Mugan Markets 2025 Year Review: Everything You Need to Know

Summary

Mugan Markets is a forex and CFD broker registered in the Marshall Islands. It is owned by Meydan Ltd and was established in 2015. The broker offers different account types for various trading styles, which helps traders find what works for them. A key feature is its ECN trading platform with a low minimum deposit of just $50. They also offer a bonus of up to $20 for eligible traders, making it attractive for beginners. However, many users have complained about delayed withdrawals, which hurts the broker's reputation. This mixed feedback raises questions about how reliable their service really is. While the low entry cost makes it easy for beginners and small traders to start, potential clients should be careful. In this detailed mugan markets review, we look at the broker's good and bad points using user feedback, trading conditions, and regulatory information. By understanding these factors, readers can decide if Mugan Markets fits their trading needs.

Important Considerations

Mugan Markets is run by Meydan Ltd and registered in the Marshall Islands. The broker does not give detailed information about specific regulatory licenses or oversight by known financial authorities. This may create risks for traders who want protection for their funds. This review uses user feedback, public data, and reports from various sources to give you information. We should note that our evaluation did not include on-site tests of the platform or services. Some aspects like withdrawal times and customer service response are based mainly on client testimonials and research from other sources. Potential traders should check current information carefully before putting money into their accounts.

Rating Framework

Broker Overview

Mugan Markets started trading in 2015. The company is owned by Meydan Ltd and registered in the Marshall Islands. It focuses mainly on forex and CFD markets, trying to be an easy choice for beginners. The broker requires only a $50 minimum deposit, which lets small traders start with little money. Mugan Markets tries to attract many different traders by offering various account types for different trading styles. The low deposit and bonus of up to $20 look good, but they don't give clear information about commissions and spreads. This lack of detail is a big problem for traders who want to know all costs upfront.

The broker uses an ECN trading platform designed for fast traders who want direct market access. However, there is no clear regulatory oversight, and no specific regulatory body or license is mentioned. This hurts its reputation among experienced traders and analysts who value proper regulation. As this mugan markets review continues, it's important to know that while account conditions look attractive, the overall package has problems with trust and customer service. Potential traders should think about the benefits of low deposits versus the risks of limited regulation and reported withdrawal delays.

Regulatory Region:

Mugan Markets is registered in the Marshall Islands. It does not provide detailed information about oversight by a recognized regulatory authority, which raises concerns about trader fund safety. Various sources note that this lack of regulatory credentials is a key risk factor that traders should consider.

Deposit and Withdrawal Methods:

The broker's deposit and withdrawal options are not clearly explained in available documentation. Specific methods and processing times are not specified, and users have complained about withdrawal delays. This lack of information creates uncertainty for people who need fast and reliable fund management services.

Minimum Deposit Requirement:

Mugan Markets requires a minimum deposit of $50 to open an account. This low amount is meant to attract new traders and those with smaller amounts of money. However, low deposit requirements must be weighed against potential problems in other areas like service and transparency.

Bonus Promotion:

A bonus offer gives traders up to $20 extra as an incentive. While this bonus can help with initial trading, traders must read the terms and conditions carefully. Available documentation shows that bonus requirements and limitations are not fully detailed, so careful reading is needed before accepting the offer.

Tradable Assets:

Traders at Mugan Markets can access major and minor forex pairs and various CFDs. The asset selection is broad, helping those who want to diversify in forex and other CFD instruments. However, the depth of available instruments and platform support for other asset classes is limited by the information provided.

Cost Structure:

The cost structure at Mugan Markets, including spreads and commissions, is not clearly outlined. Sources show that users have not received clear, complete information about trading costs. This lack of clarity about fees may create hidden costs for traders, which is especially concerning for those who trade frequently.

Leverage Information:

Leverage ratios available on the platform are not specified in public information. The absence of this important detail makes risk assessment harder for potential clients. Traders must make decisions without knowing all the details about their risk exposure.

