EFM 2025 Review: Everything You Need to Know

Executive Summary

EFM is a Virginia corporation operating as a licensed property broker, established under Docket Number MC962797. The company maintains legitimate licensing status and operates from its principal place of business at 41650 Gardenbrook Road, Suite 120, Novi Michigan 48375, but traders should exercise significant caution when considering this entity for forex trading services. Our comprehensive efm review reveals that the company primarily functions as a freight brokerage and transportation logistics provider rather than a dedicated forex broker. The lack of transparent trading conditions, unclear regulatory status for financial services, and limited information about trading platforms raise serious concerns about its suitability for forex market participants. The company appears to target clients seeking freight and logistics services rather than active forex traders. This makes it an unconventional choice for currency trading activities.

Important Notice

This review is based on publicly available information and user feedback regarding EFM's operations. It's crucial to note that EFM operates primarily as a freight brokerage service, and its involvement in forex trading services remains unclear. Regional regulatory differences may apply, and potential clients should verify the company's authorization to provide financial services in their jurisdiction before engaging. The evaluation presented here has not involved direct testing of trading platforms or services, as the company's primary focus appears to be logistics rather than financial trading. Users should conduct independent research and consider consulting with financial advisors before making any investment decisions.

Scoring Framework

Broker Overview

EFM operates as Estes Final Mile, LLC, a Virginia corporation that has been functioning as a licensed property broker since its registration under Docket Number MC962797. The company's primary business model centers around freight brokerage and transportation logistics services, with its principal operations based in Novi, Michigan. According to available documentation, EFM specializes in arranging transportation services for customers, including exporters, importers, consignors, and consignees of various shipments.

The company's business structure indicates it functions as an intermediary in the logistics sector. It handles freight brokerage terms and conditions for transportation services. EFM's role involves coordinating between shippers and carriers, managing documentation, and ensuring compliance with transportation regulations. However, the connection between these logistics operations and forex trading services remains unclear, raising questions about the company's actual involvement in financial markets trading.

This efm review must emphasize that the available information predominantly relates to freight and logistics services rather than forex trading platforms or financial market operations. The company's regulatory status as a property broker under Virginia law does not automatically extend to financial services authorization, which is a critical consideration for potential forex trading clients.

Important Notice on Regional Operations

EFM's operations under Virginia state licensing may vary significantly from financial services regulations in different jurisdictions. The company's property broker license specifically relates to transportation and logistics services rather than financial trading activities. Potential clients should verify whether EFM holds appropriate licenses for forex trading services in their respective regions before engaging with the company for any financial trading purposes.

Regulatory Status

EFM operates under Virginia state licensing as a property broker with Docket Number MC962797. However, specific information regarding financial services regulation or forex trading authorization is not available in the accessible documentation.

