JKV 2025年评测:您需要了解的一切

Executive Summary

Our comprehensive jkv review reveals a forex broker that positions itself as a trading partner rather than a traditional brokerage firm. JKV Global presents itself as a company dedicated to simplifying the trading experience for forex traders worldwide, though this commitment requires closer examination. According to available information, JKV operates under the regulation of the Mauritius Financial Services Commission (FSC). This provides a certain level of regulatory oversight for its operations.

The broker offers what it describes as a feature-rich desktop trading platform designed to accommodate traders of all experience levels. These traders range from beginners to seasoned professionals who need advanced tools. JKV Global emphasizes its role as a "Forex success partner," providing access to multiple global financial instruments through a single trading account. The company claims to offer world-class trading platforms, dedicated customer support, and convenient deposit and withdrawal options to streamline the trading journey, though these claims need verification.

However, it's important to note that several critical aspects of JKV's operations are not clearly disclosed. These include specific account conditions, spreads, commissions, and minimum deposit requirements that remain unclear in publicly available information. This lack of transparency in key trading conditions may be a concern for potential clients seeking detailed information before making trading decisions.

The broker targets a global audience of forex traders. It positions itself as suitable for various trader types and experience levels, though specific details about account types and trading conditions require further investigation.

Important Notice

Regional Entity Differences: Due to JKV's regulation under the Mauritius Financial Services Commission (FSC), the broker's regulatory framework and legal responsibilities may vary across different jurisdictions. Traders should be aware that regulatory protections and legal recourse options may differ depending on their country of residence and the specific regulatory environment applicable to their region, which creates potential complications for international clients.

Review Methodology Disclaimer: This evaluation is based on publicly available information, official company statements, and user feedback available at the time of writing. Market conditions, regulatory requirements, and broker offerings may change over time, potentially affecting the accuracy of this assessment and requiring updated reviews. Prospective clients are advised to verify current information directly with the broker and conduct their own due diligence before making trading decisions.

Rating Framework

Broker Overview

JKV Global positions itself distinctively in the forex market by emphasizing its role as a trading partner rather than a conventional broker. According to the company's official statements, JKV Global was established with the mission to "simplify trading" for forex participants worldwide, though the execution of this mission remains to be evaluated. The company's business model focuses on providing comprehensive trading support and educational resources to help clients navigate the complexities of foreign exchange markets.

The broker's approach centers on offering what it describes as "an exclusive and lucrative opportunity to trade in a large number of global financial instruments using a single account." This multi-asset approach suggests that JKV Global aims to serve as a one-stop solution for traders interested in diversifying their portfolios across various financial markets, which could be beneficial for traders seeking convenience. The company emphasizes its commitment to providing world-class trading technology, dedicated customer support services, and streamlined financial operations to enhance the overall trading experience.

JKV Global operates under the regulatory oversight of the Mauritius Financial Services Commission (FSC). This provides a framework of financial regulation and consumer protection, though the strength of this protection may vary compared to other jurisdictions. The broker offers access to multiple global financial instruments through its trading platform, though specific details about the range of available assets, including currency pairs, CFDs, and other financial products, are not comprehensively detailed in available public information. This jkv review finds that while the company presents itself as a comprehensive trading solution, potential clients may need to contact the broker directly to obtain detailed information about specific trading conditions and available instruments, which creates an additional step in the evaluation process.

Regulatory Jurisdiction: JKV Global operates under the regulation of the Mauritius Financial Services Commission (FSC). This regulatory framework provides certain legal protections and operational standards, though the level of investor protection may vary compared to other major regulatory jurisdictions such as the FCA, ASIC, or CySEC, which are generally considered more stringent.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in the available materials. The company mentions offering "convenient deposit/withdrawal options" but does not specify which payment methods are supported or the processing times for financial transactions, leaving potential clients without crucial operational details.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with JKV Global is not specified in publicly available information. Prospective clients would need to contact the broker directly to obtain this crucial information, which adds an extra step to the evaluation process.

