ABUSA 2025 Review: Everything You Need to Know

Executive Summary

ABUSA has been assessed as an unsafe broker by multiple evaluation sources and user feedback. This comprehensive abusa review reveals significant concerns regarding the platform's regulatory status and overall trustworthiness, which should worry potential investors. While ABUSA offers trading in various financial products including forex, stocks, futures, energy commodities, precious metals, and cryptocurrencies, the broker operates without proper regulatory oversight. The platform targets investors seeking diversified trading opportunities, but the lack of regulatory protection poses substantial risks that cannot be ignored.

User testimonials consistently highlight safety concerns and poor service quality. This leads to widespread classification of ABUSA as a potentially fraudulent operation that traders should avoid. Based on available information and user experiences, ABUSA fails to meet industry standards for broker safety and reliability, making it unsuitable for most traders seeking secure investment environments.

Important Notice

ABUSA operates as a US-headquartered online trading platform that lacks regulatory supervision from recognized financial authorities. Traders should be aware that this broker functions outside established regulatory frameworks, which significantly impacts investor protection measures and creates serious risks for anyone considering using their services.

This evaluation is based on publicly available information, user feedback, and reports from various financial review platforms. The assessment methodology incorporates data from multiple sources including user complaints, platform analysis, and industry reports that paint a concerning picture of this broker's operations. Due to limited official documentation and the broker's unregulated status, some operational details remain unclear. Potential users should exercise extreme caution and consider regulated alternatives before engaging with this platform.

Rating Framework

Broker Overview

ABUSA emerged in the online trading landscape in 2023. The company established its headquarters in the United States while operating as an international trading platform that claims to serve global clients. Despite its relatively recent establishment, ABUSA has quickly gained attention in the trading community, though predominantly for negative reasons related to safety concerns and questionable business practices.

This abusa review reveals that the broker's business model centers on providing trading access to six major asset categories. These include foreign exchange currencies, equity securities, futures contracts, energy commodities, precious metals, and cryptocurrency markets that appeal to diverse investors. The platform claims to serve international clients seeking diversified investment opportunities, though specific platform technology and execution methods remain poorly documented. The absence of clear regulatory oversight raises immediate red flags about the broker's legitimacy and operational transparency, making it essential for potential users to understand these risks before considering any engagement with the platform.

Regulatory Status: Available information indicates ABUSA operates without supervision from recognized financial regulatory authorities. This creates significant investor protection gaps that expose users to unnecessary risks.

