FEX Global 2025 Review: Everything You Need to Know

Executive Summary

This fex global review looks at an unregulated forex and commodities broker. The company has received mixed user feedback since 2007. FEX Global says it is a financial services company that specializes in energy, environmental, and commodity futures and options contracts, and it operates mainly from Sydney, Australia.

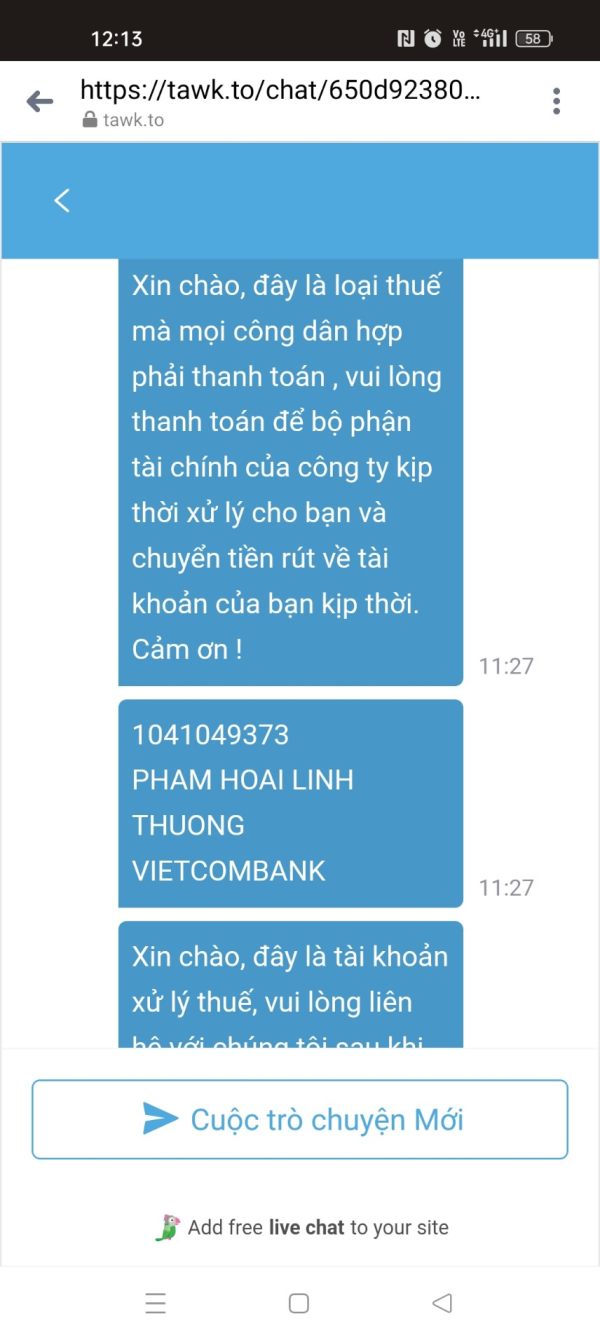

User feedback shows FEX Global has a concerning profile with mostly negative reviews. The broker lacks regulatory oversight, which is a major red flag for potential traders. The company claims to have expertise in commodities trading, but it doesn't have proper licensing and users have mostly negative experiences, which means there are big risks for future clients.

Traders who are specifically interested in commodity contracts might find the broker appealing, especially in energy and environmental sectors. However, the unregulated status and poor user satisfaction ratings mean traders should be extremely careful. People considering FEX Global should know about the potential risks of unregulated brokers, including limited ways to get help and questionable fund security measures.

Key Statistics:

- Established: 2007

- Regulation: Unregulated

- User Reviews: 1 positive, 1 neutral, 9 negative exposure reviews

- Headquarters: Sydney, Australia

Important Notice

FEX Global's unregulated status means the broker's operations may face legal restrictions and compliance issues in different places. Traders should be very careful because unregulated companies typically offer limited investor protection and may not follow international financial standards.

This review uses publicly available information and user feedback analysis. The assessment doesn't include independent verification of actual trading experiences or platform testing. Since there is limited regulatory oversight, potential clients should do thorough research before considering any engagement with this broker.

Rating Framework

Broker Overview

FEX Global started in the financial services sector in 2007. The company set up its headquarters in Sydney, Australia. FEX Global presents itself as a diversified financial services provider with operations that include brokerage services and energy sector activities.

