R Wadiwala Review 1

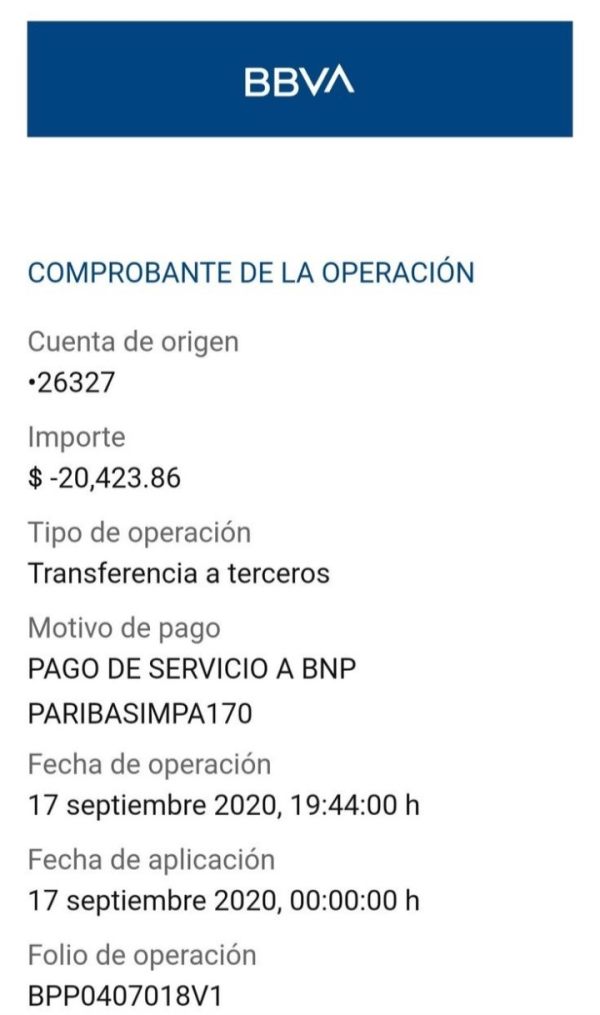

I lost all my money and they did not approve my withdrawal.

R Wadiwala Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I lost all my money and they did not approve my withdrawal.

R Wadiwala Securities is a time-tested brokerage firm located in Surat, India, with a legacy dating back to 1943. The company offers a suite of services, significantly focusing on personalized investment advisory and portfolio management, aimed at both retail investors and high-net-worth individuals (HNI). As a full-service broker, R Wadiwala is notable for its investor-centric approach, promising customized services that cater to the unique needs of its clients. However, potential investors should exercise caution due to regulatory ambiguities and a mixed reputation, particularly concerning service quality and fee structures.

The broker specifically targets investors seeking tailored investment strategies and a high level of customer service. In contrast, it is less suited for novice investors who are looking for cost-effective or low-fee brokerage solutions, given their complex fee structures and past customer service concerns. As such, those who prioritize a secure, fully regulated environment may find themselves at risk with R Wadiwala Securities.

In this review, we will analyze the brokerages operational framework, cost structure, platform usability, customer support, and overall trustworthiness to equip prospective clients with a thorough perspective on whether R Wadiwala Securities represents an investment opportunity or a potential pitfall.

Risk Statement: R Wadiwala Securities may not be the most suitable choice for investors concerned about regulatory compliance, as the firm has faced allegations of ambiguous regulatory practices and unfavorable user reviews.

Potential Harms:

How to Self-Verify:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 2 | Regulatory overhead and mixed customer reviews raise concerns about overall trustworthiness. |

| Trading Costs | 3 | Competitive trading fees for some services, but potential hidden fees complicate the cost structure. |

| Platforms & Tools | 3.5 | Variety of platforms available, though some are less user-friendly, particularly the mobile version. |

| Customer Support | 3 | Provides adequate support, but mixed reviews about responsiveness and effectiveness. |

| User Experience | 3.5 | Generally positive feedback about the overall experience aside from specific complaints regarding support and user interface. |

| Account Conditions | 4 | Minimal brokerage requirement and flexibility in account settings are beneficial for investors. |

Established in 1943, R Wadiwala Securities has become a prominent name in India's financial services landscape, particularly in Surat, Gujarat. Founded by Bachoo Bhai Wadiwala, the firm pioneered equity trading in the region, cultivating a reputation that spans generations. Under the current leadership of Nainish Wadiwala, the brokerage became an official SEBI-registered entity in 2005 and has since grown into a full-service brokerage house. The strategic positioning emphasizes trust, research-backed advice, and personalized portfolio management, catering mainly to retail and HNI clients.

