FPFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fpfx review reveals serious concerns about the broker's legitimacy and regulatory claims. Potential traders must carefully consider these issues before making any decisions. FPFX presents itself as a global financial technology service provider specializing in forex and CFD trading, claiming operations since 2005.

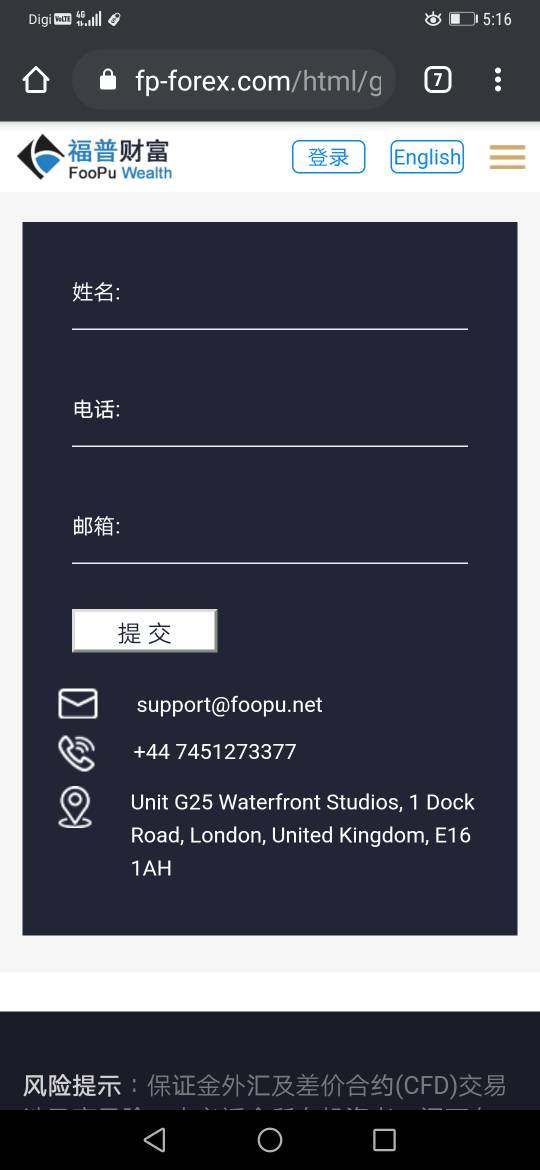

Our investigation uncovers troubling differences between the broker's stated regulatory status and verifiable information. The broker offers trading in forex, commodities, indices, stocks, and cryptocurrencies, positioning itself as a comprehensive trading platform. Despite these offerings, FPFX fails to provide transparent information about crucial trading conditions such as spreads, commissions, and minimum deposit requirements.

Most concerning are the unverified regulatory claims and user feedback expressing serious doubts about the company's legitimacy. According to available information, FPFX claims regulation by both the FCA and ASIC, but these claims remain unproven upon verification. The target audience appears to be investors seeking forex and CFD trading opportunities, though the lack of regulatory transparency raises significant red flags for potential clients.

Recent developments, including the termination of licenses for associated entities due to alleged fraud schemes, further compound credibility concerns.

Important Notice

Traders should exercise extreme caution when considering FPFX. The broker's regulatory status varies significantly across different jurisdictions, with actual regulatory information remaining unclear and unverified. The company's claims of FCA and ASIC regulation have not been proven through official regulatory databases.

This raises serious questions about compliance and oversight. This evaluation is based on publicly available information and user feedback collected from various sources. Given the concerning nature of our findings, potential clients are strongly advised to conduct thorough research and verify all trading conditions directly through official channels before making any financial commitments.

The lack of transparent regulatory information and negative user sentiment should be primary considerations in any decision-making process.

Rating Framework

Broker Overview

FPFX, also known as FP Markets in some contexts, positions itself as a global financial technology service provider established in 2005. The company focuses primarily on forex and contract for difference trading services. The company markets itself as offering comprehensive trading solutions across multiple asset classes, targeting both retail and institutional clients seeking exposure to international financial markets.

The broker's business model centers around providing access to forex, commodities, indices, stocks, and cryptocurrency trading through what it claims to be advanced trading platforms. However, specific details about platform types, such as whether they offer MetaTrader 4 or MetaTrader 5, remain unclear in available documentation. This lack of transparency regarding fundamental trading infrastructure raises questions about the company's commitment to providing clear information to potential clients.