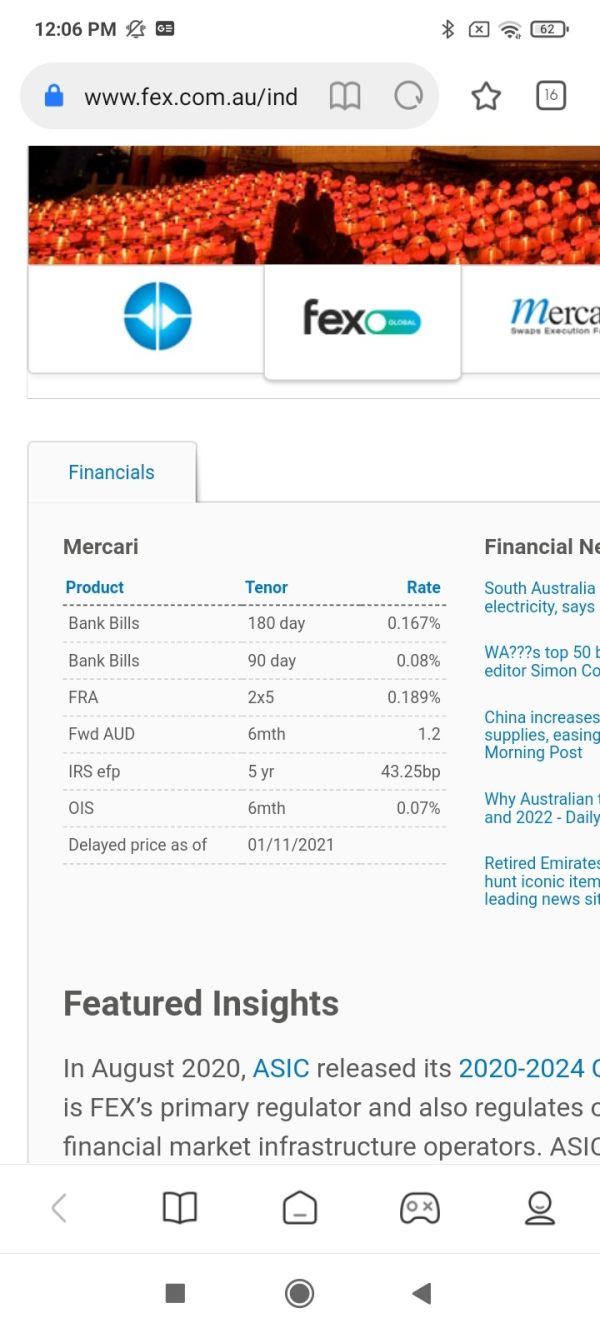

Available information shows that FEX Global focuses mainly on providing access to specialized commodity markets. The company positions itself as an intermediary for energy, environmental, and commodity futures and options contracts. This specialization in commodity contracts may attract traders with specific interest in energy markets and environmental trading instruments, but the company's operational framework and regulatory compliance remain areas of significant concern based on available user feedback and regulatory status verification.

Trading Assets and Platform Information:

FEX Global's main offerings include energy futures, environmental contracts, and various commodity options. The specific trading platform information was not detailed in available resources, which raises questions about transparency and operational clarity. The broker focuses on commodity markets, which suggests a specialized approach, though the lack of comprehensive platform details may concern potential traders seeking detailed technical specifications.

This fex global review must emphasize that the broker's unregulated status significantly impacts its credibility and operational legitimacy within the global financial services industry.

Regulatory Status: FEX Global operates without regulatory oversight from recognized financial authorities. This presents substantial risks for potential clients. The absence of regulatory supervision means traders lack standard investor protections typically provided by licensed brokers.

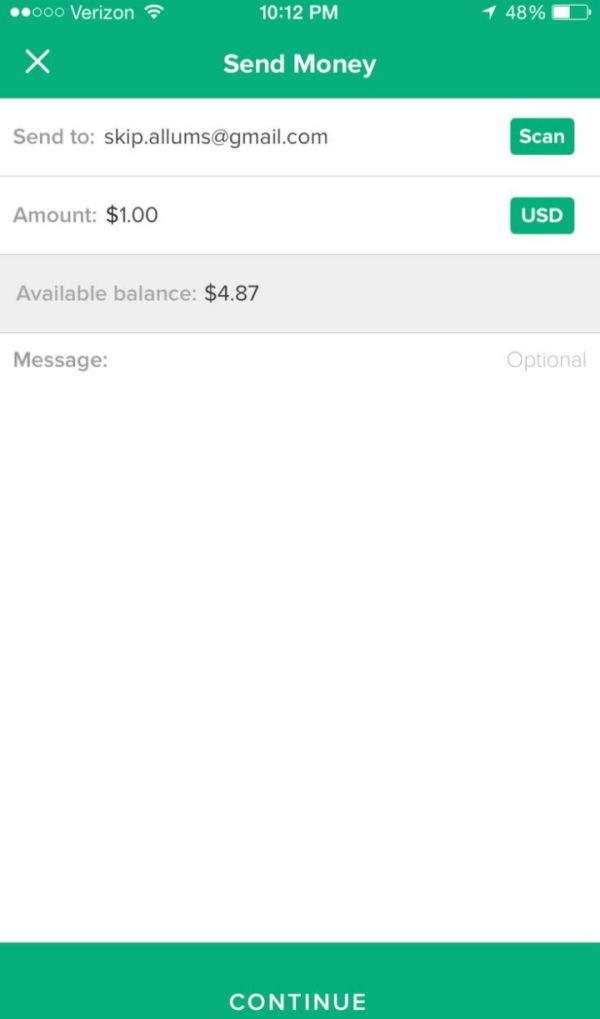

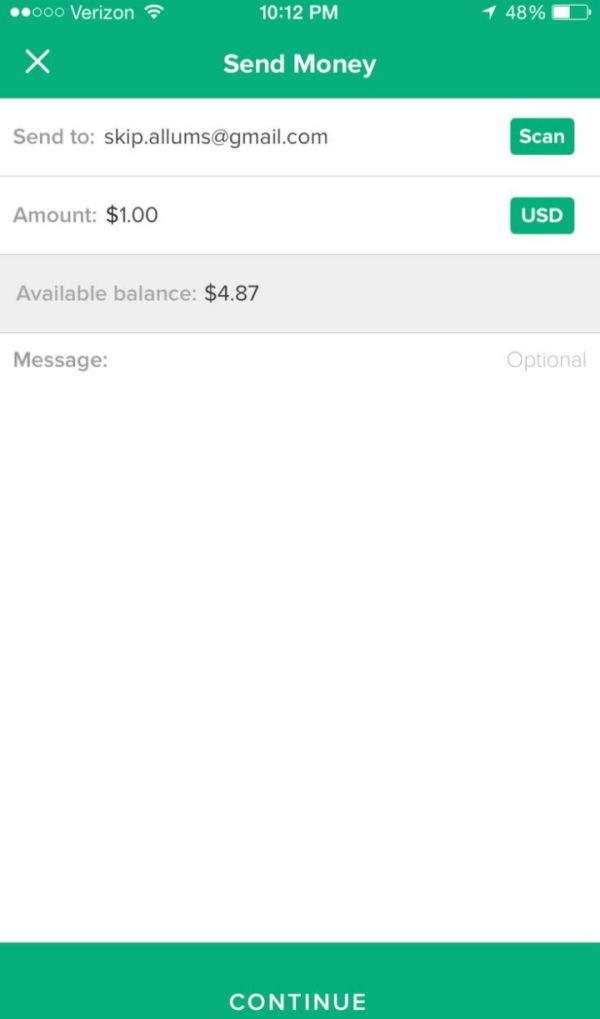

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options was not detailed in available resources. This indicates a lack of transparency in financial operations procedures.

