Is HYZQ safe?

Pros

Cons

Is Hyzq Safe or Scam?

Introduction

Hyzq is a forex broker that has garnered attention in the trading community, primarily for its low service charges and the promise of high returns. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is often rife with scams and unregulated entities, making it imperative for traders to assess the legitimacy of brokers like Hyzq. This article seeks to evaluate whether Hyzq is a safe trading platform or if it poses potential risks to investors. Our investigation will be based on an analysis of regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

One of the first indicators of a broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards and practices. Unfortunately, Hyzq currently operates without any valid regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation is a significant red flag. In the forex industry, brokers that are not regulated can engage in practices that may harm traders, such as manipulating prices or denying withdrawals. Without oversight from reputable regulatory bodies, traders have minimal recourse in the event of disputes or fraudulent activities.

Additionally, reports indicate that Hyzq has been associated with high-risk business practices, including alleged complaints of clients being unable to withdraw their funds. This lack of regulatory framework raises concerns about the overall safety of trading with Hyzq.

Company Background Investigation

Hyzq is registered in China and has been operational for several years. However, details about its ownership structure and management team are scarce, which raises questions about transparency. A broker's history and the experience of its management team are crucial for assessing its credibility.

The company's website lacks comprehensive information about its founders and key personnel, making it challenging for potential clients to gauge the expertise and reliability of those managing their investments. Furthermore, the lack of transparency can often indicate a broker's unwillingness to adhere to ethical business practices.

In summary, while Hyzq has been in the market for some time, its opaque ownership and management structure, combined with the absence of regulatory oversight, cast doubt on its legitimacy.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is vital. Hyzq claims to offer competitive trading conditions, but the lack of transparency regarding its fee structure is concerning.

| Fee Type | Hyzq | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information about spreads and commissions can lead to unexpected costs for traders. Additionally, several users have reported hidden fees, which can significantly affect trading profitability.

Given the potential for undisclosed charges, traders should approach Hyzq with caution and consider the impact these fees may have on their overall trading experience.

Client Fund Security

Client fund security is paramount in the forex trading environment. A reputable broker should have robust measures in place to protect client funds. Unfortunately, Hyzq's lack of regulatory oversight raises serious concerns about the safety of client deposits.

The broker's website does not provide adequate information regarding fund segregation, investor protection, or negative balance protection policies. These elements are essential for ensuring that traders' funds are safe from potential broker insolvency or misconduct.

Moreover, historical complaints suggest that some clients have faced challenges in withdrawing their funds, indicating potential issues with the broker's financial practices.

In conclusion, without clear policies on fund security and a history of client complaints regarding withdrawals, it is difficult to ascertain if Hyzq is safe for trading.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability. In the case of Hyzq, numerous reviews and complaints have surfaced, indicating a troubling pattern of negative experiences among clients.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Information | Medium | Inconsistent |

| Unresponsive Support | High | Poor |

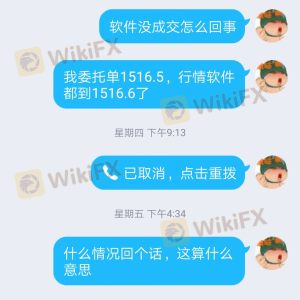

Common complaints include difficulties in withdrawing funds and unresponsive customer support. Many users have reported feeling misled by the broker's marketing tactics, which promised low fees and high returns but failed to deliver satisfactory service.

In some cases, clients have reported being unable to access their accounts or retrieve their funds, leading to significant financial losses. These recurring issues raise serious questions about the broker's integrity and commitment to customer service.

Platform and Trade Execution

The trading platform's performance and the quality of trade execution are critical factors for any trader. Hyzq's platform has received mixed reviews, with some users noting issues with stability and execution speed.

Traders have reported instances of slippage and order rejections, which can negatively impact trading outcomes. Additionally, the lack of transparency regarding the platform's technology and execution policies raises concerns about potential manipulative practices.

A reliable trading platform should provide users with a seamless experience, but the reported issues with Hyzq suggest that traders may face challenges when executing their strategies.

Risk Assessment

Using Hyzq for trading comes with inherent risks. The absence of regulation, coupled with a history of customer complaints and unclear trading conditions, contribute to a higher risk profile for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Complaints about fund withdrawals |

| Operational Risk | Medium | Issues with platform stability |

To mitigate risks, traders should consider starting with a small investment, if they choose to trade with Hyzq. Additionally, they should closely monitor their trading activities and be prepared to withdraw funds quickly if issues arise.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hyzq poses significant risks to traders. The lack of regulatory oversight, combined with a troubling history of customer complaints and unclear trading conditions, raises serious concerns about the broker's legitimacy.

For traders seeking a safe trading environment, it is advisable to consider alternative brokers that are regulated by reputable authorities and demonstrate a commitment to transparency and customer service. Some recommended alternatives include brokers regulated by the FCA, ASIC, or CFTC, which offer a higher level of investor protection and reliability.

In summary, potential clients should be cautious and conduct thorough research before engaging with Hyzq, as the current indicators suggest that it may not be a safe option for forex trading.

Is HYZQ a scam, or is it legit?

The latest exposure and evaluation content of HYZQ brokers.

HYZQ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HYZQ latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.