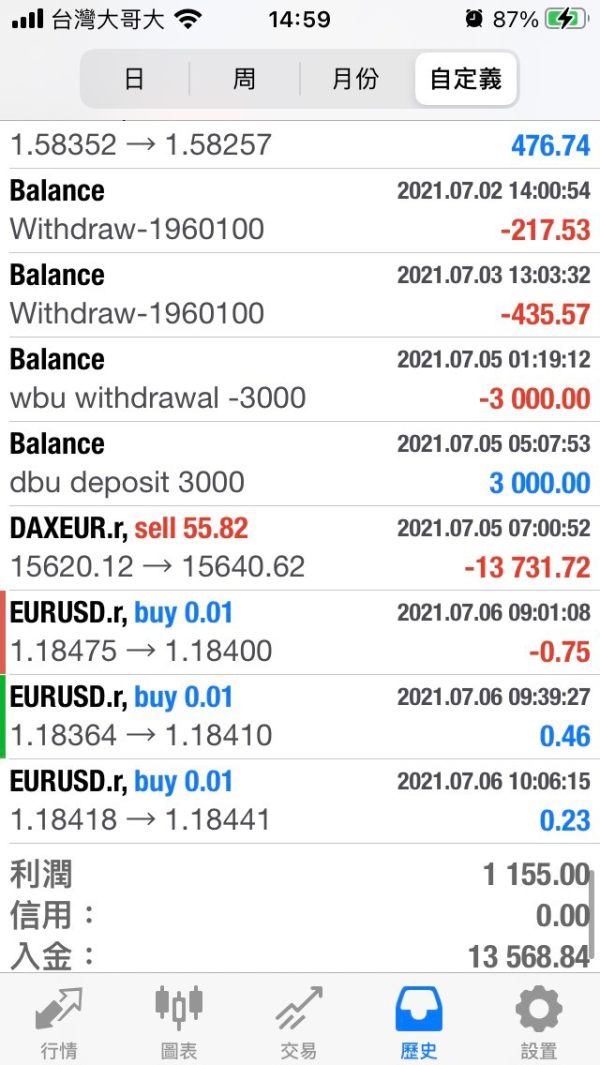

Gelber Group 2025 Review: Everything You Need to Know

Gelber Group is a proprietary trading firm that has garnered mixed reviews from employees and industry observers alike. While many praise the firm for its supportive environment and opportunities for ambitious traders, others highlight the high-pressure atmosphere and lack of support for new traders. This review aims to provide a comprehensive overview of Gelber Group based on various sources and user experiences.

Note: It is essential to consider that the experiences may vary across different regions and entities, which can affect the overall perception of the firm. This review incorporates various perspectives to ensure fairness and accuracy.

Ratings Overview

We score brokers based on a combination of user reviews, expert opinions, and factual data.

Broker Overview

Founded in 1990, Gelber Group is based in Chicago, Illinois, and primarily focuses on proprietary trading across various financial instruments. The firm operates with a unique model that allows traders to take risks while managing their own strategies. While no specific trading platforms like MT4 or MT5 were mentioned, the emphasis on technology suggests that traders may have access to advanced trading tools. However, it is noteworthy that Gelber Group has faced regulatory scrutiny in the past, including a $750,000 penalty from the CFTC for trading abuses, which raises questions about its compliance practices.

Detailed Section

Regulatory Regions

Gelber Group operates primarily in the United States. However, it lacks a solid regulatory framework, which can lead to concerns regarding investor protection. The absence of a well-known regulatory authority overseeing its operations may deter some potential traders.

