LTG GoldRock 2025 Review: Everything You Need to Know

Executive Summary

LTG GoldRock is an unregulated forex broker that has been liquidated. This represents a major concern for potential traders who might consider this platform. According to available data, this ltg goldrock review reveals troubling patterns that warrant serious consideration. The broker was established in 2009 and operated from Hong Kong. It has received consistently poor user feedback with an average rating of just 2.0 out of 5 stars across multiple review platforms.

Only 20% of reviewers recommend LTG GoldRock. This indicates widespread dissatisfaction among users who have engaged with the platform. The broker's regulatory status presents the most significant red flag - it operates without proper oversight and has been officially liquidated by ASIC (Australian Securities and Investments Commission) as of March 2022. This regulatory action underscores the high-risk nature of engaging with this platform.

The target audience for LTG GoldRock appears to be traders seeking forex trading opportunities and educational resources. However, given the broker's liquidation status and overwhelmingly negative user feedback, extreme caution is advised for anyone considering this platform. The combination of regulatory issues, poor user ratings, and liquidation status makes this broker unsuitable for most trading scenarios. This is particularly true for novice traders who require reliable, regulated platforms.

Important Notice

Due to LTG GoldRock's unregulated status and subsequent liquidation, users across different regions may face varying degrees of legal and financial risks. The lack of regulatory oversight means that typical investor protections are not available. The liquidation status suggests that normal business operations have ceased.

This review is based on comprehensive analysis of user feedback, regulatory information, and available public data about LTG GoldRock's operations. Given the broker's current status, prospective users should exercise extreme caution and consider regulated alternatives. The information presented reflects the most recent available data, though the broker's operational status may impact the relevance of certain details.

Rating Framework

Broker Overview

LTG GoldRock was established in 2009 as a forex trading platform based in Hong Kong. The company positioned itself as providing forex trading opportunities alongside educational resources for traders seeking to develop their market knowledge and trading skills. However, the broker's journey from establishment to liquidation represents a cautionary tale in the forex industry.

The company's business model focused primarily on forex trading services. It also placed some emphasis on educational content delivery. According to available information, LTG GoldRock attempted to serve retail traders by offering access to foreign exchange markets, though specific details about their service offerings remain limited in publicly available documentation.

The most significant development in LTG GoldRock's corporate history occurred in March 2022. ASIC officially declared the company to be in liquidation at that time. This regulatory action effectively ended the broker's operations and highlighted the risks associated with unregulated forex brokers. The liquidation status means that normal business operations have ceased, and users may face significant challenges in recovering funds or receiving ongoing services.

This ltg goldrock review must emphasize that the broker's current liquidated status makes it unsuitable for new account openings or continued trading activities. The lack of regulatory oversight throughout its operational period, combined with the subsequent liquidation, creates an environment of substantial risk for any potential users.

Regulatory Status: LTG GoldRock operated without proper regulatory oversight. ASIC officially liquidated it in March 2022. This unregulated status meant that users lacked the typical protections associated with regulated brokers.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. User feedback suggests there were concerns about fund accessibility.

Minimum Deposit Requirements: The minimum deposit requirements are not specified in available documentation. This represents a lack of transparency in the broker's operational parameters.

Bonuses and Promotions: Information about bonuses and promotional offers is not mentioned in available sources. This suggests either absence of such programs or lack of transparency in marketing materials.

Tradeable Assets: The platform focused primarily on forex trading. The specific range of currency pairs and other financial instruments available is not detailed in accessible information.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in the source materials. This represents another area where transparency was lacking.

Leverage Options: Specific leverage ratios offered by LTG GoldRock are not mentioned in available documentation. This is concerning given the importance of this information for risk management.