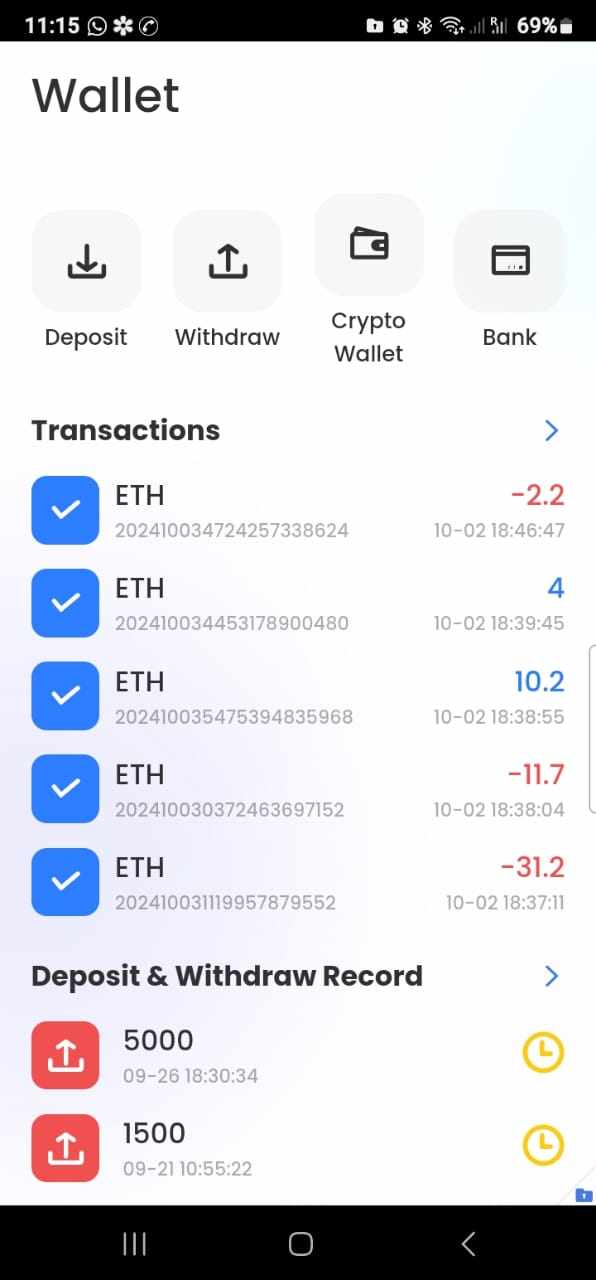

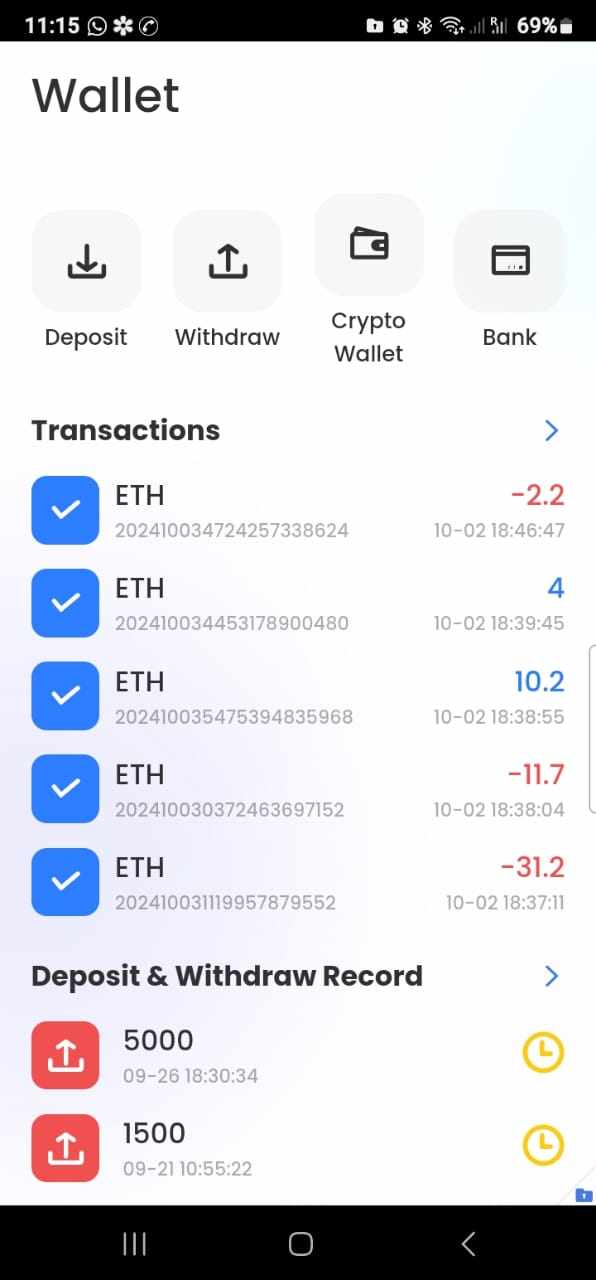

Deposit and Withdrawal Methods: Specific information regarding funding options and withdrawal procedures has not been clearly documented in available sources.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds for account opening or maintenance.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not mentioned in available documentation.

Tradeable Assets: ABUSA provides access to forex pairs, stock securities, futures contracts, energy commodities including oil and gas, precious metals such as gold and silver, and various cryptocurrency instruments.

Cost Structure: Comprehensive information about spreads, commissions, overnight fees, and other trading costs remains undisclosed in this abusa review analysis.

Leverage Ratios: Maximum leverage offerings and margin requirements have not been specified in available broker documentation.

Platform Options: Technical specifications about trading platforms, software compatibility, and system requirements are not detailed in accessible sources.

Regional Restrictions: Geographic limitations and country-specific access policies have not been clearly outlined.

Customer Support Languages: Available customer service language options are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Account opening procedures and conditions at ABUSA present multiple concerns that significantly impact the user experience. The broker fails to provide transparent information about account types, tier structures, or specific features available to different client categories, which creates immediate challenges for potential users attempting to understand what services they can access and under what conditions.

