Opal 2025 Review: Everything You Need to Know

Executive Summary

This opal review examines Opal Securities Investment Pvt., a stock brokerage firm that has been operating in Nepal for over 20 years. Based on available information, Opal represents a regional brokerage service focusing primarily on stock trading and investment advisory services within the Nepalese market. The company has established itself as a provider of personalized investment solutions. It particularly targets high-end clients seeking individualized portfolio management services.

Key highlights include the firm's stable customer service framework and reportedly high client satisfaction rates. The brokerage offers stock trading services alongside comprehensive investment consulting, positioning itself as more than just a trading platform. However, it's important to note that Opal operates primarily as a stock brokerage rather than a traditional forex broker. This may limit its appeal to currency traders specifically.

The company primarily serves affluent clients who require sophisticated investment advisory services and personalized portfolio management. While customer feedback indicates positive service experiences, the overall evaluation remains neutral due to limited transparency regarding specific trading conditions and account requirements.

Important Considerations

When evaluating this opal review, readers should understand that Opal Securities operates specifically within Nepal's regulatory framework. This differs significantly from international forex brokerage standards. The company is regulated by the Securities Exchange Board of Nepal, which primarily oversees stock market activities rather than forex trading.

This review is based on publicly available information and customer feedback rather than direct testing of services. Due to the regional nature of Opal's operations and limited public disclosure of specific trading conditions, some aspects of the evaluation rely on general industry standards and available customer testimonials.

Rating Framework

Broker Overview

Opal Securities Investment Pvt. Ltd. has established itself as a significant player in Nepal's financial services sector for more than two decades. Founded in the early 2000s, the company operates from its headquarters in Kathmandu, Nepal's capital city. The firm has built its reputation on providing comprehensive stock brokerage services, investment portfolio management, and personalized investment advisory services to clients throughout Nepal.

The company's business model centers around traditional stock trading services combined with sophisticated investment consulting. Unlike many international brokerages that focus primarily on forex trading, Opal concentrates on equity markets and investment portfolio optimization. This approach has allowed the company to develop deep expertise in local market conditions and regulatory requirements. It has also helped build strong relationships with institutional and individual investors.

Opal operates under the regulatory oversight of the Securities Exchange Board of Nepal, which ensures compliance with local securities regulations. The firm's primary asset classes include stock trading and comprehensive investment portfolio management services. While specific details about trading platforms are not extensively documented in available sources, the company's focus remains on providing personalized service rather than automated trading solutions.

Regulatory Framework: Opal Securities operates under the supervision of the Securities Exchange Board of Nepal, ensuring compliance with local securities regulations and investor protection standards.