Minimum Deposit Requirements: The minimum deposit requirements were not specified in available documentation. This represents a significant transparency gap for potential clients evaluating account opening procedures.

Promotional Offers: Details about bonus structures or promotional offers were not mentioned in available resources. This suggests either absence of such programs or inadequate marketing transparency.

Available Trading Assets: The broker primarily focuses on energy, environmental, and commodity futures and options contracts. This specialized approach makes FEX Global different from broader-spectrum brokers but may limit trading opportunities for diverse portfolio strategies.

Cost Structure: Specific information about spreads, commissions, and fee structures was not detailed in available resources. This represents another transparency concern for potential traders evaluating cost-effectiveness.

Leverage Options: Leverage ratios and margin requirements were not specified in available documentation. This is crucial information typically provided by legitimate brokers.

Platform Selection: Detailed trading platform specifications were not mentioned in available resources. This raises questions about technological capabilities and user interface quality.

This fex global review highlights significant information gaps that potential clients should consider when evaluating broker selection criteria.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

FEX Global's account conditions present several concerning transparency issues. These issues significantly impact the overall user experience. The lack of detailed information about account types, minimum deposit requirements, and specific account features creates uncertainty for potential traders trying to evaluate the broker's offerings.

Available user feedback shows that account opening procedures appear to lack the clarity and transparency typically expected from legitimate financial services providers. The absence of clearly defined account tiers, trading conditions, and fee structures represents a significant deficiency in operational transparency. Users have reported difficulties in getting comprehensive information about account specifications, which raises concerns about the broker's commitment to client transparency.

The account verification process and documentation requirements were not clearly outlined in available resources. This may indicate inadequate compliance procedures. Professional brokers typically provide detailed account condition information to ensure regulatory compliance and client understanding, but the lack of such transparency in this fex global review analysis suggests potential operational deficiencies.

Regulated brokers maintain detailed account condition transparency, but FEX Global's approach appears significantly lacking compared to them. The absence of clear account specifications may indicate operational challenges or deliberate opacity that could disadvantage potential clients.

FEX Global's trading tools and resources profile presents a mixed assessment based on available information. The broker claims specialization in commodity futures and options contracts, but the specific details about trading tools, analytical resources, and educational materials remain largely unspecified in available documentation.

The broker focuses on energy and environmental commodity contracts, which suggests some level of specialized market access. This could be valuable for traders specifically interested in these sectors, but the absence of detailed information about research capabilities, market analysis tools, and educational resources indicates potential deficiencies in comprehensive trader support services.

User feedback suggests limited availability of essential trading tools and analytical resources compared to industry standards. The lack of detailed platform specifications and tool descriptions raises questions about the broker's technological capabilities and commitment to providing comprehensive trading support.

Educational resources and market analysis materials appear to be limited or inadequately promoted. This could disadvantage traders seeking to develop their market knowledge and trading skills. Professional brokers typically offer extensive educational libraries, market analysis, and trading guides to support client development.

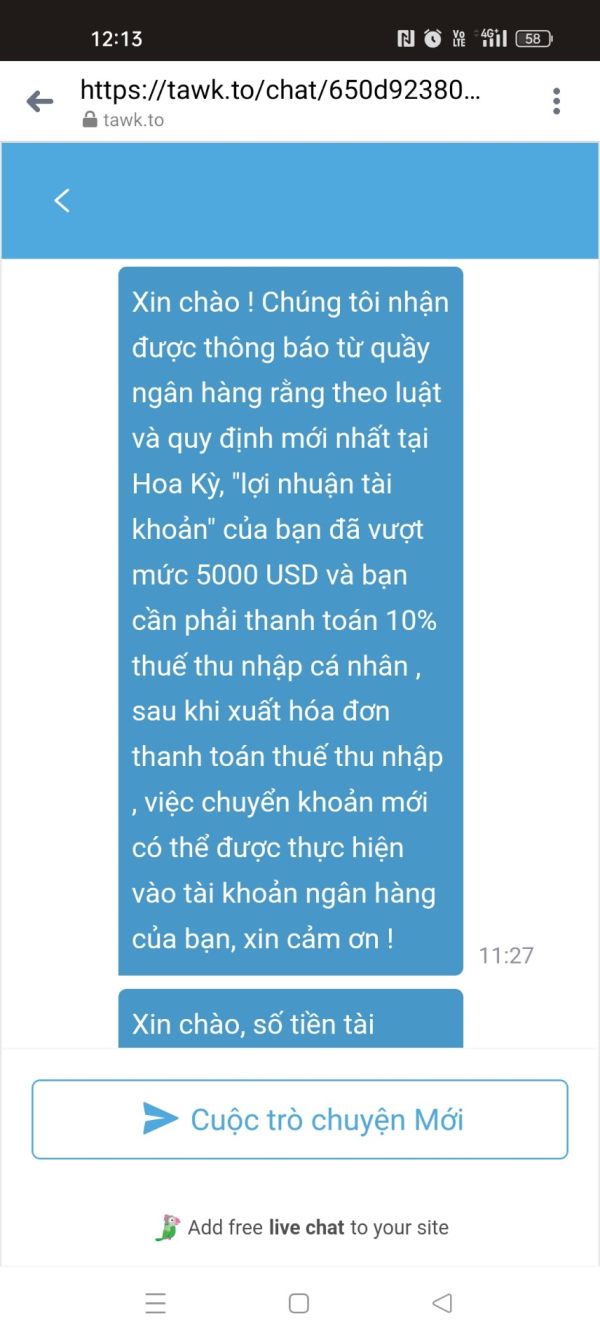

Customer Service Analysis (Score: 3/10)

