ACM 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive acm review examines ACM as a forex broker operating within the financial services sector. Based on available information, ACM appears to be connected to academic computing review systems and broker evaluation platforms, though specific operational details remain limited in publicly accessible sources. The broker evaluation landscape shows ACM listed on various forex comparison websites. This suggests some level of market presence in the trading industry.

ACM's positioning in the forex market appears to target traders seeking broker evaluation services, though comprehensive details about trading conditions, regulatory status, and specific service offerings require deeper investigation. The available information suggests ACM operates in a competitive environment. Broker transparency and user feedback play crucial roles in market positioning.

This evaluation aims to provide traders with an objective assessment based on currently available information. We acknowledge the limitations in comprehensive data access for detailed analysis.

Important Disclaimer

This acm review is compiled based on limited publicly available information extracted from various online sources. Traders should note that specific information regarding trading conditions, regulatory compliance, account features, and customer service details was not comprehensively available in the source materials reviewed.

The evaluation methodology employed for this review relies on accessible data points, and the absence of detailed user feedback and comprehensive service documentation may impact the completeness of this assessment. Potential clients are strongly advised to conduct independent research. They should directly contact ACM for current and accurate information about their services.

Rating Framework

Broker Overview

ACM operates within the competitive forex brokerage landscape. Broker evaluation and comparison services play increasingly important roles in trader decision-making. The available information suggests ACM has established some market presence, as evidenced by its inclusion on various forex broker comparison platforms and review websites.

The broker appears to target traders who prioritize thorough evaluation processes when selecting financial service providers. This positioning aligns with current market trends where transparency and comprehensive broker analysis have become essential factors in trader decision-making processes.

ACM's market approach seems to emphasize the importance of broker evaluation services. Specific details about the company's founding, operational history, and core business model require additional verification. The broker operates in an environment where regulatory compliance, trading conditions, and customer satisfaction metrics are crucial differentiators.

The available sources indicate ACM's presence in broker comparison databases. This suggests active participation in the forex industry's evaluation ecosystem. However, comprehensive information about asset offerings, trading platforms, and specific service features remains limited in publicly accessible documentation.

Regulatory Status: Specific regulatory information was not detailed in the available source materials. This requires direct verification with the broker.