The absence of detailed minimum deposit requirements makes it impossible for traders to properly plan their initial investment. Additionally, the account opening process lacks the standard verification procedures typically required by regulated brokers, which while potentially convenient, raises serious questions about compliance with international anti-money laundering standards that legitimate brokers must follow.

User feedback consistently indicates dissatisfaction with account conditions, particularly regarding unexpected limitations and unclear terms of service. Many users report discovering restrictive conditions only after funding their accounts, suggesting inadequate disclosure during the registration process that borders on deceptive practices. The lack of specialized account types, such as Islamic accounts for Muslim traders or professional accounts for experienced investors, further limits the broker's appeal to diverse trading communities.

This abusa review finds that ABUSA's account conditions fall well below industry standards. The broker performs particularly poorly when compared to regulated brokers that offer transparent, well-structured account hierarchies with clear benefits and requirements for each tier.

ABUSA's trading tools and educational resources present a mixed picture. Basic functionality exists but is overshadowed by significant limitations in advanced features and support materials that serious traders expect from professional platforms.

The broker appears to offer standard trading instruments across its advertised asset categories, but lacks the comprehensive research resources typically expected from professional trading platforms. Advanced charting capabilities, technical analysis tools, and market research reports are either absent or poorly implemented, limiting traders' ability to conduct thorough market analysis that could improve their trading performance.

Educational resources, which are crucial for trader development and platform adoption, appear to be minimal or non-existent. The absence of webinars, trading guides, market analysis, or educational content significantly reduces the platform's value proposition, particularly for novice traders who require guidance and learning materials to develop their skills.

Automated trading support and algorithmic trading capabilities have not been documented. This suggests limited options for traders seeking to implement systematic trading strategies that could enhance their performance. The lack of API access or third-party integration further restricts the platform's utility for experienced traders who rely on external tools and services.

Customer Service and Support Analysis (Score: 3/10)

Customer service quality emerges as one of ABUSA's most significant weaknesses. User feedback consistently highlights poor responsiveness, inadequate problem resolution, and limited support availability that frustrates customers and leaves issues unresolved.

Response times for customer inquiries are reportedly slow, with many users experiencing delays of several days or even weeks before receiving assistance. This poor responsiveness is particularly problematic in the fast-paced trading environment where timely support can be crucial for resolving account issues or technical problems that may impact trading activities and potentially cost traders money.

Service quality feedback indicates that when support is provided, it often fails to address user concerns adequately. Many complaints suggest that customer service representatives lack the knowledge or authority to resolve complex issues, leading to repeated exchanges without satisfactory resolution that wastes time and increases frustration. The high volume of user complaints across various review platforms indicates systematic problems with the support structure.

Communication channels appear limited, with unclear availability hours and insufficient multilingual support for the broker's claimed international client base. The absence of comprehensive FAQ sections, help documentation, or self-service options forces users to rely entirely on direct support, which compounds the problems caused by poor service quality.

Trading Experience Analysis (Score: 4/10)

The trading experience at ABUSA suffers from multiple technical and operational issues that significantly impact user satisfaction and trading effectiveness. Platform stability concerns dominate user feedback, with reports of system outages, connection problems, and execution delays that can be particularly damaging in volatile market conditions where timing is crucial.

Order execution quality appears inconsistent based on user reports, with concerns about slippage, requotes, and delayed fills that can negatively impact trading profitability. These execution issues are particularly problematic for active traders who rely on precise timing and accurate price fills to implement their trading strategies effectively and maintain their competitive edge.

Platform functionality seems limited compared to industry-standard trading software, with users reporting missing features, poor interface design, and inadequate customization options. The absence of advanced order types, comprehensive charting tools, and professional-grade execution capabilities restricts the platform's appeal to serious traders who need sophisticated tools to succeed.

Mobile trading experience, increasingly important in today's trading environment, appears to be poorly implemented or non-existent based on available information. This limitation significantly restricts traders' ability to monitor positions and react to market movements when away from their primary trading setup, which could result in missed opportunities or increased losses.

This abusa review reveals that the overall trading environment fails to meet modern standards for professional trading platforms. Technical limitations and reliability issues create substantial barriers to effective trading that could harm user performance.