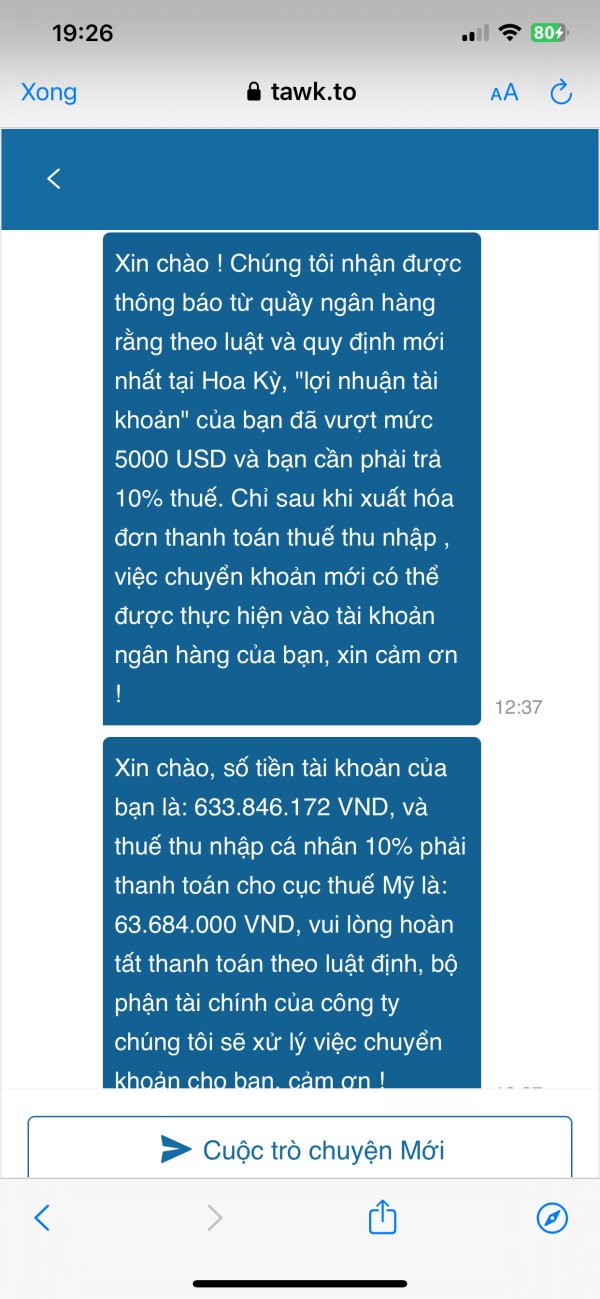

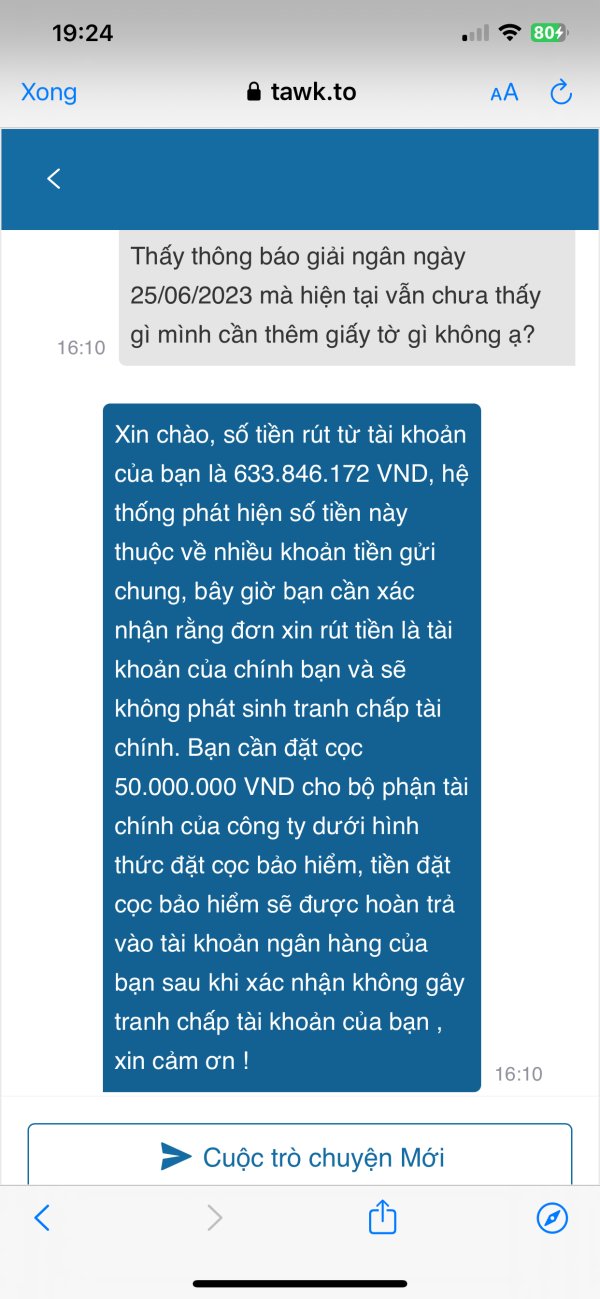

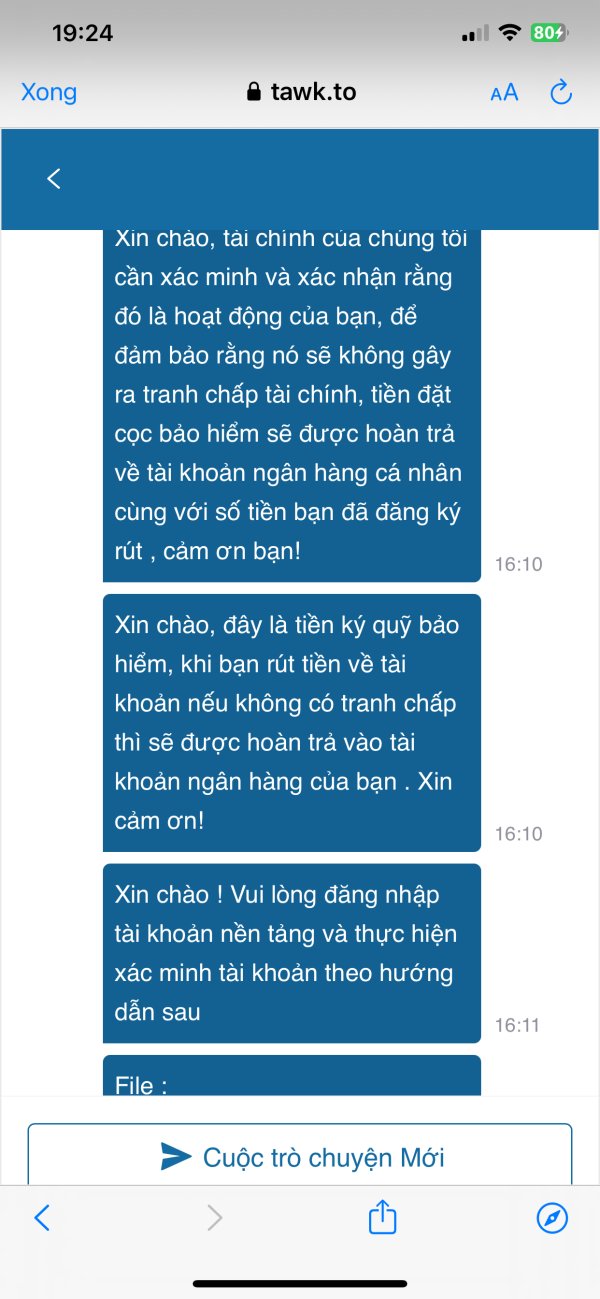

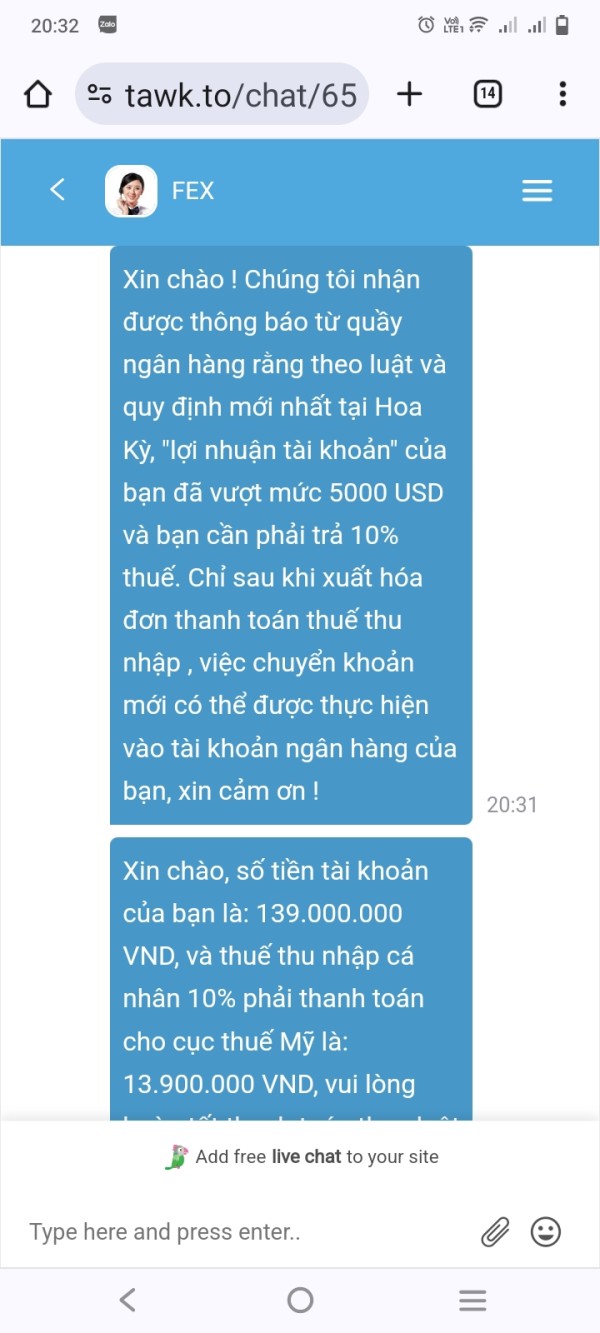

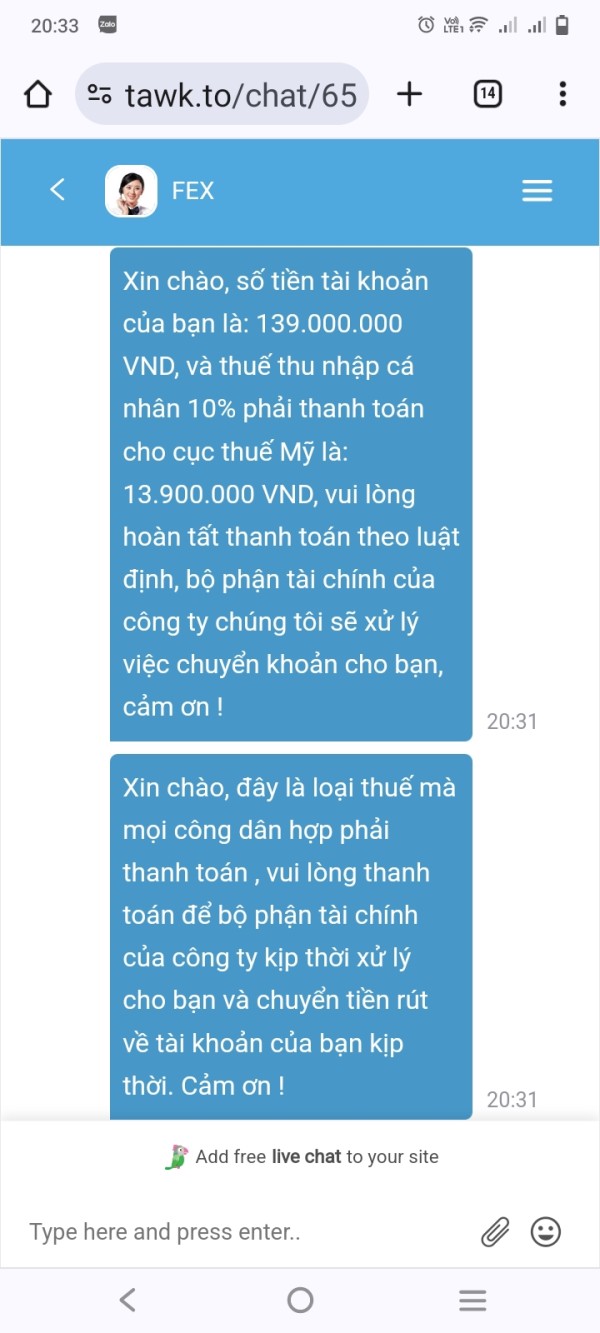

