Is Atex coin safe?

Business

License

Is Atex Coin A Scam?

Introduction

Atex Coin is an online trading platform that positions itself within the forex market, promising potential high returns through various trading options. As a relatively new entrant in the industry, it claims to offer a range of investment services tailored to both novice and experienced traders. However, the influx of dubious brokers in the forex landscape necessitates a cautious approach by traders when evaluating the legitimacy and safety of such platforms. This article aims to investigate whether Atex Coin is a reliable broker or a potential scam. The evaluation will be based on regulatory compliance, company background, trading conditions, client fund safety, customer experiences, platform performance, and an overall risk assessment.

Regulation and Legitimacy

The regulatory status of a trading platform is paramount in determining its reliability. A regulated broker is typically subject to oversight by a financial authority, which helps ensure the protection of client funds and adherence to ethical trading practices. Unfortunately, Atex Coin operates without any recognized regulation, which raises significant red flags regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Atex Coin is not bound by the standards that protect investors in many jurisdictions. This lack of oversight can lead to unethical practices, including the mismanagement of funds and difficulty in withdrawing money. Moreover, the company does not appear in any reputable regulatory registries, further solidifying concerns about its legitimacy. The historical compliance of regulated brokers is crucial; however, Atex Coin's unregulated status suggests that it lacks the necessary oversight to ensure safe trading practices.

Company Background Investigation

Atex Coin Limited, the entity behind Atex Coin, has a murky background. Established in 2021, the company claims to be based in Hartlepool, England. However, the provided address has been flagged as potentially fake, and there is little verifiable information regarding its ownership structure or management team. The lack of transparency surrounding the company's operations is a major concern for potential investors.

The management teams experience is crucial in establishing trust. However, Atex Coin does not disclose any specific information about its executives or their backgrounds, which makes it difficult to assess their qualifications and experience in the financial sector. This opacity is a common characteristic of many scam brokers, as it allows them to operate without accountability.

Trading Conditions Analysis

Understanding the trading conditions offered by Atex Coin is essential for evaluating its reliability. The broker presents a tiered account structure, which includes options such as trial, silver, gold, and diamond accounts, each requiring progressively higher minimum deposits. However, the overall fee structure appears to be opaque, with little information provided about spreads, commissions, or other trading costs.

| Fee Type | Atex Coin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding fees is troubling, as traders may encounter unexpected costs that could erode their profits. Furthermore, vague withdrawal policies are often a tactic employed by scam brokers to limit access to funds, which has been reported by several users as a common complaint with Atex Coin.

Client Fund Safety

The safety of client funds is a critical aspect of any trading platform. Atex Coin's lack of regulation means that it is not required to implement standard safety measures such as fund segregation or investor protection schemes. This absence of safeguards poses a significant risk to traders, as their investments may not be protected in the event of the company's insolvency or fraudulent practices.

Historically, unregulated brokers like Atex Coin have faced numerous allegations of mishandling client funds. The absence of transparency regarding their fund management practices further exacerbates concerns about the safety of investments with this broker. Without proper oversight, clients are left vulnerable to potential losses.

Customer Experience and Complaints

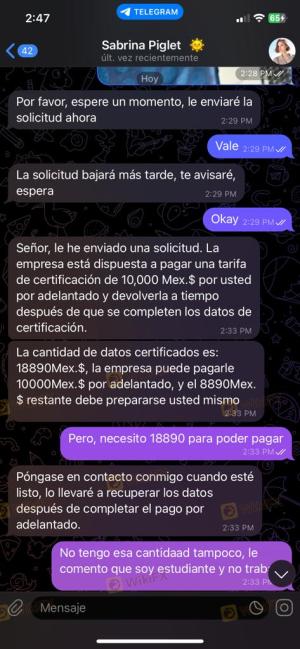

Customer feedback is a valuable indicator of a broker's reliability. Atex Coin has garnered a plethora of negative reviews and complaints from users, many of whom report difficulties in withdrawing their funds. Common complaints include delayed withdrawals, unresponsive customer support, and aggressive sales tactics from account managers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Accessibility | Medium | Poor |

| Misleading Promotions | High | Unresponsive |

One notable case involved a user who reported being unable to withdraw their capital after multiple requests, leading to frustration and financial loss. Such experiences highlight the risks associated with trading through Atex Coin and reinforce the notion that it may not be a safe option for traders.

Platform and Execution Performance

Evaluating the performance of Atex Coin's trading platform is essential for understanding the user experience. Reports suggest that the platform suffers from stability issues, with users experiencing frequent downtime and lag during trading sessions. Additionally, the quality of order execution is a critical factor; users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

There are also concerns regarding potential market manipulation, a common issue with unregulated brokers. Traders should be wary of platforms that do not provide transparent information about their execution practices.

Risk Assessment

Given the numerous red flags associated with Atex Coin, the overall risk of trading with this broker is high. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Security Risk | High | Lack of client fund protection |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

| Execution Risk | High | Issues with order execution |

To mitigate these risks, potential investors should consider conducting thorough due diligence and exploring regulated alternatives that offer greater transparency and security.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Atex Coin exhibits several characteristics typical of a scam broker. The lack of regulation, poor customer feedback, and opacity surrounding its operations raise significant concerns about its reliability. Traders are advised to exercise extreme caution when considering investments with Atex Coin and to be aware of the potential risks involved.

For those seeking safer trading options, it is recommended to explore well-regulated brokers with a proven track record of transparency and customer support. Always prioritize platforms that provide robust investor protection measures to safeguard your investments. In summary, Is Atex Coin safe? The overwhelming consensus is that it is not, and traders should be vigilant in avoiding this platform.

Is Atex coin a scam, or is it legit?

The latest exposure and evaluation content of Atex coin brokers.

Atex coin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Atex coin latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.