Abacus 2025 Review: Everything You Need to Know

Executive Summary

This abacus review looks at a company that works in many different business areas. The company focuses mainly on AI solutions and insurance services. Abacus shows a mixed profile with limited transparency about traditional brokerage operations, based on available information. The company has strong technological innovation through its AI platform offerings. However, it lacks detailed disclosure of regulatory oversight and specific trading conditions that traders typically expect from financial service providers.

Abacus works through different entities. These include Abacus Insurance Brokers established in 1982 and Abacus.AI which provides enterprise-level artificial intelligence solutions. The platform supports personalization, prediction, planning, and anomaly detection capabilities. This positions the company primarily toward enterprise users and clients seeking AI-driven solutions rather than traditional retail trading services.

The target audience appears to be sophisticated enterprise clients requiring AI automation tools and specialized insurance products. They do not focus on individual retail traders seeking conventional forex or CFD trading services. This positioning creates a unique market niche but may not satisfy traditional trading community expectations.

Important Notice

This evaluation uses publicly available information and user feedback from various sources. Readers should note that information about regulatory compliance, trading conditions, and operational procedures may be limited. This happens because the company focuses on enterprise solutions rather than retail trading services.

The assessment method includes analysis of company websites, available documentation, and industry reports where accessible. However, comprehensive regulatory verification and detailed trading condition analysis remain limited by information availability.

Rating Framework

Broker Overview

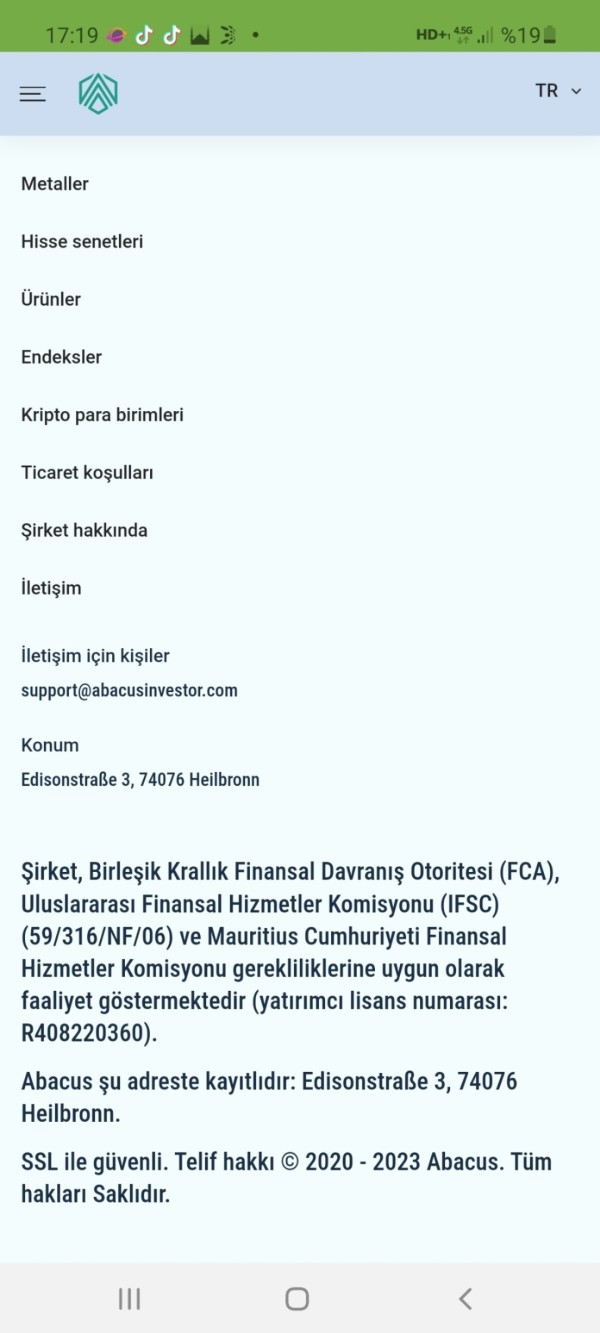

Abacus operates as a multi-faceted organization with roots tracing back to 1982. Abacus Insurance Brokers was established in Santa Monica, California that year. The company has evolved to include different business segments, with Abacus.AI emerging as a significant enterprise-focused artificial intelligence solutions provider. This evolution reflects the company's adaptation to technological advancement and market demands for automated business solutions.

The organization specializes in delivering enterprise-grade AI solutions designed to simplify business automation processes. Their platform integrates various machine learning capabilities. It supports deep learning model construction and deployment across different business applications. According to available information, the company focuses on integrating multiple insurance product lines from various carriers into comprehensive insurance programs, though specific details about trading services remain limited.

The business model appears centered on B2B relationships rather than traditional retail brokerage services. This positioning distinguishes Abacus from conventional forex brokers. The company's primary focus lies in providing technological solutions and specialized insurance products rather than facilitating individual trader access to financial markets. The platform architecture supports enterprise-level implementations, suggesting significant infrastructure investment in AI and automation technologies.

