Regarding the legitimacy of GUOTAI HAITONG forex brokers, it provides CFFEX and WikiBit, .

Is GUOTAI HAITONG safe?

Pros

Cons

Is GUOTAI HAITONG markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

国泰君安期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is GTJA A Scam?

Introduction

GTJA, officially known as Guotai Junan Securities, is a prominent player in the Chinese financial services sector, specializing in forex trading and various other financial instruments. Established in 1999, GTJA has carved out a significant presence in the market, particularly within China and Hong Kong. As with any forex broker, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with potential risks, including scams and unregulated brokers, making it imperative for traders to ensure that they are dealing with a trustworthy entity. This article aims to provide a comprehensive assessment of GTJA by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile, using a structured evaluation framework based on data gathered from various credible sources.

Regulation and Legitimacy

The regulatory framework surrounding a broker is one of the most critical factors influencing its legitimacy. GTJA operates under the supervision of the China Financial Futures Exchange (CFFEX), which is responsible for regulating trading activities in financial futures and derivatives. This regulatory oversight is essential for ensuring that brokers adhere to industry standards and protect their clients' interests. Below is a summary of GTJA's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0001 | China | Verified |

The CFFEX is recognized as a reputable regulatory body, providing a level of assurance to traders regarding the safety and security of their investments. However, it is important to note that while CFFEX is authoritative, some reports indicate that GTJA has faced challenges related to customer withdrawals and complaints of scams. This duality raises questions about the overall compliance and operational integrity of the broker.

The quality of regulation can vary significantly between jurisdictions, and while CFFEX is considered credible, it is essential for traders to remain vigilant and conduct their own due diligence. Historical compliance records and any past regulatory actions against the broker should also be examined to gauge its reliability.

Company Background Investigation

GTJA has a rich history, having been established in 1999 as a subsidiary of Guotai Junan Financial Holdings. Over the years, it has expanded its services to include a wide array of financial products, including stocks, futures, and wealth management services. The company's ownership structure is clear, with its parent company being one of the largest financial service providers in China.

The management team at GTJA boasts a wealth of experience in the financial sector, with many of its leaders having backgrounds in finance, investment banking, and asset management. This professional expertise can enhance the brokers credibility and operational effectiveness. However, transparency regarding the company's operations and decision-making processes is crucial for building trust with clients.

GTJA provides a reasonable level of information disclosure on its website, including details about its services, contact information, and regulatory compliance. However, the absence of a demo account option may deter some potential clients, particularly those who prefer to test the trading environment before committing real funds.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions it offers is vital. GTJA has a competitive fee structure, but it is essential to scrutinize any hidden costs or unusual fees that may arise. The overall cost of trading can significantly affect a trader's profitability. Below is a comparison of GTJA's core trading costs against industry averages:

| Fee Type | GTJA | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Variable | $5 - $10 per lot |

| Overnight Interest Range | Variable | 2% - 5% |

GTJAs spreads are variable, which may lead to higher costs during periods of market volatility. Additionally, the commission structure may not be as transparent as some traders would prefer, raising concerns about potential hidden fees. Traders should carefully review the fee schedule before opening an account to avoid any unexpected charges.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading industry. GTJA implements several measures to ensure the security of its clients' investments. The company claims to utilize segregated accounts to keep client funds separate from its operational capital, which is a critical practice for protecting client assets. Furthermore, GTJA adheres to investor protection policies, including negative balance protection, which prevents clients from losing more than their initial investment.

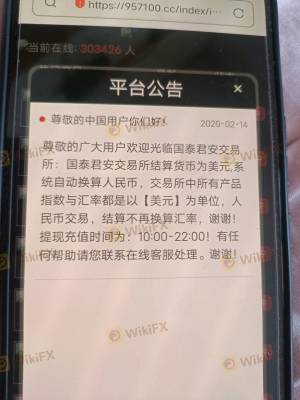

However, there have been reports of issues related to fund withdrawals and allegations of scams, which could indicate potential vulnerabilities in the company's operational practices. Historical disputes or incidents involving client funds should be thoroughly investigated to understand the level of risk associated with trading through GTJA.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of GTJA reveal a mixed bag of experiences, with some clients praising the broker for its responsive customer service and effective trading platform, while others express frustration over withdrawal issues and lack of communication. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

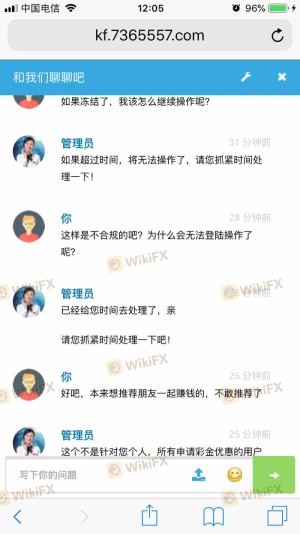

| Withdrawal Issues | High | Slow response |

| Lack of Communication | Medium | Average response |

| Platform Stability | Medium | Generally responsive |

Two notable cases highlight the concerns raised by clients. In one instance, a trader reported being unable to withdraw funds after a series of successful trades, leading to frustration and allegations of a scam. In another case, a client expressed dissatisfaction with the level of communication from customer service, particularly when seeking assistance with account issues.

Platform and Execution

The trading platform offered by GTJA is designed to cater to both novice and experienced traders. Users generally report a stable trading environment with minimal downtime. However, some reviews indicate instances of slippage and rejected orders during volatile market conditions, which can adversely affect trading outcomes.

The quality of order execution is crucial for traders, especially in a fast-paced market. While GTJA does provide a robust platform, any signs of manipulation or discrepancies in execution should be closely monitored by users.

Risk Assessment

Trading with GTJA involves certain risks that potential clients should be aware of. The overall risk profile can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Some complaints about withdrawals |

| Operational Risk | Medium | Mixed reviews on customer service |

| Market Risk | High | Forex trading is inherently risky |

To mitigate these risks, traders should consider diversifying their investments and only using capital they can afford to lose. Additionally, maintaining constant communication with customer service and staying informed about market conditions can help manage potential challenges.

Conclusion and Recommendations

In conclusion, GTJA presents itself as a well-established broker with a solid regulatory framework and a range of financial services. However, potential clients should remain cautious due to reports of withdrawal issues and customer complaints. While there is no definitive evidence to classify GTJA as a scam, the mixed reviews and some operational challenges warrant a careful approach.

For traders considering GTJA, it is advisable to start with a small investment and thoroughly evaluate the trading conditions and customer service responsiveness. If concerns persist, exploring alternative brokers with a more robust reputation and clearer fee structures may be prudent. Brokers like IG, OANDA, and Saxo Bank are examples of reputable alternatives that offer competitive trading conditions and a strong regulatory framework. Always conduct thorough research and consider personal trading needs before making a decision.

Is GUOTAI HAITONG a scam, or is it legit?

The latest exposure and evaluation content of GUOTAI HAITONG brokers.

GUOTAI HAITONG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GUOTAI HAITONG latest industry rating score is 7.91, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.91 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.