FPFX claims regulatory oversight from major financial authorities including the Financial Conduct Authority and the Australian Securities and Investments Commission. However, verification attempts through official regulatory databases have failed to confirm these claims, creating significant concerns about the broker's actual regulatory status. The company's operational history since 2005 suggests longevity, but recent negative developments and unverified regulatory claims overshadow any potential credibility from years of claimed operation.

This fpfx review emphasizes the critical importance of verified regulatory status in broker selection.

Regulatory Jurisdiction: FPFX claims regulation by both FCA and ASIC. These represent two of the most respected financial regulatory bodies globally. However, verification through official regulatory databases has failed to confirm these claims, raising serious red flags about the broker's actual compliance status and oversight.

Deposit and Withdrawal Methods: Specific information regarding funding options remains unavailable in accessible documentation. This represents a significant transparency gap for potential clients seeking to understand their financial transaction options.

Minimum Deposit Requirements: No specific minimum deposit amounts are disclosed in available materials. This makes it impossible for potential traders to assess entry-level requirements or account accessibility.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not detailed in accessible information. This limits understanding of potential incentives or additional trading capital opportunities.

Tradeable Assets: The broker offers access to forex pairs, commodities, stock indices, individual stocks, and cryptocurrencies. This provides a diverse range of trading instruments across major market categories for portfolio diversification strategies.

Cost Structure: Critical pricing information including spreads, commissions, overnight financing rates, and other trading costs remains undisclosed in available documentation. This prevents accurate cost analysis for potential clients.

Leverage Ratios: Specific leverage offerings are not detailed in accessible materials. This represents another significant information gap regarding trading conditions and risk management parameters.

Platform Options: Available trading platforms and their specific features remain unclear. There is no definitive information about MetaTrader availability, proprietary platforms, or mobile trading applications.

Geographic Restrictions: Information about service availability across different jurisdictions is not specified in available documentation. This limits understanding of global accessibility.

Customer Support Languages: Available support languages are not detailed in accessible materials. This fpfx review highlights the importance of comprehensive information disclosure, which FPFX fails to provide adequately.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

FPFX's account conditions receive a below-average rating due to significant transparency issues and lack of detailed information about fundamental trading parameters. The absence of clear account type specifications makes it impossible for potential clients to understand what trading conditions they might encounter. It also prevents them from understanding how different account tiers might serve varying trading strategies and capital levels.

The lack of disclosed minimum deposit requirements represents a major shortcoming in account condition transparency. Most reputable brokers clearly outline entry-level requirements, allowing traders to assess accessibility and plan their initial capital allocation accordingly. Without this basic information, potential clients cannot properly evaluate whether FPFX's services align with their financial capacity or trading objectives.

Account opening procedures and verification processes remain undisclosed. This creates uncertainty about onboarding experiences and compliance requirements. The absence of information about special account features, such as Islamic accounts for Sharia-compliant trading, further limits understanding of the broker's accommodation for diverse client needs and religious considerations.

User feedback regarding account conditions is limited, but existing concerns about the broker's legitimacy overshadow any potential positive aspects of account offerings. The combination of poor transparency and questionable regulatory status significantly impacts the overall assessment of account conditions. This fpfx review emphasizes that reliable account conditions require clear disclosure and verified regulatory oversight, both of which FPFX fails to provide adequately.

The tools and resources category receives an average rating. This is primarily based on the broker's claimed offering of multiple asset classes rather than detailed analysis of actual trading tools and educational resources. While FPFX advertises access to forex, commodities, indices, stocks, and cryptocurrencies, specific information about trading tools, analytical resources, and platform capabilities remains largely undisclosed.

Research and analysis resources that are crucial for informed trading decisions are not detailed in available documentation. Most reputable brokers provide market analysis, economic calendars, technical indicators, and research reports to support client decision-making. The absence of clear information about these resources suggests either limited offerings or poor communication of available tools.

Educational resources, which are essential for trader development and skill enhancement, are not specified in accessible materials. Quality brokers typically offer webinars, tutorials, trading guides, and educational content to help clients improve their trading knowledge and strategies. The lack of disclosed educational support represents a significant gap in value-added services.

Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, remains unclear. Without specific information about platform features and automated trading options, potential clients cannot assess whether FPFX supports advanced trading strategies or systematic approaches to market participation.

Customer Service and Support Analysis (3/10)

Customer service and support receive a poor rating due to the absence of detailed information about support channels, availability, and service quality. This is combined with user concerns about the broker's overall legitimacy. The lack of transparent communication about customer support infrastructure raises questions about the company's commitment to client service and problem resolution.