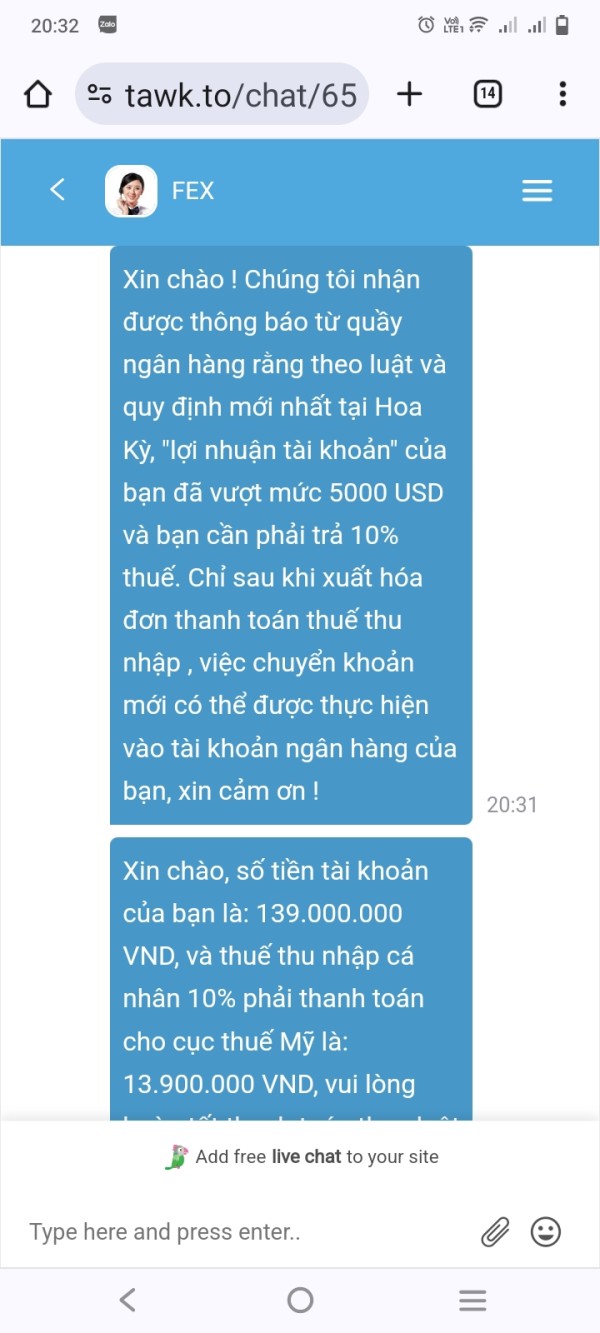

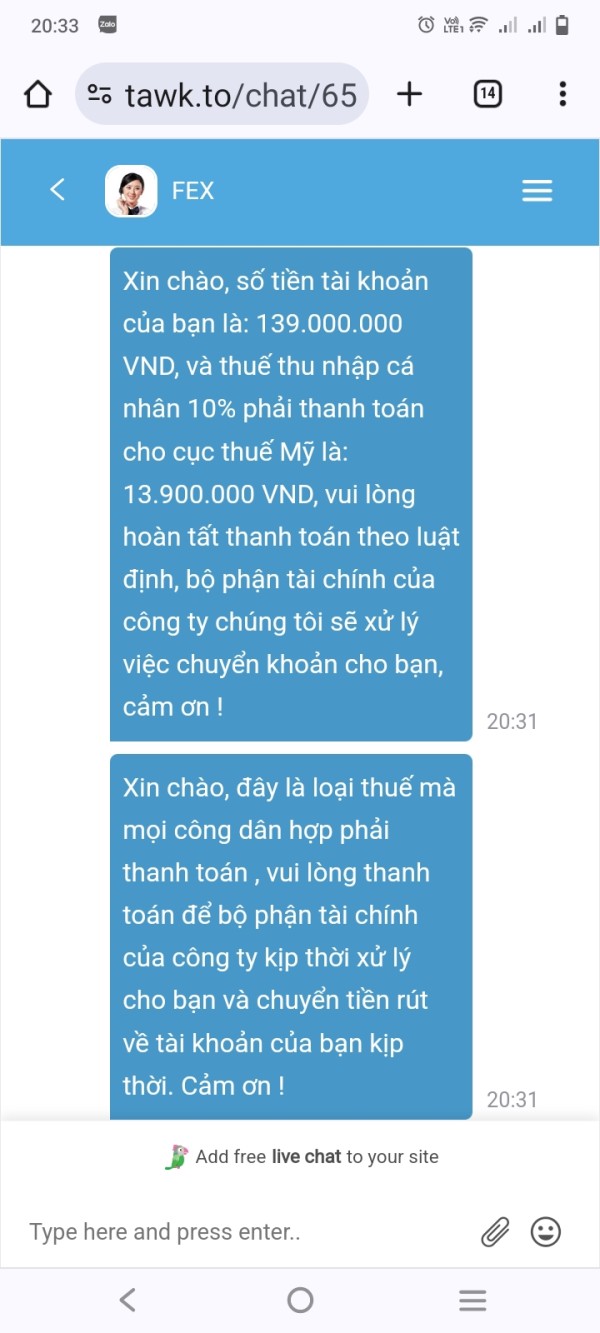

Customer service quality emerges as a significant concern in user feedback analysis. Multiple reports indicate inadequate support responsiveness and professional service standards. Available user reviews consistently highlight challenges in getting timely and effective customer support, which represents a critical operational deficiency.

