Focus Markets 2025 Review: Everything You Need to Know

Summary: Focus Markets has garnered mixed reviews, with some users appreciating its low fees and diverse asset offerings, while others raise concerns about withdrawal issues and regulatory transparency. Key features include the use of popular trading platforms like MT4 and MT5, as well as a wide range of tradable assets.

Note: It is essential to recognize the different entities operating under the Focus Markets name across various regions, which may affect regulatory compliance and user experience. This review aims to provide a balanced and accurate assessment based on available information.

Ratings Overview

How We Rate Brokers: Our ratings are based on user experiences, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

Established in 2019, Focus Markets is an online trading platform offering a range of financial instruments including forex, commodities, cryptocurrencies, and CFDs. The broker operates on popular trading platforms, namely MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are well-regarded for their user-friendly interfaces and robust trading features. Focus Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC), but there are discrepancies regarding its operational legitimacy, particularly concerning its offshore entity in Saint Vincent and the Grenadines.

Detailed Breakdown

Regulatory Regions

Focus Markets is primarily regulated by ASIC in Australia. However, many reviews indicate that it operates under multiple entities, which complicates the regulatory landscape and raises concerns about its legitimacy in other regions. Users have reported issues regarding the lack of transparency about the broker's operational status outside Australia.

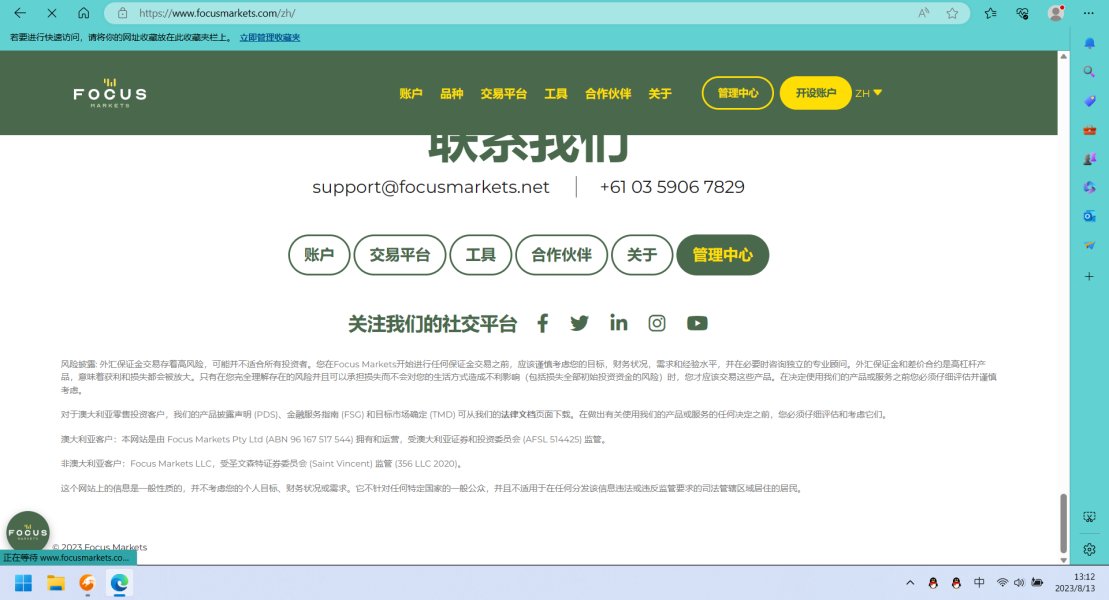

Deposit/Withdrawal Currencies and Cryptocurrencies

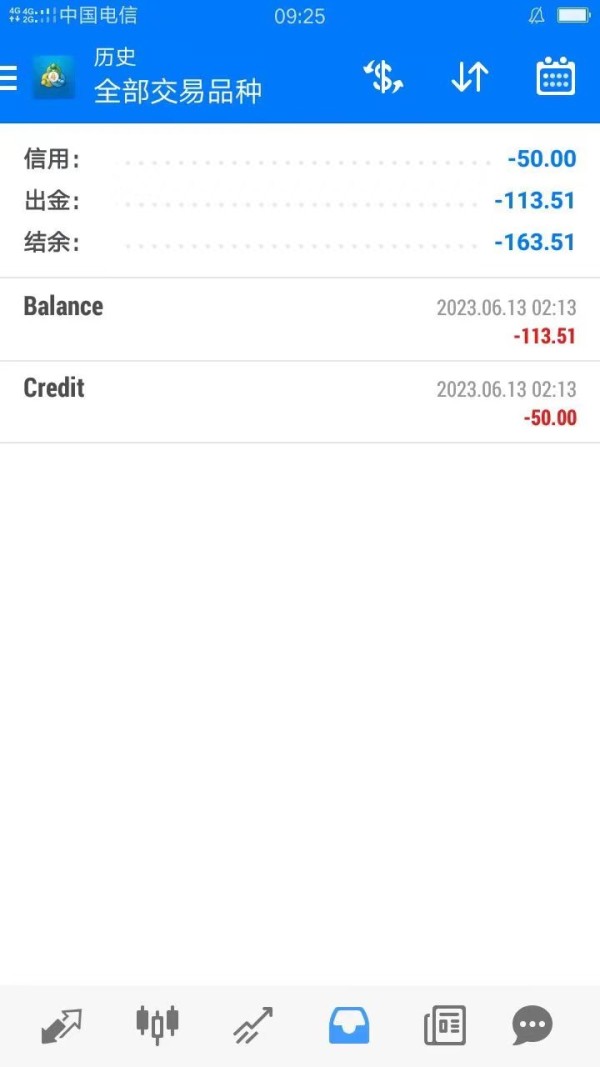

Focus Markets supports multiple base currencies for trading accounts, including AUD, USD, GBP, EUR, NZD, CAD, JPY, and SGD. Deposits can be made through various methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Poli. Notably, there are no withdrawal fees charged by the broker, although third-party fees may apply.

Minimum Deposit

The minimum deposit required to open a trading account with Focus Markets is $100, which is relatively low compared to many competitors in the same space.