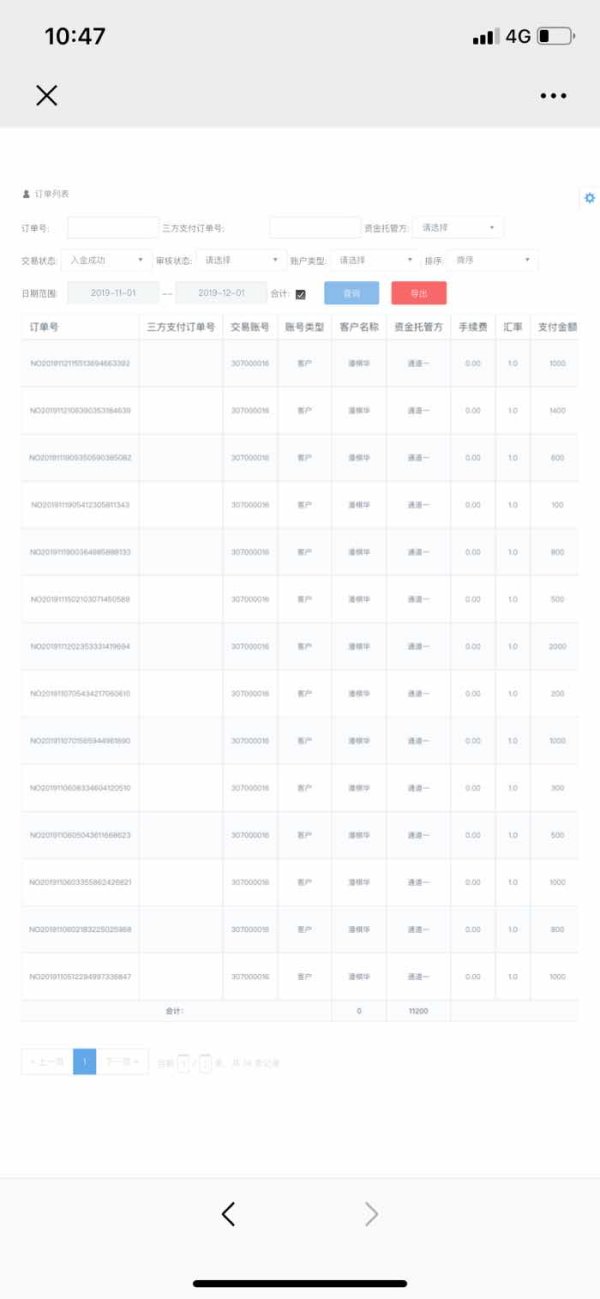

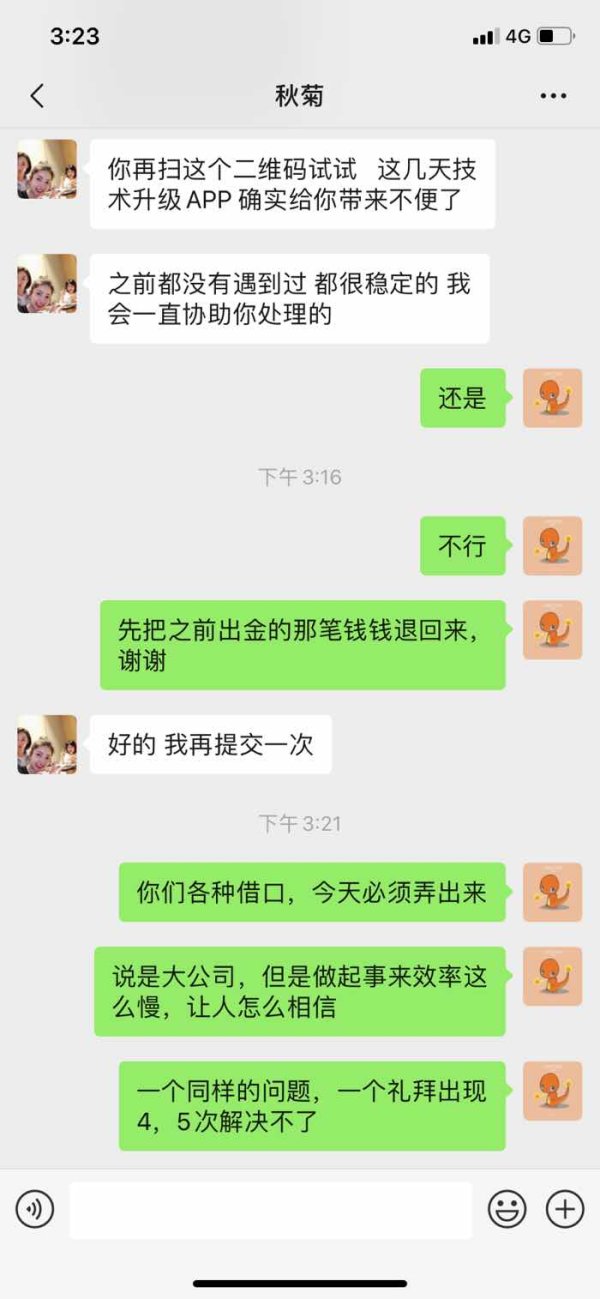

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods for trading accounts is not detailed in available materials. The company's primary focus appears to be freight brokerage services.

Minimum Deposit Requirements

No minimum deposit requirements for trading accounts are specified in the available documentation. This documentation primarily addresses freight brokerage terms and conditions.

Information regarding trading bonuses or promotional offers is not available in the current documentation. This is consistent with the company's apparent focus on logistics rather than financial trading services.

Tradeable Assets

The range of tradeable assets, including forex pairs, commodities, or other financial instruments, is not specified in available materials related to this efm review.

Cost Structure

Trading costs, spreads, commissions, or fee structures for financial trading services are not detailed in the accessible company information.

Leverage Ratios

Information about available leverage ratios for trading positions is not provided in the current documentation.

Details about trading platforms, software options, or technological infrastructure for forex trading are not available in the reviewed materials.

Geographic Restrictions

Specific geographic restrictions for trading services are not outlined. The company operates under Virginia state licensing.

Customer Service Languages

Information about multilingual customer support for trading services is not specified in available documentation.