Response times for customer inquiries appear to be substantially longer than industry standards. Users report delays in receiving support for account-related issues and trading concerns. The quality of customer service interactions has been criticized for lacking professional expertise and comprehensive problem-solving capabilities.

Communication channels and availability information were not clearly specified in available resources. This may indicate limited customer support infrastructure. Professional brokers typically maintain multiple communication channels including phone, email, live chat, and comprehensive FAQ sections to ensure adequate client support.

The absence of detailed customer service specifications, combined with negative user feedback about support quality, suggests significant deficiencies in client service operations. Users have reported frustration with the level of professional expertise and problem resolution effectiveness provided by customer service representatives.

Trading Experience Analysis (Score: 4/10)

The trading experience evaluation reveals several areas of concern based on available user feedback and operational transparency analysis. Platform stability and execution quality information was not detailed in available resources. This raises questions about the technical reliability of trading operations.

User feedback about trading experience varies significantly, with some reports indicating challenges in order execution and platform functionality. The absence of detailed platform specifications and performance metrics makes it difficult to assess the actual quality of trading infrastructure and execution capabilities.

Mobile trading capabilities and platform accessibility information were not specified in available documentation. This may indicate limited technological development or inadequate platform modernization. Contemporary traders typically expect comprehensive mobile trading solutions and cross-platform compatibility.

The lack of detailed trading environment information represents a significant transparency gap, including execution speeds, platform features, and trading tools integration. This fex global review emphasizes that comprehensive trading experience evaluation requires detailed platform specifications that appear to be lacking in available resources.