Platform Selection:

Mugan Markets provides an ECN trading platform designed to improve order execution speed and transparency. While the platform appeals to those who prefer direct market access, information about other platform options or mobile trading is limited. This single-platform focus may limit options for traders who want different trading interfaces.

Regional Restrictions:

There is no mention of specific regional restrictions in available information. It's unclear whether any geographical areas are excluded from using Mugan Markets' services. Potential clients need to seek clarification on their own.

Customer Service Language:

Available documentation does not provide details about the languages supported by customer service. Without clear information on language options, non-English speaking traders may have trouble getting timely support.

This section is an important part of our mugan markets review, making sure each detail is examined so traders can make informed decisions. Even though several key points like regulatory oversight, cost transparency, and support details remain unclear.

Detailed Rating Analysis

1. Account Conditions Analysis

Mugan Markets offers different account types for various trading styles. The low minimum deposit of $50 appeals to new traders who don't have much capital to invest. However, available information doesn't detail commission structures, spreads, or potential fees during trading, which leaves traders guessing about true costs. The lack of specifics about account opening or special features like Islamic accounts creates an incomplete picture. User feedback has highlighted problems with withdrawal processes, which directly affects how we rate account conditions. When compared to other brokers with transparent and clearly defined account features, Mugan Markets falls short in several areas. This has led to a medium score despite some attractive initial conditions that might draw in new traders.

As discussed in this mugan markets review, while the entry cost is low, the lack of detail about account management and fees significantly hurts its appeal. Traders should do their own careful assessment before choosing Mugan Markets because there are clear gaps in transparency. These gaps may affect the overall trading experience and could lead to unexpected costs or problems.

Mugan Markets provides an ECN trading platform for active and frequent traders. This model aims to give direct market access and potentially tighter spreads for fast trades in changing market conditions. However, beyond the platform type, several key elements of trading tools and resources are underdeveloped, which limits what traders can do. There is little mention of advanced charting tools, automated trading support, or research and analysis resources. These are important for both new and experienced traders who want to make informed decisions.

Educational materials like webinars, tutorials, or market analyses are not detailed, leaving a gap for those wanting to improve their skills. The absence of these support tools limits the broker's full potential and forces customers to look elsewhere for market insights. This limitation is significant when compared with competitors who have built complete research departments. As noted in this mugan markets review, the tools and resources only partially meet modern trader requirements. This means traders need additional third-party support for a well-rounded trading experience.

3. Customer Service and Support Analysis

Customer service is essential for any credible brokerage, yet Mugan Markets seems to fail in this critical area. Reports from several users show problems with withdrawal delays, which reflect poor responsiveness and efficiency. There is little detailed information about support channels like live chat, phone, or email. The specific operating hours of these services are also unclear, making it hard for traders to know when they can get help.

The lack of clear communication about languages supported by customer service makes things worse for non-English speaking traders. Users who have experienced delays getting their funds highlight a lack of proper escalation processes or timely follow-up. This not only wastes valuable trading time but also undermines confidence in the broker's integrity. Compared to competitors who emphasize multi-channel, multi-language support with strict response times, Mugan Markets lags behind. As detailed in this mugan markets review, the shortcomings in customer service contribute to the low score in this category. Prospective traders should be cautious when relying on the broker for prompt and effective problem resolution.

4. Trading Experience Analysis

The overall trading experience with Mugan Markets is mixed based on varied user accounts and limited information about platform performance. While the ECN platform is designed to offer fast and direct market access, there are significant gaps in specifics about execution speed and platform stability. Some traders have reported frustrations with delayed withdrawals, which affect their trading momentum, and lack of transparency in price movements. The absence of detailed performance metrics like average latency or failure rates means traders must rely on individual reports and stories.