Trust and Safety Analysis (Score: 2/10)

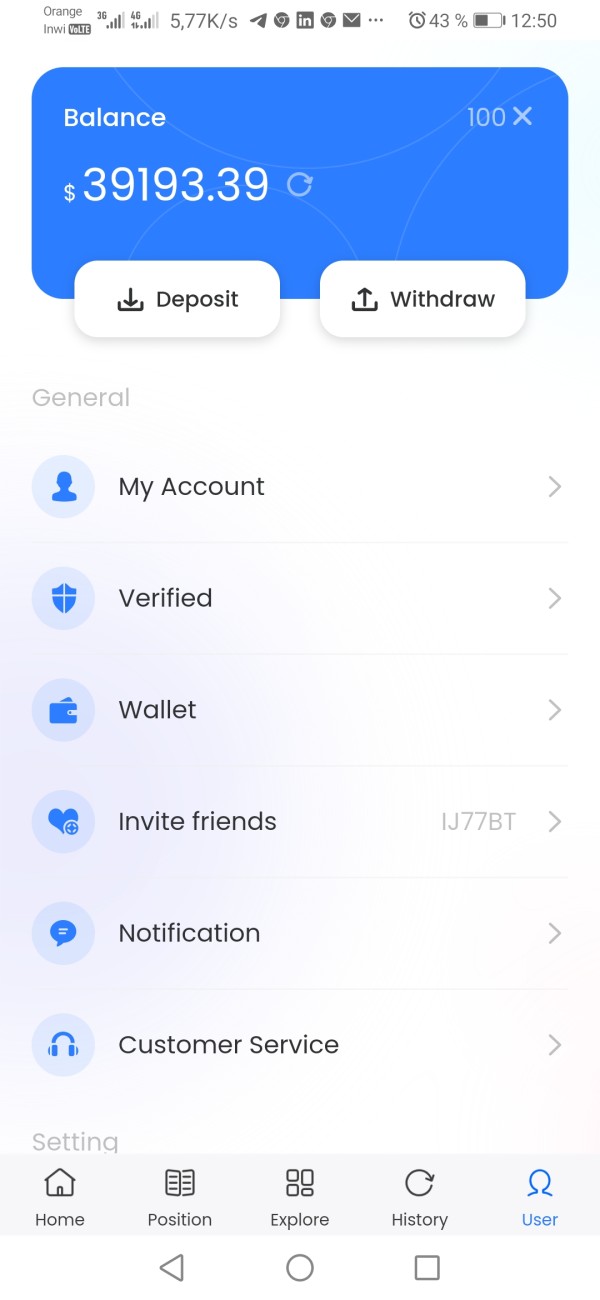

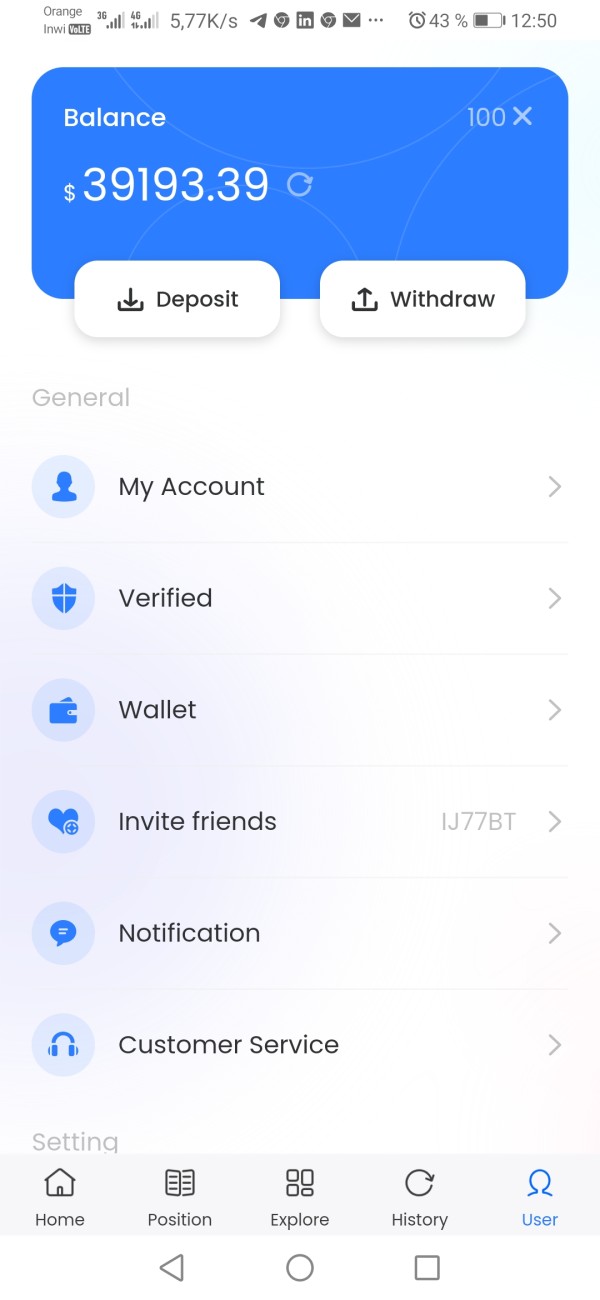

Trust and safety represent ABUSA's most critical weaknesses. The broker receives widespread classification as a potentially fraudulent operation that poses serious risks to user funds and personal information.

Regulatory credentials are notably absent, with no evidence of licensing from established financial regulators such as the FCA, ASIC, CySEC, or other reputable authorities. This regulatory gap eliminates standard investor protections including deposit insurance, segregated client funds, and regulatory oversight of business practices that legitimate brokers must maintain.

Fund safety measures appear inadequate or non-existent, with no clear information about client money protection, segregated accounts, or insurance coverage. The lack of transparency regarding fund handling creates significant risks for users who deposit money with the platform and may never see their funds again.

Company transparency is severely lacking, with minimal information available about corporate structure, management team, or operational procedures. This opacity, combined with the unregulated status, has led multiple review platforms and user communities to flag ABUSA as a potential scam operation that should be avoided at all costs.

Industry reputation is predominantly negative, with numerous warnings from financial review sites and user communities advising against engagement with the platform. The accumulation of negative feedback and scam classifications represents a clear pattern that potential users should carefully consider before risking their money.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with ABUSA remains consistently low across multiple feedback channels. Users express frustration about various aspects of the platform experience that make trading difficult and stressful.

Interface design and usability appear problematic based on user feedback, with reports of confusing navigation, poor visual design, and inadequate functionality that hampers effective platform use. These design issues contribute to user frustration and may impact trading effectiveness by making it harder to execute trades quickly and accurately.

Registration and verification processes lack the thoroughness expected from legitimate financial service providers. They simultaneously create confusion for users attempting to understand account requirements and capabilities, which results in a poor first impression.