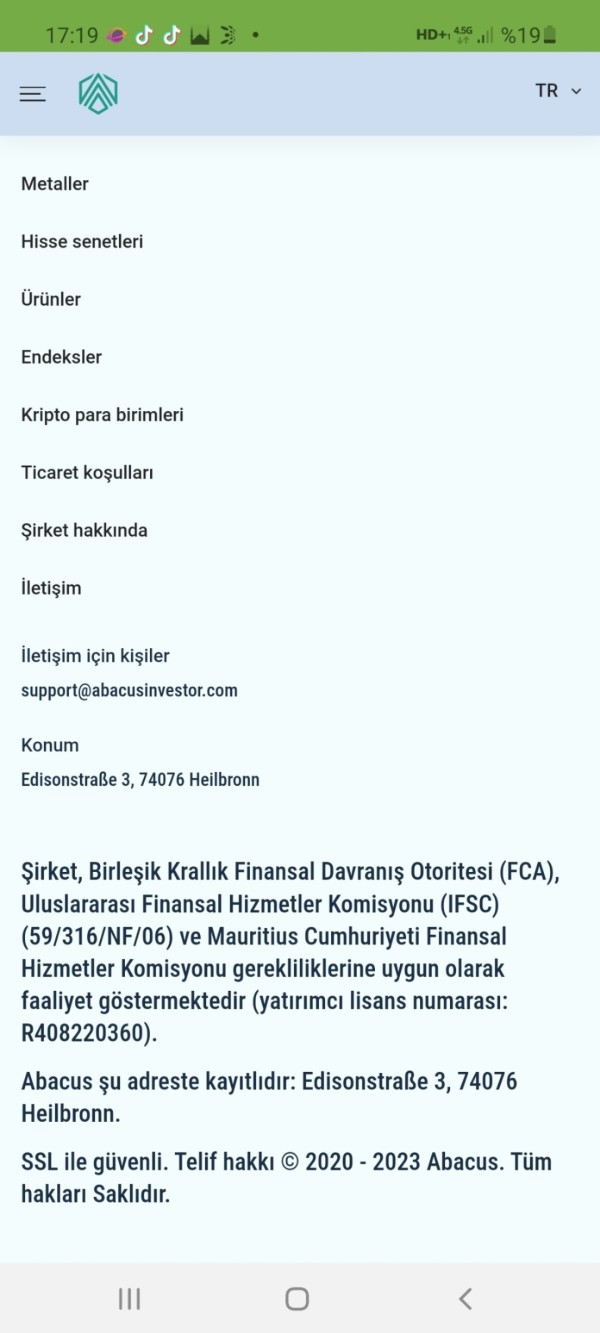

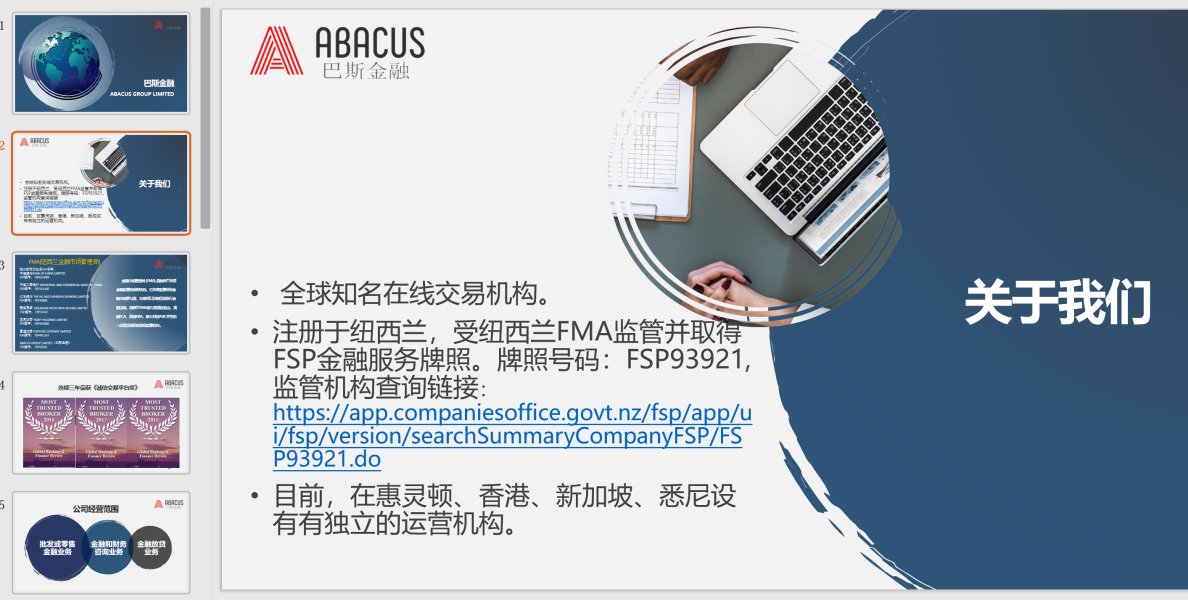

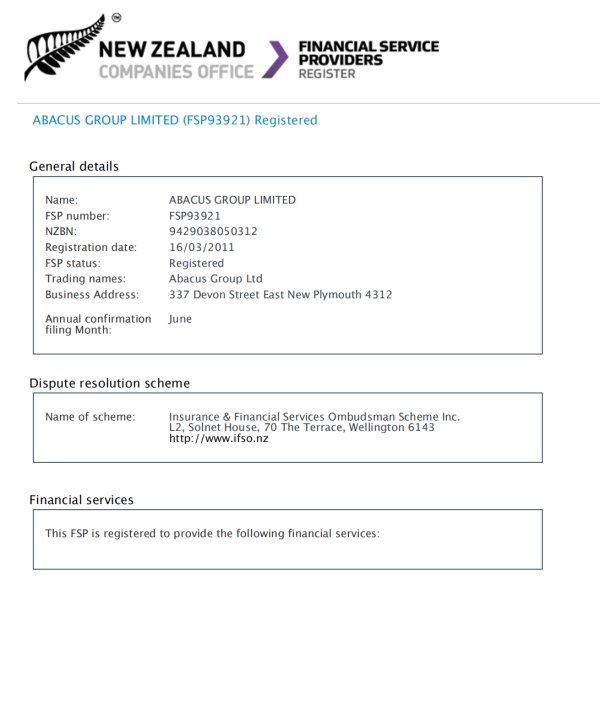

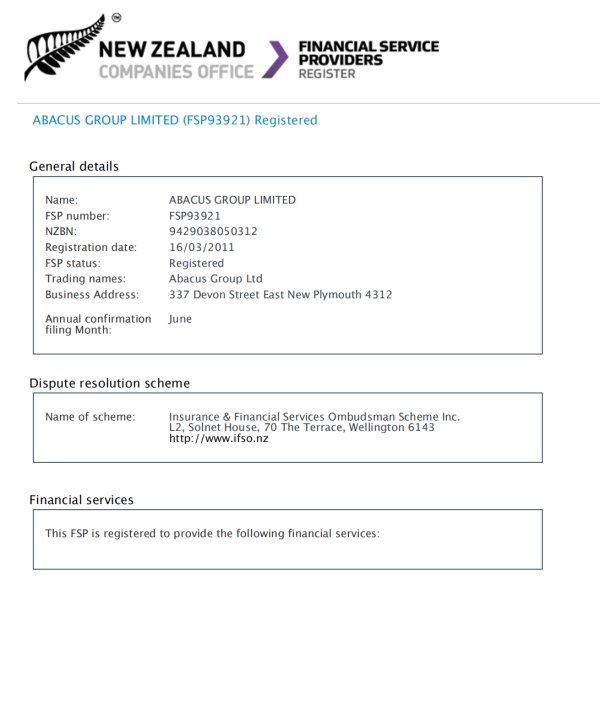

Regulatory Oversight: Specific regulatory authority information is not detailed in available materials. This creates uncertainty regarding compliance frameworks and oversight mechanisms that typically govern financial service providers.

Deposit and Withdrawal Methods: Conventional funding methods commonly expected in brokerage services are not explicitly outlined in accessible documentation. This suggests potential focus on enterprise contract-based arrangements rather than individual account funding.

Minimum Deposit Requirements: Specific minimum investment amounts or account opening requirements are not disclosed in available materials. This indicates possible customized enterprise pricing structures.

Promotional Offerings: Traditional bonus programs or promotional incentives typically associated with retail brokerage services are not mentioned in current abacus review materials.

Available Assets: Specific tradeable instruments, currency pairs, or financial products available for trading are not comprehensively detailed in accessible information sources.

Cost Structure: Detailed information regarding spreads, commissions, overnight fees, or other trading-related costs is not available in current documentation. This limits cost comparison capabilities.

Leverage Options: Maximum leverage ratios or margin requirements are not specified in available materials.

Platform Selection: Specific trading platform options, such as MetaTrader integration or proprietary platform features, are not detailed in accessible sources.

Geographic Restrictions: Service availability limitations or restricted jurisdictions are not explicitly stated in current materials.

Customer Support Languages: Available customer service language options are not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis