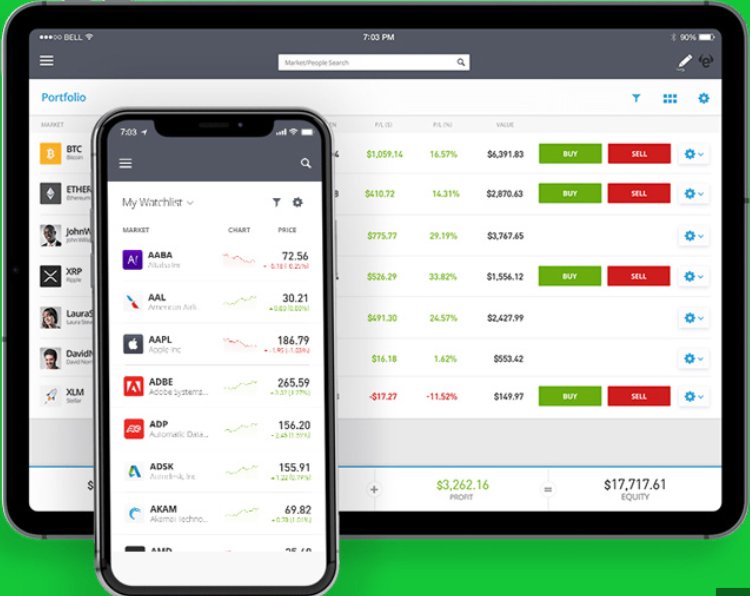

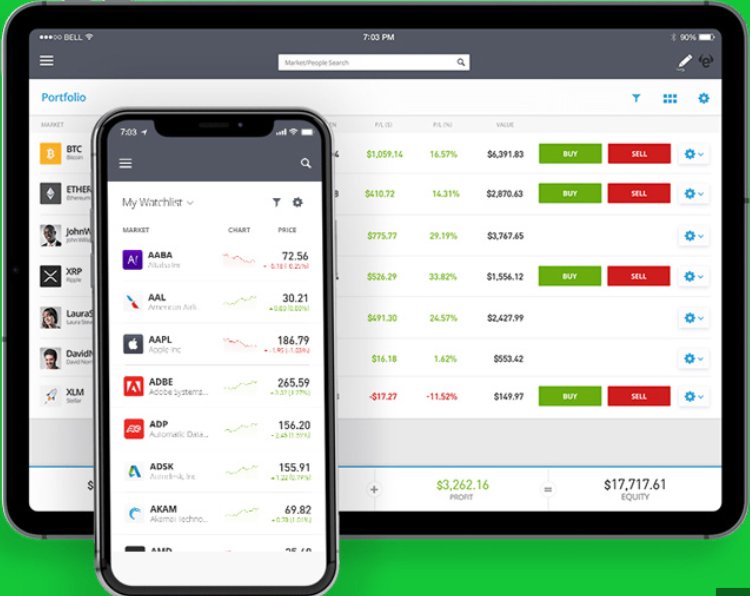

Platform Options: The specific trading platforms offered by LTG GoldRock are not detailed in available sources. The company did operate as a forex trading platform.

This ltg goldrock review highlights the significant information gaps that existed even during the broker's operational period. These gaps contributed to user concerns and ultimately regulatory action.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by LTG GoldRock receive a poor rating due to several critical factors. Available information does not specify the types of accounts offered, minimum deposit requirements, or specific features that would typically be expected from a professional forex broker. This lack of transparency regarding basic account parameters represents a significant concern for potential users.

User feedback consistently indicates dissatisfaction with account-related aspects of the service. This contributes to the overall 2.0-star rating across review platforms. The absence of clear information about account opening procedures, verification requirements, and account management features suggests a lack of professional standards in customer onboarding and service delivery.

The liquidation status of LTG GoldRock means that account conditions are no longer relevant for new users. The broker cannot legally open new accounts or maintain existing ones. For users who previously held accounts with the broker, the liquidation process may have impacted their ability to access funds or close positions properly.

Compared to regulated brokers that typically offer transparent account structures, clear fee schedules, and comprehensive account management tools, LTG GoldRock's offering appears substantially deficient. This ltg goldrock review emphasizes that the lack of clear account conditions, combined with the unregulated status, created an environment unsuitable for professional trading activities.

The tools and resources provided by LTG GoldRock receive a below-average rating based on available user feedback and the limited information about the platform's capabilities. While the broker claimed to offer educational resources, specific details about the quality, comprehensiveness, and effectiveness of these materials are not well-documented in available sources.

User reviews suggest that the trading tools and analytical resources were insufficient for effective market analysis and trading decision-making. The absence of detailed information about charting capabilities, technical indicators, market research, and educational content quality indicates a potential deficiency in this crucial area of broker services.

The platform's focus on forex trading suggests that some market-specific tools may have been available. User feedback indicates that these resources did not meet expectations for quality or utility. Educational resources, while mentioned as part of the broker's offering, appear to have been inadequate based on user experiences and the overall negative sentiment in reviews.

Given the broker's liquidated status, any tools and resources that may have been available are no longer accessible to users. This situation highlights the risks of relying on unregulated brokers for essential trading infrastructure and educational support, as these services can disappear without adequate notice or transition arrangements.

Customer Service and Support Analysis (Score: 4/10)

Customer service and support at LTG GoldRock receives a below-average rating based on user feedback indicating slow response times and inadequate service quality. Available reviews suggest that users experienced difficulties in receiving timely and effective support when needed. This contributed to the overall negative perception of the broker.