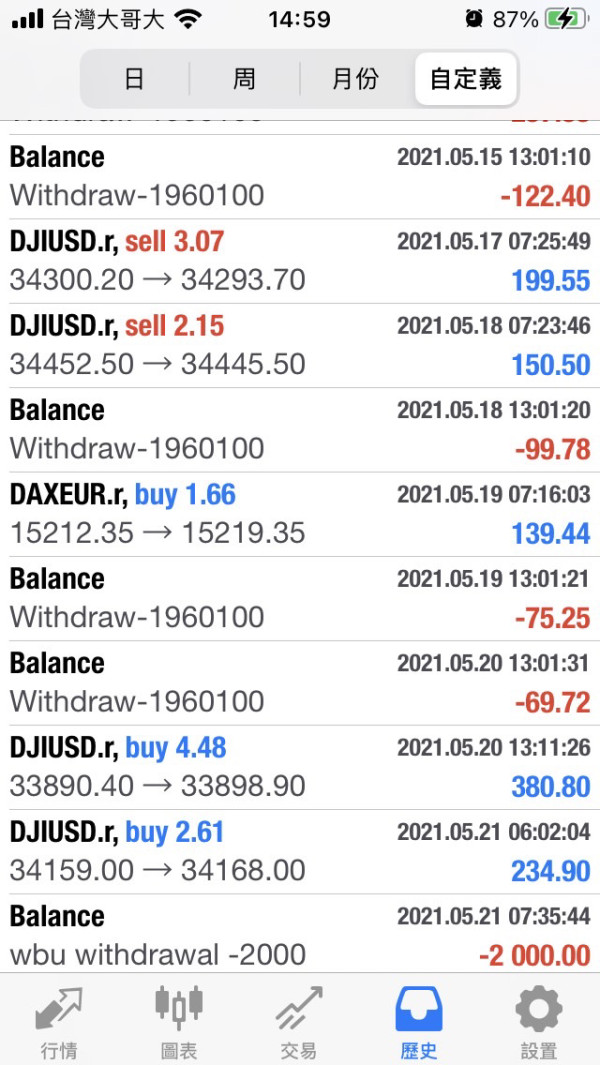

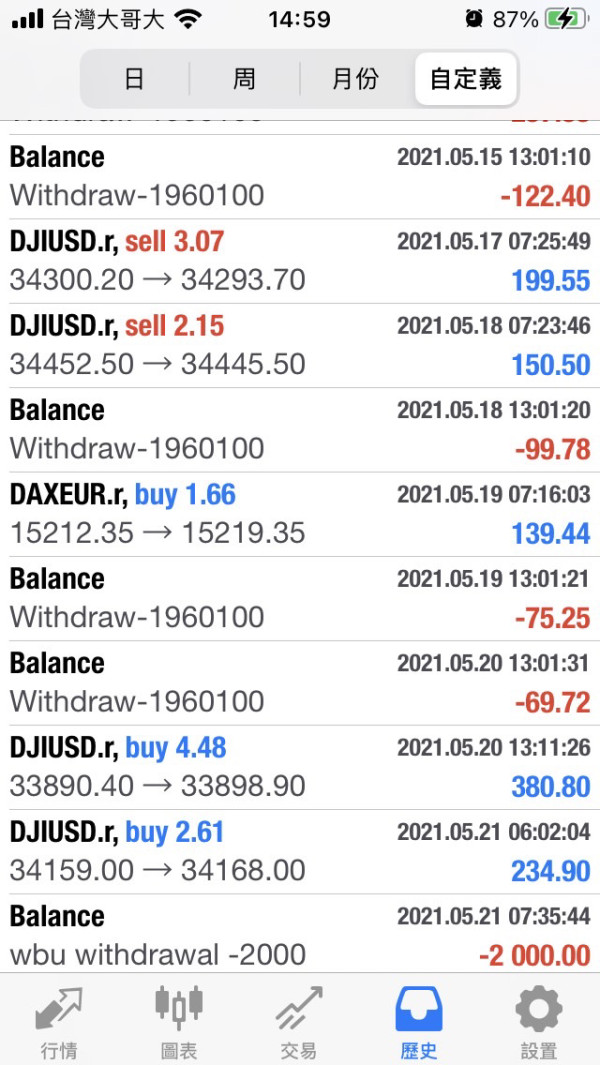

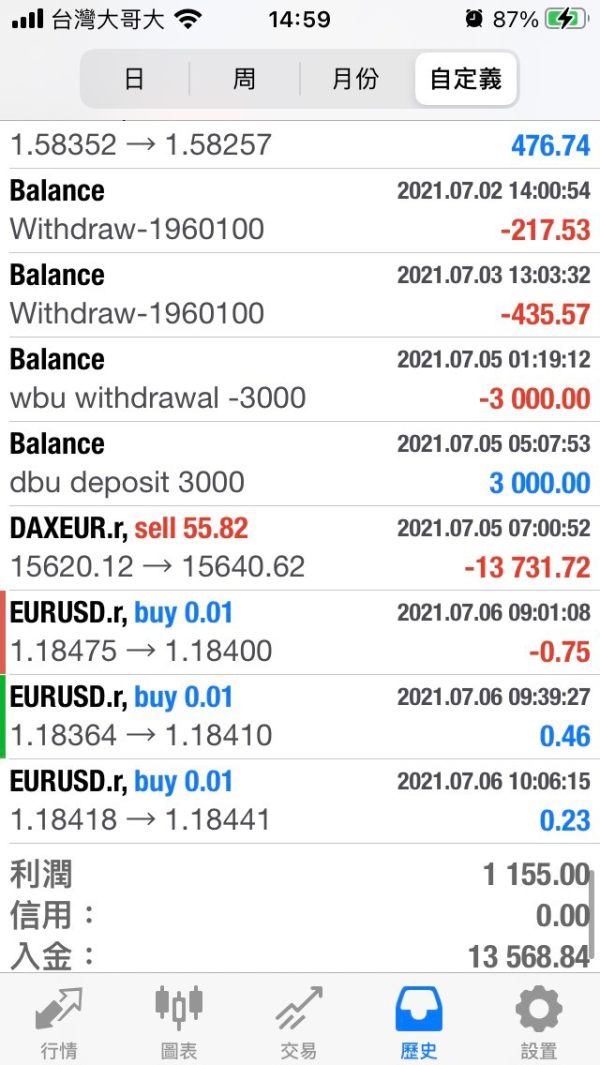

Deposit/Withdrawal Currencies

The information regarding specific deposit and withdrawal currencies is limited. However, given its U.S. base, it is likely that transactions are primarily conducted in USD.

Minimum Deposit

The minimum deposit requirements are not explicitly stated in the available reviews. However, many user experiences suggest that traders are expected to be self-sufficient and bring their own strategies, which may imply a higher threshold for entry.

There is little information regarding bonuses or promotions offered by Gelber Group. The focus appears to be more on the trading performance rather than promotional incentives.

Tradable Asset Classes

While specific asset classes were not detailed, Gelber Group is known for trading various financial instruments, including equities, commodities, and derivatives. The firm's proprietary model allows for flexibility in trading strategies.

Costs (Spreads, Fees, Commissions)

User reviews indicate that the cost structure can be a concern, with some traders reporting low base salaries and high desk fees. The overall compensation model is heavily tied to individual performance, which may not be suitable for everyone.

Leverage

Leverage details were not specifically mentioned in the reviews. However, proprietary trading firms typically offer competitive leverage ratios, allowing traders to maximize their positions.

While specific platforms were not identified, the firm is likely to utilize advanced trading technology suitable for proprietary trading activities.

Restricted Regions

There is no specific mention of restricted regions for trading with Gelber Group, but traders should be aware of local regulations that may affect their ability to trade.

Available Customer Service Languages

Customer service language options were not detailed in the reviews, but given the firm's location in Chicago, English is likely the primary language for communication.