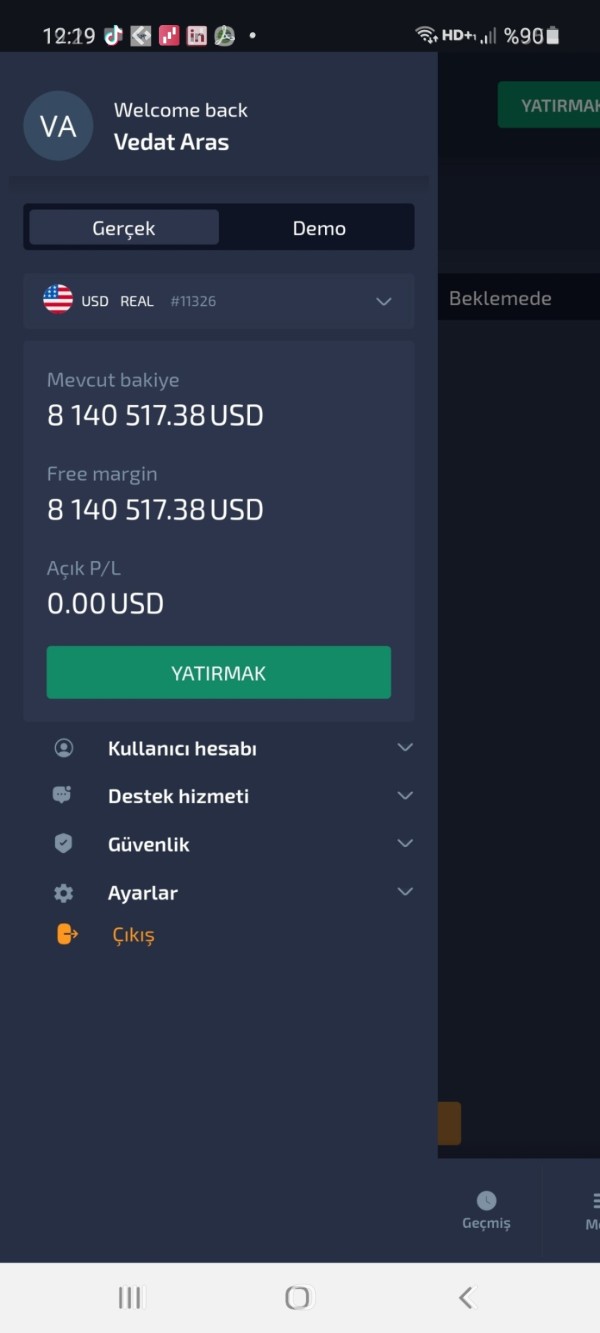

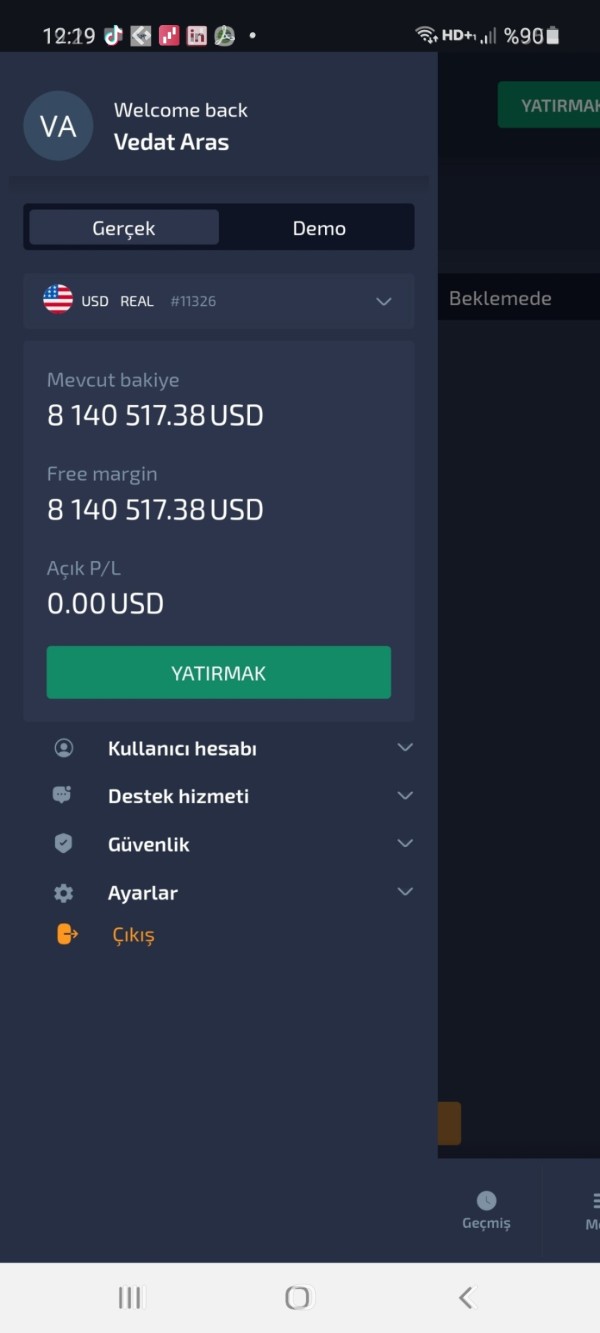

The account structure and conditions represent a significant information gap in this abacus review. Traditional account types such as standard, premium, or VIP tiers are not clearly defined in available materials. This absence of detailed account information suggests that Abacus may operate primarily through customized enterprise agreements rather than standardized retail account offerings.

Minimum deposit requirements, which typically serve as entry barriers for retail traders, remain unspecified. This lack of transparency regarding financial commitments creates uncertainty for potential clients seeking to understand investment requirements. The account opening process, including verification procedures and documentation requirements, is not detailed in accessible sources.

