Is UNITED FX safe?

Business

License

Is United FX Safe or a Scam?

Introduction

United FX is a forex broker that claims to offer trading services across various financial instruments, including forex, cryptocurrencies, and CFDs. Positioned as an innovative platform, it aims to attract traders by promising competitive trading conditions and advanced technology. However, the world of forex trading is fraught with risks, and traders must exercise caution when evaluating brokers. The potential for scams is significant, especially with firms that lack proper regulation or transparency. This article investigates whether United FX is a legitimate trading platform or a scam, employing a thorough analysis of its regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

Regulation is a critical factor for any financial trading platform. It serves as a safety net for traders, ensuring that brokers adhere to specific operational standards and that clients' funds are protected. United FX, however, is not regulated by any recognized financial authority, which raises serious concerns about its legitimacy and operational practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that United FX does not have to comply with the stringent requirements that regulated brokers must meet. This includes maintaining segregated client accounts, providing negative balance protection, and being subject to regular audits. The lack of oversight increases the risk of fraud and mismanagement of funds, making it imperative for traders to question Is United FX safe. The Financial Conduct Authority (FCA) in the UK has issued warnings about United FX, highlighting that it operates without authorization. This further corroborates the broker's dubious standing in the financial market.

Company Background Investigation

United FX claims to be based in Mountain View, California, but there is little verifiable information regarding its ownership or operational history. The company does not disclose its ownership structure, which is a significant red flag for potential investors. The management teams background is also unclear, lacking detailed profiles or experience in financial services.

Transparency is a cornerstone for trust in any financial institution, and United FX falls short in this regard. The absence of clear information about the company's founders and management raises concerns about accountability. Without knowing who is behind the broker, traders have no way to assess the team's expertise or reputation. Thus, it is crucial to consider Is United FX safe when investing your hard-earned money in a platform that lacks transparency and a clear operational history.

Trading Conditions Analysis

The trading conditions offered by United FX appear attractive at first glance, but a closer examination reveals potential pitfalls. The broker claims to offer low spreads and various account types, yet specific details regarding fees and commissions remain vague.

| Fee Type | United FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.3 pips | 1.5 pips |

| Commission Structure | 20% per lot | 0.01% - 0.02% |

| Overnight Interest Range | N/A | Varies |

The spread for major currency pairs is significantly higher than the industry average, indicating that traders may incur higher costs when trading with United FX. Additionally, the commission structure, which charges a percentage per lot, is uncommonly high compared to standard practices in the industry. This lack of competitive pricing raises questions about the broker's commitment to providing fair trading conditions, further complicating the question of Is United FX safe.

Client Fund Security

Client fund security is paramount in the trading industry. However, United FX does not provide sufficient information regarding its fund safety measures. There is no indication that client funds are kept in segregated accounts, which is a standard practice among regulated brokers to protect clients' money in the event of bankruptcy or operational issues.

Moreover, United FX does not offer any investor protection schemes, which means that in the event of a financial crisis or fraud, clients may not have any recourse to recover their funds. The absence of negative balance protection also means that traders could potentially lose more than their initial investment. This lack of security measures raises significant concerns about whether Is United FX safe for traders looking to invest their money.

Customer Experience and Complaints

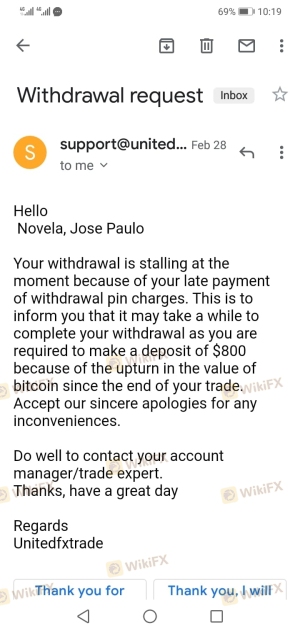

Customer feedback is invaluable in assessing the reliability of a trading platform. Reviews of United FX reveal a pattern of negative experiences, including difficulty in withdrawing funds, high-pressure sales tactics, and inadequate customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Inadequate |

| Misleading Information | High | No Response |

Many users have reported that once they deposit funds, the broker becomes unresponsive or imposes excessive conditions on withdrawals. This behavior is typical of fraudulent brokers and raises serious concerns about Is United FX safe for potential investors. A couple of notable cases illustrate these issues: one trader reported being unable to withdraw their funds for over three months, while another claimed they were pressured into making additional deposits to "unlock" their account.

Platform and Trade Execution

The trading platform offered by United FX has been criticized for its performance and user experience. Many users have reported issues with stability and execution quality, including slippage and order rejections.

In trading, the quality of order execution is crucial, as delays can lead to significant financial losses. Traders have expressed concerns about the platform's reliability, with some claiming they experienced frequent disconnections and difficulties in placing trades. These issues cast doubt on the broker's ability to provide a secure and efficient trading environment, further questioning Is United FX safe for traders.

Risk Assessment

Engaging with United FX presents various risks that potential traders should consider. The lack of regulation, poor customer feedback, and questionable trading conditions collectively contribute to a high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | No fund protection |

| Operational Risk | Medium | Platform instability |

Given these risks, it is advisable for traders to exercise extreme caution when considering United FX. Potential investors should seek out regulated brokers that provide better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that United FX exhibits several characteristics commonly associated with scam brokers. The lack of regulation, transparency issues, poor customer feedback, and questionable trading conditions raise serious concerns about its legitimacy. Therefore, it is prudent for traders to ask themselves, Is United FX safe?

For those considering entering the forex market, it is advisable to opt for well-regulated brokers that offer robust security measures, transparent fee structures, and positive user reviews. Some recommended alternatives include brokers like OANDA, IG, or Forex.com, which are known for their regulatory compliance and customer service. Always prioritize safety and due diligence when choosing a trading platform.

Is UNITED FX a scam, or is it legit?

The latest exposure and evaluation content of UNITED FX brokers.

UNITED FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UNITED FX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.