Is ACM safe?

Pros

Cons

Is ACM Safe or Scam?

Introduction

ACM, also known as Advanced Currency Markets, has established itself as a player in the forex market since its inception in 2002. Originally based in Switzerland, ACM has gained attention for its trading services, which cater to both institutional and retail clients. However, the forex market is fraught with risks, and traders must exercise caution when evaluating brokers. The complexity and variability of trading conditions, regulatory oversight, and customer experiences make it essential for traders to conduct thorough research before committing their funds. This article aims to assess whether ACM is a safe broker or a potential scam by examining its regulatory status, company background, trading conditions, customer fund security, and overall client experiences.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of any forex broker. ACM was initially regulated by the Swiss Financial Market Supervisory Authority (FINMA), which is known for its stringent requirements. However, the broker lost its license in 2010, leading to concerns about its operational legitimacy. Below is a summary of ACM's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FINMA | N/A | Switzerland | License revoked in 2010 |

The loss of regulatory oversight raises significant red flags, as it indicates that ACM is no longer subject to the stringent compliance and consumer protection measures that licensed brokers must adhere to. Additionally, the history of legal troubles, including police raids on its offices, further complicates the picture of ACM's legitimacy. Without active regulation, the broker may have the freedom to engage in practices that could jeopardize clients' funds, making it vital for prospective traders to consider these factors seriously. Thus, the question remains, is ACM safe? The answer leans towards caution due to its unregulated status.

Company Background Investigation

ACM has a history that includes notable achievements and significant controversies. Founded in 2002, it initially operated under a reputable regulatory framework, which contributed to its credibility. However, the company faced a turning point in 2010 when it lost its regulatory license. This loss prompted a restructuring and eventual acquisition by Swissquote, a larger financial institution.

The management team's background is a crucial aspect of ACM's operational integrity. While the company has had experienced professionals at the helm, the lack of transparency regarding its current management raises concerns. Information about the team's qualifications and experience is sparse, making it difficult for potential clients to assess the expertise guiding their investments. Furthermore, the opacity surrounding ACM's operations and ownership structure further fuels skepticism about its reliability.

In terms of transparency, ACM's historical performance and current operational practices suggest a lack of accountability. The absence of clear communication regarding regulatory changes and operational status can leave clients feeling vulnerable and uninformed. Therefore, the question of is ACM safe becomes increasingly relevant as traders weigh the risks involved in partnering with a broker that has experienced significant regulatory setbacks.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is paramount. ACM offers various account types with different minimum deposit requirements and trading costs. However, the overall fee structure has raised concerns among traders.

The following table summarizes ACM's core trading costs compared to industry averages:

| Fee Type | ACM | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 2.8 pips | 1.5 pips |

| Commission Structure | No commissions | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by ACM are notably higher than the industry average, which can significantly impact trading profitability, especially for retail traders. Additionally, the lack of a transparent commission structure can lead to unexpected costs, further complicating the trading experience. Given these factors, potential clients should carefully consider whether the trading conditions at ACM align with their investment strategies and risk tolerance. This analysis leads to the critical inquiry of is ACM safe for traders who may be adversely affected by unfavorable trading conditions.

Client Fund Security

The security of client funds is a vital aspect of any brokerage's reputation. ACM's history of losing its regulatory license raises substantial concerns regarding the safety measures in place to protect clients' investments. The broker's ability to segregate client funds from its operational capital is crucial in ensuring that traders' money is safeguarded in the event of financial difficulties.

ACM has not provided clear information regarding its fund protection measures, such as investor compensation schemes or negative balance protection policies. The lack of transparency in this area is alarming, especially considering the broker's past legal issues and the absence of regulatory oversight. Historical incidents involving fund mismanagement further exacerbate these concerns.

To summarize, the absence of robust safety measures and the potential for fund misappropriation raise significant alarms about is ACM safe for traders looking to invest their hard-earned money in the forex market.

