Regarding the legitimacy of IBH forex brokers, it provides LFSA and WikiBit, (also has a graphic survey regarding security).

Is IBH safe?

Pros

Cons

Is IBH markets regulated?

The regulatory license is the strongest proof.

LFSA Market Making License (MM)

Labuan Financial Services Authority

Labuan Financial Services Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

IBH Investment Bank Limited

Effective Date:

--Email Address of Licensed Institution:

howard@ibhinvestmentbank.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 6F (2), Main Office Tower, Financial Park Complex, Jalan Merdeka, 87000 Labuan F.T.Phone Number of Licensed Institution:

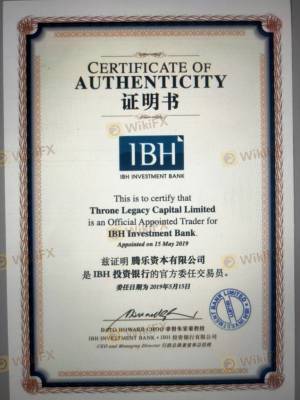

087-410 730Licensed Institution Certified Documents:

Is IBH Safe or Scam?

Introduction

IBH Investment Bank Limited, commonly referred to as IBH, is a financial broker based in Malaysia that has been operating since 2009. Specializing in forex and derivative trading, IBH positions itself as a facilitator for traders seeking to engage in the dynamic foreign exchange market. However, the brokerage industry is rife with potential pitfalls, and traders must exercise caution when selecting a broker. This article aims to provide a comprehensive assessment of IBH, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The evaluation will draw on various sources, including user reviews, regulatory disclosures, and expert analyses, to determine whether IBH is a trustworthy broker or a potential scam.

Regulation and Legitimacy

When assessing the safety of any financial broker, understanding its regulatory framework is crucial. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards for financial practices and client protection. IBH is regulated by the Labuan Financial Services Authority (LFSA), which has established guidelines for the operation of financial service providers in the Labuan territory of Malaysia.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Labuan Financial Services Authority (LFSA) | LL 06841 | Labuan, Malaysia | Verified |

While IBH holds a license from the LFSA, it is important to note that this regulatory body is often considered less stringent compared to other major financial regulators globally. The LFSA does not offer the same level of client protection as more established authorities like the FCA (UK) or ASIC (Australia). Furthermore, IBH has received numerous complaints regarding its operations, raising concerns about its compliance history. Over the past three months, there have been reports of clients unable to withdraw funds, which is a significant red flag when evaluating whether IBH is safe.

Company Background Investigation

IBH Investment Bank Limited was founded in 2009 and is headquartered in Labuan, Malaysia. The company has positioned itself as a market maker, providing access to various financial instruments, including forex, CFDs, and commodities. Despite its relatively long history in the market, there are concerns regarding the transparency of its ownership structure and management team.

The management team of IBH has not been prominently featured in public disclosures, which raises questions about their qualifications and experience in the financial sector. Transparency is a critical factor for any brokerage, as it fosters trust among clients. The lack of publicly available information about the company's executives and their professional backgrounds could be interpreted as a sign of opacity. Furthermore, the company's website offers limited information regarding its operational history and governance practices, further emphasizing the need for caution when considering whether IBH is safe.

Trading Conditions Analysis

Understanding the trading conditions offered by IBH is essential for potential clients. The overall fee structure, including spreads, commissions, and overnight interest rates, significantly impacts a trader's profitability. IBH claims to offer competitive trading conditions, but a detailed examination reveals potential issues.

| Fee Type | IBH | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Starting from 0.03 pips | 1.0 - 1.5 pips |

| Commission Structure | None for standard accounts, $7 per lot for ECN accounts | Varies widely, typically $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While IBH offers low spreads on major currency pairs, the commission structure, particularly for the ECN accounts, may not be as competitive as it appears. Additionally, the absence of a demo account restricts new traders from practicing without risk, which is a standard offering from many other brokers. Traders should consider these factors carefully when evaluating whether IBH is safe.

Client Funds Security

The safety of client funds is of paramount importance when assessing a broker's reliability. IBH claims to implement various measures to protect client deposits, including segregated accounts and adherence to local regulatory requirements. However, there is limited information available regarding the specifics of these safety measures.

A thorough analysis of IBH's policies reveals that while the company maintains segregated accounts, the level of investor protection may not be sufficient compared to brokers regulated by more stringent authorities. Additionally, there have been reports of clients facing difficulties in withdrawing their funds, which raises serious concerns about the overall safety of client capital. Historical incidents involving fund security issues further complicate the picture, leaving potential clients questioning whether IBH is safe.

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the reliability of a broker. Reviews of IBH indicate a mixed experience among clients. While some users report satisfactory trading experiences, a significant number have raised alarms about their inability to withdraw funds, which is one of the most common complaints associated with the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow and unresponsive |

| Customer Support | Medium | Limited availability |

| Platform Performance | Low | Generally acceptable |

Notably, many clients have reported that their withdrawal requests go unanswered for extended periods, leading to frustrations and financial losses. These complaints highlight a pattern of poor customer service and inadequate responses from IBH, which may indicate deeper operational issues. Potential clients should consider these factors seriously when assessing whether IBH is safe.

Platform and Trade Execution

The quality of the trading platform and execution speed are critical factors for traders. IBH provides access to popular trading platforms such as MetaTrader 4 and MetaTrader 5, known for their user-friendly interfaces and advanced charting capabilities. However, user experiences regarding platform performance have been mixed.

Traders have reported instances of slippage and execution delays, which can significantly impact trading outcomes. Additionally, there are concerns about the potential for platform manipulation, although concrete evidence supporting these claims is limited. Overall, while IBH's trading platforms are generally reliable, the reported issues with execution quality raise questions about whether IBH is safe for serious traders.

Risk Assessment

Engaging with IBH Investment Bank carries inherent risks, and potential clients should be aware of these before proceeding. The combination of regulatory concerns, customer complaints, and operational transparency issues collectively contribute to a heightened risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited protection from LFSA |

| Operational Risk | Medium | Complaints about fund withdrawal |

| Market Risk | Medium | Standard forex trading risks |

To mitigate these risks, it is advisable for traders to conduct thorough due diligence, consider using smaller investment amounts, and explore alternative brokers with stronger regulatory oversight and positive user feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that IBH Investment Bank Limited presents several red flags regarding its safety and reliability. While it is regulated by the LFSA, the quality of this regulation is questionable, and numerous complaints about withdrawal issues and poor customer service further complicate the picture. Given the potential risks associated with trading through IBH, it is prudent for traders to exercise caution.

For those considering engaging with IBH, it is essential to weigh the risks carefully and consider alternative brokers with a stronger regulatory framework and better customer feedback. Brokers such as OANDA, IG, and Forex.com are recommended as safer options for traders seeking reliable forex trading experiences. Ultimately, the question of whether IBH is safe remains uncertain, and potential clients should approach with caution.

Is IBH a scam, or is it legit?

The latest exposure and evaluation content of IBH brokers.

IBH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IBH latest industry rating score is 4.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.