Regarding the legitimacy of ANZ forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is ANZ safe?

Pros

Cons

Is ANZ markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Australia and New Zealand Banking Group Limited

Effective Date: Change Record

2003-10-01Email Address of Licensed Institution:

yourfeedback@anz.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.anz.com.au/support/contact-us/compliments-suggestions-complaints/Expiration Time:

--Address of Licensed Institution:

COMPANY SECRETARY'S OFFICE 'ANZ CENTRE MELBOURNE' L 9 833 COLLINS ST DOCKLANDS VIC 3008Phone Number of Licensed Institution:

1800 805 154Licensed Institution Certified Documents:

Is ANZ Safe or Scam?

Introduction

ANZ, or the Australia and New Zealand Banking Group, is one of the largest financial institutions in the Asia-Pacific region, offering a wide range of services including forex trading. As a prominent player in the financial market, it is crucial for traders to evaluate the credibility and safety of ANZ as a forex broker. The forex market is rife with opportunities, but it also presents numerous risks, making it imperative for traders to conduct thorough due diligence before engaging with any broker.

In this article, we will investigate whether ANZ is safe for trading or if there are underlying issues that could classify it as a scam. Our assessment will be based on various factors including regulatory status, company background, trading conditions, customer feedback, and overall risk evaluation. We will utilize data from reputable sources, customer reviews, and regulatory information to provide a comprehensive overview of ANZ's standing in the forex market.

Regulation and Legitimacy

ANZ operates under the regulatory oversight of the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulations aimed at protecting investors. Regulatory compliance is a significant indicator of a broker's legitimacy, as it ensures that they adhere to specific standards designed to safeguard clients' funds and interests.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 234527 | Australia | Verified |

The importance of regulatory oversight cannot be overstated. Brokers that are regulated by reputable authorities such as ASIC must comply with strict financial standards, including maintaining adequate capital reserves and implementing measures to protect client funds. ANZ has been established since 1835, and its long-standing presence in the financial industry adds to its credibility. Furthermore, there have been no significant negative regulatory disclosures against ANZ, suggesting a history of compliance with regulatory requirements.

Company Background Investigation

ANZ has a rich history that dates back nearly two centuries, having evolved from its origins as the Bank of Australasia. Over the years, it has grown into one of the "big four" banks in Australia, providing a wide range of financial services. The ownership structure of ANZ is transparent, with shares publicly traded on the Australian Securities Exchange (ASX). This public trading status requires ANZ to disclose financial information regularly, which enhances its accountability.

The management team at ANZ comprises experienced professionals with extensive backgrounds in finance and banking. This expertise is essential for navigating the complexities of the financial markets and ensuring that the institution operates efficiently. ANZs commitment to transparency is evident in its comprehensive reporting and communication with stakeholders.

Trading Conditions Analysis

When evaluating whether ANZ is safe, it is essential to analyze its trading conditions, including fees and commissions. ANZ's fee structure is relatively straightforward, but it can be perceived as high compared to other brokers in the market. Understanding the costs associated with trading is crucial for traders to make informed decisions.

| Fee Type | ANZ | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable | 1-2 pips |

| Commission Model | $19.95/trade | $10-15/trade |

| Overnight Interest Range | 0.5%-2% | 0.1%-1% |

ANZ charges a commission of $19.95 for trades, which is on the higher end when compared to industry averages. Additionally, the spreads can vary significantly depending on market conditions. Understanding these costs is vital, as they can impact profitability. Traders should be cautious of any unusual fees that may arise, particularly during high volatility periods.

Client Fund Security

The safety of client funds is a paramount concern for any trader. ANZ employs several measures to ensure the security of client funds, including segregating client accounts from company funds. This practice protects clients' investments in the event of financial difficulties faced by the broker. Furthermore, ANZ is a member of the Financial Ombudsman Service, which provides an additional layer of protection for clients in case of disputes.

ANZ also implements negative balance protection, ensuring that clients cannot lose more than their initial investment. This is a crucial feature that adds to the overall safety of trading with ANZ. Historically, there have been no significant issues reported regarding fund security, further bolstering the argument that ANZ is safe for traders.

Customer Experience and Complaints

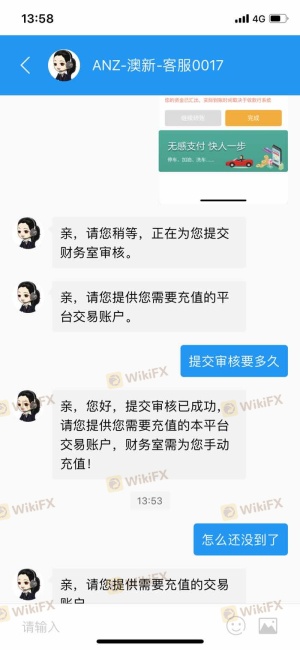

Customer feedback is an essential aspect of evaluating whether ANZ is safe. While many users have reported positive experiences, there are also notable complaints regarding customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Service Issues | Medium | Mixed responses |

Common complaints include delays in processing withdrawals and slow customer service response times. For instance, some users have expressed frustration over extended waiting periods to access their funds. While ANZ has mechanisms in place to address these issues, the response times have been criticized, leading to dissatisfaction among clients.

Platform and Execution

The trading platform offered by ANZ is generally regarded as stable, but users have reported occasional issues with execution speed and slippage. A reliable platform is crucial for effective trading, particularly in a fast-moving market like forex. Traders have noted instances of slippage during high volatility, which can impact trade outcomes negatively.

Moreover, there have been no significant reports of platform manipulation, which is a positive sign for potential traders. Overall, while the platform is functional, the user experience could be enhanced to ensure smoother trading operations.

Risk Assessment

Using ANZ for forex trading comes with certain risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by ASIC |

| Operational Risk | Medium | Occasional delays in withdrawals |

| Market Risk | High | Exposure to market volatility |

The primary risks associated with trading through ANZ include operational issues, such as delays in withdrawals and customer service responses. However, the regulatory risk is low, given ANZ's compliance with ASIC's stringent regulations. Traders should be aware of market risks, particularly in the volatile forex environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that ANZ is safe for trading, primarily due to its regulatory oversight by ASIC, comprehensive security measures for client funds, and a long-standing reputation in the financial industry. However, potential traders should remain vigilant regarding customer service issues and withdrawal processes, as these have been highlighted as areas needing improvement.

For traders looking for reliable alternatives, brokers such as Westpac or Commonwealth Bank may offer competitive services with a focus on customer experience. Ultimately, traders should assess their individual needs and risk tolerance when choosing a forex broker, but ANZ remains a credible option in the market.

Is ANZ a scam, or is it legit?

The latest exposure and evaluation content of ANZ brokers.

ANZ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ANZ latest industry rating score is 7.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.