Is Abacus safe?

Pros

Cons

Is Abacus Safe or Scam?

Introduction

Abacus is a forex broker that positions itself in a competitive market, claiming to offer various trading services to clients worldwide. However, as the financial landscape is rife with scams and unregulated entities, traders must approach brokers like Abacus with caution. The importance of thoroughly evaluating a forex broker cannot be overstated, as the safety of investments hinges on the broker's legitimacy and regulatory compliance. In this article, we will investigate whether Abacus is a safe trading option or if it presents potential risks to investors. Our analysis is based on data gathered from multiple reputable sources, focusing on regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

One of the critical factors in determining whether a broker is safe is its regulatory status. A regulated broker is typically subject to oversight by a financial authority, which ensures that it adheres to strict standards designed to protect investors. Unfortunately, Abacus has been flagged as unregulated or operating under suspicious regulatory conditions.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 522157 | United Kingdom | Suspicious Clone |

The Financial Conduct Authority (FCA) is a top-tier regulator in the UK, known for its stringent oversight of financial entities. However, Abacus's association with the FCA appears to be a case of a "suspicious clone," meaning that it is likely impersonating a legitimate entity. This lack of genuine regulation raises significant concerns regarding the safety of funds deposited with Abacus. Moreover, the absence of a robust regulatory framework can lead to unfair trading practices and inadequate investor protection.

Company Background Investigation

Abacus claims to have a history of providing forex trading services; however, its background is shrouded in uncertainty. The company's ownership structure and management team are not well-documented, which diminishes transparency. A reliable broker typically provides clear information about its founders and key executives, including their professional backgrounds and industry experience.

The lack of accessible and verifiable information about Abacus raises red flags. In the financial services industry, transparency is paramount, and brokers that fail to disclose essential information may be attempting to obscure their operations. This opacity can lead to mistrust among potential clients, making it crucial for traders to verify the legitimacy of any broker before investing.

Trading Conditions Analysis

Evaluating the trading conditions offered by Abacus reveals a concerning picture. The overall fee structure and trading costs appear to be less favorable compared to industry standards.

| Fee Type | Abacus | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable | 1.0 - 1.5 pips |

| Commission Structure | High | Low |

| Overnight Interest Range | Unclear | 2.0 - 5.0% |

Abacus has been reported to impose high commission fees and unclear overnight interest rates, which can significantly impact a trader's profitability. Furthermore, the variability in spreads can lead to unexpected costs during trading, making it essential for traders to scrutinize these conditions carefully. High fees and unfavorable trading costs are often associated with unregulated brokers, further emphasizing the need for caution when considering Abacus as a trading partner.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Abacus has been criticized for its lack of adequate security measures to protect client deposits. Key factors to consider include the segregation of client funds, investor protection mechanisms, and negative balance protection policies.

Unfortunately, Abacus does not appear to offer sufficient safeguards for client funds. Reports indicate that funds may not be held in segregated accounts, which poses a significant risk to traders. In the event of financial difficulties faced by the broker, clients could potentially lose their investments. Additionally, the absence of negative balance protection means that traders could end up owing money to the broker, further exacerbating financial risks.

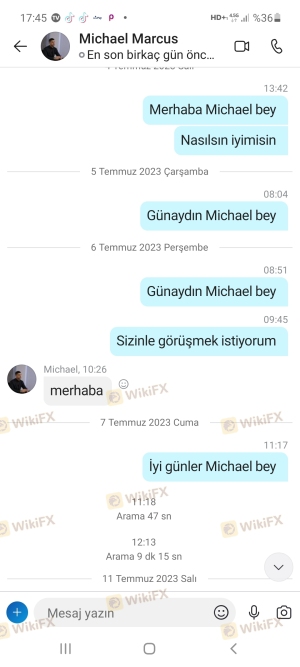

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing the reliability of a broker. An analysis of user experiences with Abacus reveals a pattern of complaints and dissatisfaction. Common issues reported by clients include poor customer service, difficulties in withdrawing funds, and unexpected fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Unexpected Fees | High | Inconsistent |

Many users have expressed frustration over the inability to access their funds, with some reporting that their accounts were frozen without explanation. These issues raise serious concerns about the broker's operational integrity and willingness to address client grievances effectively. In light of these complaints, potential traders should consider the risks associated with engaging with Abacus.

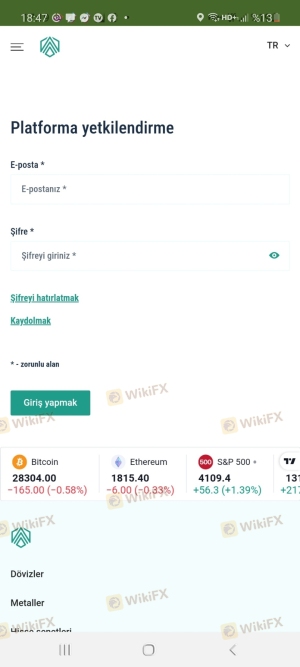

Platform and Trade Execution

The trading platform provided by Abacus is another area of concern. A reliable trading platform should offer stability, user-friendly navigation, and efficient order execution. However, reports suggest that Abacus's platform may not meet these standards, leading to issues such as slippage and order rejections.

Traders have raised concerns about the quality of order execution, with some experiencing significant delays and discrepancies between the expected and actual execution prices. Such issues can severely impact trading performance and profitability. Additionally, any signs of potential platform manipulation should be taken seriously, as they can indicate a lack of ethical practices within the brokerage.

Risk Assessment

Using Abacus as a trading partner presents several risks that traders should be aware of. A comprehensive risk assessment reveals the following:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Poor customer service and execution |

Given these risks, traders should approach Abacus with caution. It is advisable to conduct thorough research and consider alternative brokers with proven regulatory compliance and positive user experiences.

Conclusion and Recommendations

In conclusion, the evidence suggests that Abacus may not be a safe trading option. The lack of genuine regulation, combined with numerous complaints and questionable trading practices, raises significant concerns about the broker's legitimacy. Traders should be especially cautious of the potential for fraud and the risks associated with unregulated entities.

For those seeking reliable trading options, it is recommended to consider brokers that are regulated by top-tier authorities and have established positive reputations in the industry. Some trustworthy alternatives include brokers overseen by the FCA, ASIC, or other reputable regulatory bodies. Ultimately, prioritizing safety and transparency is essential for successful trading in the forex market.

Is Abacus a scam, or is it legit?

The latest exposure and evaluation content of Abacus brokers.

Abacus Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Abacus latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.