Special account features commonly offered by brokers are not mentioned in available documentation. These include Islamic accounts complying with Sharia law or demo accounts for practice trading. This absence of specialized account options may limit accessibility for diverse client populations with specific religious or educational requirements.

The overall account conditions framework appears more suited to enterprise clients requiring customized solutions. It does not serve individual traders seeking standardized account structures with clear terms and conditions.

Abacus demonstrates significant strength in technological resources, particularly in artificial intelligence and machine learning capabilities. The platform provides comprehensive AI solutions supporting deep learning model construction, data analysis, and automation processes. These technological assets represent substantial infrastructure investment and expertise in emerging technologies.

The AI platform supports multiple business functions including personalization engines, predictive analytics, planning optimization, and anomaly detection systems. These capabilities indicate sophisticated technical resources that could potentially support advanced trading algorithms and market analysis. However, specific trading applications are not explicitly documented.

Traditional trading tools are not detailed in available materials. These include technical analysis indicators, economic calendars, market research reports, or educational resources typically expected by forex traders. This gap suggests that the platform's tools are oriented toward enterprise AI applications rather than individual trading support.

Educational resources, which are crucial for trader development, are not prominently featured in accessible documentation. This absence may limit the platform's appeal to novice traders seeking learning opportunities and skill development support.

Customer Service and Support Analysis

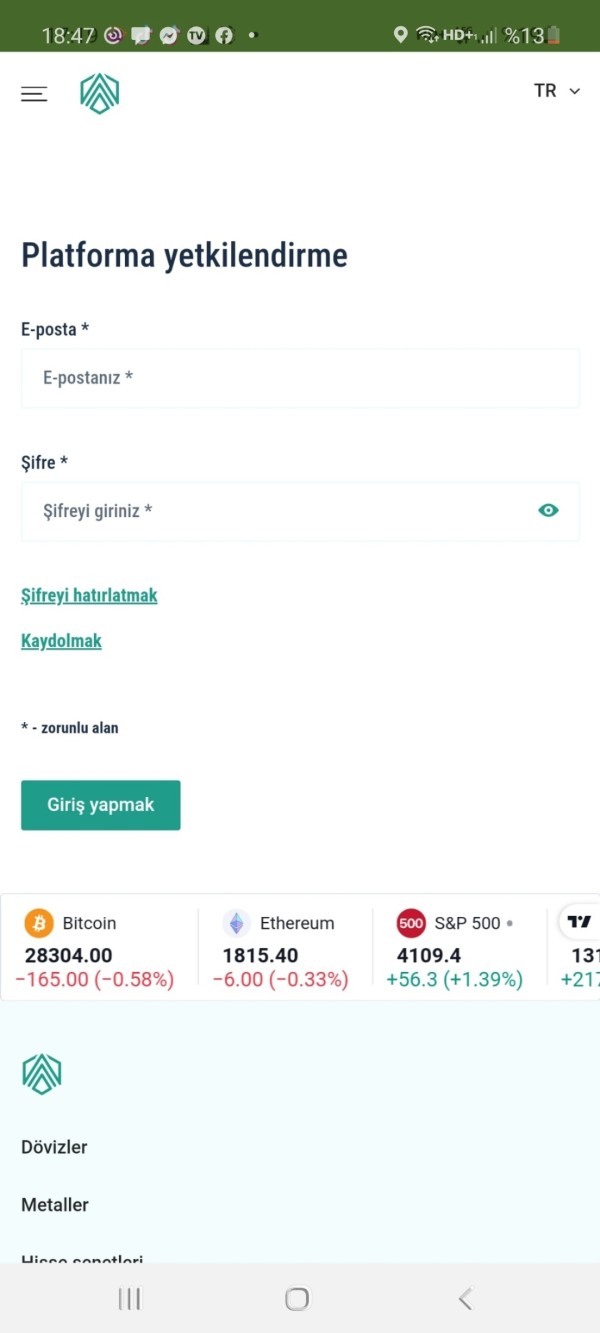

Customer service capabilities and support structures are not comprehensively detailed in available materials. This creates uncertainty about service quality and accessibility. Traditional support channels such as live chat, phone support, email assistance, or help desk tickets are not specifically outlined in current documentation.

Response time commitments, which are crucial for time-sensitive trading environments, are not disclosed in accessible sources. This lack of service level agreements or response time guarantees may concern clients requiring immediate assistance during market volatility or technical issues.

Service quality indicators are not available in current materials. These include customer satisfaction metrics, support team expertise levels, or problem resolution statistics. This absence of performance data limits the ability to assess support effectiveness and reliability.

Multilingual support capabilities, essential for international client bases, are not specified in available documentation. Additionally, customer service hours and availability across different time zones are not detailed, potentially limiting accessibility for global clients.

Trading Experience Analysis

The trading experience evaluation is constrained by limited information regarding platform functionality specifically designed for financial market trading. While the company demonstrates strong AI and machine learning capabilities, the application of these technologies to traditional trading activities is not clearly documented in accessible materials.

