Is Billionext safe?

Business

License

Is Billionext Safe or Scam?

Introduction

Billionext, a forex and CFD broker, has emerged in the financial markets, attracting attention from traders worldwide. As an entity operating in a highly volatile and competitive sector, it is crucial for traders to thoroughly assess the legitimacy and safety of brokers before committing their funds. The forex market is rife with potential risks, including scams and fraudulent practices, which makes due diligence an essential part of the trading process. This article aims to investigate whether Billionext is a safe option for traders or if it poses significant risks that warrant caution. Our analysis is based on a comprehensive review of various online sources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. Regulation provides a framework that ensures brokers adhere to industry standards, protecting traders' interests. Unfortunately, Billionext has not provided clear evidence of regulatory oversight, which raises concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Billionext claims to operate from the British Virgin Islands (BVI), a location often associated with unregulated brokers. The absence of a valid regulatory license means that traders have no recourse to regulatory bodies in case of disputes or issues with withdrawals. The lack of regulation is a significant red flag, as it indicates that the broker is not held accountable to any governing authority, which can lead to unethical practices and increased risks for investors.

Company Background Investigation

Billionext's history and ownership structure are crucial for understanding its reliability. Established in 2019, the broker operates under the name Billionext Global Limited. However, detailed information about its ownership and management team is scarce. The anonymity surrounding its founders and executives raises questions about the broker's transparency and accountability.

The lack of transparency can be detrimental to traders, as it makes it challenging to assess the company's credibility and operational history. A reputable broker typically discloses information about its management team and their professional backgrounds, which fosters trust among potential clients. The absence of such disclosures for Billionext further complicates the assessment of its safety.

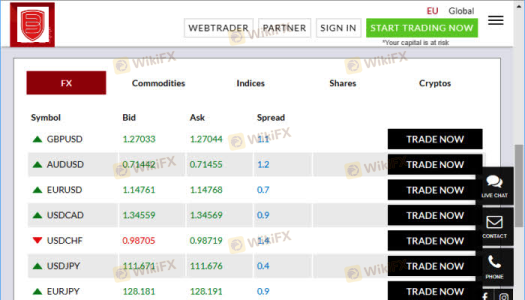

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Billionext's fee structure and trading costs can significantly impact a trader's profitability. The broker's website does not provide comprehensive information about its trading fees, which is concerning for potential clients.

| Fee Type | Billionext | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3% |

The absence of clear and transparent information regarding fees can lead to hidden costs, which may be detrimental to traders. Furthermore, if the broker employs unusual or excessive fees, it could indicate a lack of integrity and a potential risk for traders.

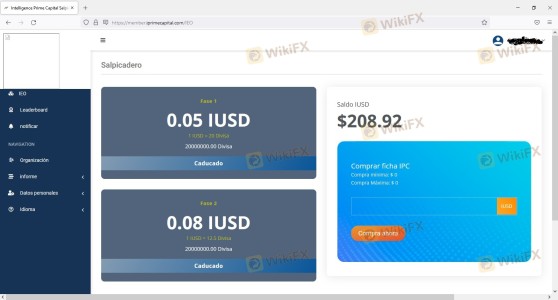

Client Funds Security

Security of client funds is paramount when selecting a broker. Billionext's approach to safeguarding client funds is unclear, as there is limited information available regarding its fund segregation practices, investor protection measures, and negative balance protection policies.

Traders should be cautious, as the lack of these safety measures can lead to significant financial losses. Historically, unregulated brokers have faced issues related to fund mismanagement and insolvency, resulting in clients losing their investments. Therefore, it is vital to assess whether Billionext implements adequate security measures to protect client funds.

Customer Experience and Complaints

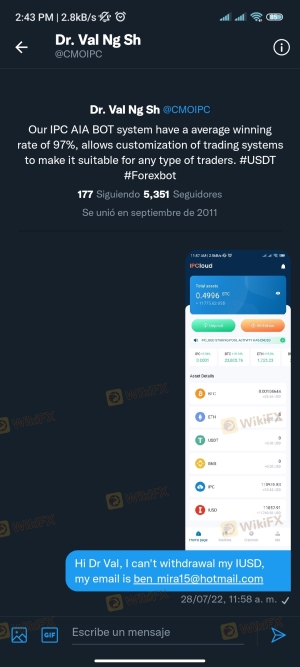

Analyzing customer feedback is crucial for understanding the overall experience with a broker. Reviews of Billionext reveal a pattern of complaints, particularly regarding withdrawal issues and customer service responsiveness. Many users have reported difficulties in accessing their funds, which is a significant concern for any trader.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

Typical complaints include users being unable to withdraw their funds and receiving inadequate responses from customer support. Such patterns indicate potential operational flaws and raise questions about the broker's commitment to client satisfaction.

Platform and Trade Execution

The trading platform's performance and execution quality are critical components of a trader's experience. Billionext reportedly utilizes a proprietary trading platform, but detailed information about its features, stability, and user interface is lacking.

Traders need to know about the platform's reliability, order execution speed, and any signs of potential manipulation. A platform that frequently experiences downtime or has high slippage rates can severely impact trading outcomes, leading to frustration and financial losses for users.

Risk Assessment

Using Billionext as a trading platform presents several risks that traders should carefully evaluate. The absence of regulation, unclear fee structures, and numerous customer complaints contribute to a high-risk environment for potential investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Complaints regarding withdrawals |

To mitigate these risks, traders should consider conducting thorough research and possibly seeking regulated alternatives that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Billionext raises several red flags regarding its safety and legitimacy. The lack of regulation, poor customer feedback, and unclear trading conditions indicate a high level of risk for potential investors. There are no substantial signs of fraud; however, the overall environment is not conducive to safe trading practices.

For traders seeking a reliable and secure trading experience, it is advisable to consider regulated brokers with proven track records and transparent operations. Brokers regulated by reputable authorities provide a safer environment for trading, ensuring that clients' funds are protected and that there is recourse in case of disputes. Thus, if you are considering trading with Billionext, it may be wise to explore alternative options that prioritize safety and regulatory compliance.

Is Billionext a scam, or is it legit?

The latest exposure and evaluation content of Billionext brokers.

Billionext Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Billionext latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.