manipulation or inefficiencies in trade execution.

The overall user experience is essential for traders, as a reliable platform can significantly affect trading outcomes. Jiusun's platform appears to lack the performance and reliability expected from a credible broker, further questioning its legitimacy and whether Jiusun is safe or a scam.

Risk Assessment

Assessing the overall risk associated with trading with Jiusun is essential. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Security Risk | High | Lack of investor protection |

| Operational Risk | Medium | Complaints about platform performance |

| Transparency Risk | High | Vague disclosures and hidden fees |

Given these risks, traders should approach Jiusun with extreme caution. It is advisable to consider alternative brokers with established regulatory oversight and a proven track record of reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that Jiusun raises several red flags that indicate it may not be a safe trading option. The lack of regulation, transparency issues, and numerous customer complaints point toward a higher likelihood of operational risks. Therefore, it is reasonable to conclude that Jiusun may be more of a scam than a reliable forex broker.

For traders seeking a safe trading environment, it is advisable to consider regulated brokers with positive reputations, such as those overseen by the FCA, ASIC, or CFTC. These brokers not only provide better protection for client funds but also offer transparent trading conditions and reliable customer support. Always conduct thorough research before engaging with any forex broker, especially those like Jiusun that exhibit signs of potential fraud.

Is JIUSUN a scam, or is it legit?

The latest exposure and evaluation content of JIUSUN brokers.

JIUSUN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JIUSUN latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.