IEXS 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive iexs review looks at one of the forex market's well-known brokers. IEXS has built a presence across multiple countries and regions. The company positions itself as a regulated forex broker with multiple licenses including FCA, ASIC, FINTRAC, and BVIFSA. This shows they care about following rules and being open about their operations across different markets.

The broker has several great features. Their zero minimum deposit requirement makes it easy for new traders to start in the forex market. The multiple regulatory frameworks under which IEXS operates show they take a careful approach to protecting client money and watching over operations. However, we need to look more closely at their trading conditions and platform features.

IEXS mainly targets traders who want a regulated trading environment with easy entry conditions. The broker's approach to working under different country rules appeals to international traders who care about safety and following rules in their trading activities. But like any broker review, potential clients should carefully look at all parts of the trading conditions and regulatory protections available in their specific area.

Important Disclaimers

Regional Entity Differences: IEXS operates under different regulatory frameworks across various jurisdictions including the UK (FCA), Australia (ASIC), Canada (FINTRAC), and British Virgin Islands (BVIFSA). These different regulatory environments may cause different trading conditions, client protections, and service offerings depending on the trader's location and the specific IEXS entity they work with.

Review Methodology: This evaluation uses publicly available information, regulatory filings, and user feedback from various sources. Trading conditions and offerings may change over time. Potential clients should check current terms directly with IEXS before making trading decisions.

Overall Rating Framework

Broker Overview

IEXS operates as an international forex broker with regulatory oversight across several major financial markets. The company has set up entities in key regulatory areas to serve global clients, according to available information from forex industry sources. The broker focuses mainly on forex trading services and positions itself within the competitive field of regulated online trading providers.

The company's business model centers on providing forex trading access through regulated entities. Each jurisdiction offers specific protections and trading conditions that match local regulatory requirements. IEXS has structured its operations to follow different international standards. This suggests they want to maintain good regulatory standing across their operating territories.

IEXS offers forex trading services through multiple regulated entities with oversight from several authorities. These include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), and the British Virgin Islands Financial Services Authority (BVIFSA). This iexs review finds that the broker's multi-regulatory approach gives clients various options for regulatory protection depending on their location and preferences.

Regulatory Jurisdictions: IEXS maintains regulatory oversight through four main authorities. FCA handles UK operations, ASIC serves Australian clients, FINTRAC ensures Canadian compliance, and BVIFSA provides offshore services. This gives comprehensive regulatory coverage across major markets.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees is not detailed in available public materials. You would need to verify this directly with the broker.

Minimum Deposit Requirements: The broker offers a zero minimum deposit requirement. This makes it accessible to traders with different capital levels and particularly attractive to those beginning their forex trading journey.

Bonus and Promotions: Current promotional offerings and bonus structures are not specified in available broker information. These may vary by jurisdiction and regulatory requirements.

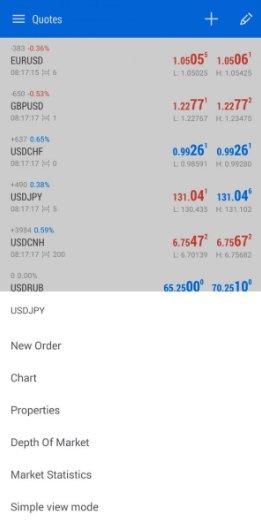

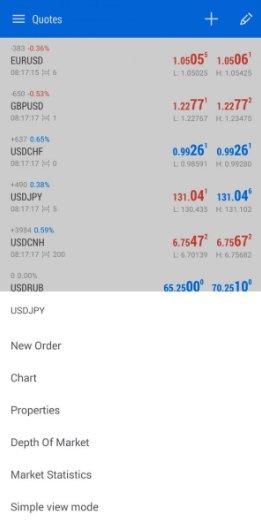

Tradeable Assets: IEXS primarily focuses on forex trading. The complete range of available currency pairs and any additional asset classes would need verification through direct broker contact.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not fully available in public materials. You need to contact them directly for accurate cost assessment.