Bonus and Promotional Offers: No specific information about bonus programs, promotional offers, or incentive schemes is available in the current materials. This absence of promotional details may indicate either a conservative approach to marketing or limited disclosure of such programs, though both scenarios raise questions about transparency.

Tradeable Assets: JKV Global advertises access to "a large number of global financial instruments," but specific details about the types and quantities of available assets are not provided. This likely includes forex currency pairs and potentially CFDs on various underlying assets, though confirmation would require direct inquiry with the broker, which limits the ability to make informed comparisons.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not disclosed in available materials. This lack of transparency in pricing structure is a significant limitation for traders attempting to evaluate the broker's competitiveness against other market participants.

Leverage Ratios: Maximum leverage ratios offered by JKV Global are not specified in publicly available information. Given the Mauritius regulatory framework, leverage limits may differ from those imposed by other major regulatory bodies, though specific ratios remain unclear.

Platform Options: The broker emphasizes its "feature-rich desktop trading platform" designed for traders of all levels. However, information about mobile trading applications, web-based platforms, or third-party platform integrations is not detailed in available materials, which limits understanding of the full technological offering.

This jkv review reveals significant gaps in publicly available information about essential trading conditions. These gaps may require direct communication with the broker for clarification, adding complexity to the evaluation process.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of JKV Global's account conditions faces significant limitations due to the lack of publicly available information about key trading parameters. This jkv review cannot provide a comprehensive evaluation of account types, minimum deposit requirements, or specific account features based on current available materials, which creates a substantial barrier to informed decision-making.

The absence of detailed information about account structures represents a notable transparency gap. Most reputable forex brokers typically provide clear information about different account tiers, their respective minimum deposits, and associated benefits, making JKV's approach unusual in the industry. Without access to these details, potential clients cannot adequately compare JKV Global's offerings with other market participants.

Account opening procedures and verification requirements are not detailed in available sources. This makes it impossible to assess the efficiency or complexity of the onboarding process, which could be a significant factor for traders seeking quick market access. Similarly, information about specialized account types, such as Islamic accounts for Sharia-compliant trading, VIP accounts for high-volume traders, or demo accounts for practice trading, is not available.

The regulatory framework provided by the Mauritius FSC may offer certain account protections. However, the specific nature and extent of these protections are not clearly outlined, leaving potential clients uncertain about their level of security. This lack of clarity about account security measures, segregation of client funds, and compensation schemes may be concerning for risk-conscious traders seeking comprehensive protection of their investments.

JKV Global emphasizes its provision of trading tools designed to accommodate various skill levels, from novice to experienced traders. The broker's commitment to offering "feature-rich desktop applications" suggests a focus on providing comprehensive analytical and trading capabilities through its primary platform, though specific details about these features remain unclear.

The company positions itself as more than a traditional broker, describing its role as a "Forex success partner." This positioning implies a commitment to providing educational resources and trading support, though specific details about research materials, market analysis, educational content, or training programs are not detailed in available information, which limits the ability to verify these claims.

Technical analysis tools and charting capabilities are essential components of modern trading platforms. JKV Global's emphasis on feature-rich applications suggests these elements are likely included, though without specific information about the types of indicators, drawing tools, timeframe options, or advanced charting features available, it's difficult to assess the platform's analytical capabilities comprehensively. The mention of tools "suitable for various trader levels" indicates scalability in the platform's complexity, potentially offering both simplified interfaces for beginners and advanced features for experienced traders.

Automated trading support, expert advisors, or algorithmic trading capabilities are not specifically mentioned in available materials. This absence of information about advanced trading features may be concerning for sophisticated traders who rely on automated strategies or algorithmic approaches to market participation.

Customer Service and Support Analysis

Information about JKV Global's customer service infrastructure and support quality is notably limited in available materials. While the company mentions providing "dedicated customer support," specific details about support channels, availability hours, response times, and service quality are not disclosed, creating uncertainty about the level of assistance available to clients.