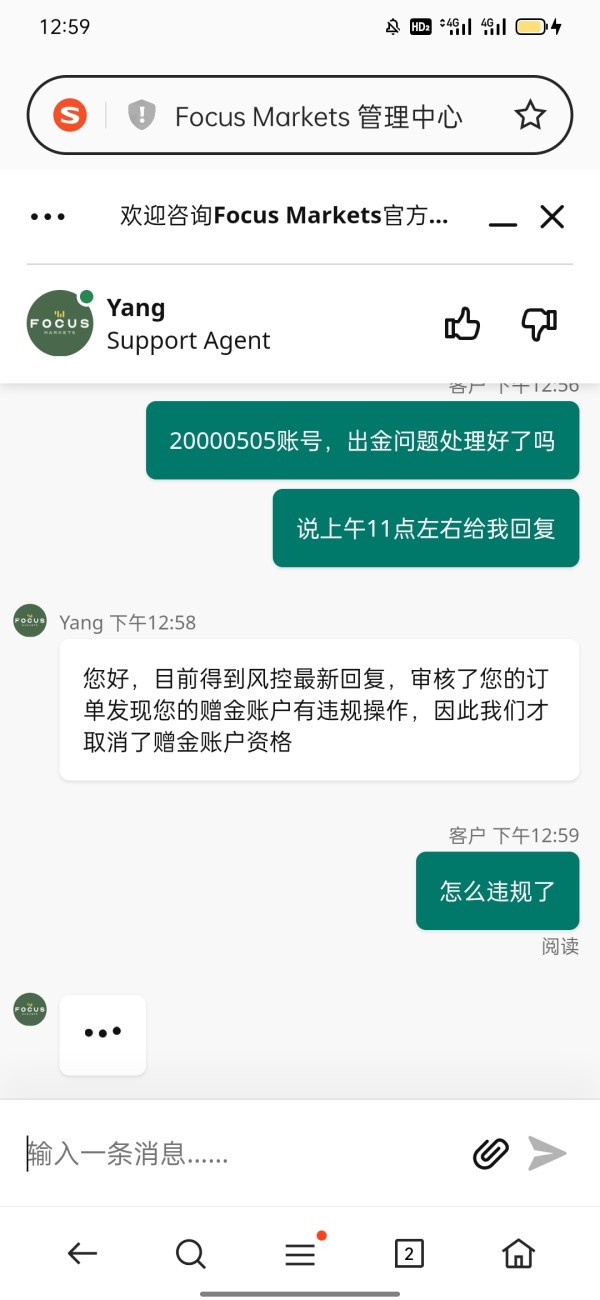

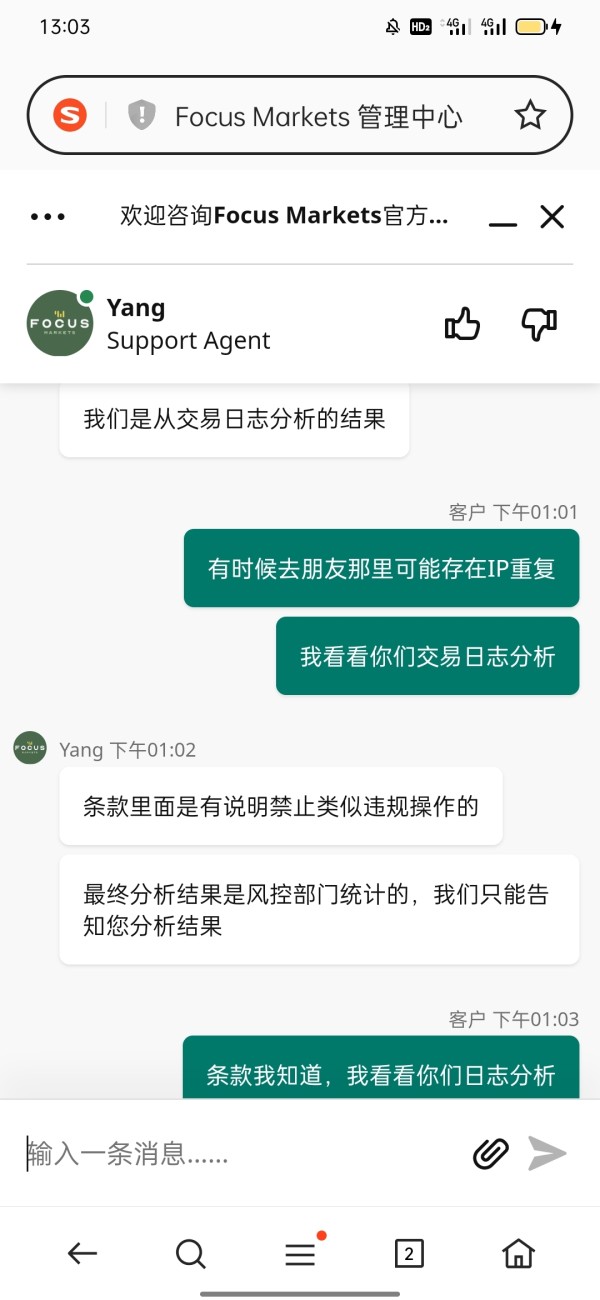

While Focus Markets advertises various promotions, including cashback offers, the specifics of these promotions are often unclear, leading to skepticism among users. Many traders have expressed concerns that such bonuses may come with conditions that complicate the withdrawal process.

Tradable Asset Categories

Focus Markets offers a diverse array of tradable instruments, including over 2,000 assets across forex pairs, commodities (like gold and oil), indices, stocks, and cryptocurrencies. This broad selection allows traders to diversify their portfolios effectively.

Costs (Spreads, Fees, Commissions)

The broker offers competitive spreads, starting from 1.0 pips on standard accounts and 0 pips on raw accounts, which come with a commission of $3.5 per lot. This pricing structure is generally considered favorable compared to industry averages. However, some users have reported hidden fees or withdrawal complications, raising concerns about overall cost transparency.

