Is Wisdom safe?

Pros

Cons

Is Wisdom A Scam?

Introduction

Wisdom, a forex broker, has recently garnered attention in the trading community. Positioned as a platform that claims to offer a range of trading services, it has attracted both novice and experienced traders. However, the forex market is notorious for its complexities and risks, making it essential for traders to carefully evaluate the legitimacy and reliability of their brokers. In this article, we will investigate whether Wisdom is a safe and trustworthy broker or if it raises red flags that suggest it could be a scam. Our evaluation will be based on extensive research from various credible sources, focusing on regulatory compliance, company background, trading conditions, client experiences, and overall risk assessment.

Regulation and Legitimacy

Regulation is a critical factor that ensures the safety and security of traders' funds. A regulated broker is typically subject to stringent rules and oversight by financial authorities, which can provide a level of assurance to clients. In the case of Wisdom, the situation is concerning. Wisdom operates without any valid regulatory oversight, which raises significant questions about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that Wisdom is not held accountable to any governing body, leaving traders vulnerable to potential misconduct. According to sources, Wisdom is associated with jurisdictions known for lax regulations, such as Saint Vincent and the Grenadines. This lack of oversight can lead to unfair trading practices, including manipulation of spreads and execution delays. Moreover, warnings from reputable regulators, such as the UK's Financial Conduct Authority (FCA), indicate that Wisdom is operating without proper authorization, reinforcing the notion that it poses a high risk to investors.

Company Background Investigation

Understanding the company behind a broker is crucial for assessing its reliability. Wisdom claims to have been established in 2007; however, investigations reveal that its domain was created in 2016, raising immediate red flags about its transparency and honesty. Additionally, the broker lists its office address in Hong Kong, yet there is no record of its registration with the Hong Kong Securities and Futures Commission (SFC), further complicating its legitimacy.

The ownership structure of Wisdom remains unclear, with little information available about its management team or their professional backgrounds. This lack of transparency can be alarming for potential investors, as a reputable broker typically provides detailed information about its leadership and operational history. Furthermore, the absence of clear communication regarding the company's history diminishes trust and raises concerns about the broker's commitment to ethical practices.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact a trader's experience and profitability. Wisdom advertises competitive spreads and a variety of trading instruments; however, the specifics of its fee structure remain vague. This lack of clarity can lead to unexpected costs for traders.

| Fee Type | Wisdom | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Unclear | 1.0 - 2.0 pips |

| Commission Model | Unclear | Varies widely |

| Overnight Interest Range | Unclear | 0.5% - 2.0% |

The absence of detailed information on spreads, commissions, and overnight interest rates is a significant drawback. Traders need to understand the total cost of trading to make informed decisions. Moreover, high leverage ratios, such as 1:500, can be enticing but also pose substantial risks, particularly for inexperienced traders who may not fully comprehend the implications of such leverage.

Client Fund Safety

The safety of client funds is paramount in the forex industry. A trustworthy broker should implement robust measures to protect traders' capital, including segregating client funds from company funds and offering negative balance protection. Unfortunately, Wisdom does not provide clear information regarding its fund safety protocols. The lack of regulatory oversight further exacerbates these concerns, as there are no guarantees that client funds are secure.

Previous reports indicate that Wisdom has faced several issues related to fund security, including allegations of mishandling client deposits. Such incidents can lead to significant financial losses for traders, making it essential to consider a broker's track record in this area before opening an account.

Customer Experience and Complaints

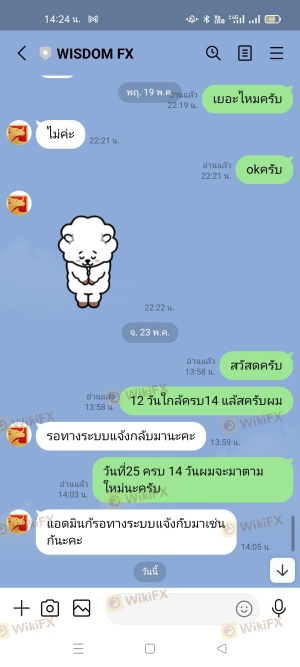

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Wisdom reveal a mixed bag of experiences, with many users reporting difficulties in withdrawing funds and receiving timely support. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Unresponsive |

| Lack of Transparency | High | No clear answers |

One notable case involved a trader who struggled to withdraw their funds for several months, ultimately leading to frustration and dissatisfaction. Such experiences highlight a potential pattern of issues that could deter prospective clients from engaging with Wisdom.

Platform and Trade Execution

A broker's trading platform is essential for facilitating smooth and efficient trading. Wisdom claims to offer a user-friendly platform; however, user feedback suggests that the platform may not be as robust as advertised. Reports of execution delays and slippage during high volatility periods are concerning, as they can significantly impact trading outcomes. Additionally, the absence of a transparent trading environment raises questions about possible manipulation or unfair practices.

Risk Assessment

Engaging with an unregulated broker like Wisdom poses several risks for traders. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operating without oversight increases vulnerability. |

| Fund Safety Risk | High | Lack of clear fund protection measures is alarming. |

| Execution Risk | Medium | Reports of slippage and delays can affect trades. |

| Customer Support Risk | High | Poor support can lead to unresolved issues. |

To mitigate these risks, traders should consider using regulated brokers with established reputations and transparent practices. Conducting thorough research and reading user reviews can also help identify potential red flags.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Wisdom raises significant concerns regarding its legitimacy and safety as a forex broker. The lack of regulation, transparency issues, and negative customer experiences suggest that traders should exercise extreme caution when considering this broker. For those seeking reliable trading options, it may be wise to explore regulated alternatives that provide better assurances in terms of fund safety, customer support, and overall trading conditions.

In summary, while Wisdom may appear to offer attractive trading opportunities, the risks associated with this broker far outweigh the potential benefits. Traders are encouraged to prioritize their safety by selecting well-regulated brokers with positive track records and transparent business practices.

Is Wisdom a scam, or is it legit?

The latest exposure and evaluation content of Wisdom brokers.

Wisdom Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Wisdom latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.