Regarding the legitimacy of BP PRIME forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is BP PRIME safe?

Pros

Cons

Is BP PRIME markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Black Pearl Securities Limited

Effective Date:

2015-10-22Email Address of Licensed Institution:

compliance@bpprime.comSharing Status:

No SharingWebsite of Licensed Institution:

www.bpprime.comExpiration Time:

--Address of Licensed Institution:

28 King Street London EC2V 8EH UNITED KINGDOMPhone Number of Licensed Institution:

+4402037457101Licensed Institution Certified Documents:

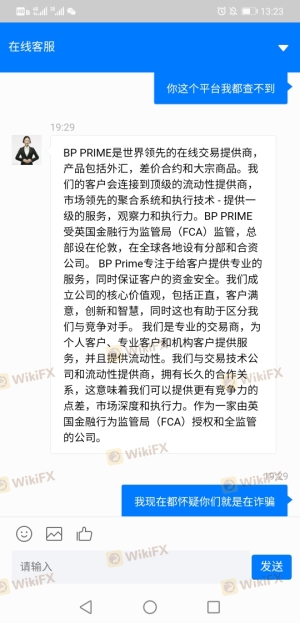

Is BP Prime A Scam?

Introduction

BP Prime is a UK-based forex broker that has positioned itself as a competitive player in the online trading landscape since its inception in 2013. Operating under the name Black Pearl Securities Limited, BP Prime offers a range of trading services, including forex, commodities, and CFDs, primarily through the popular MetaTrader 4 platform. As with any financial service provider, it is crucial for traders to carefully evaluate the legitimacy and safety of the broker they choose to work with. The forex market can be rife with scams and unreliable brokers, making it imperative for traders to conduct thorough research before committing their funds.

This article aims to provide an objective analysis of BP Prime's legitimacy and safety as a trading platform. We will explore various aspects of the broker, including its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. Our investigation is grounded in a comprehensive review of available data, user feedback, and expert opinions to assess whether BP Prime is indeed a safe trading option or a potential scam.

Regulation and Legitimacy

One of the most critical factors in determining the trustworthiness of any forex broker is its regulatory status. BP Prime is regulated by the Financial Conduct Authority (FCA) in the UK, a reputable regulatory body known for enforcing stringent compliance measures to protect traders. The FCA's oversight ensures that brokers adhere to high standards of financial conduct, including maintaining segregated client accounts and providing negative balance protection.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 688456 | United Kingdom | Verified |

The FCA's regulatory framework is robust, requiring brokers to maintain sufficient capital reserves and adhere to strict reporting and operational standards. BP Prime has been compliant with these regulations, which adds a layer of trust for potential clients. However, it is essential to note that while FCA regulation is a strong indicator of legitimacy, not all brokers under this authority are free from issues. Therefore, potential traders should remain vigilant and monitor any regulatory updates or complaints.

Company Background Investigation

BP Prime was founded in 2013 by a group of seasoned forex traders and financial experts. The company is headquartered in London, with additional operational offices in Italy and China, which enhances its global reach. The ownership structure is transparent, and the firm operates under the regulatory oversight of the FCA, which mandates a high level of disclosure and accountability.

The management team at BP Prime comprises individuals with extensive experience in financial markets, risk management, and trading technologies. Their expertise contributes to the broker's reputation as a serious contender in the forex trading space. BP Prime's commitment to transparency is evident in its regular updates and accessible customer service channels, which further solidifies its legitimacy in the eyes of traders.

Trading Conditions Analysis

When evaluating whether BP Prime is safe, it is essential to analyze its trading conditions and fee structures. BP Prime offers competitive spreads and a straightforward commission model. The broker operates with a minimum deposit requirement of $5,000 for its standard and pro accounts, which may be considered high by some traders, especially beginners.

| Fee Type | BP Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 0.5 pips |

| Commission Model | Yes (varies) | Yes (varies) |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs starts at a competitive 0.3 pips, which is lower than the industry average. However, the commission structure can vary based on account type, and traders should be aware of any additional costs associated with overnight positions. While BP Prime does not charge inactivity fees, the high minimum deposit may deter novice traders who are looking for a more accessible entry point into forex trading.

Customer Fund Security

Customer fund security is paramount in assessing whether BP Prime is safe for trading. The broker employs several measures to ensure the protection of client assets. BP Prime segregates client funds from its operational capital, which means that client money is held in separate accounts at reputable financial institutions. Additionally, BP Prime is a member of the Financial Services Compensation Scheme (FSCS), which provides coverage up to £85,000 per client in the event of broker insolvency.