The absence of clear information about customer service channels represents a significant gap in transparency. Most established forex brokers typically provide multiple contact methods including live chat, email support, telephone assistance, and sometimes callback services, making JKV's lack of disclosure unusual. Without knowledge of available support channels, potential clients cannot assess the accessibility of assistance when needed.

Response time expectations and service level agreements are not specified. This makes it impossible to evaluate the efficiency of JKV Global's support operations, which could be crucial during urgent trading situations. Quality customer service is crucial in forex trading, where technical issues or account problems may require immediate attention, especially during active trading sessions.

Multilingual support capabilities are not detailed, though the global positioning of the broker suggests potential support for multiple languages. The geographic distribution of support teams and local support availability for different regions are also not specified in available information, which could affect service quality for international clients.

Training and educational support through customer service channels, such as account manager assistance or trading guidance, are not described in available materials. This leaves questions about the comprehensiveness of client support services and whether the "success partner" positioning is backed by actual support infrastructure.

Trading Experience Analysis

The evaluation of JKV Global's trading experience is constrained by limited available information about platform performance, execution quality, and user interface design. The broker's emphasis on "world-class trading platforms" suggests a commitment to providing quality trading technology, though specific performance metrics are not available to verify these claims.

Platform stability and reliability are crucial factors in trading experience, particularly during high-volatility market conditions when consistent access and execution are essential. Without access to uptime statistics, server performance data, or user reports about platform stability, it's challenging to assess the technical reliability of JKV Global's trading infrastructure, which could significantly impact trading success.

Order execution quality, including execution speeds, slippage rates, and requote frequency, are not documented in available materials. These factors significantly impact trading profitability and user satisfaction, particularly for scalping strategies or high-frequency trading approaches that require precise execution, making this information gap particularly concerning for active traders.

The user interface design and ease of navigation are important aspects of trading experience, especially for newer traders who may be overwhelmed by complex platforms. While JKV Global mentions suitability for "various trader levels," specific information about interface customization, layout options, or user-friendly features is not available, limiting the ability to assess usability.

Mobile trading capabilities and cross-platform synchronization are increasingly important in modern trading. These features allow traders to monitor and manage positions while away from desktop computers, which is essential for many trading strategies. This jkv review cannot assess mobile trading quality due to insufficient information about mobile applications or web-based trading options.

Trust and Regulation Analysis

JKV Global operates under the regulatory oversight of the Mauritius Financial Services Commission (FSC), which provides a framework of financial regulation and operational standards. The Mauritius regulatory environment offers certain protections for traders, though the level of investor protection may differ from more established regulatory jurisdictions such as the UK's FCA or Australia's ASIC, which are generally considered more comprehensive in their oversight.

The FSC regulation does provide some level of regulatory oversight, including requirements for operational standards, financial reporting, and client fund handling. However, the specific nature of investor compensation schemes, dispute resolution mechanisms, and regulatory enforcement capabilities under the Mauritius framework may be less comprehensive than those offered by tier-one regulatory jurisdictions, which could affect client protection in case of disputes.

Company transparency regarding operational details presents some concerns, as key information about trading conditions, fee structures, and business practices is not readily available in public materials. Established and trustworthy brokers typically provide comprehensive disclosure of their operational parameters to enable informed decision-making by potential clients, making JKV's approach somewhat unusual.

The absence of detailed information about fund segregation practices, bank relationships, auditing procedures, and financial reporting raises questions about operational transparency. While regulatory compliance with FSC requirements is assumed, the specific measures taken to protect client interests are not clearly documented, which may concern security-conscious traders.

Industry reputation and track record information is limited in available sources. This makes it difficult to assess the broker's standing within the forex community or its history of regulatory compliance and client satisfaction, which are important factors in broker selection.

