Is ELE Trader safe?

Business

License

Is Ele Trader Safe or Scam?

Introduction

Ele Trader is a relatively new entrant in the forex market, positioning itself as a platform that offers a variety of trading instruments, including currency pairs, commodities, and cryptocurrencies. As the forex trading landscape becomes increasingly saturated, it is vital for traders to exercise caution and conduct thorough evaluations of brokers before committing their funds. This is particularly true in an industry where the risk of scams and unregulated entities is prevalent. In this article, we will investigate the legitimacy of Ele Trader, assessing its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks.

To ensure a comprehensive evaluation, we have employed a multi-faceted investigative approach, utilizing a combination of qualitative and quantitative analysis. This includes examining user reviews, regulatory databases, and expert opinions to provide a balanced view of whether Ele Trader is a safe trading option or a potential scam.

Regulation and Legitimacy

One of the most critical factors in determining if Ele Trader is safe is its regulatory status. A brokers regulation is essential as it ensures compliance with industry standards, protecting traders from potential fraud. Unfortunately, Ele Trader does not appear to be regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Ele Trader does not have to adhere to any formal oversight, leaving traders vulnerable. This lack of regulatory framework can lead to issues such as untrustworthy practices, poor customer service, and inadequate protection of client funds. Furthermore, the absence of a regulatory history raises questions about the companys compliance with financial standards and its commitment to ethical trading practices.

Quality of Regulation

The quality of regulation is paramount in assessing broker safety. A well-regulated broker is typically required to segregate client funds, provide transparency in operations, and maintain a high standard of conduct. Without such oversight, traders may find themselves at risk of losing their investments without recourse. Given Ele Trader's lack of regulation, potential clients should approach with caution and consider the implications of trading with an unregulated entity.

Company Background Investigation

Understanding the company behind Ele Trader is crucial in assessing its credibility. According to available information, Ele Trader has been operational for a few years but lacks a well-documented history. The company's ownership structure is unclear, and there is limited information about its management team.

The management team‘s background and experience play a vital role in the operation of a trading platform. A competent team with a solid track record in finance and trading can significantly enhance a broker’s reliability. However, the lack of transparency surrounding Ele Trader's management raises concerns about the company's operational integrity and reliability.

Moreover, the level of transparency and information disclosure is crucial for building trust with clients. In Ele Traders case, the scant information available about its operations, ownership, and management team contributes to an overall perception of opacity, which is often a red flag in the trading industry.

Trading Conditions Analysis

When evaluating whether Ele Trader is safe, it is essential to consider the trading conditions it offers. The overall fee structure is a critical component of this assessment. A broker‘s fees can significantly impact a trader’s profitability, making it essential to understand any potential costs involved.

Ele Trader claims to offer competitive trading conditions, including various account types and low spreads. However, it is vital to scrutinize these claims against industry standards to determine their validity.

| Fee Type | Ele Trader | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 1.5% | 1.0% |

While Ele Trader advertises low commissions and spreads, the actual costs may vary, and traders should be wary of hidden fees that can affect their overall trading experience. Furthermore, the absence of a clear commission structure raises concerns about transparency and the potential for unexpected charges.

Client Fund Safety

The safety of client funds is a paramount consideration when determining if Ele Trader is safe. A reputable broker should implement stringent measures to protect client deposits, including fund segregation, investor protection schemes, and negative balance protection.

Ele Traders lack of regulation poses a significant risk to client funds. Without oversight, there is no guarantee that client funds are kept in segregated accounts, which is a standard practice among regulated brokers. Additionally, the absence of investor protection schemes means that traders have little recourse in the event of a broker failure or misconduct.

Historically, unregulated brokers have been associated with fraudulent activities, including misappropriation of client funds and refusal to process withdrawals. Therefore, the potential risks associated with trading on Ele Trader cannot be overstated.

Customer Experience and Complaints

Analyzing customer feedback is essential in assessing whether Ele Trader is safe for trading. User reviews and testimonials provide insight into real-world experiences with the broker, highlighting common issues and the companys responsiveness to complaints.

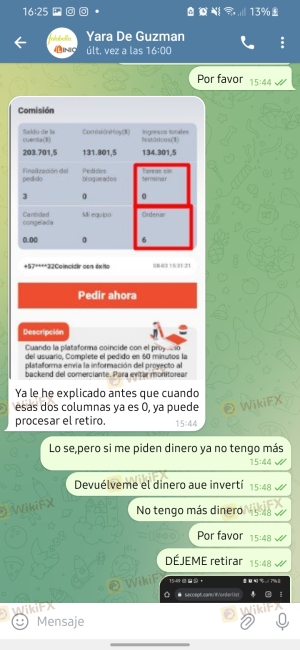

Many users have expressed concerns regarding the quality of customer service provided by Ele Trader. Common complaints include slow response times, difficulties in withdrawing funds, and a lack of transparency regarding fees and trading conditions.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Support | Medium | Inconsistent |

| Transparency | High | Lacking |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and concerns about the brokers reliability. Such issues can severely impact a trader's experience and raise doubts about the broker's commitment to customer satisfaction.

Platform and Execution

The performance of a trading platform is crucial for traders, as it directly affects their ability to execute trades efficiently. Ele Trader claims to offer a user-friendly platform with various features, but the actual performance and reliability of the platform remain questionable.

Users have reported issues with order execution, including slippage and rejected orders. These problems can be detrimental to a trader's strategy, particularly in fast-moving markets. Furthermore, any signs of potential platform manipulation should be taken seriously, as they can indicate deeper issues with the brokers operations.

Risk Assessment

Using Ele Trader involves several risks, primarily due to its unregulated status and lack of transparency. Traders should be aware of the following risks when considering this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight |

| Fund Safety Risk | High | No fund segregation |

| Customer Service Risk | Medium | Poor responsiveness |

Given these risks, traders are advised to approach Ele Trader with caution. To mitigate potential losses, it is recommended to limit the amount of capital invested and remain vigilant regarding any unusual activity on the platform.

Conclusion and Recommendations

In conclusion, the investigation into Ele Trader raises significant concerns regarding its safety and legitimacy. The lack of regulation, transparency, and customer support suggests that traders should be cautious when considering this broker. While Ele Trader may present itself as a viable trading option, the potential risks and issues outlined in this article indicate that it may not be the safest choice for traders.

For those seeking reliable alternatives, it is advisable to consider brokers that are well-regulated and have a proven track record of customer satisfaction. Options such as regulated brokers with strong reputations in the industry can provide a more secure trading environment, ensuring that traders' funds are protected and that they receive the necessary support throughout their trading journey.

Ultimately, traders must prioritize safety and due diligence when selecting a broker, as the consequences of engaging with an unregulated entity can be severe.

Is ELE Trader a scam, or is it legit?

The latest exposure and evaluation content of ELE Trader brokers.

ELE Trader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ELE Trader latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.