The broker also offers negative balance protection, which prevents clients from losing more money than they have deposited. This is particularly important in the volatile forex market, where rapid price fluctuations can lead to significant losses. Historically, BP Prime has maintained a clean record with no major incidents related to fund security, further enhancing its reputation as a trustworthy broker.

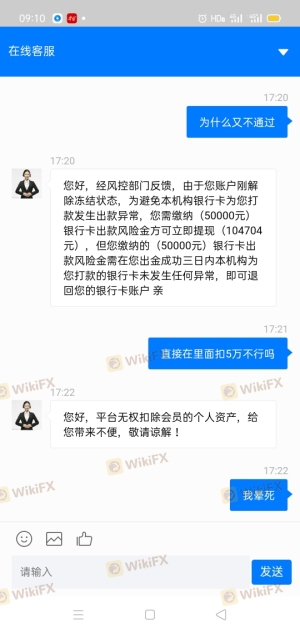

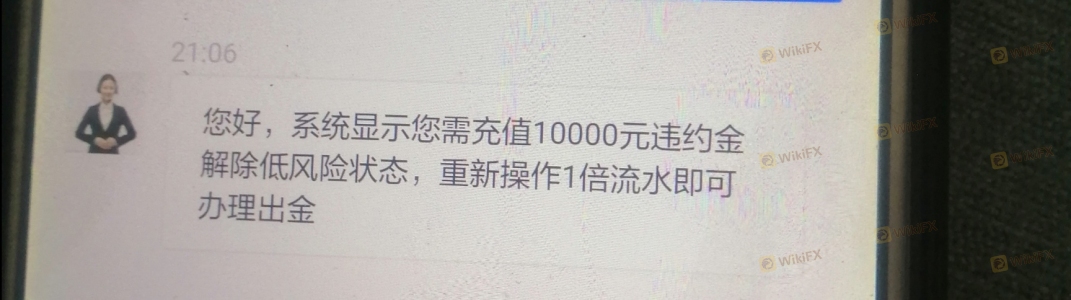

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating the safety and reliability of BP Prime. Overall, user experiences have been mixed, with many traders praising the broker's competitive trading conditions and responsive customer service. However, some common complaints have emerged, particularly regarding withdrawal processes and account verification delays.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Verification | Medium | Generally prompt |

One notable case involved a trader who reported difficulties in withdrawing funds, citing a lack of communication from customer service. This incident highlights the importance of having efficient and reliable support channels, especially during critical transactions. While BP Prime has an overall positive reputation, the presence of these complaints suggests that potential clients should approach with caution and ensure they fully understand the withdrawal policies before committing funds.

Platform and Trade Execution

The trading platform offered by BP Prime is primarily MetaTrader 4 (MT4), which is widely regarded for its user-friendly interface and advanced trading capabilities. BP Prime's platform provides traders with access to various analytical tools, automated trading options, and a customizable interface. However, some users have reported issues with order execution, including slippage and occasional rejections of orders during high volatility periods.

The broker claims to utilize a non-dealing desk model, which theoretically reduces conflicts of interest and enhances trade execution quality. However, any signs of manipulation or execution delays could raise concerns about the broker's integrity. Traders should monitor their execution quality and be prepared to switch to alternative brokers if they encounter persistent issues.

Risk Assessment

When considering whether BP Prime is safe for trading, it is crucial to evaluate the associated risks. The following risk assessment summarizes key risk areas that potential clients should be aware of:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | FCA regulation provides a strong safety net. |

| Fund Security | Low | Segregated accounts and FSCS coverage enhance security. |

| Withdrawal Issues | Medium | Some users have reported delays and complications. |

| Platform Stability | Medium | Occasional execution issues during volatile markets. |

To mitigate these risks, traders should conduct thorough research, maintain open communication with customer support, and consider starting with a demo account to familiarize themselves with the platform's features and functionalities.

Conclusion and Recommendations

In conclusion, BP Prime appears to be a legitimate forex broker regulated by the FCA, offering a range of competitive trading conditions. While there are no significant signs of scams or fraudulent activities, potential clients should remain vigilant and conduct their due diligence. The broker's strong regulatory status, fund security measures, and overall positive reputation indicate that it is safe for trading.

However, traders should be aware of the high minimum deposit requirement and the mixed feedback regarding withdrawal processes. For those who are new to forex trading or have limited capital, it may be beneficial to explore alternative brokers with lower entry barriers and more user-friendly policies.

If you are considering trading with BP Prime, ensure that you fully understand their terms, conditions, and risk management strategies. For those seeking alternatives, brokers such as IG, AvaTrade, and Swissquote may offer more accessible options while maintaining a solid reputation in the industry.

Is BP PRIME a scam, or is it legit?

The latest exposure and evaluation content of BP PRIME brokers.

BP PRIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BP PRIME latest industry rating score is 7.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.