Is GTMmarket safe?

Business

License

Is GTM Market Safe or a Scam?

Introduction

GTM Market, a forex broker based in Hong Kong, has garnered attention in the trading community for its competitive offerings and claimed regulatory oversight. As traders navigate the complex world of forex, it is crucial to thoroughly evaluate brokers like GTM Market to ensure their safety and legitimacy. The forex market is rife with opportunities, but it also harbors risks, including potential scams. Therefore, a meticulous assessment of a broker's regulatory status, company background, trading conditions, and user experiences is essential. This article employs a comprehensive investigative approach, utilizing user reviews, regulatory information, and industry benchmarks to determine whether GTM Market is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in assessing its legitimacy. GTM Market claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom; however, this license is flagged as a "suspicious clone." Such a designation raises significant concerns about the broker's compliance with regulatory standards and its operational transparency. Below is the core regulatory information for GTM Market:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 801104 | United Kingdom | Suspicious Clone |

The importance of regulation cannot be overstated, as it serves as a safeguard for traders against malpractices. A broker operating under a legitimate regulatory body is expected to adhere to strict guidelines that protect clients' interests. However, the "suspicious clone" status of GTM Market indicates that it may not meet these standards, which could expose traders to potential risks. Historical compliance issues further exacerbate these concerns, as the lack of a trustworthy regulatory framework raises red flags about the broker's operations.

Company Background Investigation

GTM Market's history and ownership structure provide additional context for evaluating its credibility. Founded in 2018, the broker is operated by Global Transaction Market Limited. However, the companys transparency regarding its management team and operational practices is limited. A thorough analysis of the company's leadership reveals a lack of publicly available information, which raises questions about their expertise and experience in the financial industry. Transparency is a hallmark of reputable brokers, and the absence of clear information about the management team can be a significant concern for potential investors.

The broker's operational history, spanning five to ten years, suggests some level of experience in the market. However, the lack of verifiable information about its ownership and management raises questions about accountability. Additionally, GTM Market's website is reportedly non-functional, further complicating the assessment of its legitimacy. In light of these factors, traders should approach GTM Market with caution, as the companys opacity may indicate underlying issues.

Trading Conditions Analysis

Understanding the trading conditions a broker offers is vital for evaluating its overall attractiveness. GTM Market presents itself as a competitive option, boasting leverage of up to 1:400 and low spreads on popular currency pairs. However, a closer examination of its fee structure reveals potential pitfalls. Below is a comparison of core trading costs associated with GTM Market versus industry averages:

| Fee Type | GTM Market | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs is slightly higher than the industry average, which could impact trading profitability. Additionally, the variable commission model may lead to unexpected costs for traders. It is essential for traders to fully understand these fees before committing their funds, as hidden costs can significantly affect overall returns. Furthermore, any unusual or problematic fee policies should be scrutinized, as they may be indicative of a broker's intent to exploit traders.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. GTM Market claims to implement various safety measures, including the segregation of client funds and investor protection policies. However, the effectiveness of these measures is questionable, especially given the broker's regulatory status. A thorough analysis of GTM Markets safety protocols reveals several areas of concern.

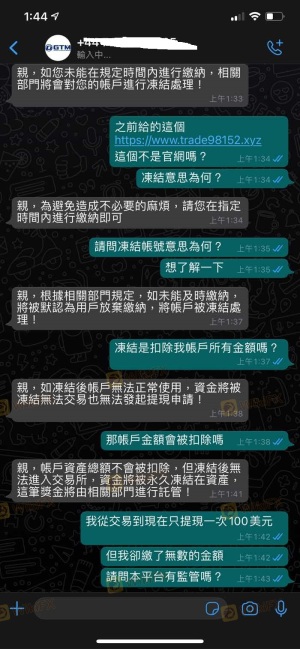

While the broker states that client funds are held in segregated accounts, the lack of robust regulatory oversight raises doubts about the actual implementation of these measures. Additionally, there have been reports of withdrawal issues and user complaints regarding the inability to access funds, which highlights potential vulnerabilities in the broker's operational framework. Historical incidents involving fund safety issues further emphasize the importance of conducting due diligence before trading with GTM Market.

Customer Experience and Complaints

User feedback and real-world experiences provide critical insights into the reliability of a broker. A review of customer experiences with GTM Market reveals a pattern of complaints related to fund withdrawals and communication issues. Below is a summary of the primary complaint types and severity assessments:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Fair |

Common complaints include difficulties in withdrawing funds, with users reporting that their requests were either delayed or denied. Additionally, the company's responsiveness to these issues has been criticized as inadequate. Such complaints indicate a potential lack of customer support and operational efficiency, which are essential for maintaining client trust. A couple of notable cases involve traders who reported being unable to access their funds after multiple requests, leading to frustration and distrust in the broker.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. GTM Market offers the widely used MetaTrader 4 (MT4) platform, known for its stability and user-friendly interface. However, an analysis of order execution quality reveals potential concerns regarding slippage and rejection rates. Traders have reported instances of significant slippage during high volatility periods, which can adversely affect trading outcomes. Furthermore, any signs of platform manipulation should be closely monitored, as they can undermine the integrity of the trading environment.

Risk Assessment

Engaging with GTM Market involves a variety of risks that traders must consider. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone status raises concerns. |

| Fund Safety | High | Reports of withdrawal issues and fund access. |

| Customer Support | Medium | Poor response to complaints. |

| Trading Conditions | Medium | Higher spreads and variable fees may impact profitability. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with stronger regulatory oversight and better customer feedback. Additionally, maintaining a cautious approach and remaining aware of market conditions can help in managing potential pitfalls.

Conclusion and Recommendations

In conclusion, the evidence suggests that GTM Market exhibits several red flags that warrant caution. The broker's suspicious regulatory status, coupled with reports of withdrawal issues and a lack of transparency, raises significant concerns about its legitimacy. While GTM Market offers competitive trading conditions, the potential risks associated with trading on this platform may outweigh the benefits.

Traders are encouraged to exercise due diligence and consider alternative brokers with robust regulatory oversight and positive customer experiences. For those seeking reliable options, brokers regulated by top-tier authorities such as the FCA, ASIC, or CySEC may provide a safer trading environment. Ultimately, it is crucial for traders to prioritize their safety and ensure that they are engaging with reputable brokers to protect their investments.

The question "Is GTM Market safe?" can be answered with caution; while it operates in the forex market, the risks associated with this broker suggest that it may not be the safest choice for traders.

Is GTMmarket a scam, or is it legit?

The latest exposure and evaluation content of GTMmarket brokers.

GTMmarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTMmarket latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.