Customer Experience and Complaints

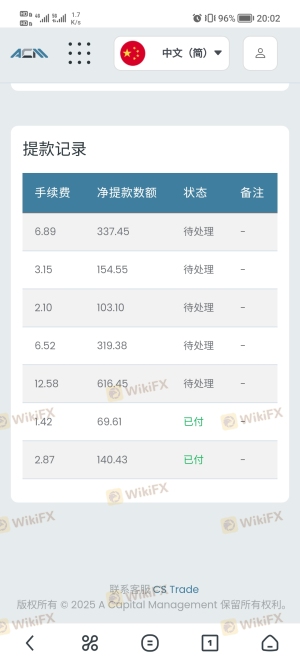

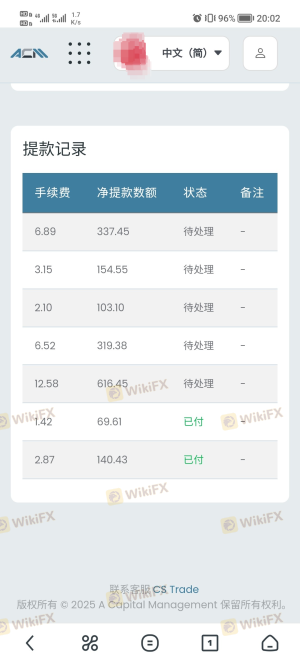

Analyzing customer feedback is essential in assessing a broker's reliability and service quality. Numerous complaints have been lodged against ACM, highlighting issues such as account freezes, withdrawal delays, and poor customer support. The following table categorizes the main types of complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account freezes | High | Slow response |

| Withdrawal delays | High | Unresponsive |

| Poor customer support | Medium | Inconsistent |

Typical case studies reveal a pattern of dissatisfaction among clients. For instance, one trader reported significant delays in processing withdrawals, which ultimately led to frustration and financial loss. Another case involved an account freeze without clear communication, leaving the trader unable to access their funds for an extended period. These experiences contribute to the growing skepticism surrounding ACM's operational practices and raise the critical question of is ACM safe for potential traders.

Platform and Trade Execution

The performance of a trading platform directly impacts a trader's experience and success. ACM offers the popular MetaTrader 4 platform, known for its stability and user-friendly interface. However, user experiences indicate that the platform may suffer from issues such as slippage and order rejections during volatile market conditions.

Traders have reported instances of significant slippage, particularly during high-impact news events, which can lead to unexpected losses. Additionally, there have been allegations of potential platform manipulation, where order execution appears to favor the broker rather than the trader. This raises a crucial concern about is ACM safe for traders who rely on timely and accurate order execution to manage their investments effectively.

Risk Assessment

When considering a broker like ACM, it is essential to evaluate the associated risks comprehensively. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated since 2010 |

| Financial Risk | High | Lack of transparency in fund security |

| Customer Service Risk | Medium | Poor response to complaints |

The high regulatory risk is particularly concerning, given ACM's history of losing its license and the subsequent lack of oversight. Traders should be aware that without a regulatory framework, they may have limited recourse in the event of disputes or financial issues.

To mitigate these risks, traders should consider conducting thorough due diligence, including researching alternative brokers with robust regulatory oversight and transparent operational practices. The question of is ACM safe remains critical, urging traders to approach this broker with caution.

Conclusion and Recommendations

After analyzing ACM's regulatory status, company background, trading conditions, client fund security, and customer experiences, it becomes evident that there are significant concerns regarding the broker's safety and reliability. The absence of regulation, coupled with a history of legal issues and numerous customer complaints, raises red flags for potential traders.

In light of these findings, it is advisable for traders to exercise caution and consider alternative brokers that offer a more secure and transparent trading environment. Brokers with strong regulatory oversight, favorable trading conditions, and positive customer feedback should be prioritized.

In conclusion, while ACM may present itself as a viable option in the forex market, the critical question of is ACM safe leans towards a negative assessment, urging traders to seek safer alternatives for their trading endeavors.

Is ACM a scam, or is it legit?

The latest exposure and evaluation content of ACM brokers.

ACM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACM latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.