Regarding the legitimacy of FOCUS Markets forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is FOCUS Markets safe?

Pros

Cons

Is FOCUS Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

FOCUS MARKETS PTY LTD

Effective Date: Change Record

2019-03-07Email Address of Licensed Institution:

compliance@focusmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.focusmarkets.comExpiration Time:

--Address of Licensed Institution:

FOCUS MARKETS PTY LTD L 35 525 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0383734804Licensed Institution Certified Documents:

Is Focus Markets A Scam?

Introduction

Focus Markets is a forex and CFD broker that has emerged in the competitive landscape of online trading since its establishment in 2019. Based in Melbourne, Australia, it claims to provide access to a wide range of financial instruments, including forex pairs, commodities, and cryptocurrencies. As the forex market continues to attract both seasoned traders and newcomers, it becomes increasingly crucial for traders to carefully evaluate the brokers they choose. The potential for scams and unregulated entities is high, prompting the need for thorough research before committing capital. This article employs a comprehensive assessment framework, drawing insights from various sources, including regulatory information, customer reviews, and expert analyses to determine whether Focus Markets is a trustworthy trading platform or a potential scam.

Regulation and Legitimacy

Regulation is a fundamental aspect of any trading broker, as it ensures compliance with financial laws and protects traders' interests. Focus Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is recognized for its stringent oversight of financial services in Australia. However, the legitimacy of this claim requires verification.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 514425 | Australia | Verified |

ASIC's regulation is considered tier-1, meaning it imposes strict requirements on brokers, including maintaining a minimum operating capital and segregating client funds. However, some reviews suggest that Focus Markets may not be fully compliant, with reports of clients facing withdrawal issues and concerns over its operational practices. While the broker has not been officially blacklisted, the mixed reviews highlight the importance of exercising caution.

Company Background Investigation

Focus Markets Pty Ltd was founded in 2019 and claims to operate under the ASIC license. However, there is limited information available about its ownership structure and management team. Transparency is vital in the financial sector, and the lack of detailed disclosures raises concerns. The company's website provides minimal information regarding its history and the qualifications of its management team, which can be a red flag for potential investors.

The absence of a physical office location in Australia has also been noted, with some sources indicating that the broker operates from offshore jurisdictions like Saint Vincent and the Grenadines, which are known for less stringent regulatory environments. This ambiguity in its operational base further complicates the assessment of its legitimacy.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees, spreads, and commissions, is essential for making informed decisions. Focus Markets offers two primary account types: a standard account and a raw account, with varying trading costs.

| Fee Type | Focus Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.5 pips |

| Commission Model | $3.5 per lot | $7 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads on the standard account start at 1.0 pips, with no commissions, while the raw account offers spreads from 0.0 pips but incurs a commission of $3.5 per lot. Although these rates are competitive, the presence of additional fees or unusual withdrawal policies can impact the overall trading experience. Some reviews have pointed out hidden costs that may arise during the withdrawal process, which could be a potential concern for traders.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Focus Markets claims to implement various security measures, including segregated accounts for client funds and negative balance protection. However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory standards.

The lack of a clear investor compensation scheme is another point of concern, as traders may not have recourse in the event of broker insolvency. Historical issues regarding fund withdrawals have been reported, which could indicate potential risks associated with the broker's financial stability.

Customer Experience and Complaints

Customer feedback is a crucial component in assessing a broker's reliability. Focus Markets has received mixed reviews, with some users praising its trading conditions and platform usability, while others have raised concerns about withdrawal delays and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

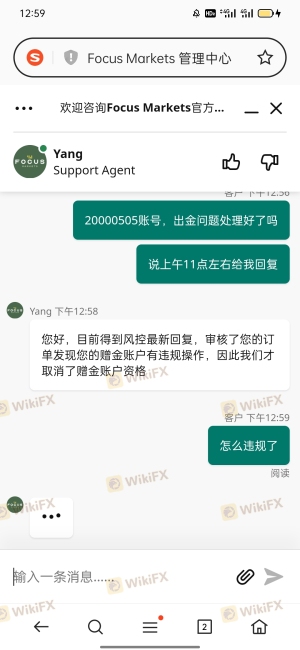

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Transparency Concerns | High | Lacking information |

Common complaints include difficulties in withdrawing funds and inadequate customer service, particularly during high-demand periods. For instance, several users have reported long wait times for withdrawal requests, leading to frustration and distrust in the broker's operations.

Platform and Trade Execution

Focus Markets provides access to popular trading platforms, MetaTrader 4 and MetaTrader 5, known for their user-friendly interfaces and advanced trading tools. However, the platform's performance and reliability are crucial for effective trading.

Reviews indicate that while the platforms are generally stable, there have been instances of execution delays and slippage during volatile market conditions. Traders should be cautious of any signs of platform manipulation, which could hinder their trading performance.

Risk Assessment

Engaging with Focus Markets carries certain risks that potential traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Uncertain compliance with ASIC regulations |

| Fund Withdrawal Issues | High | Reports of delayed or denied withdrawals |

| Transparency Concerns | Medium | Lack of detailed company information |

To mitigate these risks, potential clients should conduct thorough research, consider starting with a demo account, and be cautious about the amount of capital they commit initially.

Conclusion and Recommendations

In conclusion, while Focus Markets presents itself as a regulated broker with competitive trading conditions, significant concerns about its operational practices and client feedback warrant caution. The mixed reviews, particularly regarding withdrawal issues and transparency, suggest that potential traders should approach this broker with vigilance.

For those seeking alternative options, it may be prudent to consider brokers with a stronger regulatory standing and proven track records of customer satisfaction. Always prioritize brokers regulated by reputable authorities, ensuring a safer trading environment.

Is FOCUS Markets a scam, or is it legit?

The latest exposure and evaluation content of FOCUS Markets brokers.

FOCUS Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOCUS Markets latest industry rating score is 7.19, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.19 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.