Is EGM Finance safe?

Business

License

Is EGM Finance A Scam?

Introduction

EGM Finance is a broker operating within the forex market, targeting traders looking for various financial instruments including forex, cryptocurrencies, and CFDs. As the forex market continues to attract a growing number of participants, it becomes increasingly crucial for traders to meticulously evaluate the reliability and safety of their chosen brokers. The potential for scams and fraudulent activities in this sector necessitates a careful assessment of company practices, regulatory compliance, and customer feedback. In this article, we will conduct a comprehensive investigation into EGM Finance, utilizing data from multiple sources to ascertain whether it is a safe platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is fundamental to its legitimacy and the safety of client funds. EGM Finance operates without any recognized regulatory oversight, which raises significant concerns. The broker is reportedly based in Saint Vincent and the Grenadines, a location known for its lax regulatory framework. This lack of regulation is alarming, as it means that EGM Finance is not subject to the stringent requirements that regulated brokers must adhere to, such as maintaining segregated accounts for client funds and adhering to transparency standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

The absence of a credible regulatory body overseeing EGM Finance suggests a high-risk environment for traders. Without such oversight, there are no guarantees regarding the safety of deposits or the integrity of trading practices. Additionally, traders who engage with unregulated brokers like EGM Finance may face difficulties in resolving disputes or recovering funds in the event of issues arising.

Company Background Investigation

EGM Finance is associated with Spiral Holding Limited, but detailed information about the company's history, ownership structure, and management team is scarce. The lack of transparency regarding ownership raises red flags about the broker's accountability. A reputable broker typically provides clear information about its founders and management, including their professional backgrounds and experience in the financial sector.

The absence of such disclosures can lead to concerns about the broker's legitimacy and operational integrity. Furthermore, the company's location in a jurisdiction known for minimal regulatory oversight further exacerbates these concerns. Traders should be wary of platforms that do not provide comprehensive information about their operations, as this can be indicative of potential fraud.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. EGM Finance presents a tiered account structure, with varying minimum deposits and leverage options. However, the overall fee structure appears to be on the higher side compared to industry standards.

| Fee Type | EGM Finance | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.8 pips | 1.2 pips |

| Commission Model | Yes, up to 5% | 0-2% |

| Overnight Interest Range | Varies | Varies |

The spreads offered by EGM Finance are not competitive, especially for a broker without regulatory oversight. Traders should be cautious of high fees that can significantly erode profits. Moreover, the presence of commissions on trades can further complicate the cost structure, making it essential for potential clients to thoroughly understand any hidden fees before committing their funds.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. EGM Finance's lack of regulation raises serious questions about its fund safety measures. The broker does not provide clear information regarding the segregation of client funds, which is a critical practice for protecting traders' capital.

Without proper segregation, there is a risk that client funds could be misused or lost in the event of the broker facing financial difficulties. Additionally, the absence of investor protection schemes means that clients have no recourse if the broker fails or engages in fraudulent activities. Historical data on fund safety issues related to EGM Finance is lacking, but the absence of regulatory oversight alone is a significant risk factor.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. EGM Finance has garnered a mix of reviews, with many users expressing concerns over withdrawal issues and customer support responsiveness. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| High Fees | Medium | Minimal Explanation |

One notable case involved a trader who reported significant delays in withdrawing funds, claiming that the broker's support team was unresponsive during the process. Such experiences can severely impact a trader's confidence in the platform and highlight the potential risks associated with using EGM Finance.

Platform and Execution

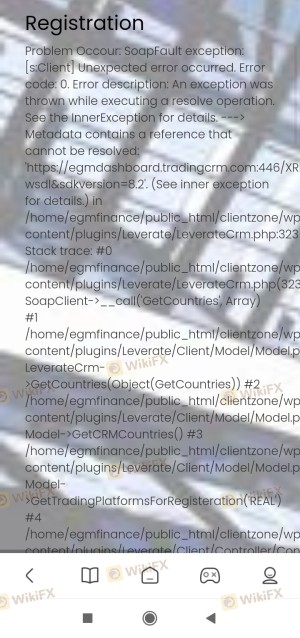

The trading platform provided by EGM Finance is another critical aspect to consider. Reviews indicate that the platform may experience stability issues, which can lead to delays in order execution and slippage during volatile market conditions. These factors can significantly affect trading outcomes, especially for those employing high-frequency trading strategies.

Moreover, the absence of advanced trading features or tools raises concerns about the platform's competitiveness. Traders should be wary of platforms that do not offer robust trading capabilities, as this could hinder their ability to execute trades effectively.

Risk Assessment

Using EGM Finance comes with several inherent risks. The lack of regulation, combined with high fees and questionable customer service, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight or protection |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Platform stability issues |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with EGM Finance. It may be wise to explore regulated alternatives that offer greater security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that EGM Finance operates in a high-risk environment, primarily due to its lack of regulation and transparency. The broker's questionable practices, combined with negative customer feedback, raise significant concerns about its legitimacy.

For traders seeking a reliable forex broker, it is advisable to avoid EGM Finance and consider alternatives that are regulated and have a proven track record of customer satisfaction. Brokers like EGM Securities, which operate under strict regulatory frameworks, offer a more secure trading environment.

Overall, is EGM Finance safe? The answer leans towards caution, and potential clients should be vigilant in their assessments before proceeding with any investments.

Is EGM Finance a scam, or is it legit?

The latest exposure and evaluation content of EGM Finance brokers.

EGM Finance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EGM Finance latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.