R Wadiwala Securities offers a variety of investment products ranging from equities, derivatives, to portfolio management services (PMS). The brokerage has sought to incorporate advanced trading platforms, although it lacks support for popular retail trading platforms like MT4 and MT5, which might deter some users. Its regulatory classifications see them operating under the aegis of the BSE and NSE, albeit with concerns surrounding their unregulated brokerage status.

| Aspect | Details |

|---|---|

| Regulation | SEBI Registered, but concerns about compliance |

| Minimum Deposit | Zero margin required for account opening |

| Leverage | Up to 6x for intraday trading |

| Major Fees | 0.29% for equity delivery, 0.03% for intraday |

| Annual Charges | Demat AMC: ₹290; Trading AMC: ₹250 |

| Customer Support | Responsive but mixed reviews |

R Wadiwala Securities operates in an environment characterized by regulatory scrutiny. While it holds SEBI registration, reviews indicate concerns regarding compliance and the clarity of user data protection. User testimonials reflect worries:

“Very third class service, nobody can observe your portfolio, nobody can give proper answers.”

— User Review

These sentiments illuminate potential risks that investors may face when entrusting their finances to the brokerage.

To ensure a safer trading environment, users should take the following steps:

Overall, while a fraction of testimonials highlight R Wadiwala Securities as credible and client-oriented, a notable portion raises alarms regarding questionable practices, which investors should consider before engaging.

R Wadiwala Securities presents a competitive fee structure with low commission rates, especially in intraday trading, making it attractive. As highlighted in their execution details:

However, the brokerages cost structure may be marred by hidden fees that have led to unhappy customer feedback about unexpected financial burdens. One user reported:

“They have very deep of understanding of securities market, but hidden charges make it risky.”

— User Review

Such sentiments emphasize the importance of scrutinizing non-trading related fees, including:

The strategically competitive brokerage rates can serve well for cost-conscious traders, but the emergence of hidden fees poses significant risks, particularly for long-term investors.

R Wadiwala Securities provides access to various trading platforms, catering to a range of trading preferences. Specifically, the following platforms are available:

The brokerage offers various analytical tools and research insights but has room for improvement in terms of offering more educational resources for beginners. The user interface has been described as navigable, but certain elements could benefit from simplification for novice traders.

Feedback highlights a divide among users regarding platform usability. While many find the tools helpful:

“I just use the app to track the market rates and my holdings, very simplistic and user-friendly experience.”

— User Review

Conversely, issues related to the mobile interface and complexity of analytics are recurring complaints among less experienced users.

User experience at R Wadiwala is varied, with many praising the knowledgeable staff and advisory services, while others express dissatisfaction regarding communication and support.

R Wadiwala Securities offers customer service primarily through email and telephone support. However, the lack of a 24/7 assistance system has left some users wanting more responsive options, particularly during active trading sessions.

R Wadiwalas account conditions are favorable for both small and large investors, with no initial margin requirement for opening an account and 6x leverage available for selected trading instruments, facilitating entry for a range of investor types.

In summary, R Wadiwala Securities presents a compelling yet cautionary case for potential investors. While their offerings resonate well with seasoned investors comfortable with personalized advisory services and dynamic trading platforms, concerns about regulatory clarity, hidden fees, and user support merit careful consideration. Investors should comprehensively assess their risk tolerance and operational preferences before engaging with R Wadiwala, ensuring an informed and appropriate partnership with the brokerage firm.

FX Broker Capital Trading Markets Review