Is ABUSA safe?

Business

License

Is ABUSA A Scam?

Introduction

ABUSA is a relatively new player in the forex market, having been established in 2023. Positioned as an online trading platform, it offers a wide array of financial products, including forex, stocks, commodities, and cryptocurrencies. However, the influx of new brokers in the forex market necessitates a cautious approach from traders. Evaluating the credibility of a broker is crucial, as the forex market is rife with scams and unregulated entities that can jeopardize investors' funds. This article aims to provide a comprehensive analysis of ABUSA, examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, risk assessment, and ultimately, whether ABUSA is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a trading platform is a significant indicator of its reliability and trustworthiness. ABUSA operates as an unregulated broker, which means it is not overseen by any recognized financial authority. This lack of regulation raises serious concerns regarding investor protection and operational transparency.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory license means that ABUSA does not adhere to the stringent standards typically enforced by financial authorities such as the SEC in the United States, FCA in the UK, or ASIC in Australia. This unregulated status poses significant risks to traders, as there are no legal protections in place to safeguard their investments. Furthermore, the Securities and Futures Commission (SFC) of Hong Kong has issued warnings against ABUSA, indicating that it may be providing financial services without proper authorization. This is a critical red flag, suggesting that ABUSA may not be a safe option for traders.

Company Background Investigation

ABUSA's inception in 2023 means it lacks a substantial track record in the financial markets. The company's ownership structure remains opaque, with limited information available regarding its management team and their professional backgrounds. A transparent company usually provides detailed information about its founders and executives, including their qualifications and experience in the financial industry. However, ABUSA does not appear to meet these transparency standards, which raises questions about its legitimacy.

The lack of an official address and a functional website further complicates the evaluation of ABUSA's credibility. A legitimate trading platform typically provides clear contact information and operational transparency. In contrast, ABUSA's vague information and recent registration (only a few months old) contribute to the perception that it may not be a trustworthy broker. Overall, the insufficient background information on ABUSA indicates that it may not be safe for traders to engage with this platform.

Trading Conditions Analysis

When assessing a broker's trading conditions, it is essential to evaluate its fee structure and any unusual charges that may apply. ABUSA claims to offer competitive spreads and a diverse range of trading products, but the lack of transparency regarding fees raises concerns.

| Fee Type | ABUSA | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific figures regarding spreads and commissions makes it difficult for potential clients to gauge the overall cost of trading with ABUSA. Moreover, reports from users indicate that there may be hidden fees or unexpected charges, which could significantly impact profitability. Unusual fee policies, such as excessive withdrawal fees or minimum deposit requirements, are also common indicators of a potentially fraudulent broker. Therefore, the lack of clarity in ABUSA's trading conditions raises further doubts about its safety and legitimacy.

Client Funds Security

The safety of client funds is paramount when choosing a trading platform. ABUSA's unregulated status raises significant concerns regarding the security measures it has in place to protect investor capital. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection to ensure that clients' funds are safe.

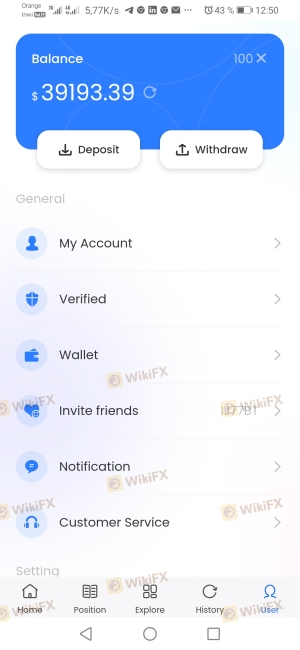

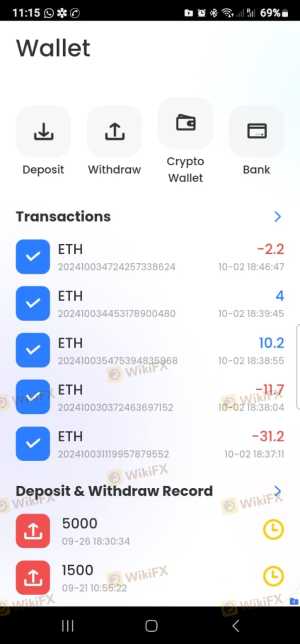

However, with ABUSA operating without regulatory oversight, there are no guarantees that it adheres to such practices. Reports of withdrawal issues and complaints about unresponsive customer service further exacerbate concerns about the safety of funds held with ABUSA. If a broker does not provide transparent information about how it safeguards client funds, it is prudent for traders to approach with caution. The lack of robust safety measures and the absence of historical data on fund security incidents suggest that ABUSA may not be a safe choice for traders.

Customer Experience and Complaints

Understanding customer experiences is vital when evaluating a broker's reliability. Feedback from ABUSA's clients indicates a pattern of negative experiences, particularly concerning withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | High | Poor |

Is ABUSA a scam, or is it legit?

The latest exposure and evaluation content of ABUSA brokers.

ABUSA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ABUSA latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.