User Experience Analysis

The assessment of user experience at JKV Global is limited by the scarcity of detailed user feedback and experience reports in available materials. The broker's positioning as suitable for "traders of all experience levels" suggests an attempt to create an inclusive user environment, though specific user satisfaction data is not available to verify this claim.

Interface design and platform usability are crucial components of user experience, particularly for traders who spend significant time analyzing markets and executing trades. While JKV Global emphasizes its "feature-rich" platform, detailed information about user interface design, customization options, and ease of navigation is not provided in available sources, making it difficult to assess the actual user experience quality.

The account opening and verification process significantly impacts initial user experience, but specific information about registration procedures, documentation requirements, verification timeframes, and onboarding support is not detailed in available materials. Streamlined onboarding processes are increasingly important for user satisfaction in the competitive forex market, and the lack of information about JKV's process creates uncertainty for potential clients.

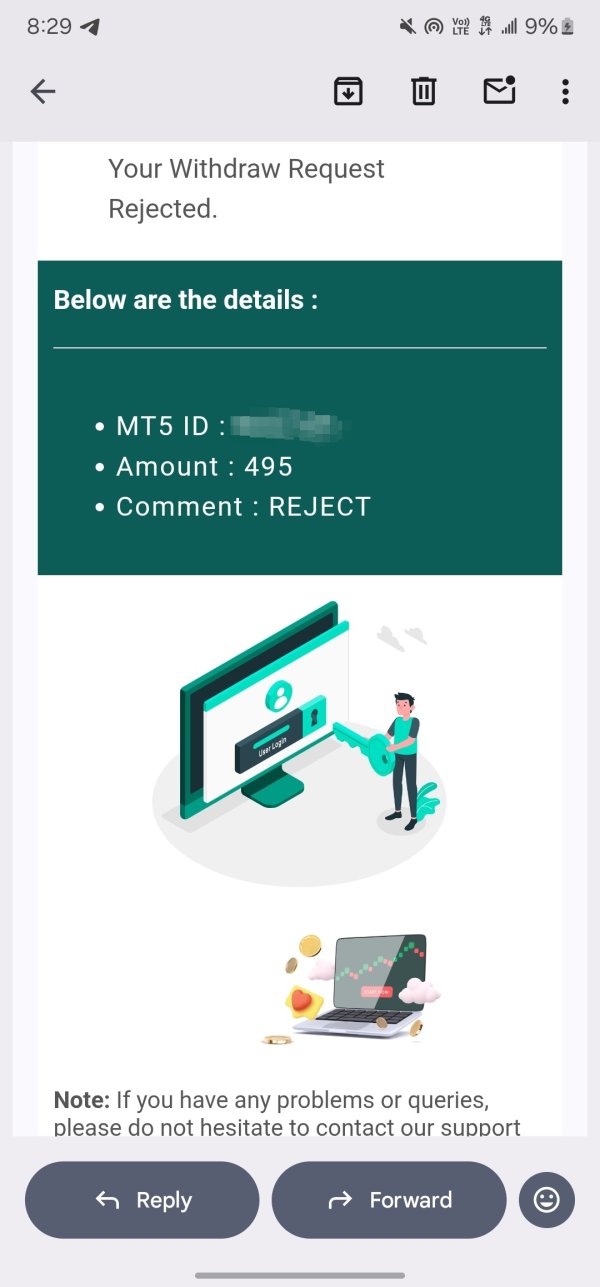

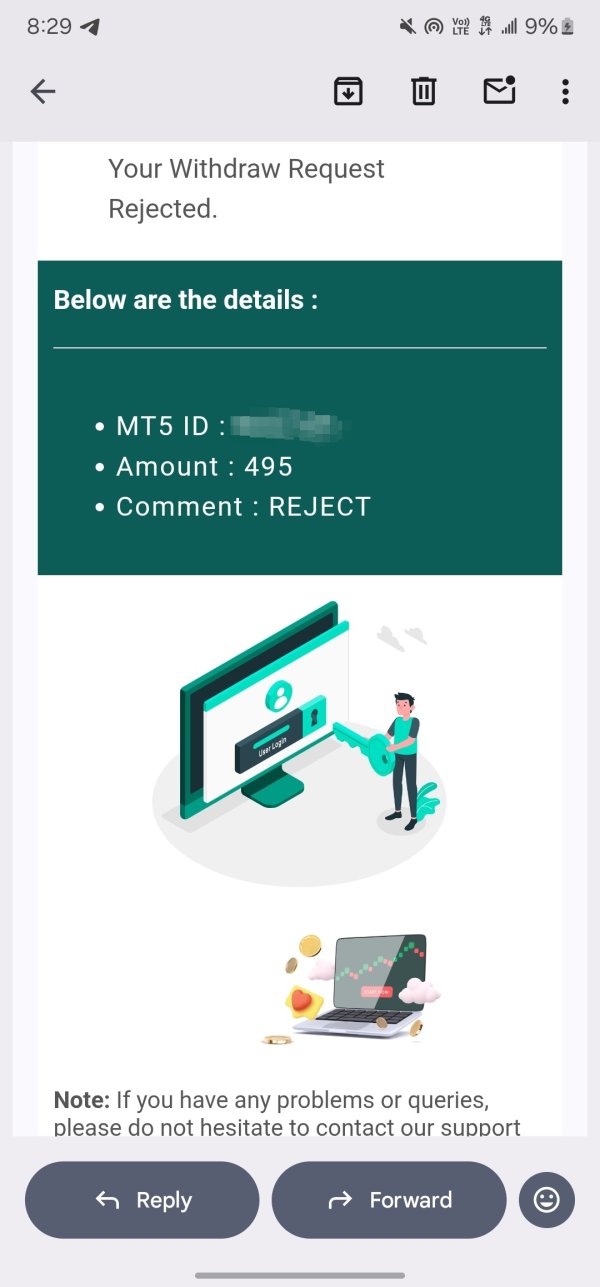

Deposit and withdrawal experiences are critical aspects of user satisfaction, affecting both the initial funding of accounts and the ability to access profits. While JKV Global mentions "convenient deposit/withdrawal options," specific information about processing times, available methods, fees, and user experiences with financial transactions is not available, which could significantly impact overall satisfaction.

Educational support and user guidance can significantly enhance the trading experience, particularly for newer traders. The broker's self-description as a "Forex success partner" suggests a commitment to user education and support, though specific details about educational resources, tutorials, or ongoing trader development programs are not documented in available sources, making it impossible to verify this positioning.

Conclusion

This comprehensive jkv review reveals a broker that presents itself as a trading partner committed to simplifying the forex trading experience. JKV Global operates under Mauritius FSC regulation and emphasizes providing feature-rich trading platforms suitable for various trader experience levels, though the actual delivery of these promises requires verification through direct contact.

The broker's positioning as a "Forex success partner" suggests a focus on client support and education. However, the evaluation is significantly limited by the lack of transparency in crucial trading details, including spreads, commissions, minimum deposits, and specific account conditions, which creates substantial barriers to informed decision-making.

This absence of key information may concern traders who require comprehensive details before making broker selection decisions. The lack of publicly available information about essential trading parameters is unusual in the modern forex industry and may indicate either a deliberate strategy or oversight in marketing communications.

JKV Global appears most suitable for traders who prioritize regulatory oversight and are willing to contact the broker directly for detailed trading conditions. The broker may be less suitable for traders who prefer complete transparency in publicly available information or those seeking detailed cost comparisons before engagement, as this information is not readily accessible.

The main advantages include regulatory oversight from Mauritius FSC and positioning as a comprehensive trading partner. The primary disadvantages center on limited public disclosure of essential trading conditions and the need for direct inquiry to obtain crucial operational details, which adds complexity to the broker evaluation process.