Platform stability and execution speed, critical factors for successful trading operations, are not detailed in available sources. Order execution quality metrics, such as slippage rates, rejection frequencies, or fill rates, are not disclosed. This limits the ability to assess trading environment quality.

The platform's functionality appears focused on AI model construction and enterprise automation rather than traditional trading interfaces. Features such as one-click trading, advanced order types, or risk management tools commonly expected by traders are not specifically mentioned in current documentation.

Mobile trading experience, increasingly important for active traders, is not detailed in available materials. This abacus review cannot adequately assess mobile platform capabilities, app functionality, or cross-device synchronization features that modern traders typically require.

Trust and Reliability Analysis

Trust and reliability assessment is significantly hampered by limited regulatory information and transparency gaps in available materials. Specific regulatory authority oversight, license numbers, or compliance certifications are not detailed in accessible documentation. This creates uncertainty about legal framework adherence.

Fund security measures are not explicitly outlined in current materials. These include segregated account structures, deposit insurance coverage, or client fund protection mechanisms. This absence of security information may concern potential clients regarding asset protection and safety.

Company transparency regarding ownership structure, financial statements, or operational procedures is limited in available sources. This lack of detailed disclosure may impact client confidence and due diligence processes for potential users.

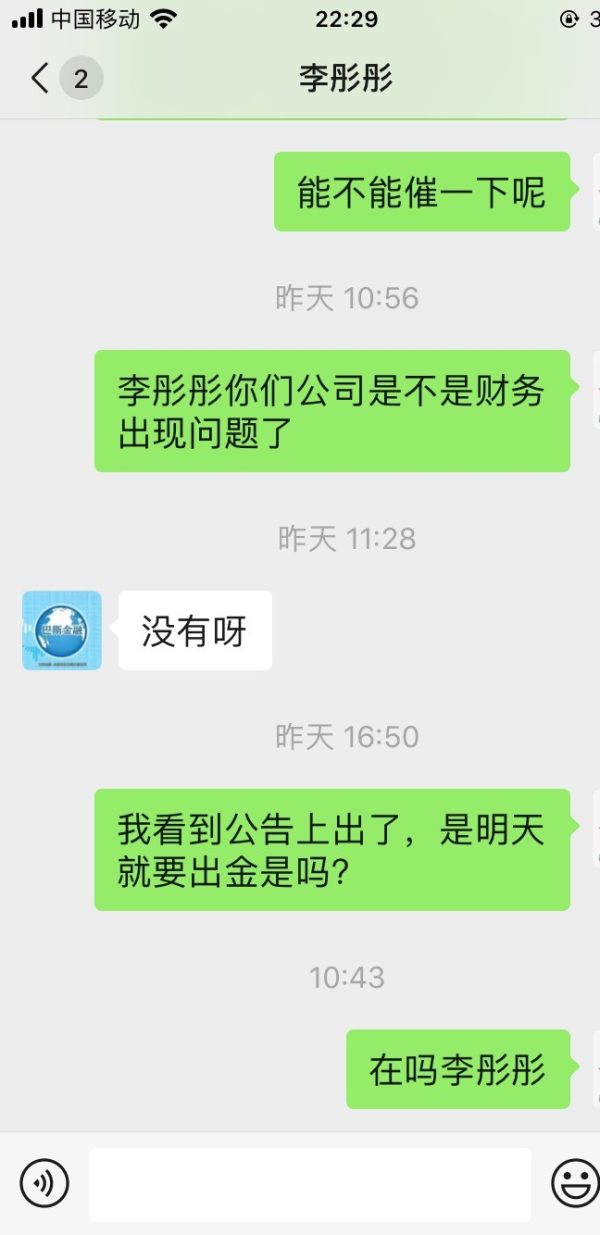

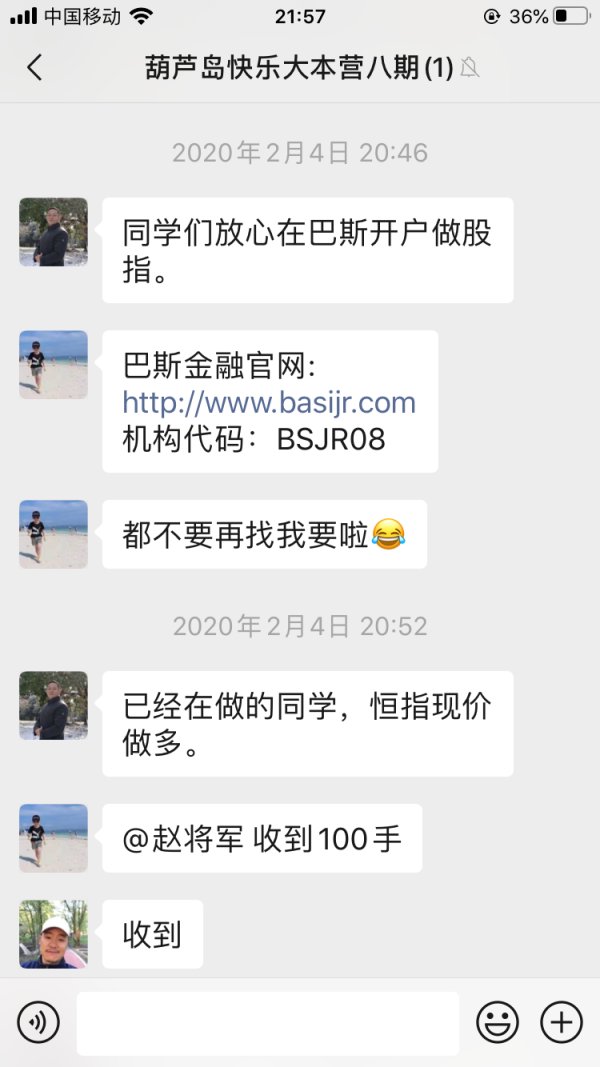

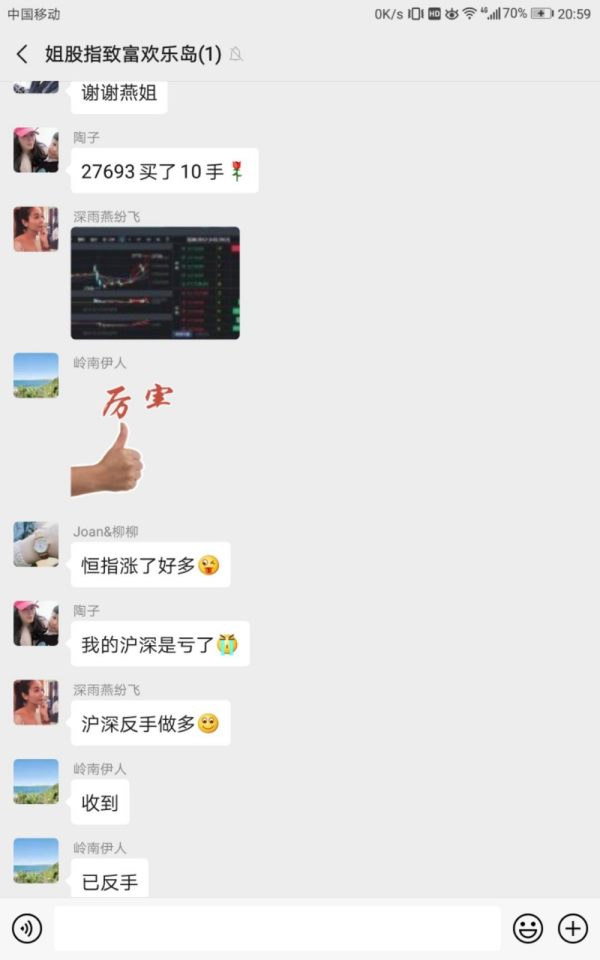

Industry reputation indicators are not prominently featured in accessible documentation. These include awards, recognition, or peer reviews. Additionally, information about negative event handling, dispute resolution procedures, or complaint management processes is not detailed in current materials.

User Experience Analysis

User experience assessment is constrained by limited availability of user feedback and satisfaction data in accessible sources. Overall user satisfaction metrics, testimonials, or case studies are not prominently featured in current documentation. This limits the ability to gauge actual user experiences.

Interface design and usability information is not detailed in available materials. User interface screenshots, navigation descriptions, or accessibility features are not provided. This makes it difficult to assess platform user-friendliness and design quality.

