Is First Brokers safe?

Business

License

Is First Brokers Safe or a Scam?

Introduction

First Brokers is a relatively new player in the forex market, claiming to offer a wide range of trading services, including forex, commodities, and cryptocurrencies. However, the rapid growth of online trading has led to an influx of brokers, making it imperative for traders to exercise caution when selecting a trading partner. The legitimacy and safety of a broker can significantly impact a trader's experience and financial security. In this article, we will explore the safety of First Brokers by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk assessment. Our investigation is based on a review of multiple credible sources and expert opinions regarding First Brokers.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. First Brokers claims to be operated by Tera Holdings Ltd., which is purportedly based in Hong Kong. However, a thorough investigation reveals that First Brokers is not listed as a regulated entity by the Hong Kong Securities and Futures Commission (SFC), raising concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong SFC | N/A | Hong Kong | Not Regulated |

The absence of regulation from a reputable authority like the SFC suggests that First Brokers operates without the necessary oversight, which is essential for protecting traders' funds and ensuring fair trading practices. The lack of regulatory compliance can expose traders to risks such as fraud, mismanagement of funds, and untrustworthy trading practices. Given these findings, it is evident that First Brokers is not safe to trade with.

Company Background Investigation

First Brokers presents itself as a modern forex broker, but its ownership and operational history raise several red flags. The broker claims to be operated by Tera Holdings Ltd., yet there is limited information available about this company. The lack of transparency regarding the company's history, ownership structure, and regulatory status is concerning. Furthermore, the absence of a solid track record in the industry is a significant indicator that potential traders should be wary.

The management team behind First Brokers is not well-documented, making it difficult to assess their expertise and experience in the financial sector. A broker with a competent and experienced management team is crucial for establishing trust and credibility. Unfortunately, First Brokers fails to provide sufficient information about its management, which further erodes confidence in its operations. The overall opacity surrounding the company's operations suggests that First Brokers may not be a safe option for traders.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. First Brokers offers several account types, including a self-manage account with a minimum deposit of €250 and leverage up to 1:400. However, the broker does not provide clear information regarding spreads or commissions, which is unusual for a reputable broker.

| Fee Type | First Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | Typically 1-2 pips |

| Commission Model | Not Disclosed | Varies by broker |

| Overnight Interest Range | Not Disclosed | Varies by broker |

The lack of transparency in fee structures can lead to unexpected costs and diminish potential profits. Additionally, the high leverage offered by First Brokers is a double-edged sword; while it can amplify profits, it also increases the risk of significant losses. Traders should be cautious of brokers that offer excessively high leverage without clear guidelines, as this could indicate a lack of regulatory oversight and a propensity for risky trading practices. Thus, First Brokers does not appear to be a safe choice for those seeking transparent trading conditions.

Client Fund Security

The safety of client funds is a paramount concern for any trader. First Brokers claims to operate with client fund security measures, but the specifics are vague. There is no mention of segregated accounts, which are essential for ensuring that clients' funds are kept separate from the broker's operational funds. This lack of clarity raises concerns about the safety of deposited funds.

Moreover, First Brokers does not provide information on investor protection mechanisms or negative balance protection policies. These features are crucial in safeguarding traders from losing more than their initial investment. The absence of such protective measures further indicates that First Brokers may not be a safe trading environment.

Customer Experience and Complaints

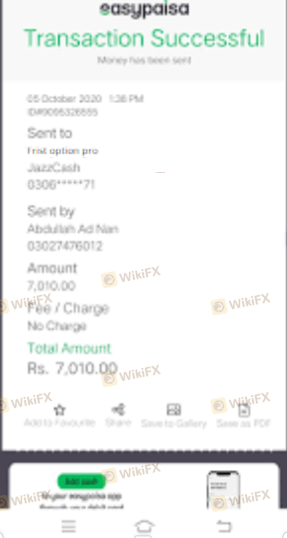

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of First Brokers reveal a pattern of complaints regarding withdrawal issues, lack of responsive customer support, and unclear trading conditions. Many users have reported difficulties in accessing their funds, which is a significant red flag for any broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Response | Medium | Slow |

| Unclear Trading Conditions | High | Unresolved |

For instance, several traders have reported that their withdrawal requests were delayed or denied without clear explanations. Such practices are often indicative of a scam or a broker that does not prioritize customer service. The overall negative sentiment surrounding customer experiences with First Brokers strongly suggests that it is not a safe option for traders.

Platform and Trade Execution

The trading platform offered by First Brokers is another area of concern. Many reviews indicate that the platform lacks essential features commonly found in established trading platforms, such as MetaTrader 4 or MetaTrader 5. The absence of advanced trading tools and functionalities may hinder traders' ability to execute trades effectively and manage their portfolios.

Additionally, reports of poor order execution quality, including slippage and rejected orders, have surfaced. These issues can significantly impact trading performance and profitability. If a broker's platform is unreliable, it can lead to losses and frustration for traders. Therefore, the platform offered by First Brokers raises further doubts about its safety and reliability.

Risk Assessment

Considering the findings from our investigation, the risks associated with trading with First Brokers are substantial. The lack of regulation, transparency, and customer support, combined with poor trading conditions and platform performance, culminates in a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker |

| Fund Security | High | No clear protection measures |

| Customer Support | Medium | Poor response to complaints |

| Trading Conditions | High | Lack of transparency in fees |

To mitigate these risks, traders are advised to thoroughly research brokers before opening accounts and to opt for regulated entities with a proven track record. It is crucial to prioritize safety and transparency when choosing a trading partner.

Conclusion and Recommendations

In conclusion, the investigation into First Brokers reveals numerous concerning factors that suggest it is not a safe trading option. The lack of regulation, transparency in trading conditions, and poor customer feedback are significant indicators of a potentially fraudulent operation. Traders should be extremely cautious when considering First Brokers as their trading partner.

For those seeking a secure trading environment, it is advisable to explore alternative brokers that are regulated by reputable authorities and have positive customer reviews. Consider brokers like Plus500, AvaTrade, or eToro, which are known for their reliability and transparency. Always prioritize safety and ensure that the broker you choose aligns with your trading needs and risk tolerance.

Is First Brokers a scam, or is it legit?

The latest exposure and evaluation content of First Brokers brokers.

First Brokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

First Brokers latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.