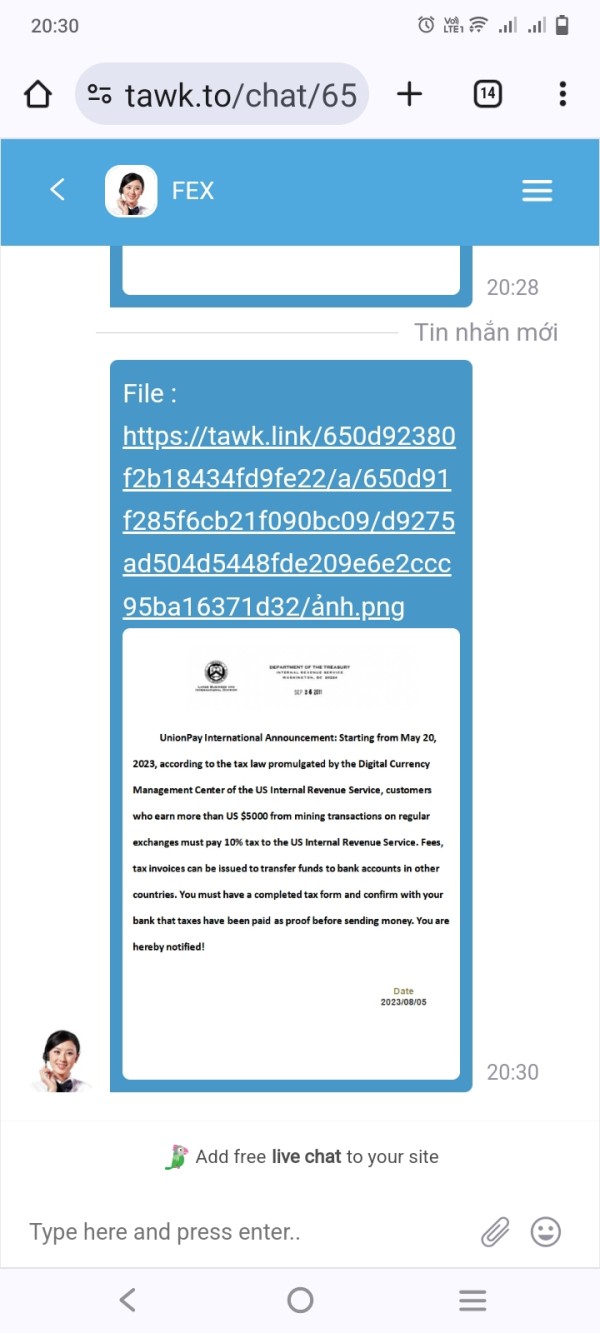

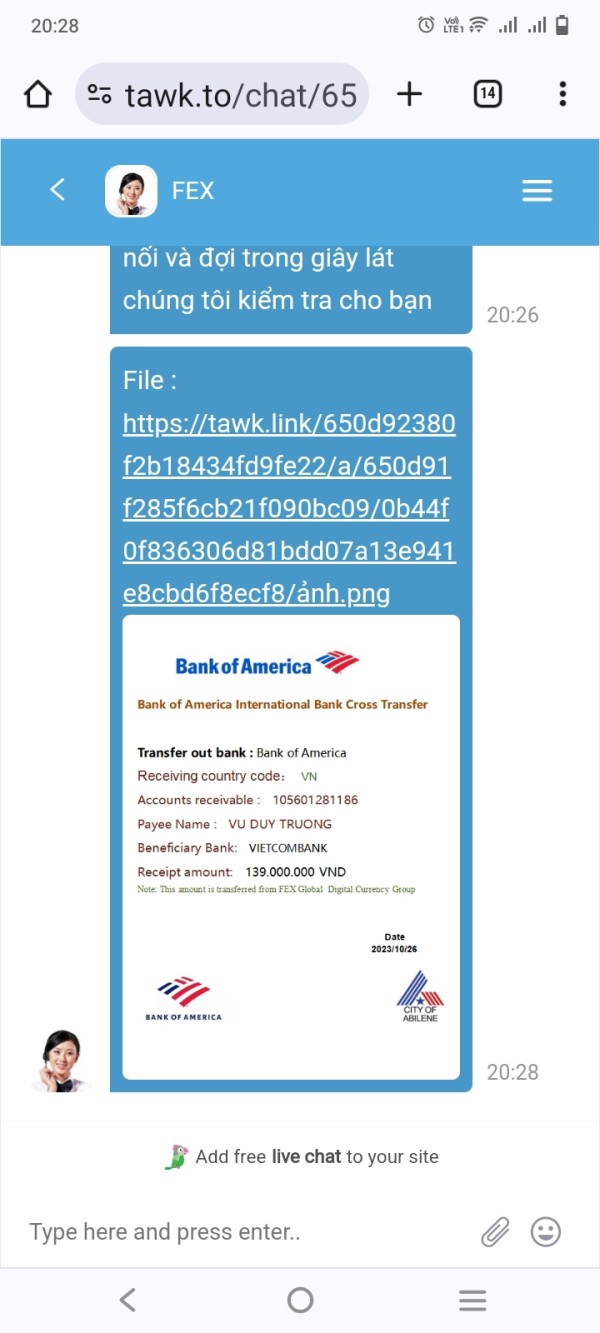

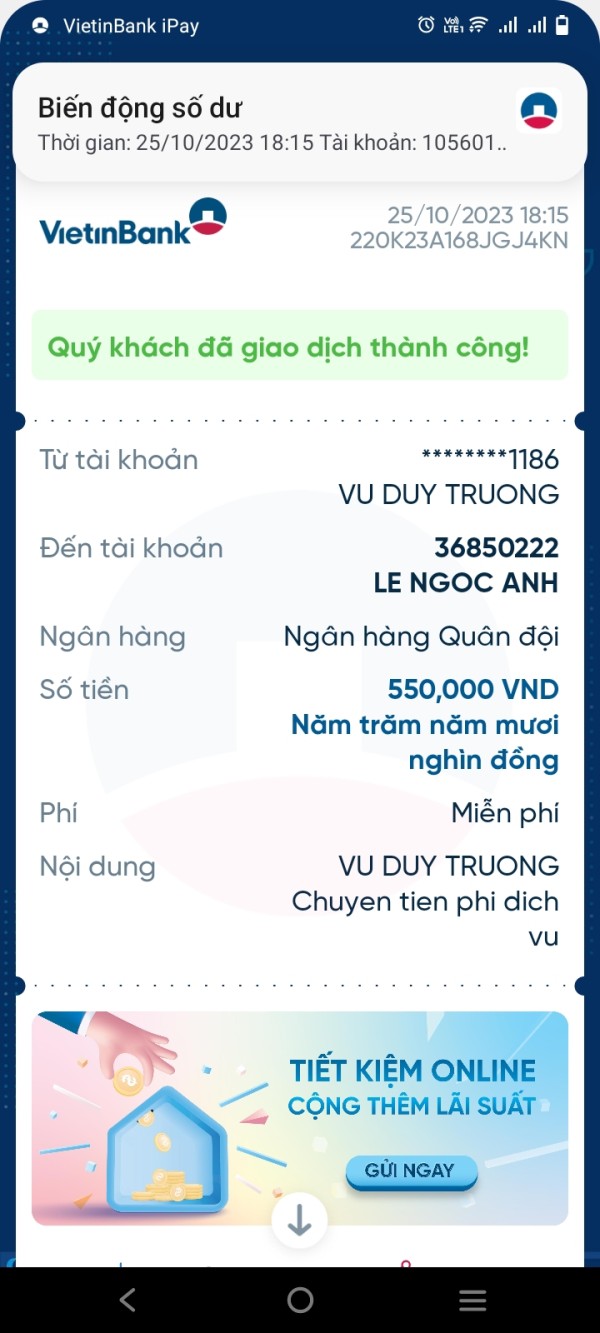

Trustworthiness Analysis (Score: 2/10)

Trustworthiness represents the most significant concern in this evaluation. This is primarily due to FEX Global's unregulated status and the prevalence of negative user feedback. The absence of regulatory oversight eliminates standard investor protections and regulatory compliance requirements that legitimate brokers must maintain.

Fund security measures and client protection protocols were not detailed in available resources. This raises serious concerns about asset safety and operational integrity. Regulated brokers typically maintain segregated client accounts, regulatory capital requirements, and comprehensive insurance coverage to protect client interests.

Company transparency about financial reporting, operational procedures, and regulatory compliance appears significantly limited. Basic company information such as establishment date and location is available, but comprehensive operational transparency remains inadequate for thorough trustworthiness assessment.

The predominance of negative user reviews and exposure reports significantly impacts the broker's reputation and credibility within the financial services industry. These negative feedback patterns suggest systematic operational issues that may affect client satisfaction and financial security.

User Experience Analysis (Score: 3/10)

Overall user satisfaction analysis reveals predominantly negative feedback patterns. These patterns significantly impact the user experience assessment. The majority of available user reviews express dissatisfaction with various aspects of the broker's services, including operational transparency, customer support, and trading conditions.

User interface design and platform usability information were not detailed in available resources. This makes it challenging to assess the actual user experience quality. Modern trading platforms typically emphasize intuitive design, comprehensive functionality, and seamless user interaction capabilities.

Registration and account verification processes appear to lack the clarity and efficiency expected by contemporary traders. User feedback suggests challenges in navigating account opening procedures and getting necessary information for informed decision-making.

The target user profile appears to be traders specifically interested in commodity contracts, particularly in energy and environmental sectors. However, the negative feedback patterns suggest that even traders with specialized interests may encounter significant challenges with the broker's services, so potential improvements should focus on enhanced transparency, improved customer support, and comprehensive operational clarity.

Conclusion

This comprehensive fex global review reveals significant concerns about the broker's operational transparency, regulatory compliance, and overall service quality. FEX Global's unregulated status represents a fundamental risk factor that potential traders must carefully consider before engaging with the platform.

The broker's specialization in energy and environmental commodity contracts may appeal to traders with specific market interests, but the predominance of negative user feedback and lack of regulatory oversight suggest substantial risks. The broker may be suitable for experienced traders specifically seeking commodity market access, though extreme caution is advised given the operational concerns identified.

The primary advantages include specialized commodity market focus and established operational history since 2007. However, significant disadvantages include unregulated status, negative user feedback patterns, limited operational transparency, and inadequate customer service quality, so potential traders should prioritize regulated alternatives that offer comprehensive investor protections and transparent operational standards.