Available support channels, including phone, email, live chat, and help desk options, are not clearly outlined in accessible documentation. Response time expectations and service level commitments remain unspecified, making it impossible for potential clients to understand what level of support they might receive when assistance is needed.

Service quality assessments are complicated by the limited user feedback available and the overshadowing concerns about the broker's legitimacy. When users question a company's basic credibility, customer service quality becomes secondary to fundamental trust issues that affect the entire client relationship.

Multilingual support capabilities and operating hours for customer service are not detailed in available materials. International brokers typically provide support in multiple languages and across different time zones to serve global client bases effectively. The absence of this information suggests either limited international support or poor communication of available services.

Trading Experience Analysis (6/10)

The trading experience category receives an above-average rating primarily due to the broker's claimed offering of diverse trading assets across multiple market categories. However, this assessment is limited by the lack of detailed platform performance information and user experience data. The availability of forex, commodities, indices, stocks, and cryptocurrencies provides potential for diversified trading strategies and portfolio construction.

Platform stability and execution speed remain unassessed due to insufficient user feedback and technical performance data. Reliable order execution, minimal slippage, and consistent platform uptime are crucial factors in trading experience quality, but available information does not provide insights into these critical performance metrics.

Platform functionality and feature completeness cannot be properly evaluated without specific information about trading platforms, charting capabilities, order types, and analytical tools. The absence of clear platform specifications makes it difficult to assess whether FPFX provides the technical infrastructure necessary for effective trading execution and market analysis.

Mobile trading experience and application functionality are not detailed in available documentation. Modern traders increasingly rely on mobile platforms for market access and trade management, making mobile capability assessment important for overall trading experience evaluation. This fpfx review notes that while asset diversity is positive, comprehensive trading experience requires transparent platform information that FPFX fails to provide.

Trust and Reliability Analysis (2/10)

Trust and reliability receive a very poor rating due to unverified regulatory claims, negative industry events, and fundamental transparency issues. These undermine confidence in the broker's credibility and operational integrity. The failure to substantiate claimed FCA and ASIC regulation represents a critical trust deficit that affects all aspects of the client relationship.

Regulatory credentials form the foundation of broker trustworthiness, and FPFX's inability to verify claimed regulatory oversight creates serious concerns about compliance, client protection, and operational standards. Legitimate brokers maintain verifiable regulatory status that can be confirmed through official regulatory databases and documentation.

Client fund safety measures and segregation practices are not detailed in available information. This represents another significant trust concern. Reputable brokers typically provide clear information about client fund protection, segregated accounts, and compensation schemes that protect client assets in case of broker insolvency or operational difficulties.

Company transparency regarding financial reporting, ownership structure, and operational details remains poor. The combination of unverified regulatory claims and limited corporate transparency creates a profile inconsistent with trustworthy financial service providers. Recent negative industry events, including license terminations for associated entities due to alleged fraud schemes, further compound reliability concerns and suggest potential systemic issues within the organization.

User Experience Analysis (4/10)

User experience receives a below-average rating based on limited positive user feedback and significant concerns about the broker's legitimacy. These overshadow potential platform usability or service quality aspects. The overall user sentiment appears negative, with particular emphasis on questions about the company's credibility and operational legitimacy.

Interface design and platform usability cannot be properly assessed due to insufficient user feedback and lack of detailed platform information. Modern trading platforms require intuitive design, responsive functionality, and comprehensive features to support effective trading activities, but available information does not provide insights into these user experience elements.

Registration and account verification processes are not detailed in accessible documentation. This makes it impossible to assess the ease and efficiency of client onboarding procedures. Streamlined account opening and verification processes are important factors in overall user experience, particularly for new clients seeking quick market access.

