Is GRO safe?

Pros

Cons

Is gro Safe or a Scam?

Introduction

In the fast-paced world of forex trading, choosing a reliable broker is crucial for both novice and experienced traders. One such broker that has garnered attention is gro, a platform that positions itself as a competitive player in the forex market. Given the prevalence of scams and unregulated brokers, it is imperative for traders to conduct thorough due diligence before committing their funds. This article will investigate whether gro is a safe trading option or if it raises red flags that could indicate fraudulent practices. Our assessment will incorporate insights from various sources, including regulatory information, customer feedback, and an analysis of trading conditions.

Regulation and Legitimacy

The regulatory status of a broker is a pivotal factor in determining its legitimacy. gro claims to operate under specific regulatory frameworks, but the details are often vague. A broker's regulation ensures that it adheres to strict guidelines, offering a layer of protection for traders. Below is a summary of gro's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | USA | Not Authorized |

| ASIC | N/A | Australia | Not Authorized |

The absence of a valid license from a recognized regulatory body raises concerns about gro's legitimacy. Regulatory authorities such as the NFA (National Futures Association) and ASIC (Australian Securities and Investments Commission) are known for their stringent oversight and investor protection measures. The lack of authorization from these bodies suggests that gro may not be operating within a secure framework, making it essential for potential users to exercise caution. Furthermore, historical compliance issues or regulatory violations could further undermine trust in the broker.

Company Background Investigation

Understanding the background of a trading platform is essential for assessing its reliability. gro was established several years ago, but specific details about its founding and ownership structure remain unclear. The company's transparency regarding its management team and their professional experiences is also limited. This lack of clarity can be alarming for potential clients, as a well-established broker typically provides comprehensive information about its leadership and operational history.

Moreover, the absence of a clear corporate structure can lead to concerns about accountability and the potential for fraudulent activities. If a broker does not disclose its ownership details or the qualifications of its management team, it becomes challenging for traders to trust that their funds will be handled responsibly. Such transparency is critical in an industry where trust and integrity are paramount.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can significantly impact the overall trading experience. gro presents a variety of trading options, but the fee structure is essential to understand. Heres a comparison of gro's core trading costs against industry averages:

| Fee Type | gro | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The above table indicates that gro's spreads are higher than the industry average, which could reduce profitability for traders. Additionally, the commission model is variable, which may lead to unexpected costs depending on trading volume and account type. Traders should be wary of any unusual fees that could diminish their returns and make sure to read the fine print before opening an account.

Customer Funds Safety

The safety of customer funds is a critical aspect of any trading platform. gro claims to implement various security measures, including fund segregation and negative balance protection. However, the effectiveness of these measures is often contingent upon regulatory oversight. In the absence of a strong regulatory framework, the enforcement of such safety measures may be questionable.

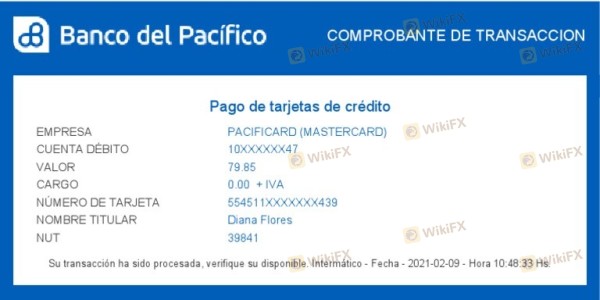

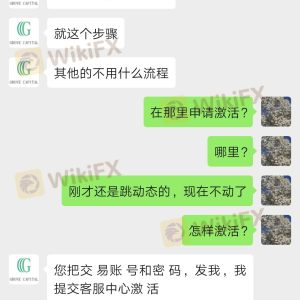

Traders should inquire about the specifics of how their funds are protected. For instance, are client funds held in separate accounts? Is there any investor compensation scheme in place to cover potential losses? Historical incidents involving fund mismanagement or security breaches can serve as red flags. Therefore, it is essential to research any past issues that may have affected the broker's reputation.

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's reliability. Reviews of gro reveal a mixed bag of experiences. While some users report satisfactory trading experiences, others express frustration over the responsiveness of customer support and various complaints. Below is a summary of common complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Unclear Fee Structures | High | Limited Clarity |

One notable case involved a trader who faced significant delays in withdrawing funds, leading to frustration and a loss of trust in the platform. Such experiences raise concerns about the broker's operational efficiency and commitment to customer service. A broker's ability to respond to complaints effectively is crucial in establishing a trustworthy relationship with its clients.

Platform and Trade Execution

The quality of a trading platform can significantly influence a trader's success. gro offers a user-friendly interface, but the stability and execution quality of its platform are critical factors to assess. Traders should be wary of any signs of platform manipulation, such as excessive slippage or order rejections. These issues can lead to detrimental trading outcomes and are often indicative of deeper systemic problems within the broker's operations.

Risk Assessment

Using gro as a trading platform carries a certain level of risk. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of valid licenses |

| Customer Support | Medium | Mixed feedback on responsiveness |

| Trading Conditions | High | Higher spreads than industry average |

To mitigate these risks, traders are advised to conduct thorough research, set strict risk management protocols, and consider diversifying their trading activities across multiple platforms.

Conclusion and Recommendations

In conclusion, the evidence suggests that gro raises several red flags that warrant caution. The lack of regulatory oversight, combined with a mixed reputation among users, indicates that traders should approach this broker with skepticism. While some users may have positive experiences, the potential for issues related to fund safety and customer support cannot be overlooked.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with proven track records. Platforms regulated by top-tier authorities like the FCA or ASIC offer a higher level of security and trustworthiness. Always prioritize due diligence and ensure that any broker you choose has a transparent operational structure and positive customer feedback.

Is GRO a scam, or is it legit?

The latest exposure and evaluation content of GRO brokers.

GRO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GRO latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.