Royal Trading FX 2025 Review: Everything You Need to Know

Executive Summary

This detailed royal trading fx review looks at a forex broker registered in Saint Vincent and the Grenadines that offers trading services with leverage up to 1:1000. Royal Trading FX says it provides multiple tradeable financial instruments, including forex pairs, contracts for difference, and other derivatives. The broker features floating spreads starting from 0.1 pips. It supports both MT4 and web-based trading platforms.

The platform targets traders seeking high leverage opportunities and access to diverse financial instruments. Our analysis shows mixed user feedback, with some traders expressing concerns about the broker's credibility. The lack of detailed regulatory information creates uncertainty about the broker's overall reliability. Limited transparency regarding company background also adds to these concerns. According to available data from WikiBit, Royal Trading FX has received positive reviews alongside neutral feedback. However, specific user concerns about trustworthiness have been documented.

Based on current available information, Royal Trading FX presents a neutral overall assessment. The broker offers competitive trading conditions but lacks the comprehensive regulatory framework expected from top-tier brokers. Transparency also falls short of industry standards.

Important Disclaimers

Due to Royal Trading FX's registration in Saint Vincent and the Grenadines, traders should know that regulatory standards may differ significantly from those in major financial jurisdictions such as the UK, EU, or Australia. Saint Vincent and the Grenadines operates under different regulatory frameworks. These may not provide the same level of investor protection as more established financial regulatory bodies.

This review is based on publicly available information and user feedback collected from various sources, including WikiBit and other industry platforms. We have not conducted independent verification of all claims made by the broker. Traders should perform their own due diligence before making any investment decisions. The information presented reflects the current state of available data. Details may change as more information becomes available.

Rating Framework

Broker Overview

Royal Trading FX Ltd operates as a forex and CFD broker. Specific information about its establishment date remains unclear in available documentation. The company claims to provide access to multiple tradeable financial instruments. It positions itself within the competitive online trading sector. However, detailed information about the company's headquarters location and corporate structure is not readily available in current public sources.

The broker's business model centers on providing retail traders with access to forex markets, contracts for difference, and various derivative products. Royal Trading FX emphasizes high leverage trading opportunities. This appeals to traders who seek to maximize their market exposure with relatively smaller capital requirements.

The platform supports MT4 trading software alongside proprietary web-based trading solutions. This caters to both experienced traders familiar with MetaTrader and those preferring browser-based trading environments. The broker offers forex pairs, CFDs, and other derivative instruments. However, the complete asset inventory is not comprehensively detailed in available materials. Notably, specific information about regulatory oversight from established financial authorities is not prominently featured in current royal trading fx review materials. This may concern traders prioritizing regulatory compliance.

Regulatory Jurisdiction: Royal Trading FX operates under registration in Saint Vincent and the Grenadines. However, specific details about regulatory oversight from established financial authorities are not clearly documented in available sources.