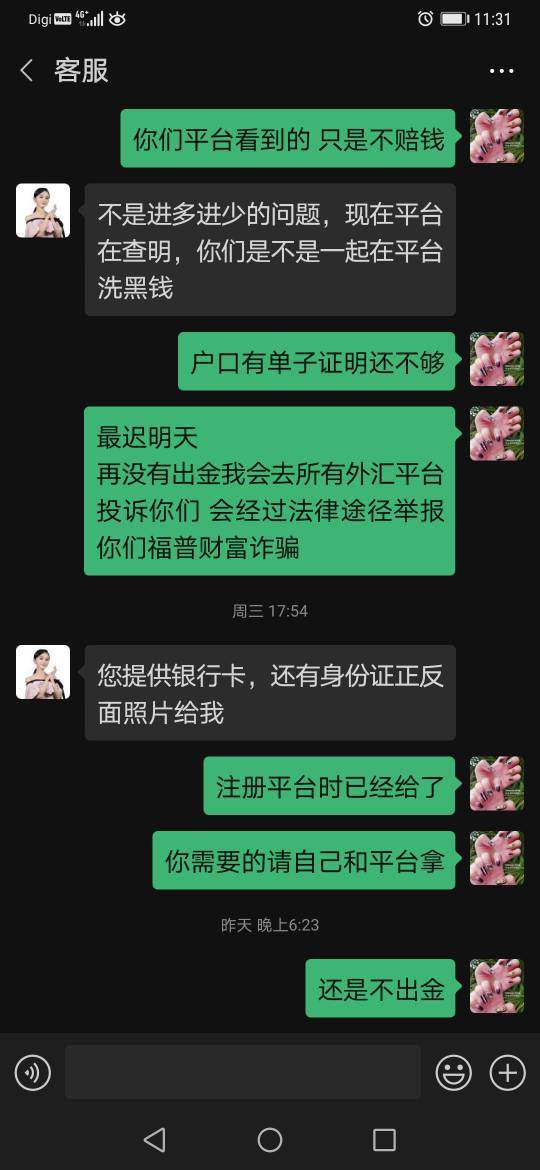

Funding operation experiences, including deposit and withdrawal convenience, processing times, and fee structures, remain unclear due to lack of specific information. Efficient and transparent financial transactions are crucial components of positive user experience, but FPFX's failure to provide clear funding information represents a significant user experience deficit.