Leverage

Focus Markets provides a maximum leverage of 1:30, which is within regulatory limits for ASIC-regulated brokers. While this leverage can enhance profit potential, it also comes with increased risk, particularly for inexperienced traders.

Traders at Focus Markets can utilize both MT4 and MT5 platforms, which are widely recognized for their advanced trading capabilities, including automated trading and extensive analytical tools.

Restricted Regions

Focus Markets does not accept clients from several countries, including the United States, the United Kingdom, Canada, and various others, due to regulatory restrictions. This limitation may affect potential clients seeking to trade from these regions.

Available Customer Service Languages

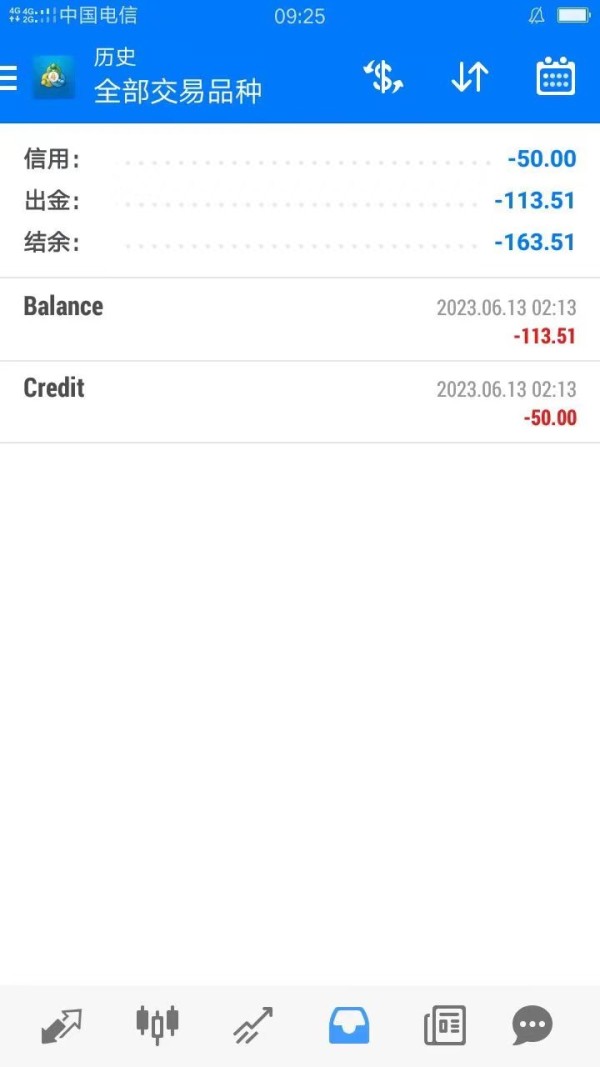

Customer support at Focus Markets is available in multiple languages, primarily English. However, many users have reported slow response times and limited support options, particularly regarding live chat availability.

Final Ratings Overview

Detailed Breakdown of Ratings

-

Account Conditions (6.0): The minimum deposit is low, and the range of account types is adequate, but the lack of transparency regarding fees and withdrawal conditions affects this score.

Tools and Resources (4.5): The brokers educational resources are limited, and while MT4 and MT5 are robust platforms, the absence of additional trading tools is a drawback.

Customer Service and Support (5.0): While support is available, the absence of live chat and slow response times detract from the overall user experience.

Trading Setup (Experience) (6.5): The trading experience is generally positive due to the use of popular platforms and a diverse asset range, but withdrawal issues reported by users impact this rating.

Trust Level (4.0): The mixed reviews about regulatory compliance and withdrawal issues contribute to a lower trust rating.

User Experience (5.5): Overall user experiences are varied, with some positive aspects overshadowed by reports of withdrawal difficulties and regulatory concerns.

Regulatory Compliance (3.5): The broker's claims of ASIC regulation are undermined by reports of its offshore operations and lack of transparency.

In conclusion, while Focus Markets offers competitive trading conditions and a diverse range of assets, potential clients should exercise caution due to regulatory concerns and mixed user reviews regarding withdrawal processes. Always ensure to conduct thorough research before engaging with any trading platform.