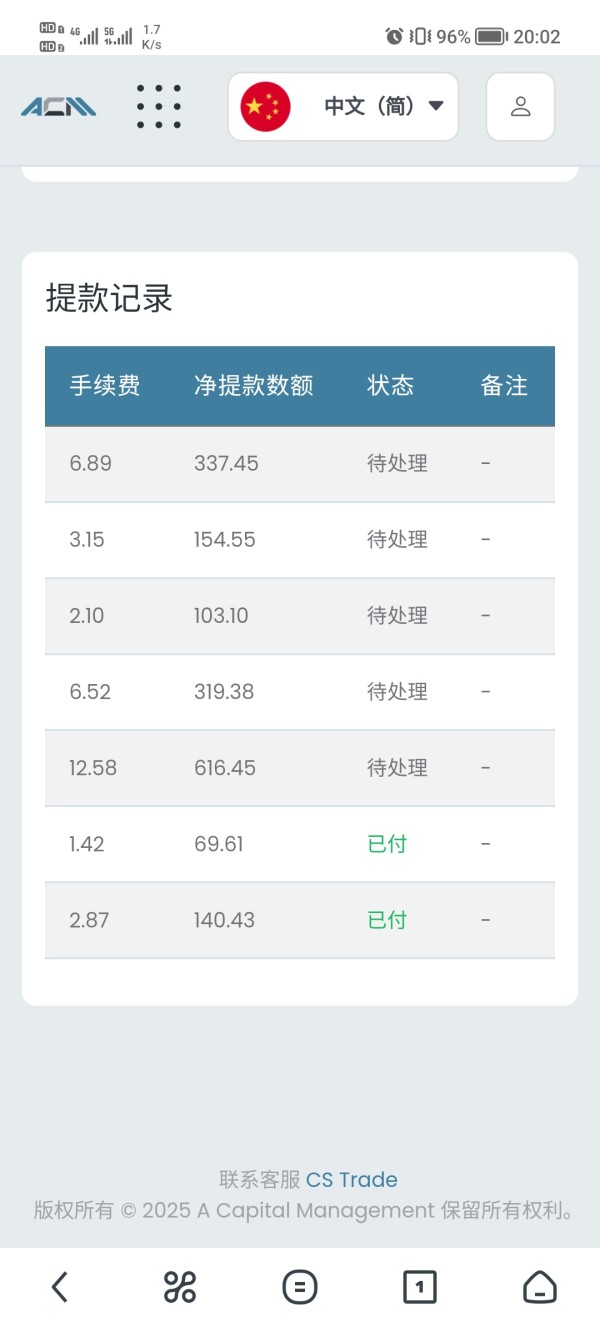

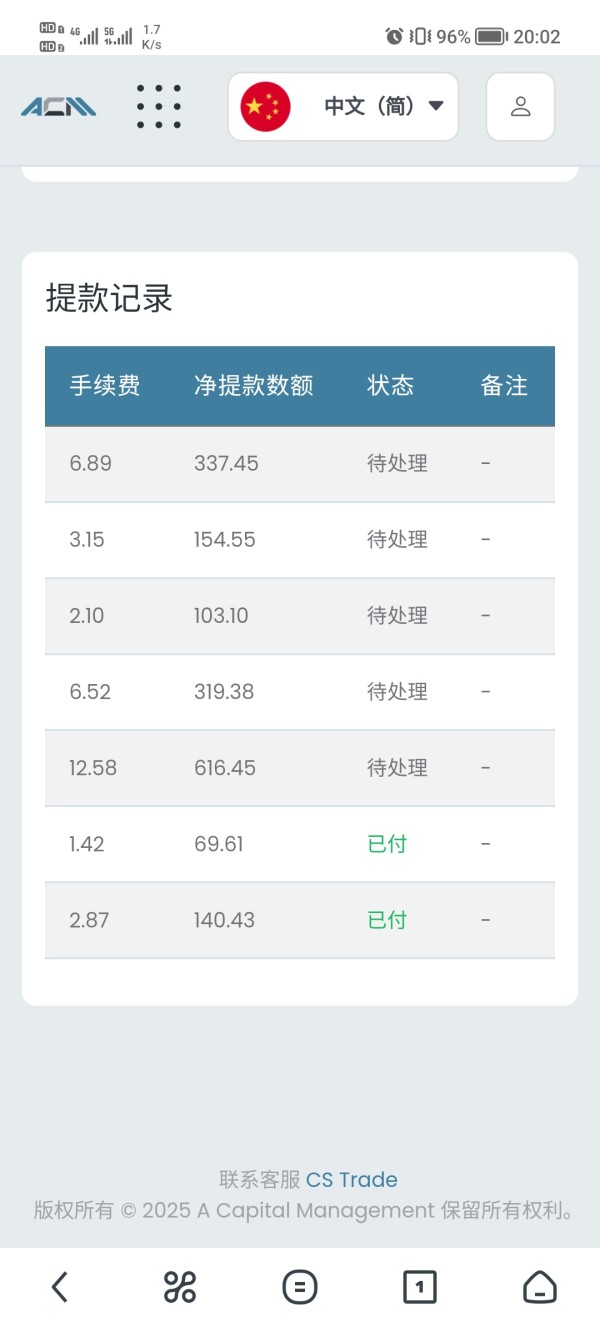

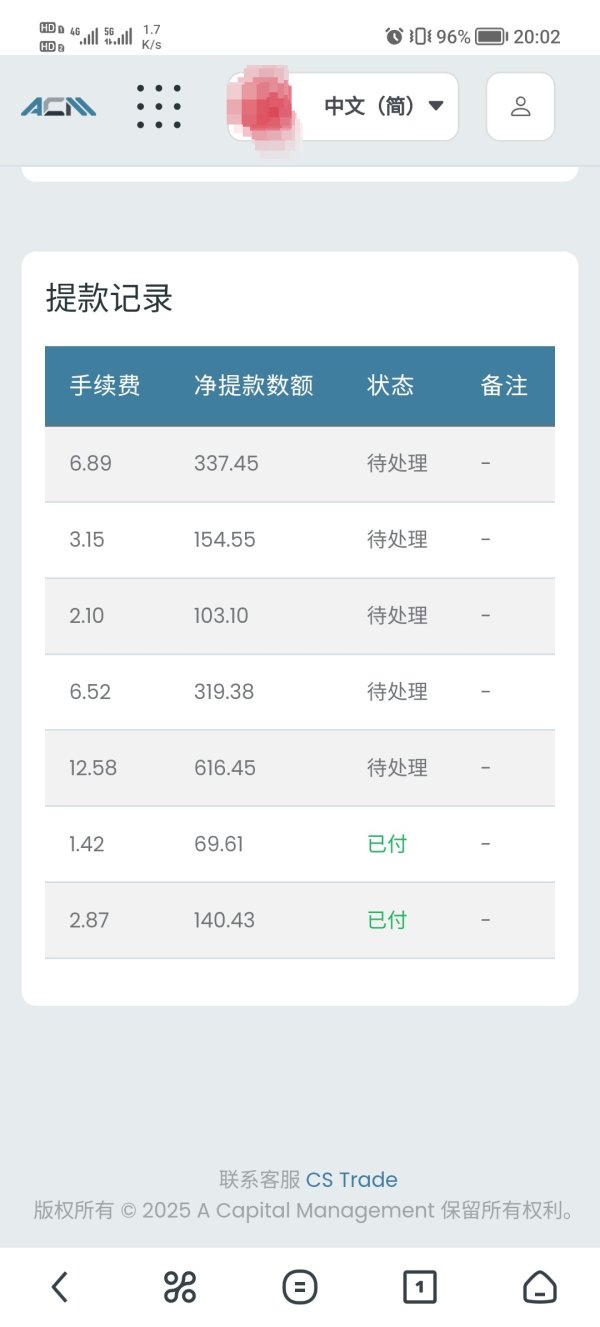

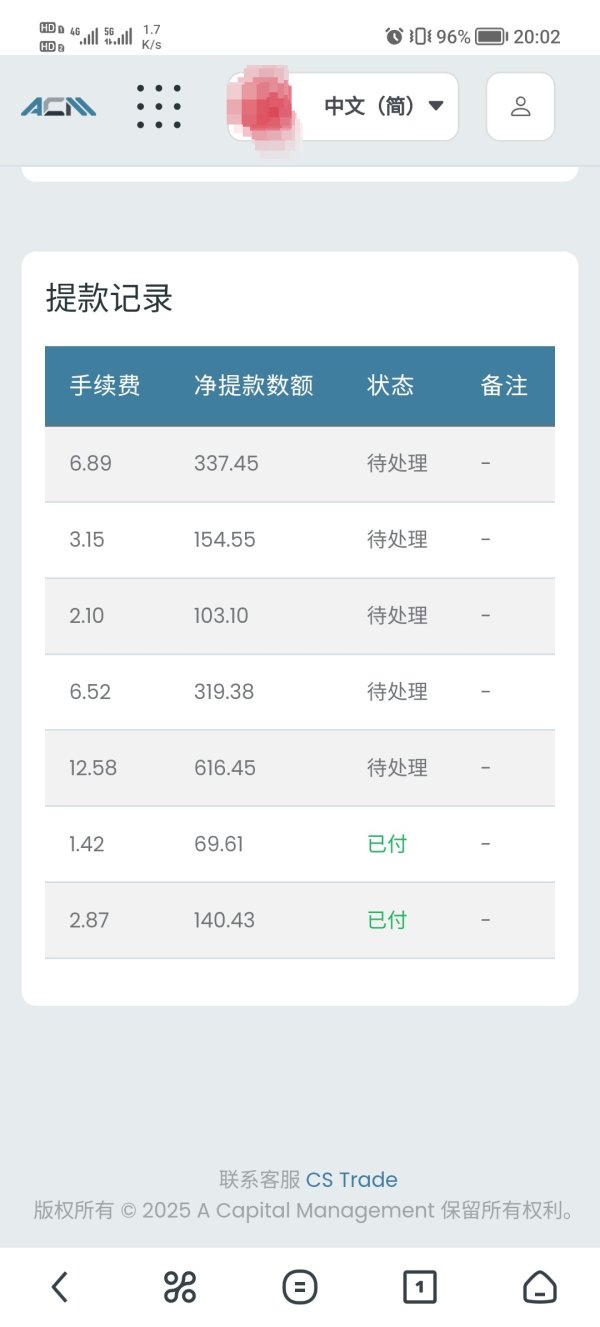

Deposit and Withdrawal Methods: Source materials did not provide comprehensive information about available payment methods, processing times, or associated fees.

Minimum Deposit Requirements: Specific minimum deposit amounts were not documented in the reviewed information sources.

Promotional Offers: Details regarding welcome bonuses, trading incentives, or promotional campaigns were not available in the source materials.

Tradeable Assets: While ACM appears positioned as a forex broker, specific information about currency pairs, commodities, indices, or other tradeable instruments was not comprehensively detailed.

Cost Structure: Spread information, commission rates, overnight fees, and other trading costs were not specified in the available documentation. This makes cost comparison challenging.

Leverage Options: Maximum leverage ratios and margin requirements were not detailed in the reviewed source materials.

Platform Options: Specific trading platform offerings, including mobile applications and web-based solutions, require direct verification with the broker.

Geographic Restrictions: Information regarding service availability in different countries was not specified in the available sources.

Customer Support Languages: Multilingual support options were not detailed in the reviewed materials.

