Is IEXS safe?

Pros

Cons

Is IEXS A Scam?

Introduction

IEXS, also known as Integrated Exchange Securities, is a relatively new player in the forex market, having been established in 2019. Positioned as a multi-asset broker, it offers a range of financial products, including forex, commodities, cryptocurrencies, and indices. Given the competitive nature of the forex industry, it is crucial for traders to carefully assess the credibility and reliability of brokers before committing their funds. The risk of scams and fraudulent activities is prevalent in the trading landscape, making it imperative for traders to conduct thorough research. This article aims to provide an objective analysis of IEXS by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment.

To compile this analysis, I conducted an extensive review of various online resources, including regulatory filings, customer reviews, and expert assessments. The evaluation framework focuses on key aspects that contribute to the overall safety and reliability of a forex broker.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. IEXS claims to be regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Vanuatu Financial Services Commission (VFSC). The presence of these regulatory bodies suggests a level of oversight and compliance, which is essential for the protection of traders' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 923324 | United Kingdom | Verified |

| ASIC | 001301063 | Australia | Verified |

| VFSC | 40171 | Vanuatu | Verified |

Despite these regulatory affiliations, the quality of regulation varies. The FCA and ASIC are considered top-tier regulators, offering robust protection for traders. However, the VFSC is often viewed as a less stringent regulatory body, which raises concerns about the level of investor protection for accounts under its jurisdiction. Historical compliance records indicate that while IEXS has not faced significant regulatory actions, the lack of clarity regarding its fund segregation practices and negative balance protection policies warrants caution.

Company Background Investigation

IEXS was founded in 2019 by a group of financial professionals with over 20 years of experience in the industry. The company is headquartered in London, UK, and also has offices in various global financial centers, including Australia and the British Virgin Islands. The management team comprises individuals with diverse backgrounds in finance, technology, and trading, which can be seen as a positive indicator of the company's operational capability.

However, the transparency of IEXS's ownership structure and operational practices is somewhat limited. While the broker provides general information about its team and mission, specific details about key personnel and their professional histories are not readily available. This lack of disclosure can raise red flags for potential investors who value transparency in their trading partners. Overall, while IEXS appears to be a legitimate entity, the opacity surrounding its management and operational practices may lead to concerns among prospective traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital for assessing overall costs and potential profitability. IEXS offers a minimum deposit requirement of $200, which is relatively standard in the industry. The broker provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, known for their user-friendly interfaces and advanced trading tools.

However, the fee structure at IEXS has raised some eyebrows. The broker advertises tight spreads, but specific details regarding commissions and overnight interest rates are often vague. Below is a comparative analysis of core trading costs:

| Fee Type | IEXS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | Variable | Variable/Fee-Free |

| Overnight Interest Range | Unclear | Varies by Broker |

The spread for major currency pairs at IEXS is above the industry average, which could impact profitability for frequent traders. Additionally, the lack of clarity regarding commission structures and potential hidden fees may pose risks for traders, especially those who rely on precise cost calculations for their trading strategies.

Customer Fund Security

The safety of customer funds is paramount when choosing a forex broker. IEXS claims to implement several measures to protect clients' investments, including segregating client funds from company operating funds. This practice is essential for ensuring that traders can access their money even in the event of company insolvency.

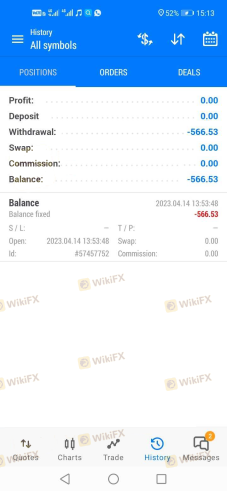

However, there is limited information available regarding the specifics of these security measures. The broker does not explicitly state whether it offers negative balance protection, which is a critical feature for traders using high leverage. Historical issues related to fund security have not been reported for IEXS, but the lack of clarity surrounding its fund protection policies could be a concern for potential investors.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of IEXS reveal a mixed bag of experiences. While some users report positive interactions with customer support and satisfactory trading experiences, others have raised concerns about withdrawal processes and the handling of complaints.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

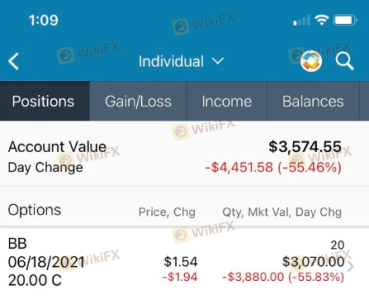

| Withdrawal Delays | High | Slow Response |

| Account Management Issues | Medium | Moderate Response |

| Platform Performance Problems | Medium | Varies |

For instance, some traders have reported delays in fund withdrawals, leading to frustration and dissatisfaction. In contrast, others have praised the customer support team for their responsiveness and helpfulness. These discrepancies highlight the importance of considering a range of user experiences when evaluating a broker.

Platform and Execution Quality

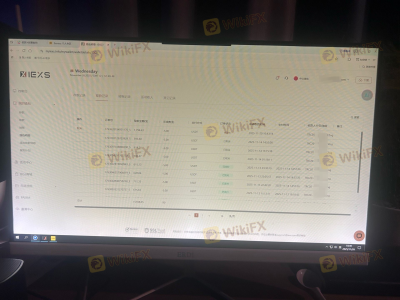

The trading platform's performance is critical for a seamless trading experience. IEXS utilizes the MetaTrader 4 and MetaTrader 5 platforms, which are widely regarded for their reliability and functionality. The platforms offer various features, including advanced charting tools, automated trading capabilities, and a user-friendly interface.

However, reports of slippage and order execution issues have surfaced, raising concerns about the broker's execution quality. Traders have noted instances of delayed order fills and difficulty in executing trades during volatile market conditions. While such issues can occur with any broker, frequent occurrences may indicate underlying problems with the broker's execution infrastructure.

Risk Assessment

Using IEXS comes with inherent risks that traders should carefully consider. Below is a summary of key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Varying quality of regulation across jurisdictions. |

| Fund Security Risk | High | Unclear policies on negative balance protection. |

| Trading Cost Risk | Medium | Higher spreads than industry average may impact profits. |

| Execution Risk | Medium | Reports of order execution delays and slippage. |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, maintaining a diversified trading strategy and setting strict risk management parameters can help protect against potential losses.

Conclusion and Recommendations

In conclusion, while IEXS appears to be a legitimate broker with several regulatory affiliations, potential traders should exercise caution. The mixed reviews regarding customer experiences, unclear fee structures, and potential execution issues raise concerns that warrant careful consideration.

For traders seeking a reliable broker, it may be prudent to explore alternatives with stronger regulatory oversight and clearer fee disclosures. Brokers regulated by top-tier authorities such as the FCA or ASIC, with proven track records of customer satisfaction, are generally safer choices. Always conduct thorough research and consider your trading needs and risk tolerance before selecting a broker.

Is IEXS a scam, or is it legit?

The latest exposure and evaluation content of IEXS brokers.

IEXS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IEXS latest industry rating score is 2.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.