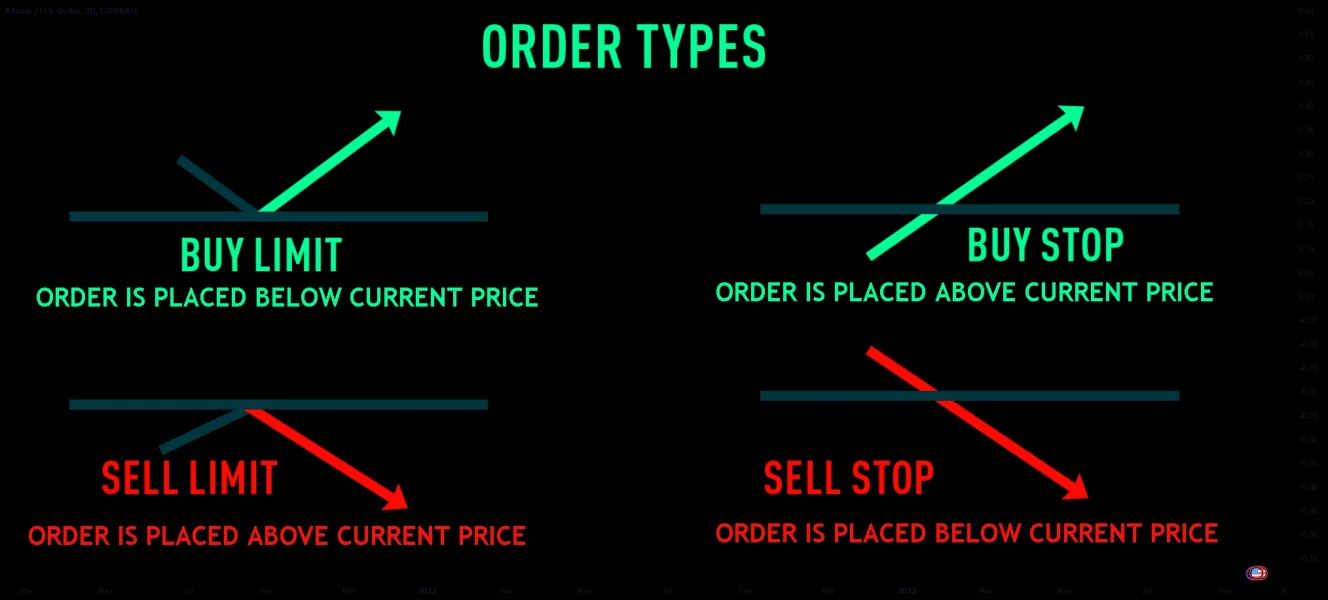

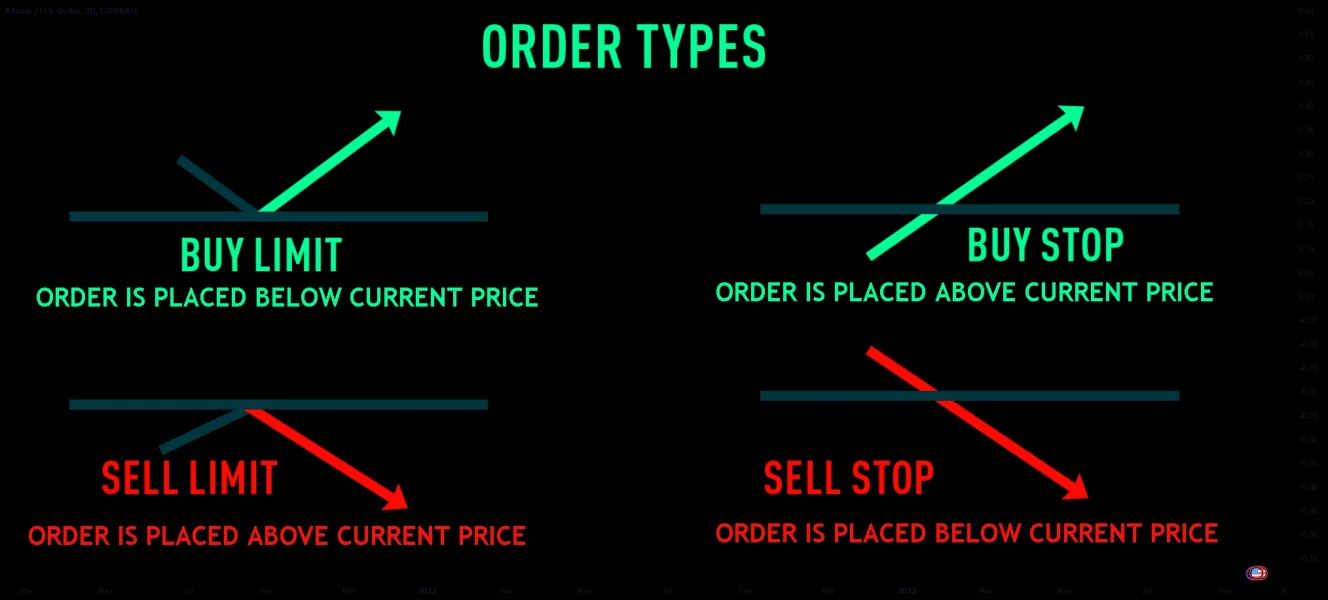

Features that could improve the trading experience, including customizable dashboards, advanced order types, and integrated risk management tools, are not clearly outlined. When compared with industry competitors that provide detailed performance statistics and robust features, Mugan Markets appears underdeveloped. As highlighted in this mugan markets review, while there are some appealing aspects like the ECN platform structure, the practical trading experience doesn't fully meet modern expectations. The overall trading conditions require careful consideration and willingness to deal with potential execution or withdrawal issues.

5. Trustworthiness Analysis

Trust is essential when selecting a broker, and unfortunately, Mugan Markets faces significant challenges here. One major concern is the absence of detailed regulatory oversight that would protect trader interests. Being registered in the Marshall Islands, the broker doesn't provide clear evidence of following strict standards typically enforced by well-recognized financial authorities. This lack of transparent regulatory supervision raises serious questions about fund security and fair trading practices.

Many user reports of withdrawal delays further reduce the broker's credibility and make traders question their reliability. The lack of clarity around cost structures, specific fee details, and operational procedures contributes to insufficient transparency. The combination of these factors has led to a reduced trust score, especially when other brokers offer clear regulatory identification and detailed disclosures. In this mugan markets review, we note that deficiencies in regulatory clarity and operational transparency are significant red flags. Traders are advised to proceed with caution and consider the potential risks of an environment that doesn't meet industry best practices.

6. User Experience Analysis