This acm review highlights the need for potential clients to directly contact the broker for comprehensive and current service information.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The evaluation of ACM's account conditions faces significant limitations due to insufficient publicly available information. The source materials reviewed did not provide comprehensive details about account types, minimum deposit requirements, or specific features that differentiate various account tiers.

Without access to detailed account specifications, it becomes challenging to assess the competitiveness of ACM's offerings compared to industry standards. The absence of information regarding Islamic accounts, VIP services, or specialized trading accounts further limits the evaluation scope.

The account opening process, verification requirements, and documentation needed for different account types were not detailed in the available sources. This lack of transparency regarding account conditions significantly impacts the overall rating for this category.

Potential clients seeking specific account features or comparing minimum deposit requirements across brokers will need to contact ACM directly for accurate and current information. The limited availability of account condition details suggests either restricted public disclosure or limited online presence regarding these crucial trading parameters.

This acm review emphasizes the importance of direct broker communication for obtaining comprehensive account information.

The assessment of ACM's trading tools and resources reveals limited publicly available information about the broker's technological offerings and analytical capabilities. The source materials did not provide specific details about trading platforms, charting tools, or technical analysis resources.

Educational resources, which have become increasingly important in broker evaluation, were not documented in the reviewed materials. The absence of information about webinars, trading guides, market analysis, or educational content significantly impacts this category's rating.

Automated trading support, including Expert Advisor compatibility and API access, could not be evaluated due to insufficient source material. These features are increasingly important for modern traders seeking algorithmic trading capabilities.

Research and analysis tools, including economic calendars, market sentiment indicators, and fundamental analysis resources, were not detailed in the available information. The lack of transparency regarding these essential trading resources limits the comprehensive evaluation of ACM's service offering.

The absence of detailed information about trading tools and educational resources suggests potential clients will need to directly engage with ACM. They must understand the full scope of available trading support.

Customer Service and Support Analysis (3/10)

Evaluating ACM's customer service capabilities proves challenging due to the absence of specific information about support channels, response times, and service quality metrics in the reviewed source materials. The lack of documented customer service features significantly impacts this category's assessment.

Support channel availability, including live chat, phone support, email assistance, and help desk systems, could not be verified through the available sources. Modern traders typically expect multiple communication options with responsive customer service teams.

