Regarding the legitimacy of CL GrouP forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is CL GrouP safe?

Pros

Cons

Is CL GrouP markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Cheong Lee Securities Limited

Effective Date: Change Record

2005-11-24Email Address of Licensed Institution:

compliance@cheongleesec.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.cheongleesec.com.hkExpiration Time:

--Address of Licensed Institution:

香港灣仔告士打道56號東亞銀行港灣中心16樓B室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CL Group Safe or Scam?

Introduction

CL Group, a forex broker based in Hong Kong, has been gaining attention in the trading community. Established in 2004, it offers a range of trading services, including forex and CFDs. However, the rise of online trading has also brought about a surge in fraudulent activities, making it crucial for traders to carefully evaluate the trustworthiness of brokers like CL Group. In this article, we will investigate whether CL Group is a safe trading option or if it raises red flags that potential clients should be wary of. Our investigation is based on a thorough analysis of regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory environment is a key factor in determining the safety of any brokerage. CL Group claims to be regulated by the Securities and Futures Commission (SFC) in Hong Kong. This regulatory body is known for its stringent oversight and high compliance standards, which is an essential aspect for any trading platform.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | N/A | Hong Kong | Verified |

The importance of regulation cannot be overstated. A regulated broker must adhere to strict guidelines, ensuring that client funds are kept secure and that the broker operates transparently. However, while CL Group is regulated, it is essential to assess the quality of this regulation. Some reviews have indicated that although the broker is regulated, the scope of its business and the nature of its operations may raise suspicions.

Moreover, historical compliance issues can also signal potential risks. While there are no significant public records of CL Group facing regulatory actions, the lack of detailed transparency regarding its operations could be a cause for concern. Therefore, it is critical for potential clients to consider not just the fact that CL Group is regulated, but also the specifics of that regulation and any potential issues in its past.

Company Background Investigation

CL Group (Holdings) Limited has been operating for nearly two decades. The company is headquartered in Wan Chai, Hong Kong, and has established itself within the forex and CFD trading landscape. The ownership structure is relatively straightforward, with the company being publicly traded, which can add a layer of accountability.

The management team at CL Group comprises individuals with varying degrees of experience in the finance and trading sectors. However, the specific backgrounds of the executives are not widely publicized, which raises questions about the level of transparency the company maintains.

In terms of information disclosure, CL Group appears to have a moderate level of transparency. While it provides basic information regarding its services and regulatory status, more detailed insights into its operational practices and management could enhance investor trust. The overall assessment suggests that while CL Group has a solid foundation, the lack of comprehensive information about its management and operations is a point that potential clients should consider.

Trading Conditions Analysis

When evaluating whether CL Group is safe for trading, the conditions it offers are pivotal. The broker provides various financial instruments, including forex, CFDs, and commodities. However, the overall fee structure and any unusual fees can significantly impact a trader's experience.

| Fee Type | CL Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5%-1% | 0.3%-0.7% |

The spread on major currency pairs at CL Group is slightly higher than the industry average, which could affect profitability for active traders. Additionally, the commission structure is variable, which may lead to unexpected costs for clients. This lack of clarity in fees could be a potential drawback, making it essential for traders to fully understand the cost implications before engaging with the broker.

Client Funds Safety

The safety of client funds is a critical aspect of assessing whether CL Group is safe. The broker claims to implement several measures to protect client funds, including segregated accounts and investor protection schemes. However, the specifics of these measures are not extensively detailed in their disclosures.

The absence of comprehensive information regarding fund security can be a red flag for potential clients. While CL Group is regulated, the degree of protection offered to clients in the event of a financial dispute remains uncertain. Historical issues concerning fund safety in the trading industry can also inform potential clients about the risks involved.

Therefore, while CL Group may have some safety measures in place, the lack of detailed information regarding these protections makes it essential for traders to conduct thorough research before investing their funds.

Customer Experience and Complaints

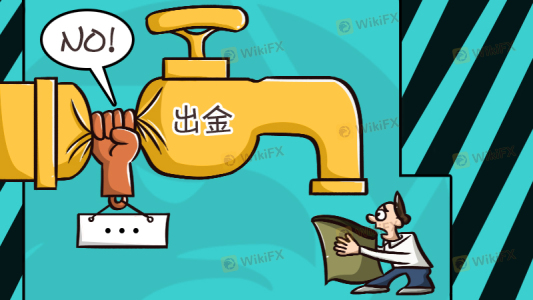

Customer feedback is a vital component in evaluating whether CL Group is safe. Reviews from users indicate a mixed experience, with some clients reporting satisfactory service while others have raised concerns about responsiveness and withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Average response |

| Account Management Issues | High | Poor response |

Common complaints include delays in withdrawals and inadequate customer support. Such issues can significantly impact a trader's experience and trust in the broker. In one notable case, a client reported difficulty in withdrawing funds after experiencing initial trading success, which ultimately led to frustration and concern regarding the broker's reliability.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for any forex trader. CL Group offers a proprietary trading platform; however, reviews indicate mixed feelings about its performance.

Users have reported instances of slippage and order rejections, which can be detrimental in a fast-moving market. The overall execution quality appears to be average, but there are concerns regarding the platform's stability during high volatility periods.

Such issues raise questions about whether CL Group is safe for traders who rely on timely execution and stability, especially during critical trading hours.

Risk Assessment

Using CL Group comes with its own set of risks that traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated but with potential concerns regarding compliance. |

| Financial Risk | High | Higher spreads and variable fees could impact profitability. |

| Operational Risk | Medium | Mixed reviews on platform stability and customer support. |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, maintaining a diversified portfolio and setting strict risk management rules can help in managing potential losses.

Conclusion and Recommendations

In conclusion, while CL Group is regulated and has a long-standing presence in the forex market, there are several areas of concern that potential clients should consider. The mixed reviews regarding customer experiences, lack of transparency in fees, and questions surrounding the safety of client funds suggest that traders should exercise caution.

For those considering CL Group, it is advisable to conduct thorough research and perhaps start with smaller investments to gauge the broker's reliability. If significant concerns arise, exploring alternative brokers with stronger reputations and clearer fee structures may be prudent. Ultimately, while CL Group may not be outright fraudulent, the potential risks warrant careful consideration and due diligence from prospective traders.

In summary, is CL Group safe? The answer is nuanced; while it operates under regulatory oversight, the overall experience and feedback indicate that traders should remain vigilant and informed before proceeding with this broker.

Is CL GrouP a scam, or is it legit?

The latest exposure and evaluation content of CL GrouP brokers.

CL GrouP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CL GrouP latest industry rating score is 6.95, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.95 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.