Is Royal Trading Fx safe?

Business

License

Is Royal Trading FX Safe or a Scam?

Introduction

Royal Trading FX is a forex broker that has gained attention in the trading community for its offerings in the foreign exchange market. As with any financial service provider, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their capital. The forex market, known for its volatility and complexity, can be a breeding ground for unscrupulous activities, making it imperative for traders to discern between legitimate brokers and potential scams. This article aims to systematically assess the safety and legitimacy of Royal Trading FX using a structured evaluation framework, focusing on regulatory compliance, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that influences its credibility and safety. Regulatory bodies enforce rules and standards that brokers must adhere to, providing a level of protection for traders. Royal Trading FX has raised red flags regarding its regulatory compliance. It has been reported as unregulated, with no valid licenses from recognized authorities. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation significantly diminishes the safety profile of Royal Trading FX. Regulated brokers are typically required to maintain segregated accounts for client funds, undergo regular audits, and adhere to strict financial standards. In contrast, unregulated brokers can operate with little oversight, posing higher risks to traders investments. Historical compliance issues further exacerbate concerns, as Royal Trading FX has been linked to warnings from various financial authorities, indicating a lack of transparency and accountability. This raises substantial doubts about whether Royal Trading FX is safe for traders.

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its legitimacy. Royal Trading FX claims to operate in the forex market, but details regarding its history and ownership structure are scant. The company does not provide comprehensive information about its founders or management team, which is a critical factor in evaluating its credibility. A transparent ownership structure and experienced management are indicators of a broker's reliability.

Furthermore, the lack of a clear operational history raises questions about the broker's stability and commitment to ethical trading practices. Transparency in operations, including clear disclosures about company ownership and management, is vital for building trust with clients. Unfortunately, Royal Trading FX falls short in this regard, making it difficult for potential clients to ascertain the broker's legitimacy. Therefore, it is prudent to question whether Royal Trading FX is safe for investment.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact the trading experience and potential profitability. Royal Trading FX advertises competitive spreads and leverage, but the absence of regulatory oversight raises concerns about the reliability of these claims. The fee structure of the broker is crucial for understanding the overall trading costs. Below is a comparison of key trading costs:

| Fee Type | Royal Trading FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Royal Trading FX claims to offer low spreads, traders must be cautious of hidden fees or unfavorable trading conditions that may not be immediately apparent. The lack of transparency in fee structures can lead to unexpected costs, which could diminish overall profitability. Moreover, the absence of a clear commission model raises further questions about the broker's intent. Therefore, traders should carefully consider whether Royal Trading FX is safe for their trading activities.

Customer Funds Security

The security of customer funds is a critical aspect of any brokerage. Royal Trading FX's lack of regulation raises significant concerns about the safety of client deposits. Regulated brokers are typically required to implement robust security measures, including segregating client funds from operational capital and providing investor protection schemes. Unfortunately, Royal Trading FX does not appear to offer such safeguards.

Without regulatory oversight, there is no guarantee that client funds will be protected in the event of financial difficulties or insolvency. Additionally, the broker's failure to disclose information about its fund security measures further exacerbates concerns. Traders must prioritize brokers that provide clear policies on fund segregation, negative balance protection, and investor compensation. Given the current information, it is reasonable to conclude that Royal Trading FX is not safe for traders concerned about the security of their investments.

Customer Experience and Complaints

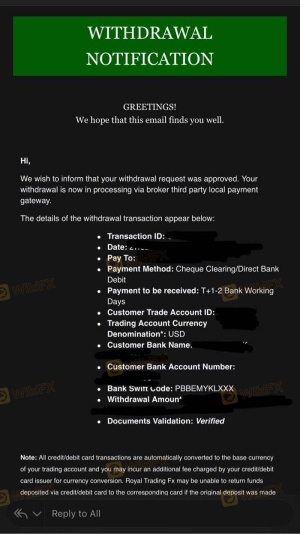

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. Reviews and testimonials about Royal Trading FX reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving timely support. The following table summarizes common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Fair |

| Lack of Transparency | High | Poor |

Many traders have voiced frustrations regarding prolonged withdrawal processes, with some claiming their requests went unanswered for extended periods. Such issues not only indicate poor customer service but also raise red flags about the broker's operational integrity. Given the reported experiences, it is clear that potential clients should be cautious and consider whether Royal Trading FX is safe for their trading needs.

Platform and Trade Execution

The trading platform's performance and execution quality are critical to a trader's success. Royal Trading FX offers the popular MetaTrader 4 platform, which is known for its user-friendly interface and advanced trading tools. However, the platform's reliability and execution speed are paramount. Traders have reported instances of slippage and order rejections, which can lead to significant losses in fast-moving markets.

The absence of reliable execution can be a warning sign of potential manipulation or inadequate infrastructure. Traders must ensure that the platforms they use provide stable performance and transparent execution policies. The concerns surrounding Royal Trading FX's execution quality further emphasize the need for caution. Therefore, it is essential to question whether Royal Trading FX is safe for serious traders.

Risk Assessment

Engaging with any broker carries inherent risks, and Royal Trading FX is no exception. The lack of regulation, transparency, and customer complaints all contribute to a higher risk profile. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated status raises significant concerns. |

| Fund Security | High | Lack of investor protection and fund segregation. |

| Customer Support | Medium | Reports of poor response times and unresolved issues. |

To mitigate these risks, traders should consider diversifying their investments and seeking out regulated brokers with proven track records. Additionally, conducting thorough research and utilizing demo accounts can help traders familiarize themselves with platforms before committing real capital. Given the current landscape, it is prudent to assess whether Royal Trading FX is safe for your trading endeavors.

Conclusion and Recommendations

In conclusion, the analysis of Royal Trading FX raises significant concerns about its legitimacy and safety. The lack of regulatory oversight, transparency issues, and negative customer experiences suggest that this broker may not be a reliable choice for traders. While it may offer attractive trading conditions, the associated risks far outweigh the potential benefits.

For traders seeking a safe and secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable financial authorities. Brokers such as [insert reliable broker names] provide the necessary safeguards and transparency that traders require. Ultimately, ensuring the safety of your investments should be the top priority, and the evidence suggests that Royal Trading FX is not safe for trading activities.

Is Royal Trading Fx a scam, or is it legit?

The latest exposure and evaluation content of Royal Trading Fx brokers.

Royal Trading Fx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Royal Trading Fx latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.