Detailed Scoring Analysis

Account Conditions Analysis

The evaluation of account conditions for EFM presents significant challenges due to the absence of clear information about trading account offerings. Traditional forex brokers typically provide multiple account types with varying minimum deposits, leverage options, and trading conditions. However, our efm review finds no evidence of structured trading account offerings that would be expected from a legitimate forex broker.

The company's documentation focuses entirely on freight brokerage terms and conditions. These govern transportation services rather than financial trading accounts. This raises substantial concerns about whether EFM actually provides forex trading services or if there may be confusion with the company's primary logistics business. Without transparent account structures, minimum deposit information, or trading conditions, potential clients cannot make informed decisions about account suitability.

The absence of account condition details also suggests that EFM may not be actively marketing to forex traders. It may lack the necessary infrastructure to support trading operations. This represents a significant red flag for traders seeking reliable broker services with clearly defined account parameters and trading terms.

Assessment of trading tools and resources reveals a complete absence of information regarding analytical tools, research capabilities, or educational materials typically provided by forex brokers. Professional trading platforms usually offer technical analysis tools, economic calendars, market research, and educational resources to support trader decision-making.

The lack of any mention of trading tools, charting capabilities, or market analysis resources in EFM's available documentation suggests the company does not prioritize or possibly even offer these essential services. This deficiency would significantly impact trader effectiveness and represents a major limitation for anyone considering the platform for serious forex trading activities.

Additionally, no information is available regarding automated trading support, API access, or third-party tool integration. These are increasingly important features for modern forex trading operations. The absence of these technological capabilities further questions EFM's legitimacy as a forex trading provider.

Customer Service and Support Analysis

Customer service evaluation for trading-related inquiries cannot be completed due to insufficient information about financial services support structures. While EFM likely maintains customer service for its freight brokerage operations, there is no evidence of specialized support for forex trading clients.

Effective forex brokers typically provide 24/7 customer support, multiple communication channels, and knowledgeable staff capable of addressing technical trading issues. The absence of information about trading-specific customer service capabilities raises concerns about the level of support traders could expect.

Without details about response times, service quality, multilingual support, or support hours for trading operations, potential clients cannot assess whether EFM would meet their customer service expectations for forex trading activities.

Trading Experience Analysis

The trading experience evaluation cannot be completed due to the complete absence of information about trading platforms, execution quality, or user interface design. Professional forex brokers typically provide stable, fast-executing platforms with comprehensive functionality for market analysis and trade management.

No information is available regarding platform stability, order execution speeds, slippage rates, or mobile trading capabilities that would be essential for evaluating the trading experience. This lack of transparency about core trading infrastructure represents a significant concern for potential clients.

The absence of user feedback or performance data related to trading operations further complicates the assessment of what trading experience, if any, EFM might provide to forex market participants. This efm review cannot recommend the platform for trading purposes without evidence of functional trading infrastructure.

Trust and Reliability Analysis

EFM's trust assessment reveals mixed indicators that require careful consideration. On the positive side, the company operates as a licensed property broker under Virginia state law with Docket Number MC962797, indicating some level of regulatory compliance and business legitimacy within the transportation sector.

However, the company's licensing specifically relates to freight brokerage rather than financial services. This raises questions about its authorization to provide forex trading services. The lack of clear regulatory oversight for financial trading activities represents a significant trust concern for potential forex clients.

The absence of transparent information about fund segregation, investor protection measures, or financial services compliance further undermines confidence in the company's suitability for forex trading. While EFM may be legitimate within its core freight business, this does not automatically extend to financial services credibility.

User Experience Analysis

User experience evaluation cannot be completed due to insufficient information about trading-related user interactions, platform design, or client feedback specific to forex trading services. The available documentation focuses entirely on freight brokerage terms rather than trading user experience elements.

Without information about account opening procedures, platform usability, mobile access, or user interface design for trading purposes, it's impossible to assess the quality of user experience EFM might provide to forex traders. The lack of user testimonials or feedback related to trading services further limits the evaluation.

The absence of information about common user complaints, satisfaction ratings, or user retention metrics related to trading services prevents a comprehensive assessment of the user experience quality that potential forex clients might expect.

Conclusion

This comprehensive efm review reveals significant concerns about the company's suitability for forex trading purposes. While EFM operates as a legitimate licensed property broker in the freight transportation sector, there is insufficient evidence to support its credibility as a forex trading provider. The complete absence of trading-related information, platform details, and regulatory authorization for financial services raises serious questions about the company's involvement in forex markets. Traders seeking reliable forex trading services should consider established brokers with clear regulatory oversight, transparent trading conditions, and proven track records in financial markets rather than companies primarily focused on logistics operations.