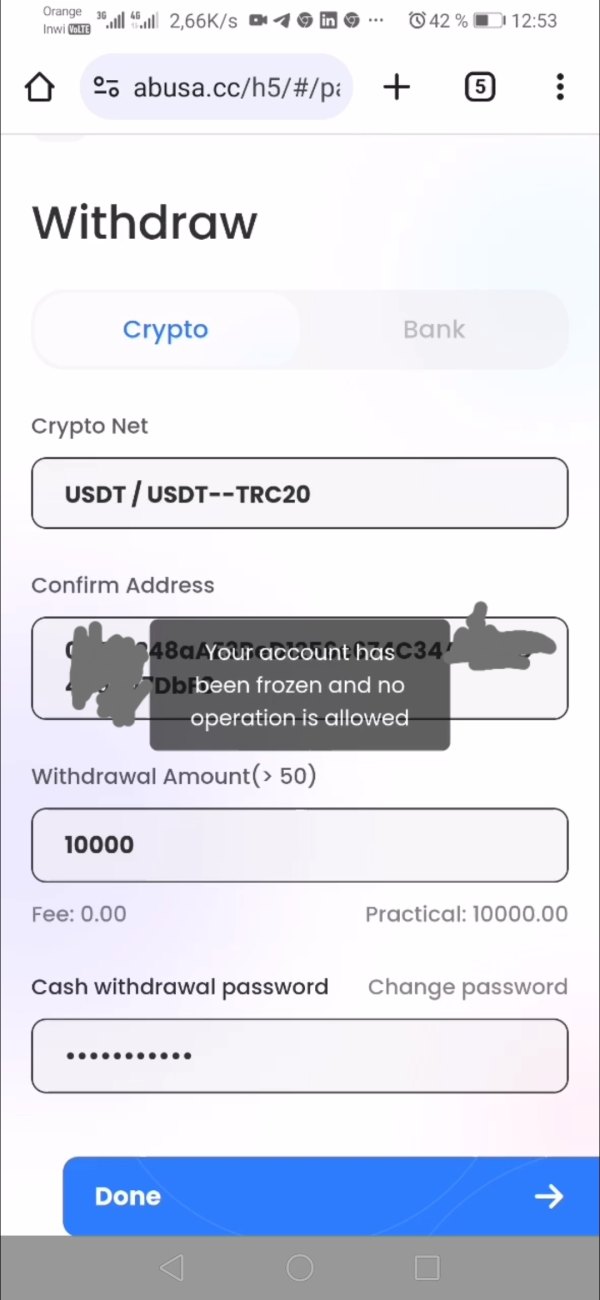

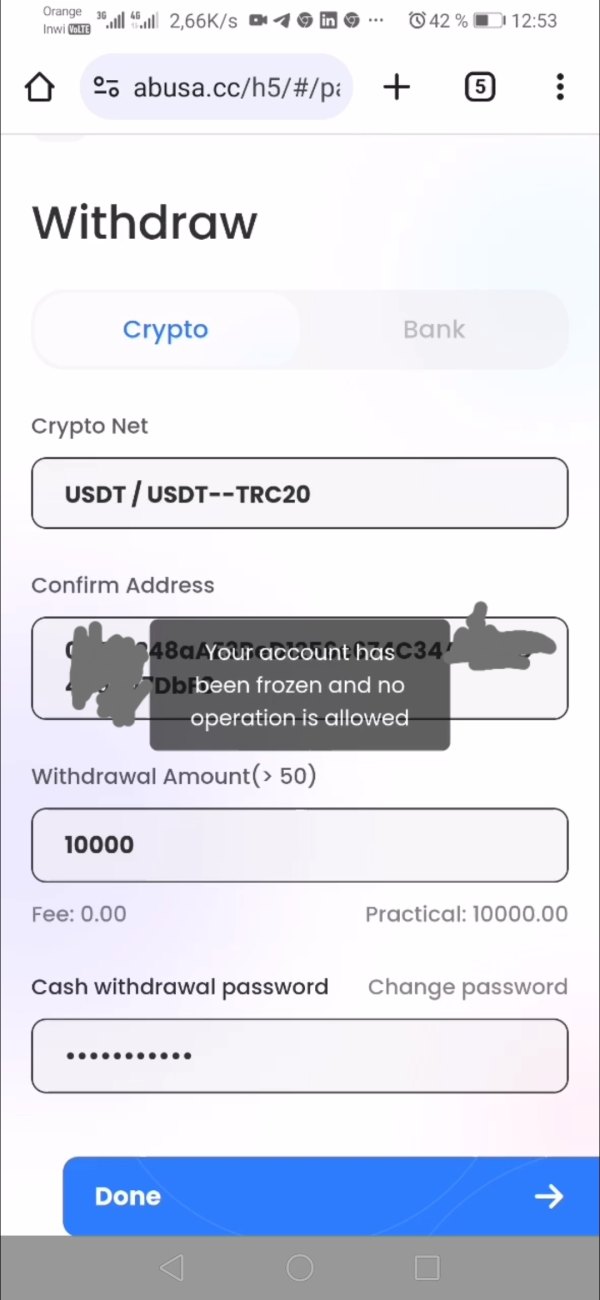

Fund management experiences generate significant user complaints, with reports of difficulties accessing funds, unclear withdrawal procedures, and delayed processing times that create anxiety and financial stress for users attempting to recover their investments. Common user complaints center on platform reliability, customer service quality, fund access issues, and overall trustworthiness concerns that affect every aspect of the user experience. The predominance of negative feedback and absence of positive user testimonials suggests systematic problems across multiple operational areas that impact the entire user experience.

Conclusion

This comprehensive abusa review reveals that ABUSA fails to meet acceptable standards for online trading services across multiple critical evaluation criteria. The broker's unregulated status, poor customer service, technical limitations, and widespread safety concerns make it unsuitable for most traders seeking reliable and secure trading environments that protect their investments.

ABUSA might only be considered by traders with extremely high risk tolerance who fully understand the potential for total loss of invested funds. However, even risk-tolerant investors would be better served by regulated alternatives that provide proper investor protections and professional service standards without the risks associated with unregulated operations.

The primary advantage of offering diverse financial products is completely overshadowed by fundamental weaknesses in regulation, safety, customer support, and platform reliability. These critical deficiencies make ABUSA a poor choice for anyone seeking legitimate trading services, regardless of their experience level or risk appetite, and traders should look elsewhere for their investment needs.