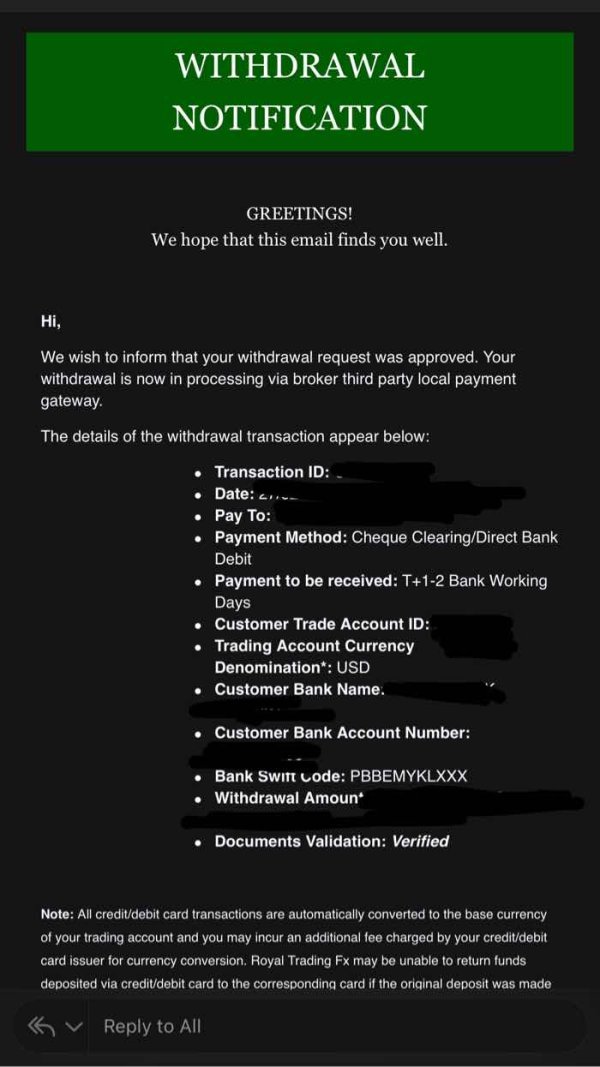

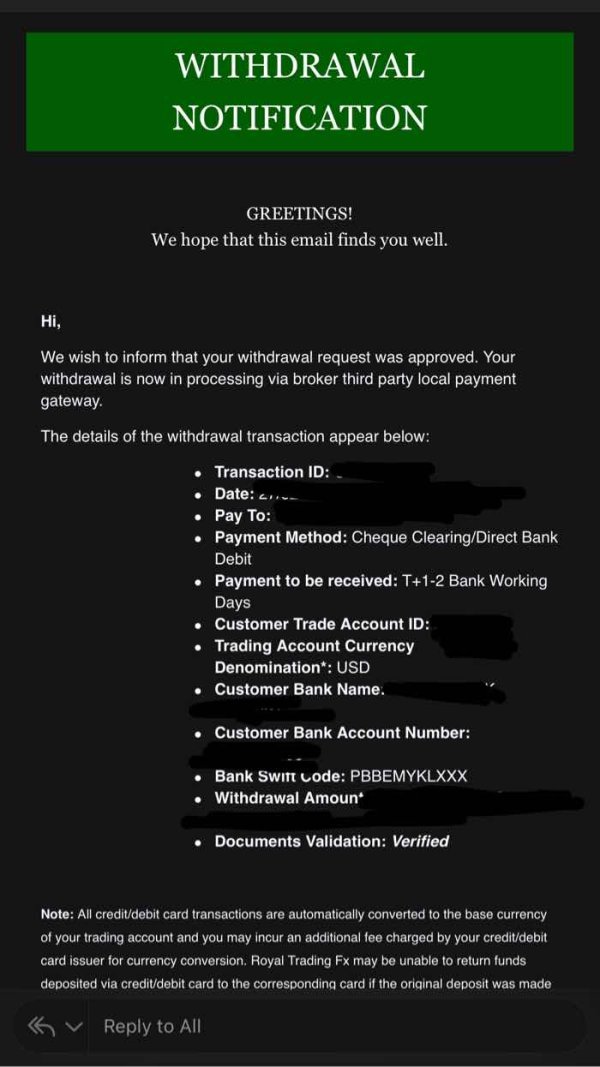

Deposit and Withdrawal Methods: Current available information does not provide comprehensive details about supported payment methods. Processing times and associated fees for deposits and withdrawals are also not specified.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not detailed in the available documentation reviewed for this analysis.

Bonus and Promotional Offers: Information about welcome bonuses, promotional campaigns, or trading incentives is not specified in current available materials.

Tradeable Assets: The broker provides access to forex currency pairs, contracts for difference, and various derivative instruments. However, the complete range of available assets requires further clarification.

Cost Structure: Royal Trading FX offers floating spreads beginning at 0.1 pips, which appears competitive within the industry. However, detailed information about commission structures, overnight fees, and other trading costs is not comprehensively available in current sources.

Leverage Options: The platform provides leverage up to 1:1000. This represents significant market exposure potential for traders.

Platform Options: Traders can access markets through MetaTrader 4 and web-based trading platforms. This provides flexibility for different trading preferences.

Geographic Restrictions: Specific information about jurisdictions where services may be restricted is not detailed in available documentation.

Customer Support Languages: Details about multilingual support options are not specified in current royal trading fx review materials.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

Royal Trading FX's account conditions receive an average rating due to limited transparency regarding account structures and requirements. The absence of detailed information about different account tiers, minimum deposit requirements, and specific features available to various client categories creates uncertainty for potential traders. While the broker advertises competitive trading conditions, the lack of comprehensive account documentation makes it difficult to assess the true value proposition.

The evaluation is further complicated by insufficient information about account opening procedures. Verification requirements and time frames for account activation are also unclear. Traders typically expect clear documentation about what each account type offers, including differences in spreads, commissions, and available features. Without this transparency, it becomes challenging for traders to make informed decisions about which account structure best suits their trading needs.

User feedback regarding account opening experiences is limited in available sources. This makes it difficult to assess the practical aspects of establishing a trading relationship with Royal Trading FX. The broker would benefit from providing more detailed account information to improve transparency and help potential clients understand their options. This royal trading fx review finds that enhanced account documentation would significantly improve the overall assessment in this category.

The broker receives an above-average rating for tools and resources primarily due to its support for MetaTrader 4. MT4 is considered an industry-standard platform. MT4 provides traders with comprehensive charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors. The inclusion of web-based trading platforms adds flexibility for traders who prefer browser-based access without software downloads.