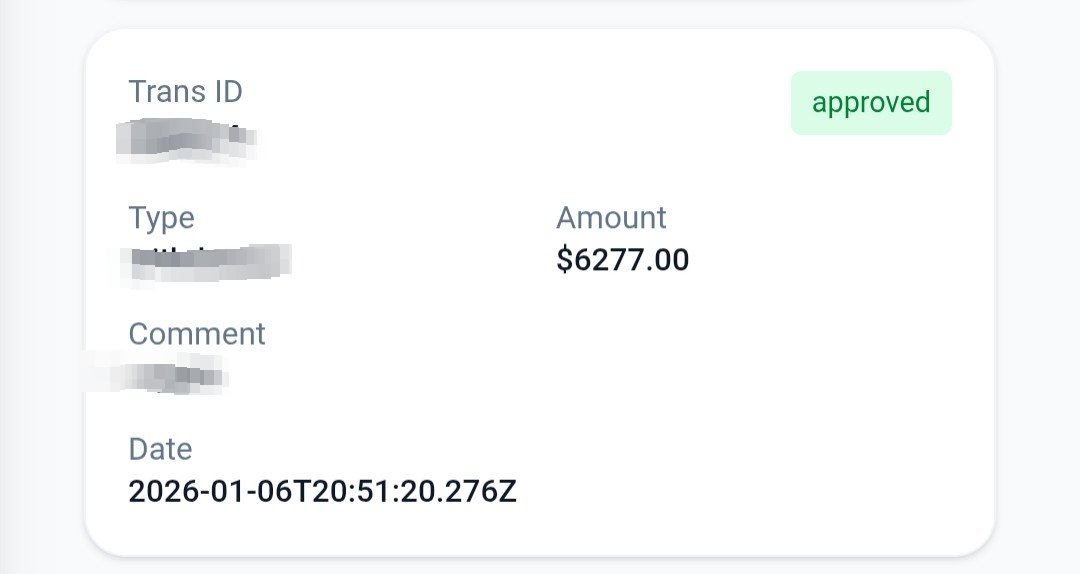

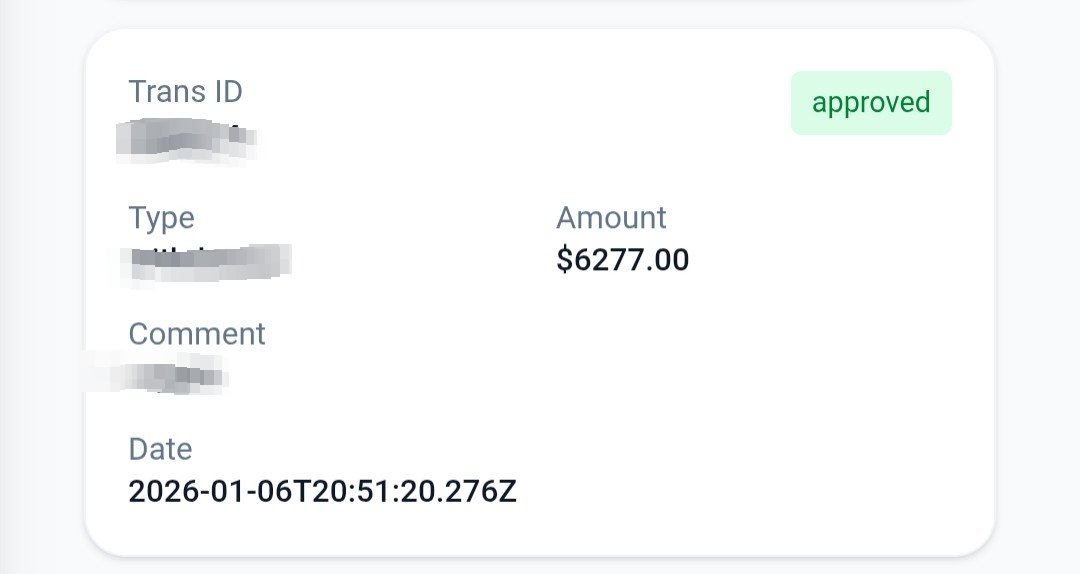

Deposit and Withdrawal Methods: Specific information regarding payment processing methods and withdrawal procedures is not detailed in available source materials.

Minimum Deposit Requirements: The company has not publicly disclosed specific minimum deposit amounts for different account types or services.

Promotional Offers: Information about current bonus structures or promotional campaigns is not available in the source documentation.

Tradeable Assets: The firm specializes in stock trading and investment portfolio management. It focuses primarily on equity markets rather than forex or commodity trading.

Cost Structure: Detailed information regarding spreads, commissions, and fee schedules is not specified in available materials. However, the company mentions providing high-yield commission opportunities.

Leverage Options: Specific leverage ratios and margin requirements are not documented in the source materials.

Platform Selection: Details about specific trading platforms or proprietary software solutions are not available in current documentation.

Geographic Restrictions: The firm primarily serves clients within Nepal. However, specific international restrictions are not detailed.

Customer Support Languages: Language support options for customer service are not specified in available information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Opal's account conditions faces significant limitations due to insufficient public disclosure of specific terms and requirements. Unlike many international forex brokers that provide detailed account specifications, Opal's documentation does not clearly outline different account tiers, minimum deposit requirements, or specific features associated with various client categories.

This lack of transparency regarding account conditions represents a significant challenge for potential clients seeking to understand their options before engaging with the firm. Industry standards typically require clear disclosure of account types, ranging from basic retail accounts to premium services for high-net-worth individuals. Without this information, prospective clients cannot adequately compare Opal's offerings against competitors. They also cannot determine which services align with their investment goals and financial capacity.

The absence of detailed account information also raises questions about the firm's approach to client onboarding and service differentiation. Most reputable brokerages provide comprehensive documentation of account features, including any special provisions for Islamic accounts, professional trader categories, or institutional services. This opal review cannot provide a meaningful assessment of account conditions without access to such fundamental information.

The assessment of Opal's trading tools and analytical resources is severely limited by the lack of detailed information in available source materials. Modern brokerage services typically offer comprehensive suites of analytical tools, market research capabilities, and educational resources to support client decision-making and portfolio optimization.