Response time expectations, service availability hours, and multilingual support options were not detailed in the reviewed materials. These factors are crucial for international traders operating across different time zones and requiring native language assistance.

Service quality indicators, including customer satisfaction ratings, problem resolution efficiency, and support team expertise, were not available in the source materials. The absence of user feedback regarding customer service experiences limits the comprehensive evaluation of this critical service component.

The limited information about customer service capabilities suggests potential clients should directly contact ACM. They need to understand available support options and service standards before committing to their platform.

Trading Experience Analysis (4/10)

The evaluation of ACM's trading experience faces significant constraints due to limited information about platform performance, execution quality, and user interface design in the reviewed source materials. These factors are fundamental to trader satisfaction and overall service quality.

Platform stability, execution speed, and order processing capabilities could not be assessed through the available sources. These technical performance metrics are crucial for active traders who require reliable and fast trade execution, particularly during volatile market conditions.

User interface design, platform functionality, and ease of navigation were not detailed in the source materials. The absence of information about platform customization options, layout flexibility, and user experience design impacts the comprehensive evaluation of trading experience quality.

Mobile trading capabilities, including smartphone applications and tablet optimization, were not documented in the reviewed information. Mobile trading has become essential for modern traders who require platform access across multiple devices and locations.

This acm review indicates that potential clients interested in understanding ACM's trading experience should request platform demonstrations or trial access. They need to properly evaluate these crucial service components.

Trust and Safety Analysis (7/10)

ACM's trust and safety evaluation shows relatively positive indicators based on its presence across multiple broker evaluation platforms and comparison websites. This visibility suggests some level of industry recognition and participation in broker assessment processes.

The broker's inclusion in forex comparison databases indicates compliance with basic industry standards for broker listing and evaluation. While specific regulatory details were not comprehensively available, the presence on evaluation platforms suggests adherence to certain operational standards.

Industry reputation appears to benefit from ACM's participation in the broker evaluation ecosystem, where transparency and comparative analysis play important roles in building trader confidence. This positioning demonstrates engagement with industry assessment processes.

However, specific information about regulatory licenses, client fund protection measures, and financial transparency was not detailed in the available source materials. These factors are crucial for comprehensive trust assessment and require direct verification with the broker.

The positive aspects of ACM's trust profile stem from its market presence and participation in broker comparison platforms. Detailed regulatory and safety information requires additional investigation for complete evaluation.

User Experience Analysis (4/10)

Assessing ACM's user experience proves challenging due to limited availability of user feedback, testimonials, and experience reports in the reviewed source materials. User satisfaction metrics and client testimonials are essential components of comprehensive broker evaluation.

Interface design quality, platform usability, and overall user satisfaction could not be evaluated through the available sources. These factors significantly impact trader retention and overall service quality, making their absence in evaluation materials particularly notable.

Registration and account verification processes were not detailed in the source materials, limiting the assessment of onboarding experience quality. Smooth account opening procedures are crucial for positive initial user experiences with any broker.

Funding and withdrawal experiences, including process efficiency and user satisfaction with financial operations, were not documented in the available information. These operational aspects significantly impact overall user experience and trader satisfaction.

The limited availability of user experience data suggests potential clients should seek direct testimonials, trial accounts, or community feedback. They need to better understand ACM's service quality from a user perspective before making trading decisions.

Conclusion

This comprehensive acm review reveals a broker with limited publicly available information about core trading services, regulatory compliance, and operational details. While ACM maintains presence on broker comparison platforms, suggesting some level of industry participation, the absence of detailed service information significantly impacts comprehensive evaluation.

The broker appears most suitable for traders who prioritize direct communication and are willing to conduct thorough due diligence through direct broker contact. The limited transparency in publicly available materials suggests ACM may operate with a more traditional approach to client acquisition and information sharing.

Key advantages include market presence and inclusion in broker evaluation platforms, while primary limitations center on insufficient public disclosure of trading conditions, regulatory status, and comprehensive service details. Potential clients should prioritize direct broker communication to obtain accurate and current information about all service aspects before making trading decisions.