Is EFM safe?

Pros

Cons

Is EFM Safe or a Scam?

Introduction

EFM, a forex broker, has made its mark in the trading community by offering a range of financial services and trading options. However, as the forex market is notorious for its volatility and the potential for scams, traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated; a broker's regulatory status, trading conditions, and customer feedback can significantly impact a trader's experience and financial safety. This article aims to provide a comprehensive evaluation of EFM, analyzing its regulatory standing, company background, trading conditions, customer safety measures, and user experiences to determine whether EFM is safe or a potential scam.

Regulatory Status and Legitimacy

The regulatory framework governing a broker is crucial in assessing its legitimacy. A well-regulated broker typically adheres to strict guidelines that protect traders' interests, while unregulated brokers may pose significant risks. In the case of EFM, it is essential to investigate its regulatory status.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

EFM has been flagged as unregulated, which raises serious concerns about its operational legitimacy. Without oversight from a recognized financial authority, traders may face risks such as unfair trading practices, lack of transparency, and potential loss of funds. Regulatory bodies like the FCA (Financial Conduct Authority) and ASIC (Australian Securities and Investments Commission) enforce stringent rules that brokers must follow. The absence of such regulation for EFM indicates a lack of accountability and investor protection, making it essential for traders to approach this broker with caution.

Company Background Investigation

Understanding the company behind a broker is vital for assessing its reliability. EFM's history, ownership structure, and management team provide insights into its operational integrity. Unfortunately, there is limited publicly available information regarding EFM's establishment, ownership, and management. This lack of transparency is a red flag for potential investors.

The absence of a well-documented history and clear ownership can lead to concerns about accountability. A broker‘s management team should ideally consist of experienced professionals with a solid background in finance and trading. In EFM’s case, the lack of information about its leadership may indicate that the broker is not committed to maintaining high standards of integrity and service.

Trading Conditions Analysis

When evaluating a broker, the trading conditions offered can significantly affect the overall trading experience. EFM claims to provide various trading options; however, the specifics of its fee structure and trading conditions require examination.

| Fee Type | EFM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While specific figures for EFMs trading costs are not readily available, it is essential to scrutinize any unusual or hidden fees that could affect profitability. Many traders have reported issues with unanticipated charges, which can be detrimental to trading success. Therefore, understanding the full cost of trading with EFM is crucial for potential clients.

Client Fund Security

The safety of client funds is paramount when evaluating a forex broker. EFMs measures for safeguarding client capital should be scrutinized closely. Key aspects of fund safety include the segregation of client funds, investor protection schemes, and negative balance protection policies.

EFM's lack of regulatory oversight raises concerns regarding its fund safety measures. Without regulation, there are no guarantees that client funds are kept in segregated accounts, which is a standard practice among reputable brokers. Furthermore, the absence of investor protection schemes means that traders may not have recourse to recover their funds in case of a broker insolvency.

Customer Experience and Complaints

Customer feedback plays a crucial role in understanding a broker's reliability. EFMs reputation among its clients can provide valuable insights into its service quality. Analyzing user experiences, common complaints, and the broker's responsiveness can help determine whether EFM is safe or potentially problematic.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

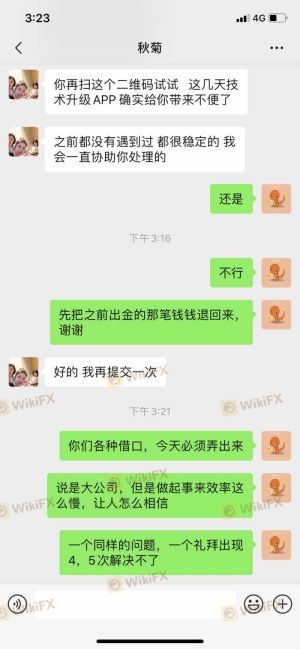

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Average |

Common complaints from EFM users include withdrawal difficulties and delays in customer support responses. Such issues can significantly impact a trader's ability to access their funds and receive assistance when needed. The severity of these complaints suggests that potential clients should consider these factors before engaging with EFM.

Platform and Trade Execution

The performance of a trading platform is critical for a successful trading experience. EFM's platform stability, order execution quality, and potential signs of manipulation must be evaluated to determine its reliability.

Users have reported mixed experiences with EFMs trading platform, with some citing issues related to execution slippage and rejected orders. Such problems can hinder trading performance and raise concerns about the broker's operational integrity. A reliable broker should provide a stable platform with efficient order execution to ensure that traders can capitalize on market opportunities.

Risk Assessment

When considering a broker, understanding the associated risks is essential. Analyzing the overall risk profile of EFM can help traders make informed decisions.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk. |

| Fund Safety Risk | High | Lack of segregation and protection. |

| Customer Service Risk | Medium | Complaints about support responsiveness. |

Given the high-risk levels associated with EFM, it is crucial for traders to exercise caution. Implementing risk mitigation strategies, such as starting with a demo account or trading with minimal capital, can help manage potential losses.

Conclusion and Recommendations

In conclusion, the investigation into EFM reveals significant concerns regarding its regulatory status, fund safety, and customer feedback. The absence of regulation and transparency raises serious red flags, suggesting that EFM is not safe for traders. Potential clients are advised to approach this broker with caution, as the risks associated with trading through an unregulated entity can outweigh the potential benefits.

For those seeking reliable alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC are recommended. These brokers typically offer better protection for client funds, transparent trading conditions, and responsive customer support. Ultimately, thorough research and careful consideration are vital in selecting a trustworthy forex broker.

Is EFM a scam, or is it legit?

The latest exposure and evaluation content of EFM brokers.

EFM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EFM latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.