Industry standards for brokerage tools include real-time market data feeds, technical analysis software, fundamental research reports, and economic calendars. Many firms also provide proprietary research, third-party analysis integration, and automated trading support through expert advisors or algorithmic trading platforms. However, specific details about Opal's tool offerings are not documented in available sources.

The absence of information regarding educational resources represents another gap in this evaluation. Reputable brokerages typically offer webinars, tutorials, market analysis videos, and written educational content to help clients improve their trading and investment skills. Without documentation of such resources, potential clients cannot assess whether Opal provides adequate support for skill development and market understanding.

Customer Service and Support Analysis

Customer service represents one of Opal's apparent strengths, based on available feedback indicating positive client experiences with the firm's support services. According to source materials, customers have provided favorable evaluations of their service interactions. This suggests that the company maintains adequate support standards for its client base.

However, the evaluation of customer service quality is limited by the lack of specific information about support channels, response times, and availability schedules. Modern brokerage services typically offer multiple contact methods including phone support, live chat, email ticketing systems, and sometimes social media engagement. The availability of 24/7 support or specific business hours for different service levels is not documented in available materials.

The positive customer feedback suggests that Opal has successfully maintained client relationships and resolved service issues effectively. This indicates a commitment to customer satisfaction and potentially strong internal processes for handling client concerns. However, without specific details about service level agreements, escalation procedures, or multilingual support capabilities, this opal review cannot provide a comprehensive assessment of the customer service framework.

Trading Experience Analysis

The evaluation of Opal's trading experience is significantly hampered by the absence of detailed information about platform capabilities, execution quality, and technical infrastructure. Modern trading experiences depend heavily on platform stability, order execution speed, and the availability of advanced trading features such as one-click trading, advanced order types, and real-time market access.

Platform reliability and execution quality represent critical factors for any brokerage service, as technical issues or poor execution can significantly impact client profitability and satisfaction. However, available source materials do not provide specific information about Opal's trading infrastructure, platform uptime statistics, or execution performance metrics.

Mobile trading capabilities have become increasingly important for modern investors who require access to markets and portfolio management tools while away from desktop computers. The availability and functionality of mobile applications, responsive web platforms, or tablet-optimized interfaces are not documented in available materials. This limits the ability to assess Opal's adaptation to contemporary trading preferences.

Trustworthiness Analysis

Opal's trustworthiness evaluation centers primarily on its regulatory status under the Securities Exchange Board of Nepal, which provides a foundation of regulatory oversight and compliance requirements. SEBON regulation ensures that the firm operates within established legal frameworks and maintains certain standards for client protection and business conduct.

However, the assessment of trustworthiness is limited by the lack of specific information about additional safety measures, insurance coverage, or client fund protection protocols. International best practices typically include segregated client accounts, deposit insurance, and clear documentation of fund security measures. These details are not available in current source materials.

The firm's longevity in the market, operating for over 20 years, suggests stability and the ability to maintain business operations through various market conditions. This operational history can indicate financial stability and established business processes. However, specific financial strength indicators or third-party credit ratings are not documented in available sources.

User Experience Analysis

User experience evaluation reveals generally positive feedback regarding client satisfaction with Opal's services, particularly noting high satisfaction rates with the company's products and service delivery. This positive sentiment suggests that the firm has successfully met client expectations and maintained satisfactory relationships with its customer base.

The company's focus on serving high-end clients indicates a business model oriented toward personalized service and potentially more sophisticated investment solutions. This approach typically involves dedicated relationship management, customized investment strategies, and enhanced service levels compared to mass-market brokerage offerings.

However, the evaluation of user experience is constrained by limited information about interface design, account management processes, and the overall client journey from registration through ongoing service delivery. Modern user experience standards include intuitive navigation, streamlined account opening procedures, and efficient fund management processes. However, specific details about these aspects are not available in current documentation.

Conclusion

This opal review reveals a regional brokerage firm with established market presence and positive customer relationships, but limited transparency regarding specific service conditions and capabilities. Opal Securities Investment Pvt. demonstrates strengths in customer service and client satisfaction while maintaining regulatory compliance within Nepal's financial framework.

The firm appears most suitable for high-net-worth individuals seeking personalized investment services within the Nepalese market, particularly those prioritizing relationship-based service over automated trading capabilities. However, the lack of detailed information about account conditions, trading tools, and specific service features limits the ability to make comprehensive comparisons with international alternatives.

Primary advantages include demonstrated customer satisfaction and established market presence. The main limitations involve insufficient transparency regarding service specifications and limited information about modern trading capabilities and tools.