Ratings Overview Revisited

Detailed Breakdown

-

Account Conditions (6/10): While the firm offers opportunities for self-starters, the lack of structured support can be a barrier for new traders. According to various reviews, traders are often left to navigate their paths without much guidance.

Tools and Resources (7/10): Gelber Group provides a supportive environment for traders, with access to resources for learning. However, the emphasis on self-sufficiency may limit the effectiveness of these resources for those who require more structured guidance.

Customer Service and Support (5/10): Reviews indicate that while the firm has a friendly atmosphere, communication between trading groups can be lacking. This can lead to a sense of isolation for some traders, impacting their overall experience.

Trading Setup/Experience (6/10): The trading environment is described as fast-paced and competitive, which may not be suitable for everyone. While some traders thrive in this setting, others find it overwhelming.

Trustworthiness (5/10): The firm has faced regulatory scrutiny in the past, which raises concerns about its overall trustworthiness. Potential traders should consider these factors carefully.

User Experience (6/10): Experiences vary widely, with some traders expressing satisfaction with their opportunities while others highlight the high-stress environment and lack of work-life balance.

Additional Category (7/10): The entrepreneurial spirit within the firm is often praised, allowing traders to take calculated risks and learn from their experiences. However, this comes with its own set of challenges.

In conclusion, Gelber Group presents a mixed bag of opportunities and challenges for traders. While it offers a dynamic environment for ambitious individuals, the high-pressure atmosphere and lack of structured support may not be suitable for everyone. Prospective traders should weigh these factors carefully before making a decision.