Is Gelber Group safe?

Pros

Cons

Is Gelber Group Safe or Scam?

Introduction

Gelber Group, a Chicago-based proprietary trading firm, has been a notable player in the financial markets since its inception in 1982. With a focus on trading across various asset classes, including foreign exchange, Gelber Group has established itself as a significant entity in the trading community. However, as the forex market continues to grow, traders are often faced with the daunting task of evaluating the credibility and safety of brokers. This is particularly important given the prevalence of scams and unregulated firms in the industry. In this article, we will explore the safety of Gelber Group by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and potential risks. Our investigation draws on a range of sources, including user reviews and regulatory filings, to provide a comprehensive assessment of whether Gelber Group is safe for traders.

Regulation and Legitimacy

The regulatory environment in which a trading firm operates is crucial in assessing its legitimacy. Regulatory bodies ensure that firms adhere to strict guidelines designed to protect traders. In the case of Gelber Group, it is essential to note that there appears to be a lack of valid regulatory information. According to sources like WikiFX, Gelber Group does not hold any licenses from recognized regulatory authorities, which raises significant concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | No valid license |

The absence of regulation means that Gelber Group operates without the oversight that typically protects traders from fraud and malpractice. This lack of regulatory compliance can expose traders to higher risks, making it critical to approach this firm with caution. Furthermore, historical compliance issues, such as sanctions imposed by the Commodity Futures Trading Commission (CFTC) for trading abuses, highlight a troubling pattern that could indicate a lack of commitment to ethical trading practices. The combination of no regulatory oversight and past violations raises red flags regarding the safety of trading with Gelber Group.

Company Background Investigation

Gelber Group was founded by Brian and Frank Gelber on the Chicago Board of Trade floor and has since evolved into a proprietary trading firm. The company has a rich history, with over three decades of experience in the trading industry. However, its transition from a brokerage to a proprietary trading firm raises questions about its operational transparency. Proprietary trading firms often have different incentives compared to traditional brokers, focusing on their own trading profits rather than client success.

The management team at Gelber Group is comprised of seasoned traders with significant industry experience. Brian Gelber, the CEO, is recognized as a prominent figure in the trading community and has contributed to the firm's reputation. However, the overall transparency of the company's operations and its ownership structure remains unclear. While the firm emphasizes a culture of mentorship and support for its traders, the lack of publicly available information makes it difficult to fully evaluate its governance and accountability.

Trading Conditions Analysis

The trading conditions offered by Gelber Group are another critical aspect to consider when evaluating its safety. While proprietary trading firms typically do not disclose their fee structures in the same way as traditional brokers, there are indications that Gelber Group may have an unusual cost structure. Reports suggest potential hidden fees and a lack of clarity surrounding commissions and spreads, which can significantly impact a trader's profitability.

| Fee Type | Gelber Group | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information about trading costs can be concerning for traders, as unexpected fees can erode profits. Additionally, the proprietary trading model may lead to conflicts of interest, where the firm's profits could come at the expense of its traders. This lack of clarity surrounding trading conditions raises further questions about whether Gelber Group is safe for traders, particularly for those new to the market.

Client Fund Security

When assessing the safety of a trading firm, the security of client funds is paramount. Gelber Group's policies regarding fund security are not well-documented, which is a significant concern for potential clients. In the absence of regulatory oversight, it is unclear what measures are in place to protect client deposits. Effective fund security measures typically include segregated accounts, investor protection schemes, and negative balance protection policies.

Unfortunately, there is little information available to ascertain whether Gelber Group employs these security measures. Historical incidents of fund mismanagement or disputes could further indicate potential risks associated with trading with this firm. Traders must be cautious and thoroughly investigate the security of their funds before engaging with Gelber Group, as the lack of transparency can lead to significant financial risks.

Customer Experience and Complaints

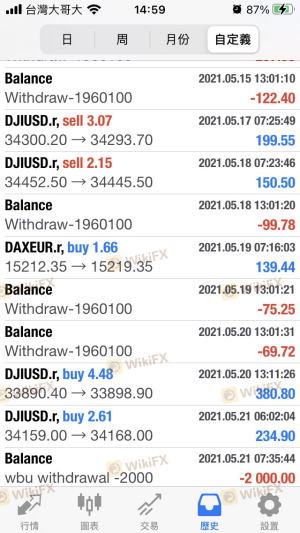

Customer feedback is a vital indicator of a firm's reliability and safety. Gelber Group has received mixed reviews from clients, with some praising the firm's trading environment and others expressing dissatisfaction. Common complaints include issues with customer service, difficulties in withdrawing funds, and concerns about transparency in trading practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Transparency Concerns | High | Inadequate explanations |

One notable case involved a trader who reported difficulties in withdrawing their funds, leading to frustration and a sense of distrust towards the firm. While Gelber Group may provide a supportive environment for some traders, the recurring themes of dissatisfaction and unresolved complaints raise significant concerns about the overall client experience. These issues contribute to the perception that Gelber Group may not be entirely safe for traders.

Platform and Trade Execution

The performance of a trading platform is critical for a trader's success. Traders need a reliable platform that offers stability, execution speed, and minimal slippage. While Gelber Group employs advanced technology in its trading operations, there are mixed reviews regarding the platform's performance. Some users report satisfactory execution quality, while others have experienced issues with slippage and order rejections.

The potential for platform manipulation is another concern that traders should consider. Any signs of irregularities in trade execution could indicate a lack of integrity in the firm's operations. Given the mixed feedback about platform performance, traders must weigh the risks associated with using Gelber Group's trading platform.

Risk Assessment

Using Gelber Group as a trading partner comes with inherent risks that traders should be aware of. The following risk assessment summarizes key risk areas associated with this firm:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid licenses; past sanctions. |

| Financial Risk | Medium | Lack of clarity in fees and commissions. |

| Operational Risk | High | Mixed reviews on platform performance. |

| Client Fund Security | High | Unclear fund protection measures. |

To mitigate these risks, traders should conduct thorough due diligence, consider trading with smaller amounts, and remain vigilant about their fund security. Seeking alternative brokers with better regulatory oversight and clearer fee structures may also be advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Gelber Group may not be a safe choice for traders. The lack of regulatory oversight, combined with historical compliance issues and mixed customer feedback, raises significant concerns about the firm's legitimacy and safety. While some traders may find success within its trading environment, the potential for hidden fees, operational risks, and inadequate client fund security cannot be overlooked.

For traders seeking a reliable and safe trading experience, it is advisable to consider alternative brokers that offer robust regulatory protection, transparent fee structures, and positive customer reviews. Firms with a proven track record of compliance and client satisfaction should be prioritized to ensure a safer trading environment. Ultimately, due diligence is key, and traders should remain cautious when engaging with Gelber Group or similar firms.

Is Gelber Group a scam, or is it legit?

The latest exposure and evaluation content of Gelber Group brokers.

Gelber Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Gelber Group latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.