Specific information about customer service channels, availability hours, and language support is not detailed in available sources. This itself represents a concern about transparency and accessibility. Professional forex brokers typically provide multiple contact methods, extended support hours, and multilingual assistance, but LTG GoldRock appears to have fallen short in these areas.

User testimonials indicate frustration with the responsiveness and effectiveness of customer support interactions. One user report mentions spending over $8,000 with the broker over three years, suggesting that even long-term, high-value customers experienced service issues that contributed to negative reviews.

The liquidation of LTG GoldRock means that customer service is no longer available. This leaves former users without recourse for ongoing issues or account resolution. This situation exemplifies the risks associated with unregulated brokers, where customer protection measures and ongoing support obligations may not be adequately maintained or enforced.

Trading Experience Analysis (Score: 3/10)

The trading experience offered by LTG GoldRock receives a poor rating based on user feedback indicating platform instability and unsatisfactory trading conditions. Available reviews characterize the platform as "high risk," suggesting that users encountered significant challenges in executing trades effectively and managing their trading activities.

User feedback indicates that the trading environment did not meet professional standards expected from forex brokers. Issues appear to have included platform reliability concerns and trading execution problems, though specific technical details about order processing, slippage, or requoting are not detailed in available sources.

The mobile trading experience and platform functionality are not specifically addressed in available information. This represents another area where transparency was lacking. Professional forex brokers typically provide comprehensive information about their trading platforms, execution methods, and technical capabilities, but LTG GoldRock appears to have been deficient in this communication.

Given the broker's liquidated status, the trading experience is no longer available for evaluation or improvement. This ltg goldrock review emphasizes that the combination of poor user feedback about trading conditions and the subsequent regulatory action suggests fundamental problems with the trading infrastructure and service delivery that ultimately contributed to the broker's downfall.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most concerning aspect of LTG GoldRock's operations. They earn the lowest possible rating due to the broker's unregulated status and subsequent liquidation. The lack of proper regulatory oversight throughout the broker's operational period meant that users had no recourse to financial authorities for dispute resolution or fund protection.

The March 2022 liquidation by ASIC represents a definitive regulatory action that confirms the broker's inability to meet basic operational and financial standards. This liquidation status indicates that the company's affairs are being wound up, potentially leaving users unable to recover funds or resolve outstanding issues.

User feedback includes serious allegations about false claims made by the broker. One reviewer specifically mentions misleading statements during their three-year relationship with the platform. Such feedback suggests systematic issues with transparency and honest communication, fundamental requirements for trustworthy financial service providers.

The combination of unregulated status, liquidation proceedings, and user allegations of false claims creates an environment of minimal trust and reliability. Professional forex trading requires confidence in the broker's integrity, financial stability, and regulatory compliance, all of which appear to have been absent in LTG GoldRock's case.

User Experience Analysis (Score: 2/10)

The overall user experience with LTG GoldRock receives a poor rating based on the 2.0-star average across review platforms and the fact that only 20% of reviewers recommend the platform. This overwhelmingly negative sentiment indicates systematic problems with user satisfaction and service delivery across multiple aspects of the broker's operations.

Available user feedback suggests widespread dissatisfaction with various aspects of the service, from trading conditions to customer support responsiveness. The low recommendation rate indicates that users who engaged with the platform would generally advise others to avoid the service, representing a significant red flag for potential users.

Interface design and platform usability information is not specifically detailed in available sources. The poor overall ratings suggest that user experience issues extended beyond just customer service to include fundamental platform functionality and design concerns. Professional forex platforms typically prioritize user-friendly interfaces and intuitive navigation, areas where LTG GoldRock appears to have been deficient.

The registration and verification processes are not specifically documented. The overall negative user sentiment suggests that even basic onboarding procedures may have been problematic. The liquidated status means that new users cannot experience the platform firsthand, though the available feedback provides clear guidance about the historical user experience quality.

Conclusion

This comprehensive ltg goldrock review reveals a broker that fails to meet basic standards for forex trading services. LTG GoldRock's combination of unregulated status, poor user ratings, and ultimate liquidation by ASIC creates a clear picture of a platform unsuitable for serious forex trading activities.

The broker is not recommended for any category of traders. This is particularly true for beginners who require regulated, reliable platforms with strong customer protections. The liquidated status means that new account opening is impossible, while existing users may face significant challenges in fund recovery or account resolution.

The primary disadvantages include complete lack of regulatory oversight, extremely poor user satisfaction ratings, liquidated operational status, and allegations of false claims. No significant advantages can be identified given the broker's current status and historical performance issues. This makes LTG GoldRock a clear example of the risks associated with unregulated forex brokers.