User experience at Mugan Markets is hurt by several operational shortcomings highlighted in trader feedback. The most obvious issue users report is frequent delays in processing withdrawals, which directly impacts satisfaction and trust. The overall platform design and interface have not been well documented, leaving many to wonder about ease of navigation and dashboard usability. The account registration and verification processes are similarly underdescribed, suggesting potential complications during onboarding that could frustrate new users.

There is limited information about technical support responsiveness during critical trading moments or multi-language support availability. The overall user interface, while built on an ECN framework for speed and efficiency, doesn't seem to fully deliver an optimal experience. As a result, many users have expressed frustration, particularly about funds management and lack of operational clarity. These factors contribute to a lower overall user experience score, as detailed in this mugan markets review. Prospective clients should weigh these experiences carefully against any potential benefits before choosing to trade with Mugan Markets.

Conclusion

In summary, Mugan Markets has some attractive features like a low minimum deposit and an ECN trading platform that may appeal to beginner traders. However, significant drawbacks exist in the form of delayed withdrawals, unclear regulatory oversight, and poor customer support. This mugan markets review highlights that while entry conditions appear accessible, the lack of transparency and persistent operational issues are cause for concern that traders should not ignore. Traders should proceed with caution and conduct further research, considering both competitive advantages and inherent risks before making a commitment. The broker may serve as a starting point for new traders, but additional research is highly recommended to avoid potential problems.