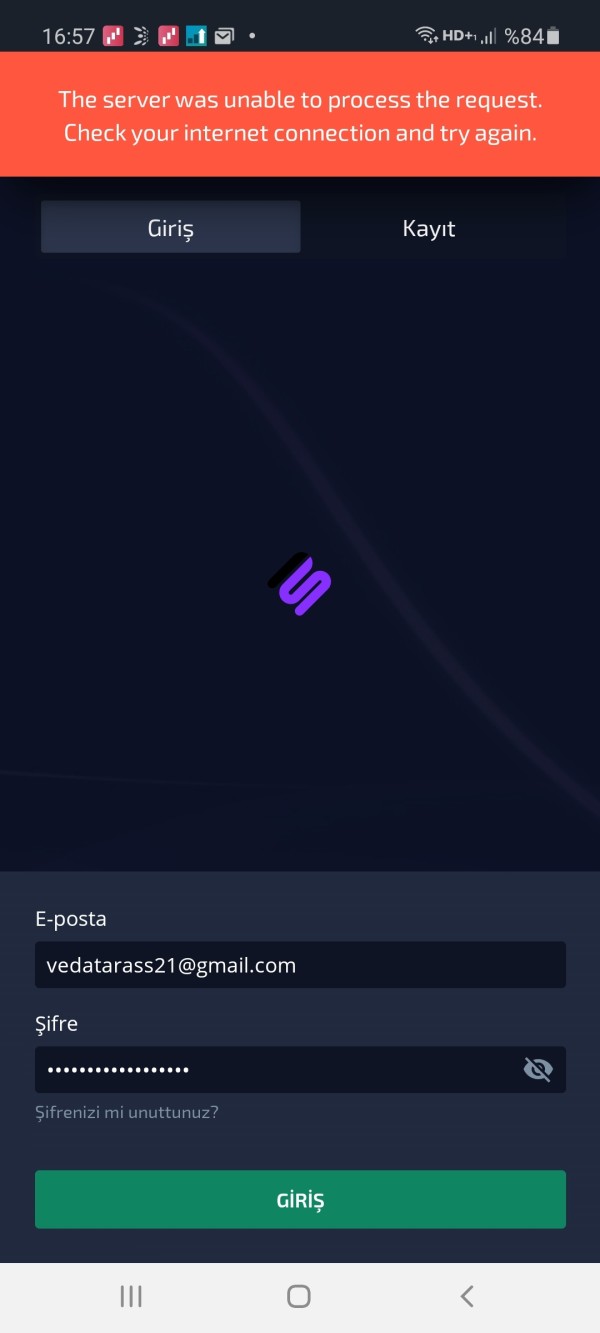

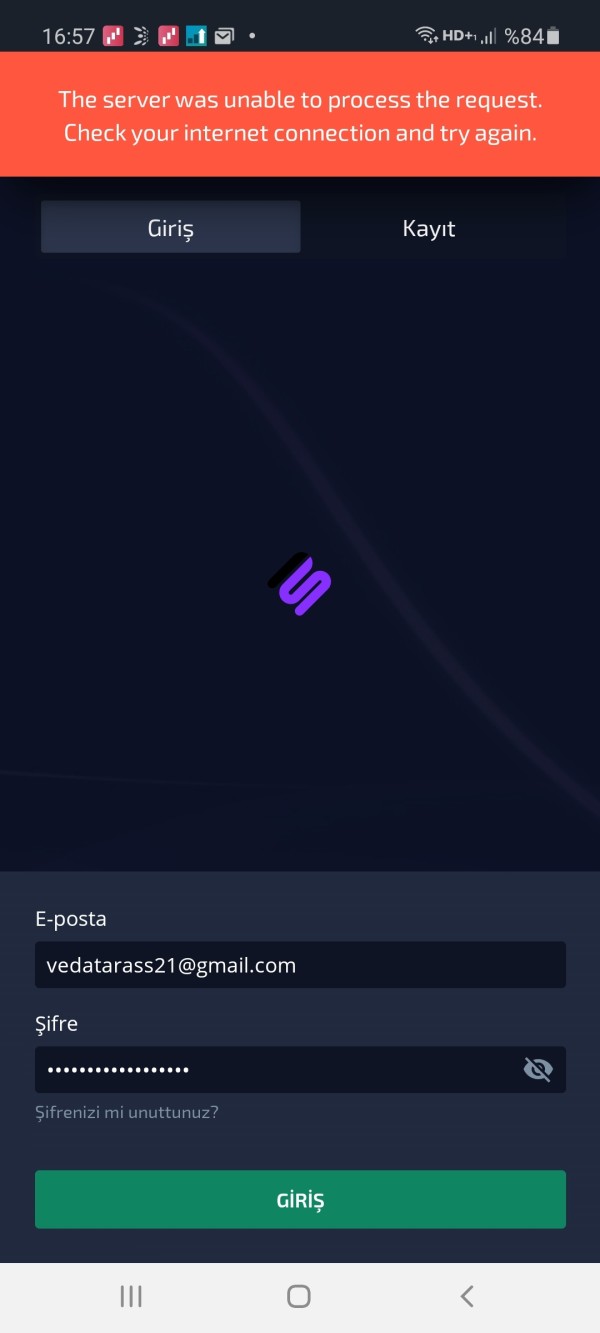

Registration and verification processes, crucial for user onboarding experiences, are not comprehensively detailed in accessible sources. Account setup procedures, documentation requirements, or verification timeframes are not specified in current materials.

Fund operation experiences are not detailed in available documentation. These include deposit processing times, withdrawal procedures, or payment method effectiveness. Common user complaints or frequently reported issues are not documented in accessible sources, limiting insight into potential user experience challenges.

Conclusion

This abacus review reveals a company with strong technological capabilities in AI and machine learning. However, it shows significant information gaps regarding traditional brokerage services and regulatory compliance. The organization appears better suited for enterprise clients seeking AI automation solutions rather than individual traders requiring conventional forex or CFD trading services.

The platform's primary strengths lie in its artificial intelligence infrastructure and enterprise-focused solutions. Notable weaknesses include limited regulatory transparency, insufficient trading condition disclosure, and minimal user feedback availability. Potential users should carefully consider whether the company's enterprise-oriented approach aligns with their specific trading or investment requirements.

Based on available information, Abacus may appeal to sophisticated enterprise clients requiring AI-driven business solutions. However, it may not satisfy traditional retail traders seeking transparent, regulated brokerage services with comprehensive trading tools and clear operational procedures.