Is R Wadiwala safe?

Pros

Cons

Is R Wadiwala Safe or Scam?

Introduction

R Wadiwala Securities is a private brokerage firm based in Surat, Gujarat, India, established in 2005 by Nainish Wadiwala. It positions itself as a full-service broker offering a range of investment services, including stock and forex trading. The forex market is notoriously competitive and fraught with risks, making it essential for traders to thoroughly evaluate their brokers before committing funds. A careful assessment of a broker's legitimacy, regulatory compliance, and service quality can significantly impact a trader's experience and financial outcomes. This article investigates the credibility of R Wadiwala Securities, employing a structured evaluation framework that encompasses regulatory status, company background, trading conditions, customer safety, user experiences, and risk assessments.

Regulation and Legitimacy

Understanding the regulatory status of a broker is paramount for evaluating its safety. R Wadiwala Securities is registered with the Securities and Exchange Board of India (SEBI), which is the primary regulatory body overseeing the securities market in India. This registration is crucial as it ensures that the broker adheres to specific operational standards and regulatory requirements.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SEBI | Not Disclosed | India | Verified |

The importance of regulation cannot be overstated. A regulated broker is subject to strict oversight, which helps protect investors from fraud and malpractice. R Wadiwala has been operational since 2005 and has maintained its SEBI registration, indicating a history of compliance. However, it is worth noting that the firm has been criticized for its lack of transparency in disclosing certain regulatory details, which can be a red flag for potential investors.

Company Background Check

R Wadiwala Securities has a rich history that dates back to 1943, when the Wadiwala group began its operations in equity trading. The company transitioned to a formal brokerage firm in 2005, acquiring memberships in the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). The ownership structure is private, and the firm is managed by the Wadiwala family, which has a longstanding reputation in the financial services industry.

The management team comprises professionals with extensive experience in finance and investment strategies. This depth of expertise is essential for fostering trust among clients. However, the company's transparency regarding its operational practices and financial disclosures has been called into question, which may affect investor confidence.

Trading Conditions Analysis

R Wadiwala Securities offers a variety of trading options, including forex, equities, and derivatives. The fee structure is a critical aspect of its trading conditions and can significantly impact a trader's profitability.

| Fee Type | R Wadiwala Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 3.0 pips |

| Commission Model | 0.03% for intraday trades | 0.1% - 0.5% |

| Overnight Interest Range | 5% - 10% | 3% - 5% |

R Wadiwala's commission rates are competitive, particularly for intraday trading. However, the firm charges a relatively high overnight interest, which could deter long-term traders. Additionally, some users have reported hidden fees associated with certain services, which could affect overall trading costs.

Customer Funds Safety

The safety of customer funds is a significant concern for any trader. R Wadiwala Securities maintains client funds in segregated accounts, ensuring that they are not mixed with the company's operational funds. This practice is essential for protecting investors in the event of financial difficulties faced by the broker. However, the firm does not offer additional investor protection mechanisms, such as negative balance protection, which can leave traders exposed during volatile market conditions.

Historically, R Wadiwala has not faced major controversies related to fund safety, but the lack of comprehensive safety measures could be a point of concern for risk-averse traders.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. R Wadiwala Securities has received mixed reviews from users, with some praising its customer support and trading platforms, while others have raised concerns about service quality and responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Poor Customer Service | High | Slow Response |

| Hidden Fees | Medium | Partial Resolution |

| Platform Stability Issues | High | Ongoing Improvements |

Common complaints include issues with customer service and unexpected fees. One notable case involved a trader who experienced significant delays in fund withdrawals, raising concerns about the company's operational efficiency. This mixed feedback suggests that while R Wadiwala has a solid foundation, there are areas requiring improvement.

Platform and Trade Execution

The trading platform offered by R Wadiwala is a crucial element of the trading experience. Users have reported that the platform is generally stable with a user-friendly interface. However, there are concerns regarding order execution quality, with some traders experiencing slippage during high volatility periods.

Traders should be cautious, as any indication of platform manipulation or execution issues could signal potential risks associated with trading with R Wadiwala.

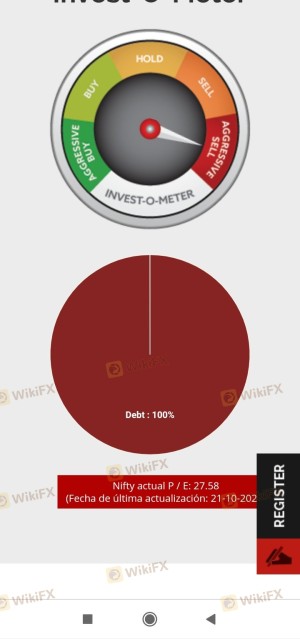

Risk Assessment

Using R Wadiwala Securities presents a range of risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | SEBI registered but lacks full transparency. |

| Fund Security | High | Limited investor protection measures. |

| Customer Service | Medium | Mixed reviews on responsiveness and support. |

To mitigate these risks, traders should consider diversifying their investments and using risk management strategies, such as setting stop-loss orders and maintaining a balanced portfolio.

Conclusion and Recommendations

In conclusion, while R Wadiwala Securities is a legitimate brokerage firm with a long history and regulatory oversight, potential traders should approach with caution. The firm exhibits several positive attributes, including a competitive fee structure and a solid foundation in the market. However, concerns regarding transparency, customer service, and fund safety warrant careful consideration.

For traders seeking a reliable broker, it may be prudent to explore alternatives that offer more robust investor protection and clearer fee structures. Brokers like Zerodha, Upstox, or ICICI Direct could provide better options, especially for those prioritizing safety and transparency in their trading activities.

In summary, while R Wadiwala is not outrightly a scam, it is essential for traders to conduct thorough research and weigh the potential risks before proceeding. Is R Wadiwala safe? The answer is complex; while it operates legally and has regulatory backing, its service quality and safety measures may not meet the expectations of all traders.

Is R Wadiwala a scam, or is it legit?

The latest exposure and evaluation content of R Wadiwala brokers.

R Wadiwala Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

R Wadiwala latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.