However, the evaluation is limited by insufficient information about additional trading tools, research resources, and educational materials. Modern traders often expect access to market analysis, economic calendars, trading signals, and educational content to support their trading decisions. The absence of detailed information about these supplementary resources prevents a higher rating in this category.

The quality and reliability of the provided platforms cannot be fully assessed based on available user feedback. Specific technical performance data is not readily available. While MT4 support is positive, the overall tools and resources offering would benefit from more comprehensive documentation about available features, research capabilities, and educational support materials.

Customer Service and Support Analysis (4/10)

Customer service receives a below-average rating primarily due to documented user concerns about the broker's credibility. Limited information about support infrastructure also contributes to this rating. According to available user feedback, some traders have expressed skepticism about Royal Trading FX's reliability, which directly impacts confidence in customer support quality.

The assessment is hindered by insufficient information about available support channels, response times, and service quality metrics. Professional forex brokers typically provide multiple contact methods including live chat, email, and phone support with clearly documented availability hours. The absence of detailed support information in available materials suggests potential gaps in customer service infrastructure.

Multilingual support capabilities are not specified in current documentation. This may limit accessibility for international traders. Response time expectations and problem resolution procedures are also not clearly outlined, creating uncertainty about the level of support traders can expect. User feedback about actual support experiences is limited. This makes it difficult to assess real-world service quality.

Trading Experience Analysis (7/10)

Royal Trading FX achieves a good rating for trading experience primarily due to competitive floating spreads starting at 0.1 pips and high leverage options up to 1:1000. These conditions can facilitate cost-effective trading and provide significant market exposure opportunities for active traders. The support for MetaTrader 4 contributes positively to the trading experience, as this platform is widely recognized for its reliability and comprehensive functionality.

The availability of both MT4 and web-based platforms provides flexibility for different trading preferences and technical requirements. Traders can choose between downloading dedicated software or accessing markets through web browsers, depending on their specific needs and device capabilities.

However, the evaluation is limited by insufficient information about order execution quality, platform stability, and mobile trading capabilities. Modern traders expect fast order execution, minimal slippage, and reliable platform performance during volatile market conditions. Without detailed technical performance data or comprehensive user feedback about actual trading experiences, it's challenging to provide a complete assessment of the trading environment quality. This royal trading fx review notes that more detailed performance metrics would enhance the evaluation.

Trust and Reliability Analysis (3/10)

Trust and reliability receive the lowest rating due to several concerning factors. The lack of clear regulatory oversight from established financial authorities creates significant uncertainty about investor protection and operational standards. While the broker is registered in Saint Vincent and the Grenadines, this jurisdiction does not provide the same level of regulatory scrutiny as major financial centers.

User feedback includes warnings about potential credibility issues. Some traders have expressed concerns about the broker's legitimacy. These concerns significantly impact the overall trust assessment, as trader confidence is fundamental to successful broker-client relationships. The absence of detailed company background information, including corporate history and financial transparency, further contributes to uncertainty.

The lack of information about client fund protection measures adds to reliability concerns. These measures include segregated accounts and compensation schemes. Established brokers typically provide clear documentation about how client funds are protected and what recourse is available in case of operational difficulties. Without this transparency, traders face increased risk when depositing funds with the broker.

User Experience Analysis (5/10)

User experience receives an average rating based on mixed feedback patterns. Available sources indicate a balance between positive and neutral reviews. According to WikiBit data, Royal Trading FX has received both positive feedback and neutral assessments, suggesting varied user experiences. However, the limited volume of detailed user feedback makes it difficult to identify consistent patterns in user satisfaction.

The broker's offering of high leverage and competitive spreads may appeal to traders seeking aggressive trading strategies. However, concerns about credibility impact overall user confidence. The availability of familiar platforms like MT4 contributes positively to user experience, as traders can utilize well-known interfaces and functionality.

However, insufficient information about user interface design, ease of navigation, and overall platform usability limits the assessment. Modern traders expect intuitive platform design, efficient order placement procedures, and streamlined account management features. The absence of detailed user feedback about these practical aspects prevents a more comprehensive evaluation. Enhanced user testimonials and detailed platform demonstrations would improve the assessment of user experience quality.

Conclusion

Royal Trading FX presents a mixed proposition for forex traders. The broker offers competitive trading conditions including high leverage up to 1:1000 and tight spreads starting from 0.1 pips, alongside support for the popular MT4 platform. However, significant concerns about regulatory transparency and user trust issues prevent a strong overall recommendation.

The broker may appeal to experienced traders who prioritize competitive trading conditions and high leverage opportunities while accepting higher risk levels associated with less regulated jurisdictions. However, traders seeking comprehensive regulatory protection and transparent corporate governance may find better alternatives in more established markets.

The main advantages include competitive spreads and high leverage options. Significant disadvantages encompass limited regulatory oversight, concerns about credibility, and insufficient transparency regarding company operations and client protection measures.