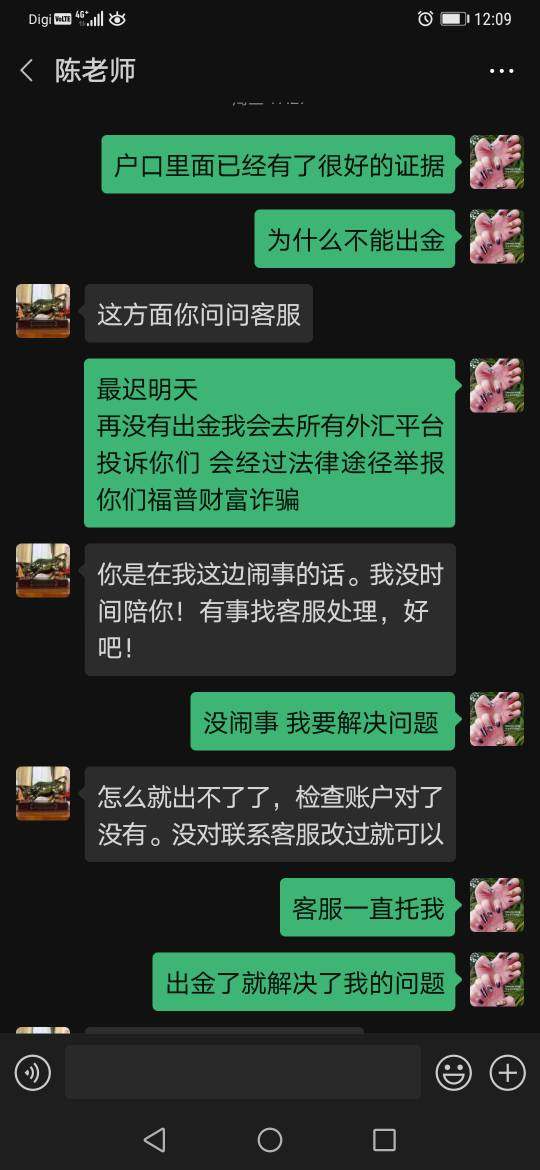

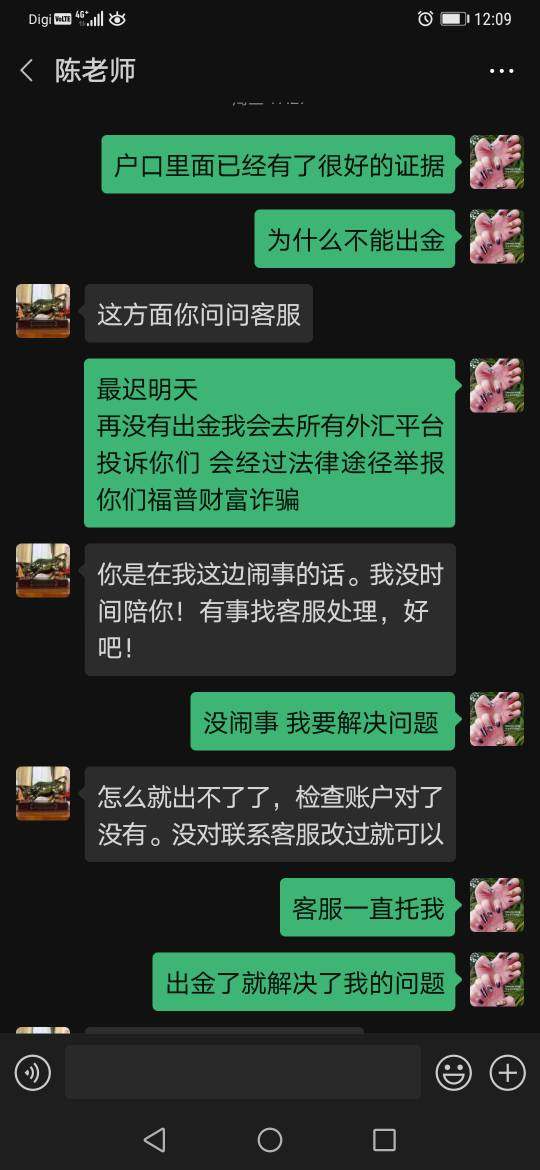

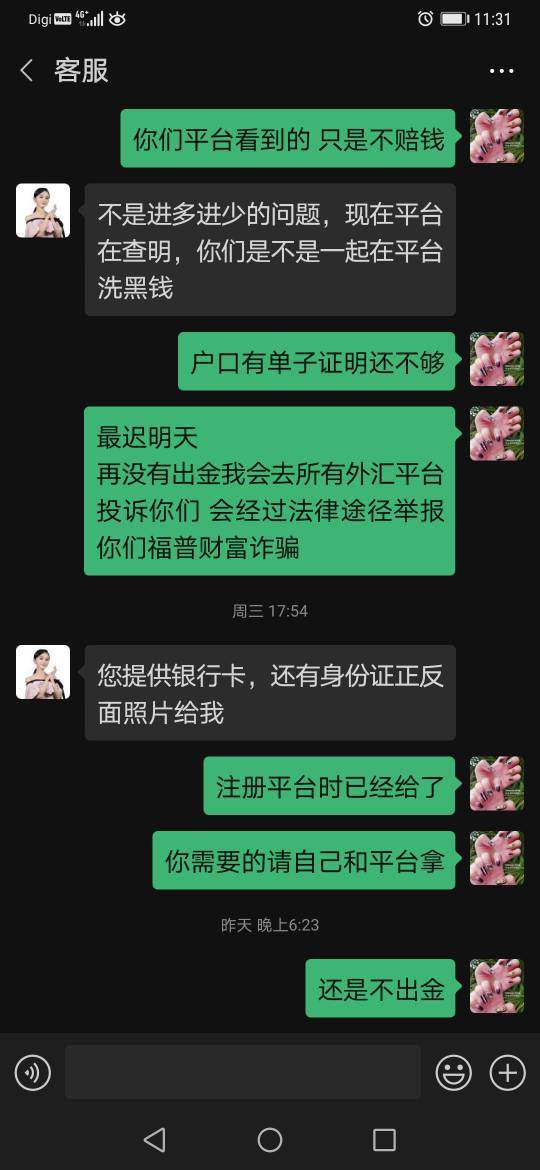

Common user complaints center on legitimacy concerns rather than specific platform or service issues. This suggests that fundamental trust problems overshadow operational user experience considerations. The target user profile of forex and CFD traders seeking legitimate, regulated trading services appears poorly served by FPFX's current transparency and credibility profile.

Conclusion

This comprehensive fpfx review reveals significant concerns that strongly advise caution for potential clients considering this broker. FPFX's unverified regulatory claims, lack of transparency regarding essential trading conditions, and negative industry associations create a risk profile unsuitable for traders seeking legitimate, regulated trading services.

The broker's claimed offering of diverse trading assets represents its primary strength. However, this advantage is overshadowed by fundamental credibility issues and transparency failures. Investors prioritizing regulatory protection, clear trading conditions, and verified compliance should consider alternative brokers with established regulatory credentials and transparent operational practices.

The combination of unverified FCA and ASIC regulatory claims, absence of detailed trading condition disclosure, and negative user sentiment regarding legitimacy creates an overall assessment that favors avoiding FPFX. Traders should consider more transparent and verifiably regulated alternatives in the competitive forex and CFD trading market.