Leverage Options: Specific leverage ratios offered by IEXS are not detailed in available information. These likely vary by jurisdiction according to local regulatory requirements.

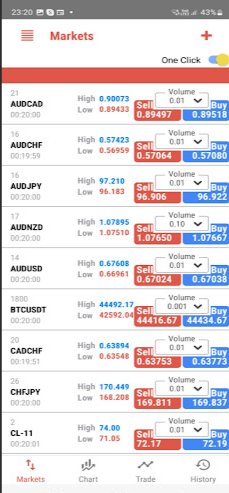

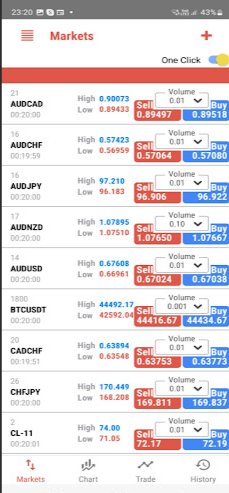

Platform Options: Trading platform details are not specified in publicly available materials. This includes whether the broker offers MetaTrader, proprietary platforms, or other trading software.

Geographic Restrictions: Specific countries or regions where IEXS services may be restricted are not detailed in available information.

Customer Support Languages: The range of languages supported by IEXS customer service is not specified in available public information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

The account conditions offered by IEXS present several attractive features for potential traders. The zero minimum deposit requirement significantly lowers the barrier to entry. This iexs review finds that removing minimum deposit requirements shows the broker's commitment to accessibility. It allows traders to begin with whatever capital they feel comfortable risking.

The lack of minimum deposit requirements positions IEXS well compared to many competitors, according to available information. Many brokers typically require initial deposits ranging from $100 to $500 or more. This accessibility factor helps new traders who want to test the platform and services without significant initial capital commitment.

However, the evaluation is limited by the lack of detailed information about account types, tier structures, or special features for different client categories. The absence of specific details about Islamic accounts, professional trader accounts, or other specialized offerings prevents a more complete assessment. We cannot fully evaluate the account condition landscape without this information.

The regulatory framework supporting these account conditions provides additional confidence. Multiple oversight bodies ensure that client funds and account structures meet established financial service standards across different jurisdictions.

The assessment of IEXS's trading tools and educational resources faces significant limitations. There is not enough publicly available information about the broker's platform offerings and support materials. This lack of transparency about trading tools, analytical resources, and educational content impacts the overall evaluation of the broker's value.

Professional forex trading typically requires access to comprehensive charting tools, technical indicators, economic calendars, market analysis, and educational resources. Without detailed information about these offerings, potential clients cannot properly assess whether IEXS provides the necessary tools for informed trading decisions.

The absence of information about automated trading support, API access, or advanced order types further complicates the evaluation. Modern forex traders often require sophisticated tools for strategy implementation, risk management, and market analysis. This information gap is particularly relevant for serious traders.

Educational resources play a crucial role in trader development, especially for newcomers to the forex market. The lack of available information about webinars, tutorials, market analysis, or educational content suggests either limited offerings or poor marketing of available resources.

Customer Service and Support Analysis (Score: 6/10)

Customer service evaluation for IEXS is complicated by mixed signals in available information. This includes user discussions about potential concerns regarding the broker's operations. While the multiple regulatory licenses suggest structured oversight of customer service standards, specific details about support quality, response times, and service channels are not fully available.

The regulatory framework under which IEXS operates should provide certain standards for customer complaint handling and service delivery. FCA, ASIC, and other regulatory bodies typically require licensed brokers to maintain adequate customer service standards and complaint resolution procedures.

However, the presence of user discussions questioning the broker's legitimacy raises concerns about service quality and customer satisfaction. These discussions, while not definitively conclusive, suggest that some users have experienced issues or have concerns about the broker's operations. This warrants careful consideration.

The lack of detailed information about available support channels, operating hours, response time commitments, or multilingual support capabilities further limits our ability to provide a comprehensive service assessment. Potential clients should verify current customer service standards and capabilities directly with the broker.

