Is FEX Global safe?

Business

License

Is FEX Global Safe or a Scam?

Introduction

FEX Global is a brokerage firm that positions itself within the forex and commodities markets, particularly focusing on the Asia-Pacific region. As a relatively new player in the financial trading landscape, it offers a range of futures and options contracts, primarily in energy and environmental sectors. However, the rapid growth of the online trading industry has led to an increase in scams and unregulated brokers, making it essential for traders to thoroughly evaluate the legitimacy of any brokerage before investing their funds. This article aims to provide a comprehensive analysis of FEX Global, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. Our investigation is based on various online sources, reviews, and regulatory databases, ensuring a well-rounded perspective on whether FEX Global is safe or potentially a scam.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is vital for ensuring the safety of traders' funds and adherence to industry standards. FEX Global currently operates without valid regulation from recognized authorities, raising significant concerns about its legitimacy. The absence of oversight from top-tier regulators such as the Australian Securities and Investments Commission (ASIC) or the Financial Conduct Authority (FCA) suggests a lack of accountability and investor protection.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The importance of regulation cannot be overstated; it serves as a safety net for traders, ensuring that brokers adhere to strict operational standards. In the case of FEX Global, the lack of regulatory oversight implies that traders may have limited recourse in the event of disputes or financial losses. Furthermore, the absence of a regulatory history raises questions about the firm's commitment to compliance and ethical trading practices.

Company Background Investigation

FEX Global was established in Australia and has been operational for several years, focusing on providing trading services in energy, environmental, and commodity derivatives. However, details about the company's ownership structure and management team remain sparse, which can be a red flag for potential investors. Transparency is a critical factor in assessing a broker's credibility, and FEX Global's limited disclosure may hinder traders' ability to make informed decisions.

The management team‘s professional experience is another crucial aspect of a brokerage’s reliability. While some information is available, the lack of a well-documented leadership profile may lead to skepticism about the firm's operational competence. In an industry where trust is paramount, potential clients may find it difficult to engage with a brokerage that does not provide clear information about its executives and their qualifications.

Trading Conditions Analysis

FEX Global offers various trading conditions, but the overall fee structure raises some concerns. While competitive spreads are often touted by brokers, the absence of transparency regarding commissions and overnight financing rates can lead to unexpected costs for traders. Understanding the fee structure is essential for evaluating the overall cost of trading with FEX Global.

| Fee Type | FEX Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2-5% |

Traders should be cautious of any unusual fees or hidden charges that may not be immediately apparent. The lack of clarity in FEX Global's fee structure could indicate potential issues, making it essential for traders to conduct thorough due diligence before committing their capital.

Customer Funds Safety

The safety of customer funds is a fundamental concern in the trading industry. FEX Global's lack of regulatory oversight raises questions about its fund security measures. Effective fund protection policies, such as segregated accounts and negative balance protection, are crucial for safeguarding traders' investments. However, FEX Global has not provided sufficient information on its fund safety protocols, leaving potential clients in the dark.

Moreover, any historical issues regarding fund security or customer complaints can significantly impact a broker's reputation. Without a clear track record of secure fund management, traders may want to consider the risks associated with depositing their money with FEX Global.

Customer Experience and Complaints

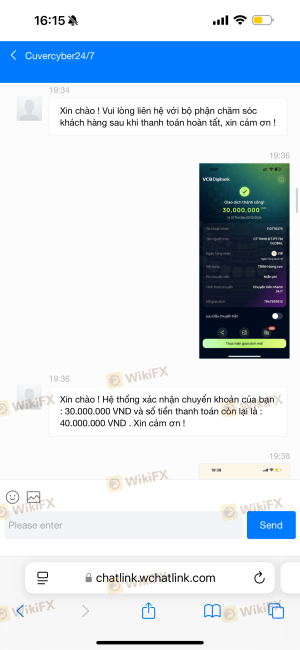

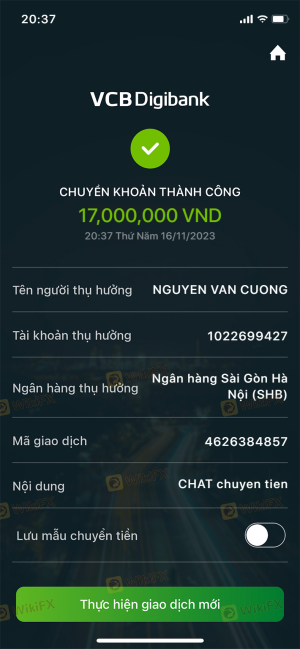

Customer feedback is an invaluable resource for assessing a brokerage's reliability. In the case of FEX Global, numerous negative reviews have surfaced, highlighting issues such as withdrawal difficulties and unresponsive customer support. These complaints can be indicative of deeper systemic problems within the brokerage.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Fair |

For instance, some users have reported being unable to withdraw their funds, which raises significant concerns about the broker's operational integrity. The quality of customer support is another critical factor; a lack of timely and effective responses can exacerbate traders' frustrations and lead to a negative trading experience.

Platform and Execution

The performance of a trading platform is critical to a trader's success. FEX Global claims to utilize advanced trading technology; however, user experiences regarding platform stability and order execution quality vary. Issues such as slippage and order rejections can significantly impact trading outcomes, and any signs of platform manipulation should be taken seriously.

Traders should evaluate the platform's performance through trial trading or demo accounts, if available, to ensure it meets their expectations for reliability and efficiency.

Risk Assessment

Using FEX Global carries inherent risks, primarily due to its unregulated status and the lack of transparency surrounding its operations. Traders should be aware of the potential for financial loss and the difficulty of recovering funds in the event of a dispute.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Fund Security Risk | High | Lack of clear fund protection measures |

| Customer Service Risk | Medium | Negative feedback on support responsiveness |

To mitigate these risks, traders should consider diversifying their investments and avoiding putting all their capital into a single unregulated broker like FEX Global. Seeking out regulated alternatives can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that FEX Global is not safe for traders. The lack of regulation, coupled with negative customer feedback and unclear trading conditions, raises significant red flags. Traders should exercise extreme caution when considering this brokerage for their trading activities.

For those seeking reliable trading options, it is advisable to explore brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Recommended alternatives include established brokers with strong regulatory oversight, transparent fee structures, and positive user reviews. Always prioritize safety and due diligence when selecting a trading partner in the forex market.

Is FEX Global a scam, or is it legit?

The latest exposure and evaluation content of FEX Global brokers.

FEX Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FEX Global latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.