Trading Experience Analysis (Score: 6/10)

Evaluating the trading experience offered by IEXS is challenging due to limited publicly available information. We lack details about platform performance, execution quality, and trading conditions. This iexs review finds that the absence of detailed platform specifications, execution statistics, and user experience data prevents a comprehensive assessment. We cannot properly evaluate the actual trading environment without this information.

Critical factors for trading experience include platform stability, order execution speed, slippage rates, and overall system reliability. Without access to performance metrics or detailed user feedback about these aspects, potential clients cannot adequately assess the quality of the trading experience they might expect.

The absence of information about mobile trading capabilities, platform customization options, or advanced trading features further complicates the evaluation. Modern forex trading often requires sophisticated platform capabilities. The lack of detailed information about these offerings represents a significant information gap.

User feedback regarding actual trading experiences is not comprehensively available. This makes it difficult to assess real-world platform performance, execution quality, or overall satisfaction with the trading environment. The lack of transparent user experience data is a notable limitation in evaluating IEXS's trading services.

Trust and Safety Analysis (Score: 7/10)

The trust and safety evaluation of IEXS benefits significantly from the broker's multi-jurisdictional regulatory approach. Licenses from FCA, ASIC, FINTRAC, and BVIFSA provide a solid foundation for client protection. These regulatory frameworks typically include requirements for client fund segregation, capital adequacy, and operational oversight.

The Financial Conduct Authority (FCA) regulation provides UK-standard client protections, while ASIC oversight offers Australian regulatory safeguards. FINTRAC compliance ensures adherence to Canadian financial transaction reporting requirements, and BVIFSA provides offshore regulatory oversight. This multi-regulatory approach suggests a commitment to maintaining compliance across different jurisdictions.

However, the evaluation is complicated by user discussions about potential concerns regarding the broker's operations. While these discussions do not constitute definitive evidence of problems, they do suggest that some users have questions about the broker's legitimacy. Potential clients should consider this carefully.

The lack of detailed information about specific client fund protection measures, insurance coverage, or transparency regarding company ownership and financial strength limits our ability to provide a more comprehensive trust assessment. Potential clients should verify current regulatory status and protection measures directly with relevant regulatory authorities.

User Experience Analysis (Score: 5/10)

User experience evaluation for IEXS is hindered by limited available feedback and the presence of concerning discussions about the broker's operations. The lack of comprehensive user reviews, satisfaction surveys, or detailed experience reports makes it difficult to assess overall client satisfaction. We cannot properly evaluate how satisfied clients are with IEXS services without this information.

The zero minimum deposit requirement represents a positive aspect of user experience. It eliminates financial barriers to account opening and platform testing. This accessibility feature demonstrates consideration for user needs, particularly for those new to forex trading or those wanting to evaluate services before committing larger amounts.

However, the presence of user discussions questioning the broker's legitimacy raises significant concerns about overall user experience and satisfaction. These discussions suggest that some users have encountered issues or have concerns that have led them to question the broker's operations. This is a notable red flag for potential clients.

The absence of detailed information about account opening procedures, verification processes, platform usability, or customer onboarding experiences further limits our ability to assess the complete user journey. Without transparent user feedback and detailed process information, potential clients cannot adequately evaluate what their experience with IEXS might involve.

Conclusion

This comprehensive iexs review reveals a broker with a solid regulatory foundation through multiple licensing jurisdictions. However, significant transparency limitations impact the overall evaluation. IEXS demonstrates commitment to regulatory compliance through its FCA, ASIC, FINTRAC, and BVIFSA licenses. This provides a framework for client protection across different markets.

The broker's zero minimum deposit requirement makes it accessible to traders with varying capital levels. This is particularly appealing to newcomers to forex trading. However, the lack of detailed information about trading conditions, platform offerings, and actual user experiences creates significant evaluation challenges.

IEXS may be suitable for traders who prioritize regulatory oversight and accessible entry conditions. But potential clients should conduct thorough research given the limited transparency about operational details and the presence of user concerns about the broker's legitimacy. The multiple regulatory licenses provide a foundation for trust, but the information gaps and user discussions warrant careful consideration before committing to this broker.